Taxes Paid Templates

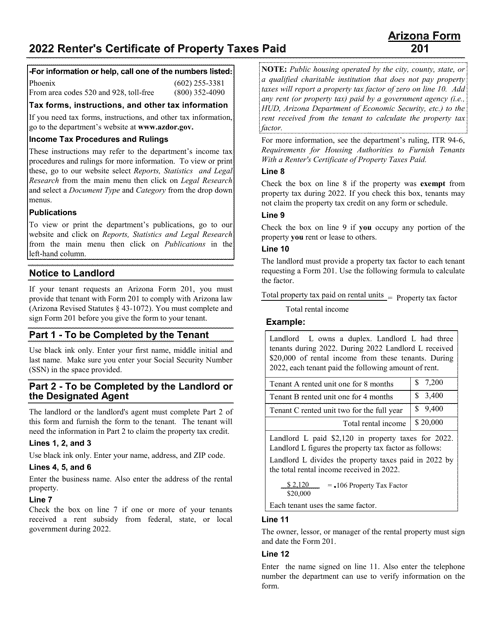

When it comes to filing and managing your taxes, having accurate records of your tax payments is crucial. Our comprehensive collection of documents, also referred to as taxes paid, tax paid, or tax paids, provides you with the necessary information to ensure compliance and avoid any potential complications.

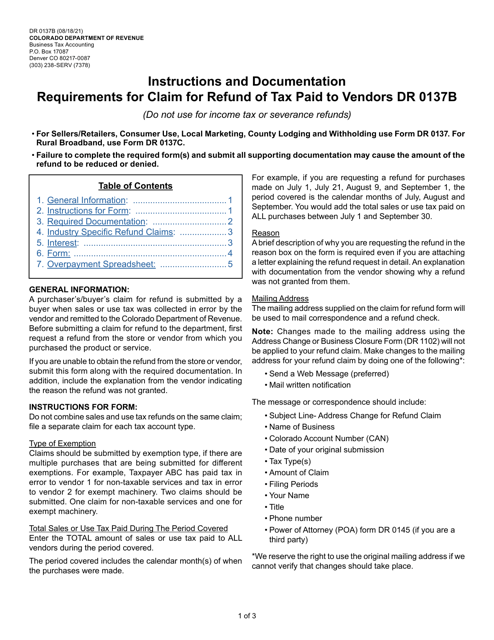

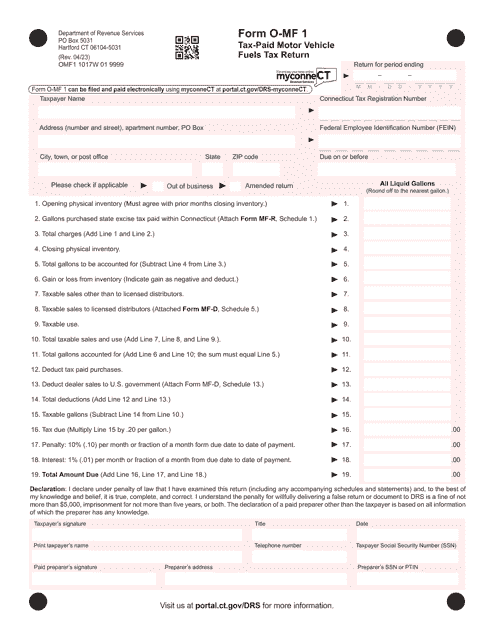

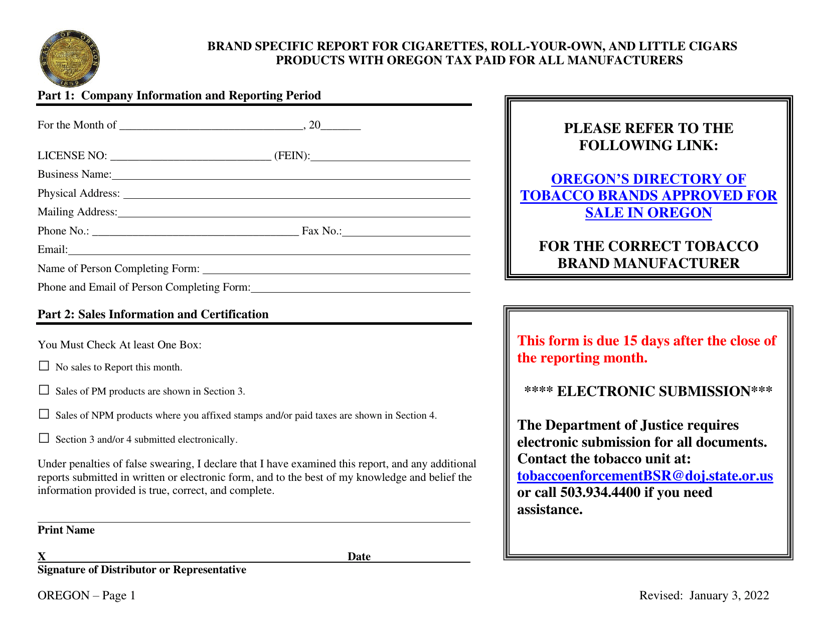

Within this document group, you will find a wide range of specific tax payment information covering various states and tax types. For example, you may come across documents such as "Form PPT-10 Schedule 9B Tax Paid to Supplier on Product Sold This Quarter - New Jersey" or "Brand Specific Report for Cigarettes, Roll-Your-Own, and Little Cigars Products With Oregon Tax Paid for All Manufacturers Signature Cover Page - Oregon." These documents are designed to accurately reflect the tax payments made in a given period and state.

