Tax Amnesty Templates

Are you looking for a way to resolve your outstanding tax issues and get a fresh start? Look no further than our tax amnesty program. Also known as tax amnesty, this program offers individuals and businesses an opportunity to come forward and voluntarily disclose their unpaid taxes without fear of penalties or prosecution.

Our tax amnesty program is designed to help taxpayers get back on track by encouraging them to take responsibility for their tax obligations. Through this program, you can benefit from certain incentives and relief options that can significantly reduce your tax debt.

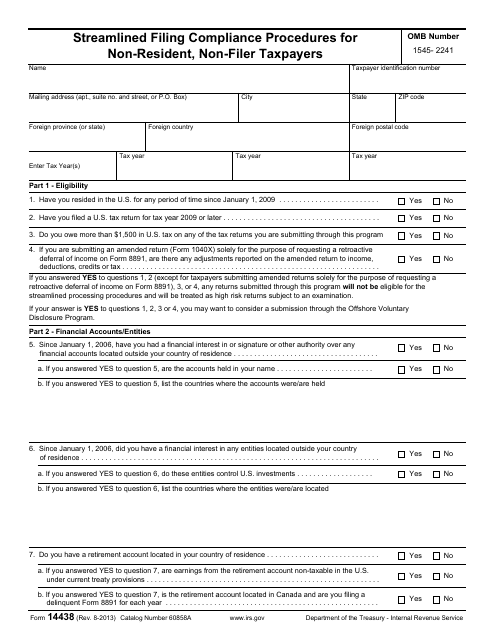

If you reside outside of the United States and have concerns about unpaid taxes, our streamlined foreign offshore procedures can provide you with a streamlined process to resolve your tax issues. We understand that navigating the complexities of the tax system can be challenging, especially for individuals residing outside of the country. That's why we have simplified the process to make it easier for you to come into compliance with your tax obligations.

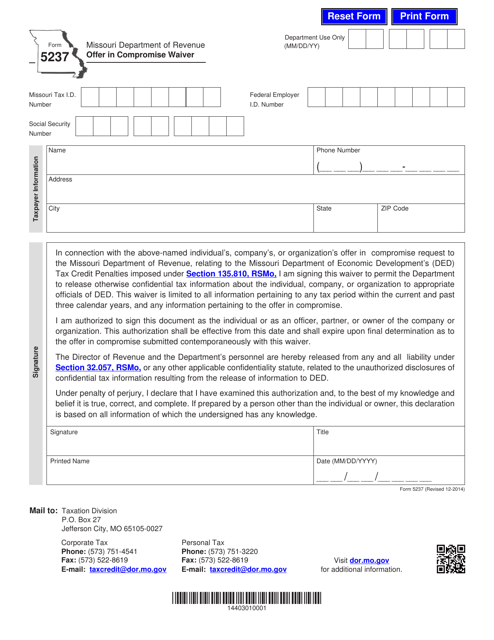

Whether you are an individual or a business, our tax amnesty program is available to you. If you have failed to file a tax return or need assistance with your self-employment taxes, our program has specific applications tailored to your needs. Our self-employed individuals' offer in compromise application can help you negotiate a settlement that is affordable and manageable.

Don't let your unpaid taxes continue to burden you. Take advantage of our tax amnesty program today and finally put your tax troubles behind you. Our application process is straightforward and confidential, ensuring that your personal information is protected throughout the entire process. Contact us now to learn more about our tax amnesty program and start your journey towards financial freedom.

Documents:

