Taxpayer Rights Templates

Taxpayer Rights: Protecting Your Rights as a Taxpayer

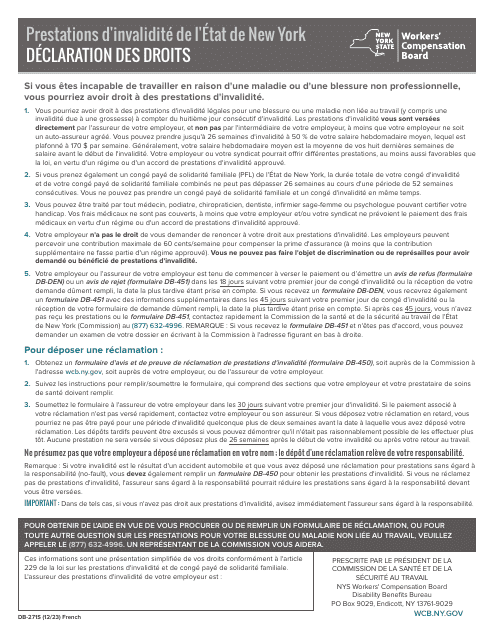

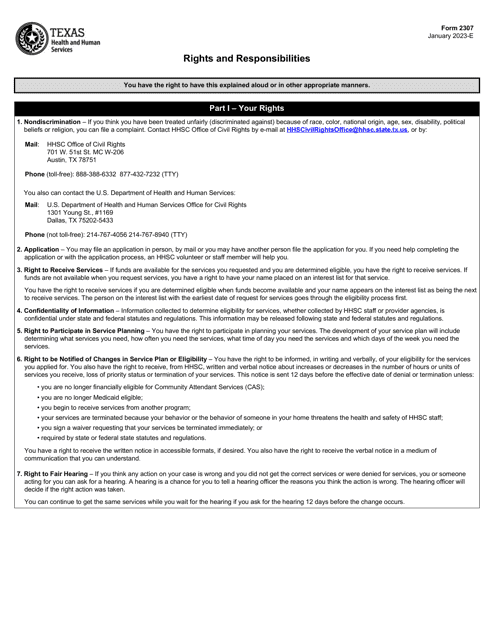

When it comes to dealing with taxes, it's important to be aware of your rights as a taxpayer. These rights are designed to ensure that you are treated fairly and provided with the necessary protections throughout the tax assessment and collection process. Our comprehensive collection of documents on taxpayer rights covers a wide range of topics and situations, serving as a valuable resource for individuals and businesses alike.