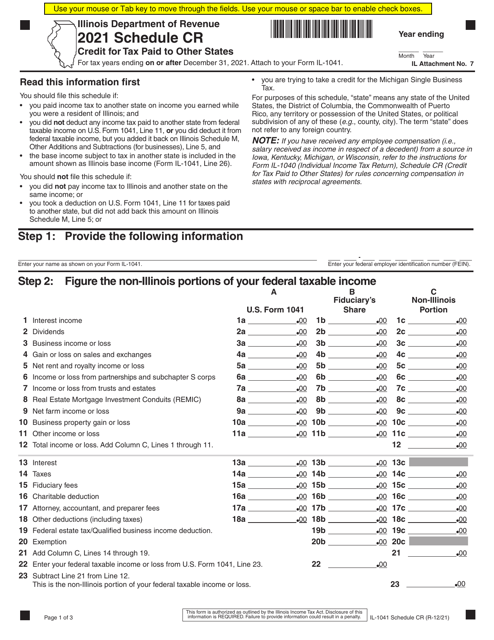

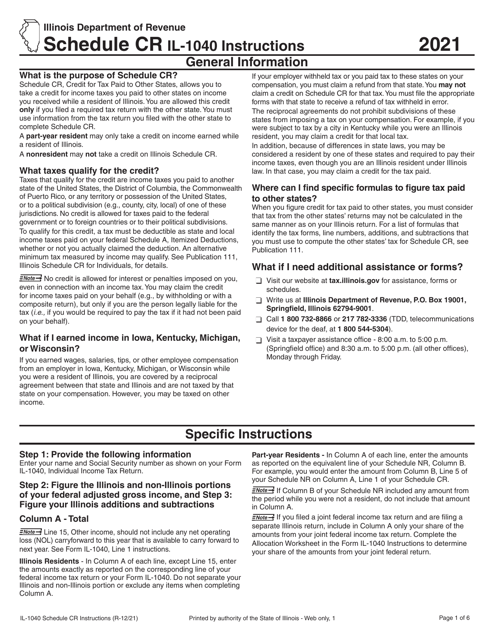

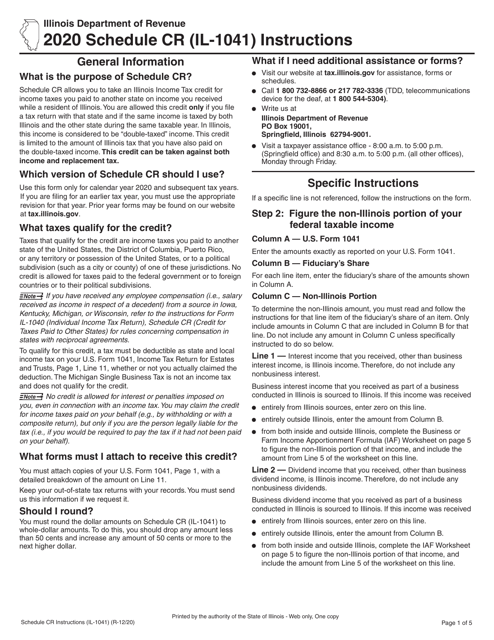

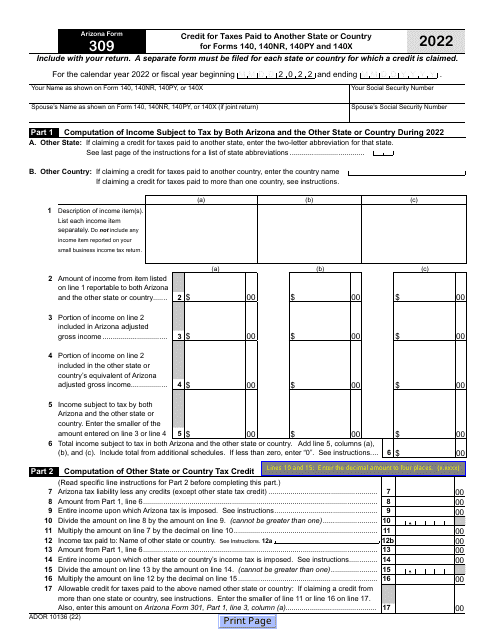

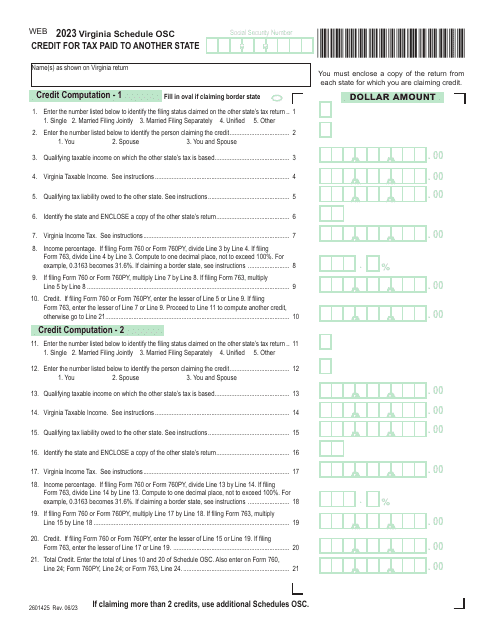

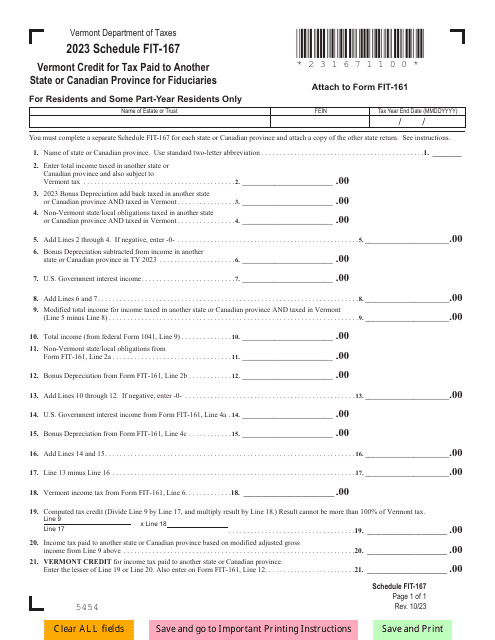

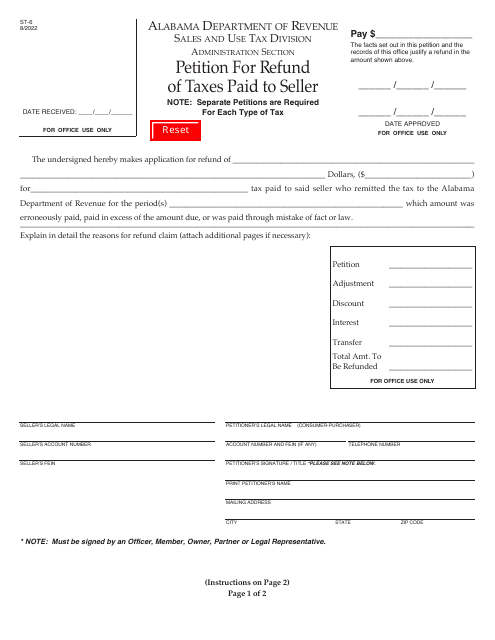

In addition to state-specific documents, you will also find forms such as "Schedule OSC Credit for Tax Paid to Another State - Virginia" or "Form R-5608-S1 Schedule 1 Retail Dealers of Vapor Products - Excise Tax Paid by Wholesaler - Louisiana." These forms allow you to account for tax payments made to other states, ensuring that you are correctly reporting your tax liabilities across different jurisdictions.