16

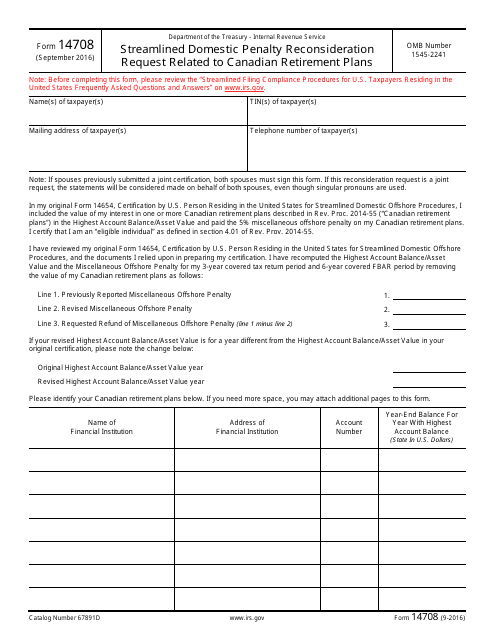

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

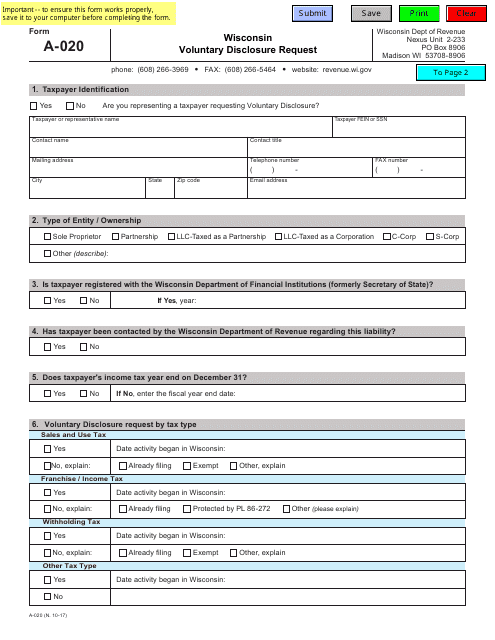

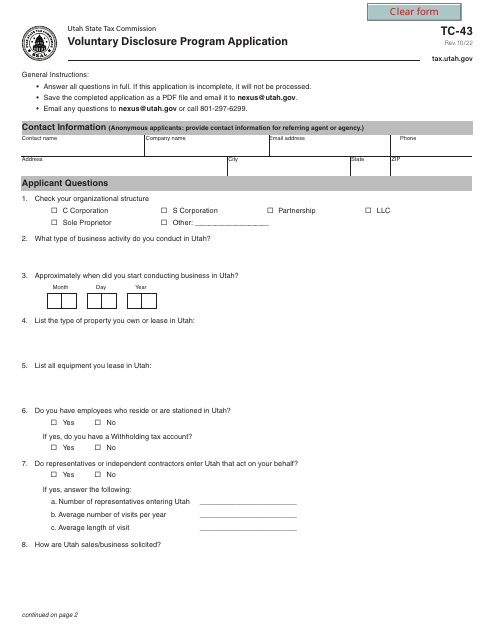

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

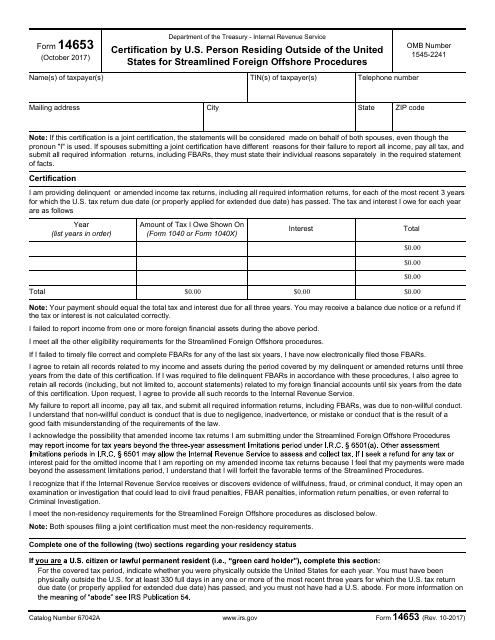

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.

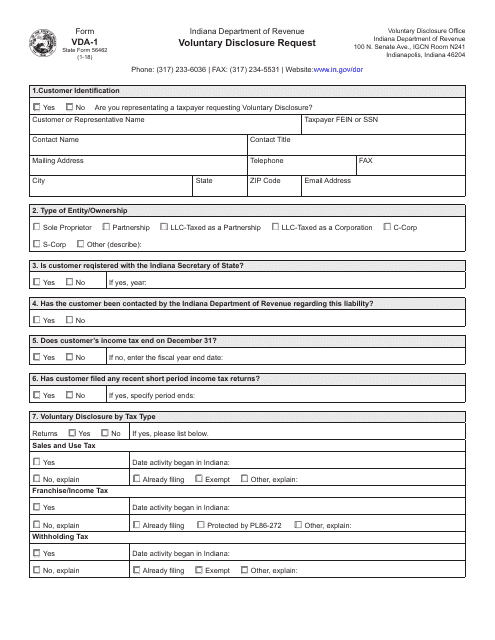

This form is used for requesting a voluntary disclosure in Indiana. It is known as the State Form 56462 (VDA-1) and is used to report any undisclosed tax liabilities.

