Tax Limits Templates

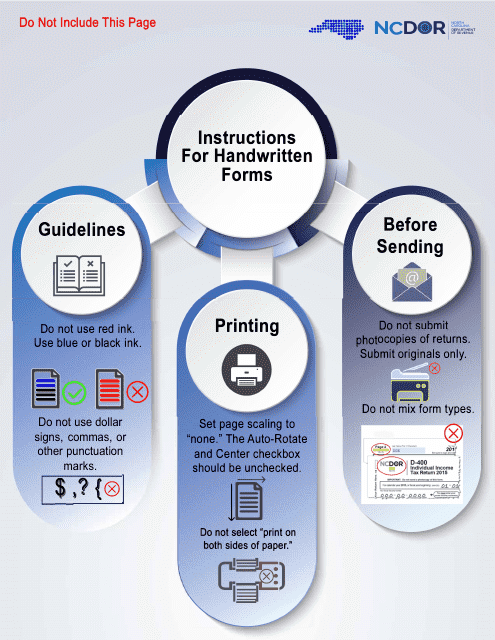

Are you looking for information on tax limits? Our website provides a comprehensive guide to tax limits, also known as tax limitations or tax caps. These limits are imposed on various types of tax credits and deductions that individuals and businesses can claim.

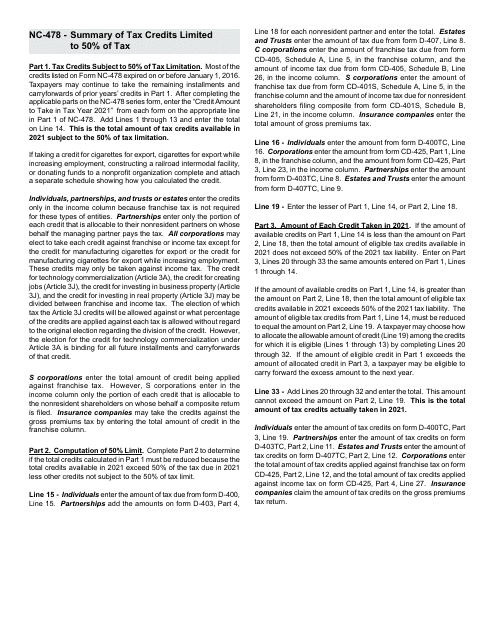

One example of a tax limit is the Form NC-478 Summary of Tax Credits Limited to 50% of Tax in North Carolina. This document outlines the specific tax credits that are subject to a 50% limitation in the state. It provides instructions on how to calculate and report these limited credits.

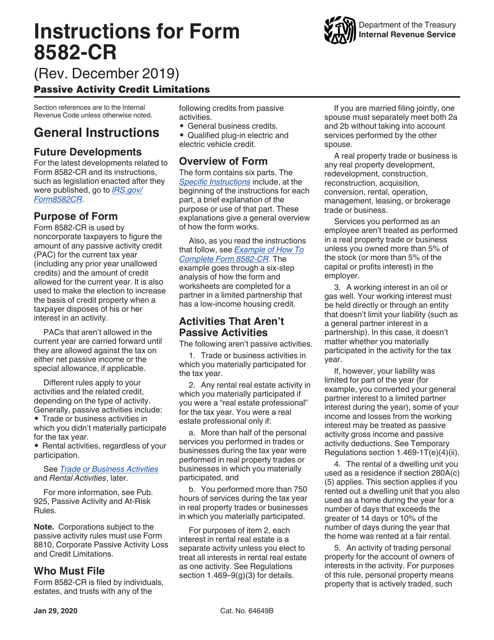

Another example is the IRS Form 8582-CR Passive Activity Credit Limitations. This form is used to determine the amount of passive activity credits that can be claimed by an individual or business. It includes instructions for calculating the limitations based on various factors.

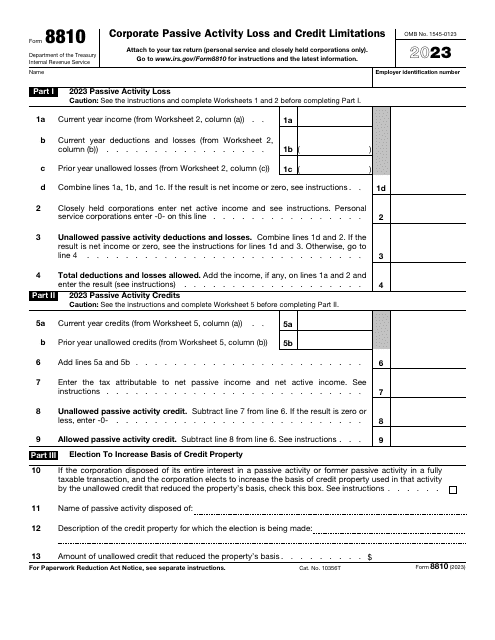

For corporations, there is the IRS Form 8810 Corporate Passive Activity Loss and Credit Limitations. This form is specifically designed for businesses to report their passive activity losses and credits and calculate any limitations that may apply.

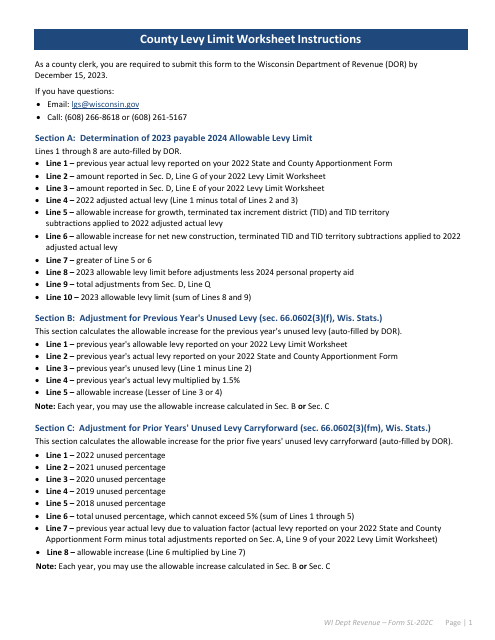

In addition, we have resources such as the Instructions for Form SL-202C County Levy Limit Worksheet in Wisconsin. This document provides guidance on calculating the levy limit for counties in Wisconsin, ensuring that they stay within the prescribed tax limits.

Whether you are an individual taxpayer or a business owner, understanding and complying with tax limits is crucial. Our website offers comprehensive information and resources to help you navigate these limitations and make informed decisions regarding your taxes.

Please note that the specific tax limits and corresponding forms may vary depending on your location and the type of tax credits or deductions involved. It is important to consult the appropriate tax authorities or seek professional advice for accurate and up-to-date information.

Documents:

5