Managing taxes can become complex, especially if you operate in multiple states or deal with various tax types. Our collection of tax paid documents provides you with the necessary tools to easily track and report your tax payments accurately. Stay organized, compliant, and avoid any unnecessary hassle by using our comprehensive tax paid documents.

Documents:

51

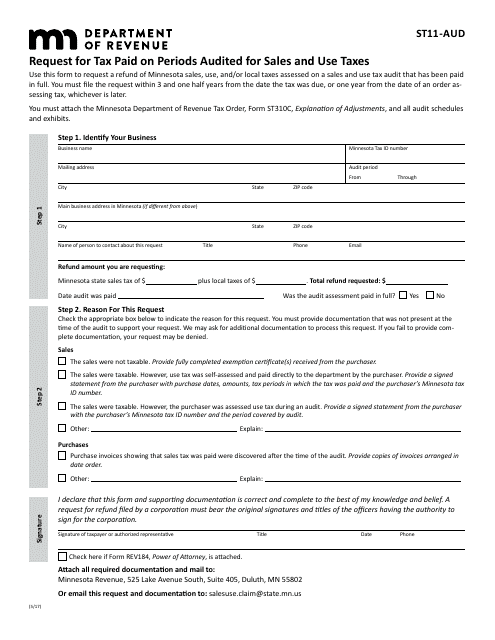

This form is used for requesting tax paid on periods that were audited for sales and use taxes in the state of Minnesota.