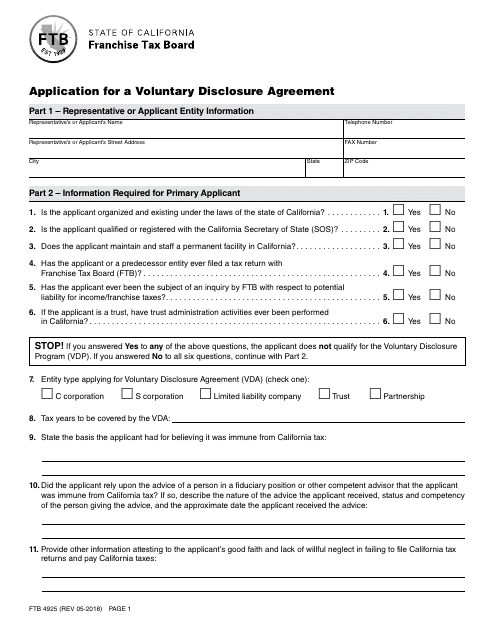

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

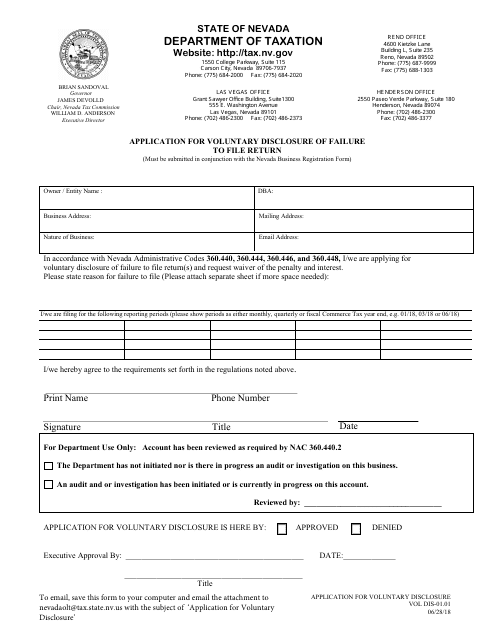

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

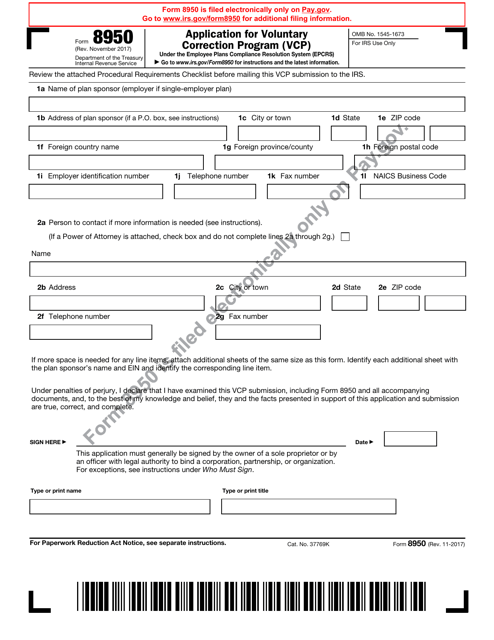

This form is used for applying to the IRS Voluntary Correction Program (VCP). The VCP allows employers to correct errors in their retirement plans and avoid penalties.

This document is used for completing the IRS Form 965-E Consent Agreement under Section 965(I)(4)(D). It provides instructions on how to properly fill out the form and comply with the requirements.

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

This document is for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to resolve their tax debt.

This form is used for applying for an offer in compromise waiver in the state of Missouri.