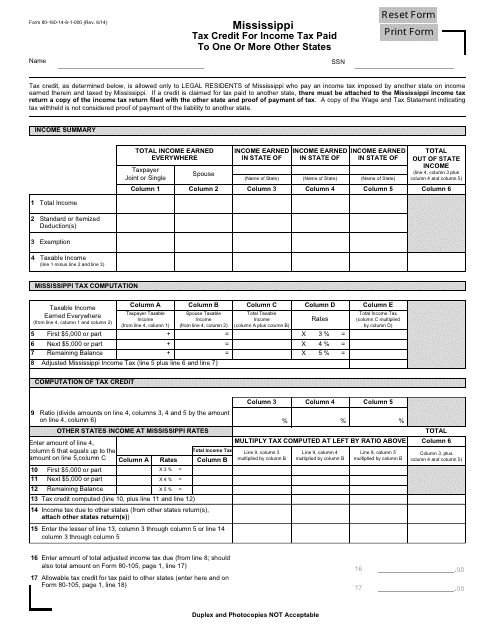

This Form is used for claiming a tax credit in Mississippi for income tax paid to other states.

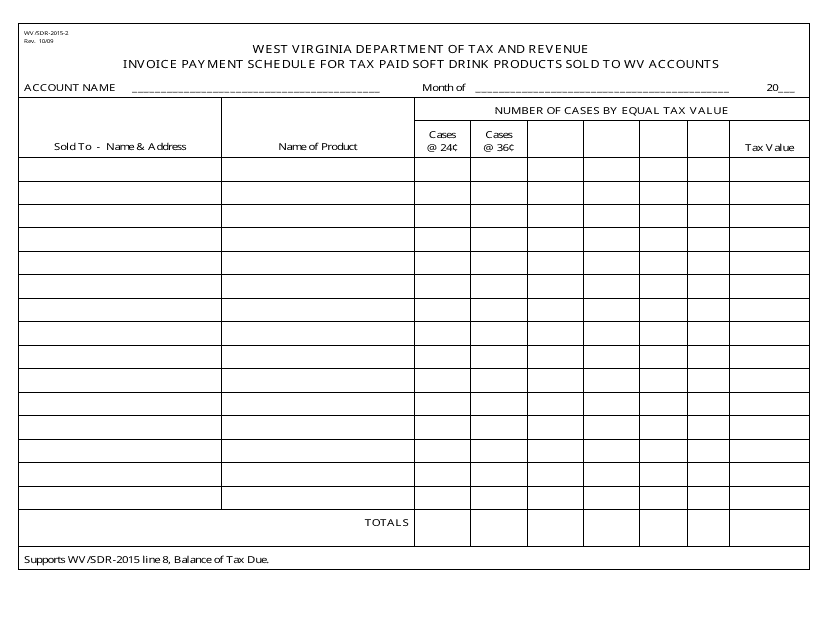

This form is used for creating an invoice payment schedule for tax paid soft drink products sold to West Virginia accounts.

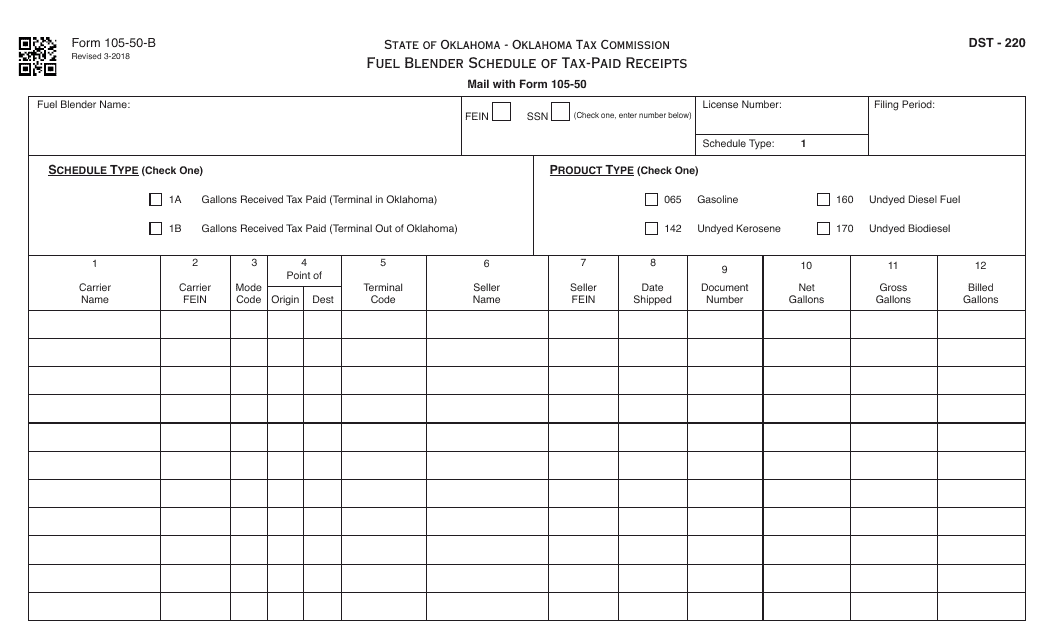

This form is used for reporting tax-paid receipts for fuel blending in Oklahoma.

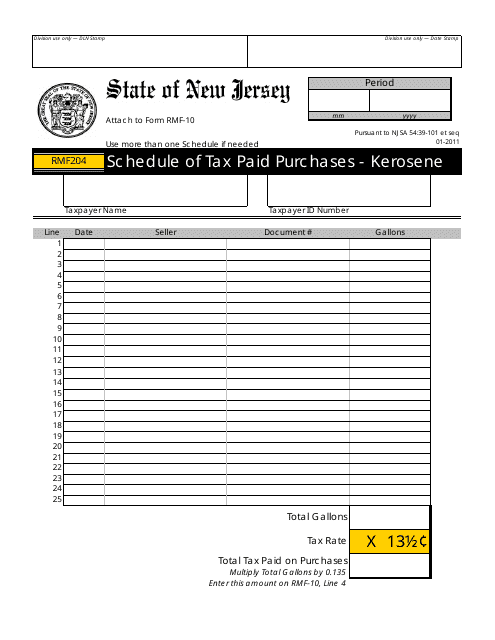

This form is used for reporting tax-paid purchases of kerosene in the state of New Jersey. It helps businesses keep track of their tax payments on kerosene purchases.

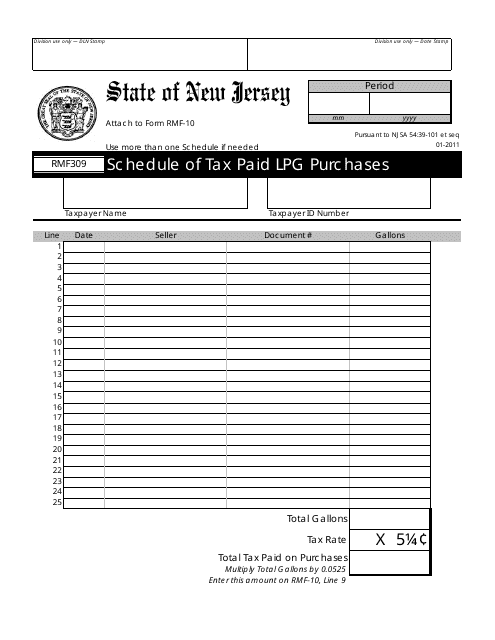

This form is used for reporting and recording the tax paid on purchases of LPG (liquefied petroleum gas) in the state of New Jersey.

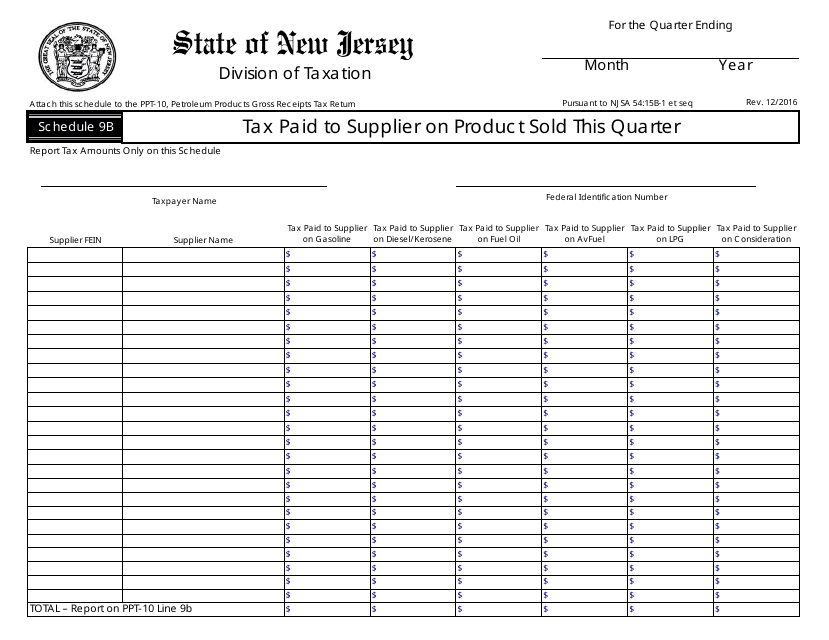

This Form is used for reporting tax paid to suppliers on products sold in the current quarter in the state of New Jersey.

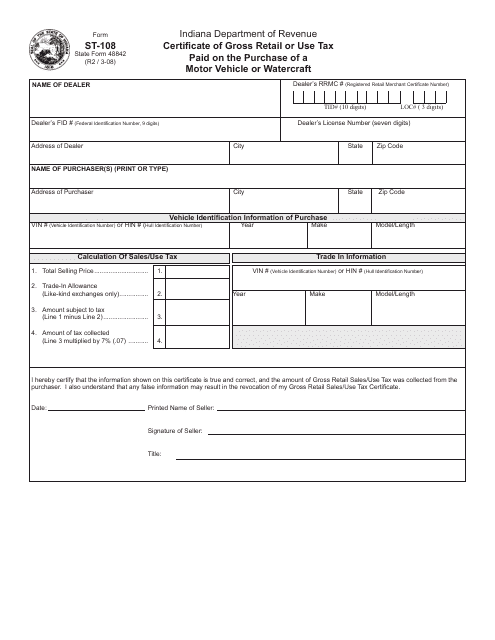

This is a formal document Indiana vehicle dealers must file to the authorities to confirm the state sales and use tax was paid during the transaction that involves a vehicle or vessel.

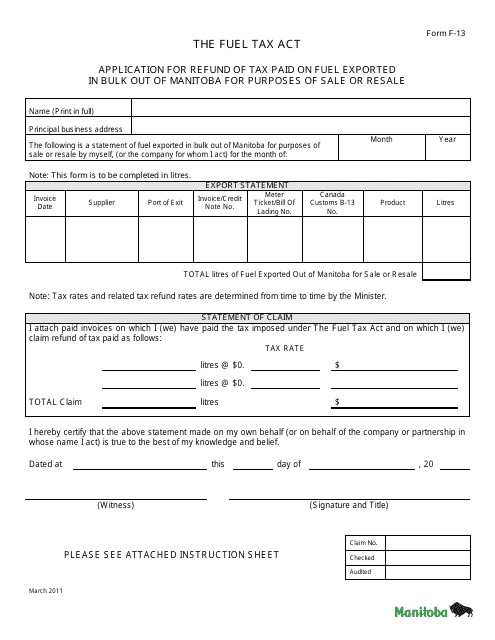

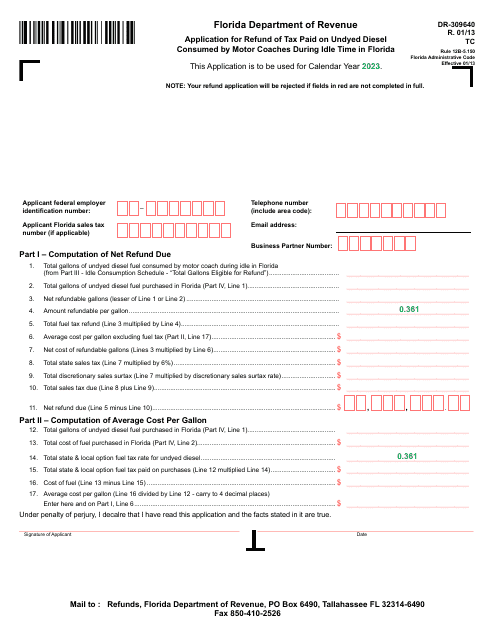

This Form is used for applying for a refund of tax paid on fuel that was exported in bulk out of Manitoba for purposes of sale or resale.

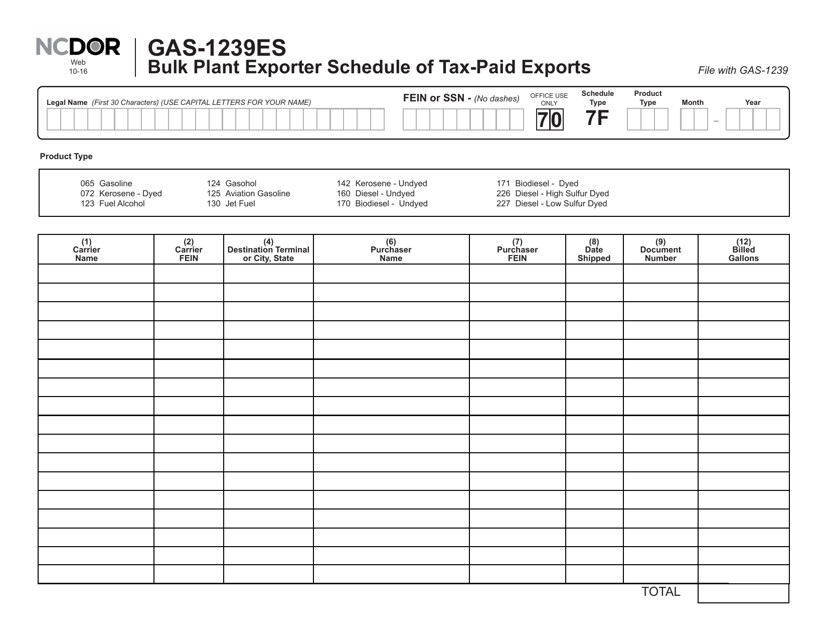

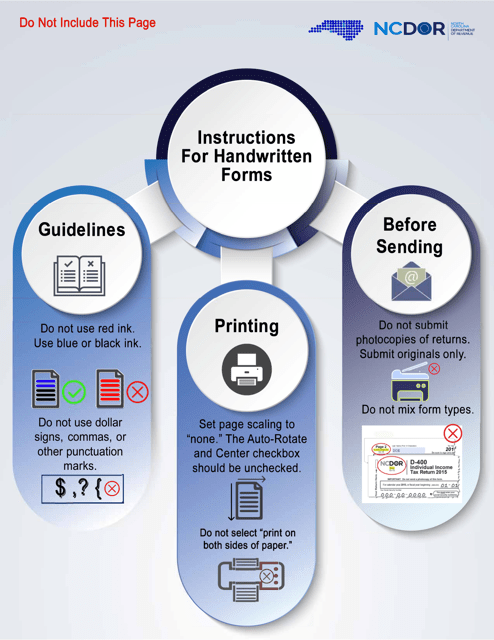

This form is used for reporting tax-paid exports of fuel from a bulk plant in North Carolina.

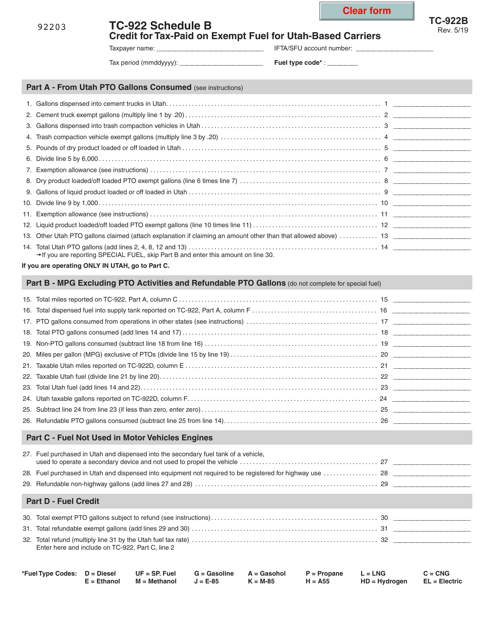

This form is used for Utah-based carriers to claim a credit for tax paid on exempt fuel.

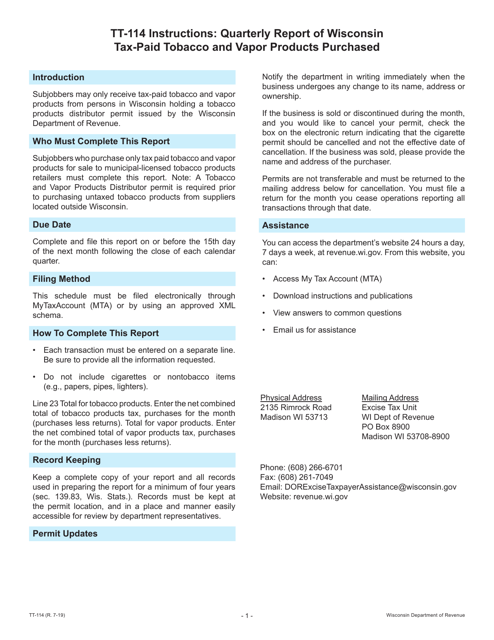

This form is used for reporting the quarterly purchase of tax-paid tobacco and vapor products in the state of Wisconsin.

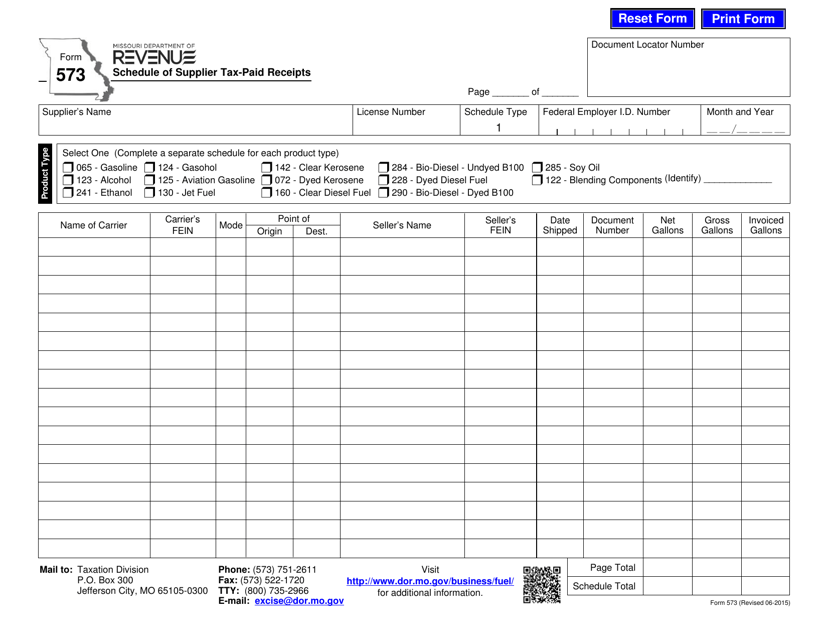

This form is used for reporting tax-paid receipts from suppliers in the state of Missouri.

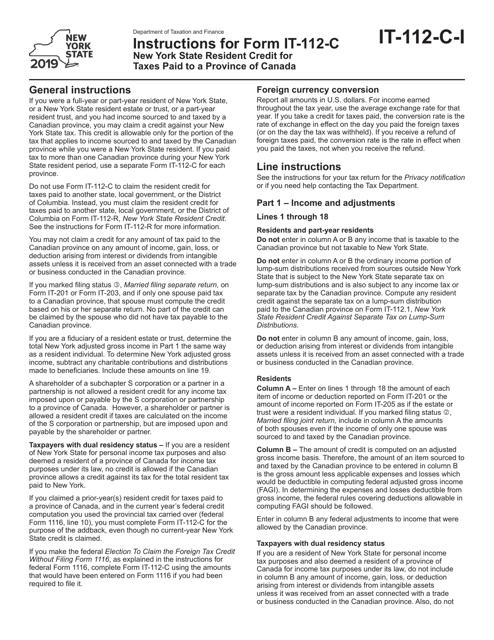

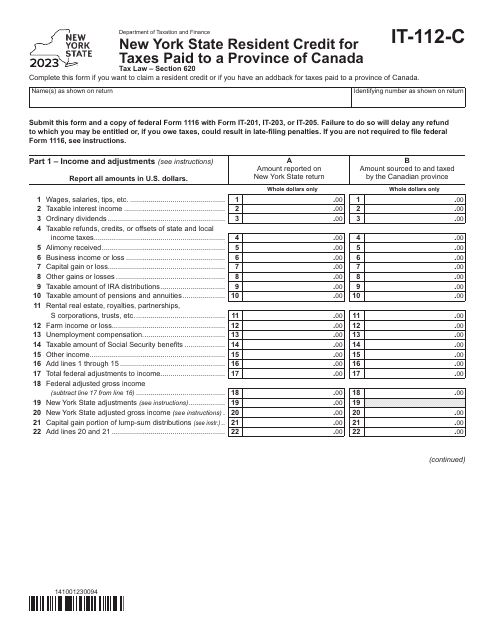

This form is used by New York State residents to claim a credit for taxes paid to a province of Canada on their New York State tax return.

This form is used for applying for a refund on the excise tax paid for other tobacco products in North Carolina, when those products have been returned to the manufacturer.

Form IT-112-C New York State Resident Credit for Taxes Paid to a Province of Canada - New York, 2023

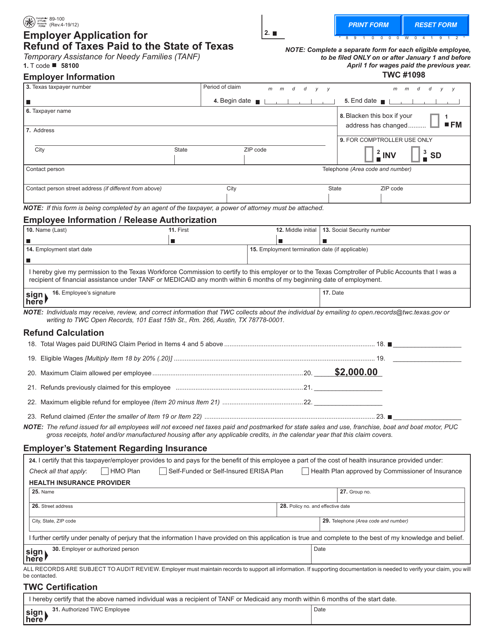

This form is used for applying for a refund of taxes paid by an eligible employer who hired someone who received Temporary Assistance for Needy Families (TANF) or Medicaid in Texas.

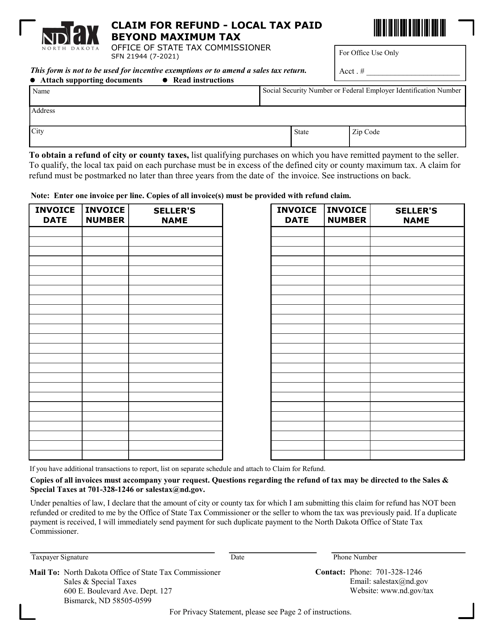

This form is used for filing a claim for a refund of local tax paid in North Dakota, beyond the maximum tax amount allowed.

This document is a brand-specific report for cigarettes, roll-your-own tobacco, and little cigars products with Oregon tax paid. It includes a signature cover page for all manufacturers.