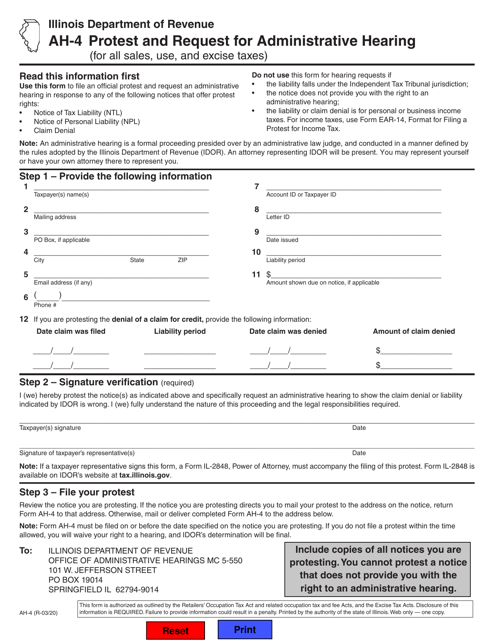

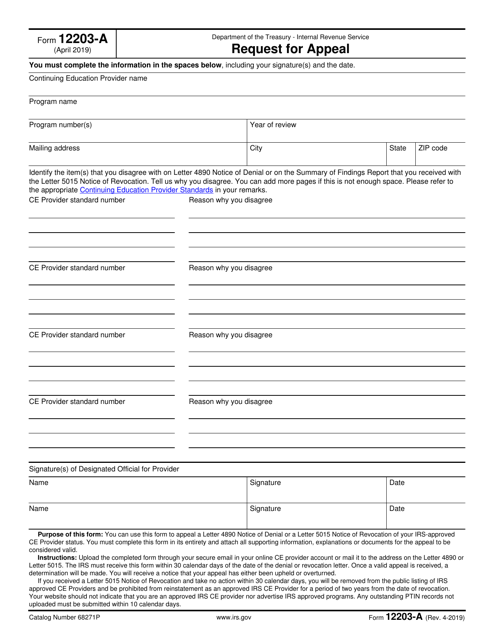

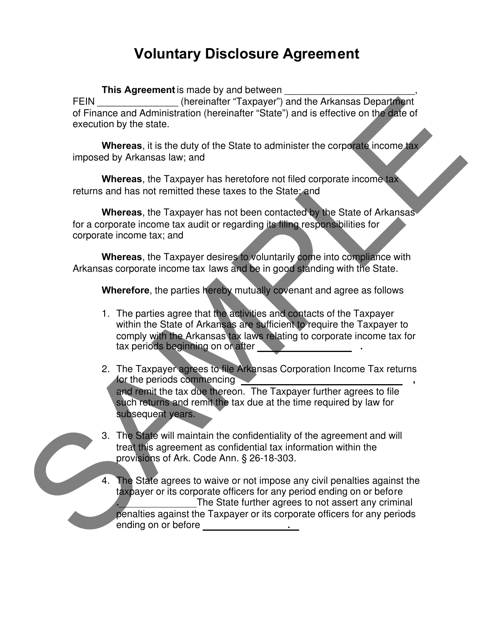

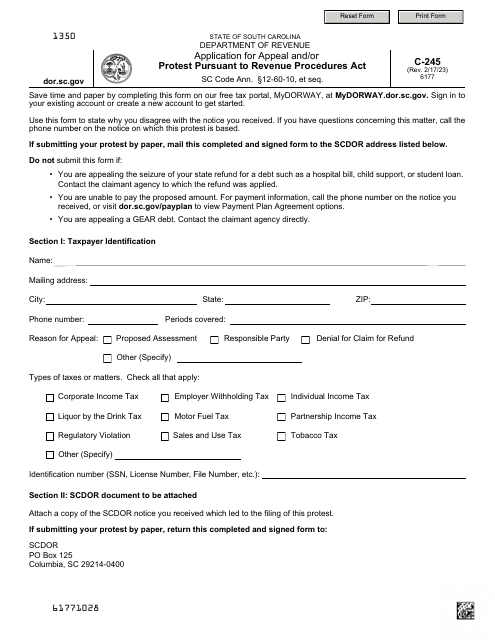

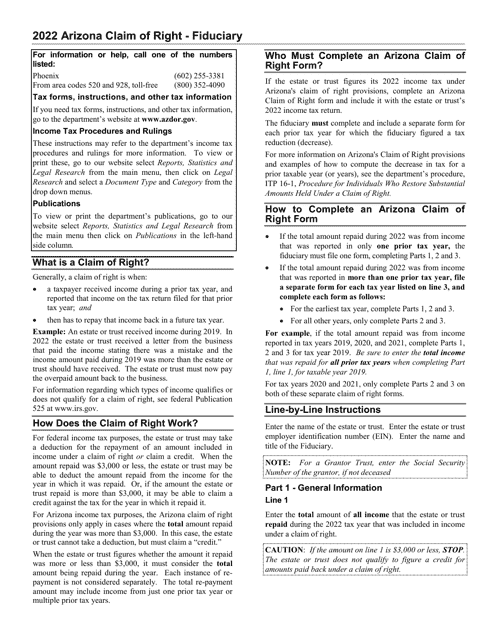

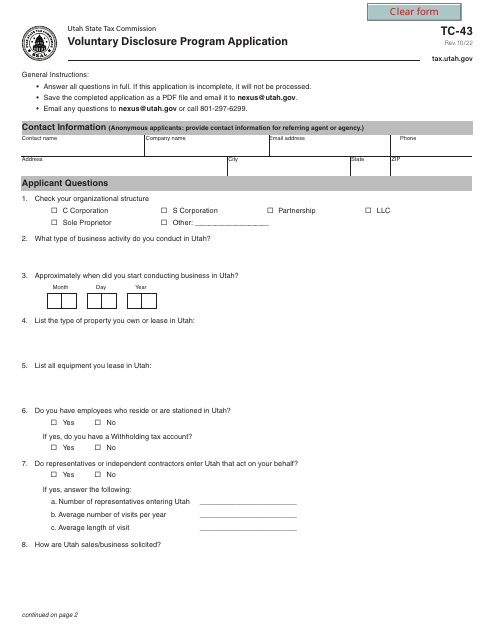

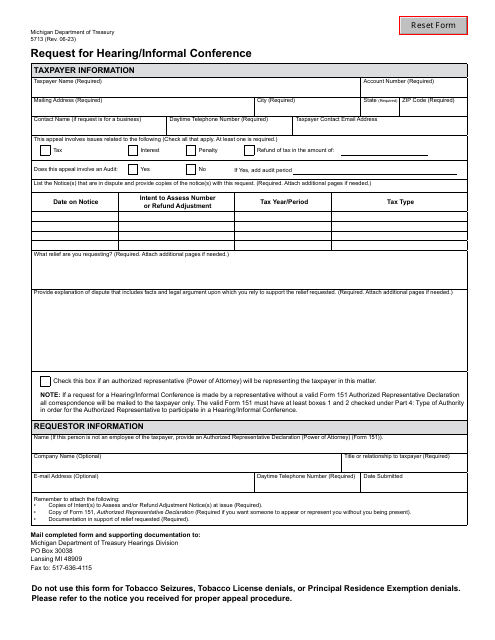

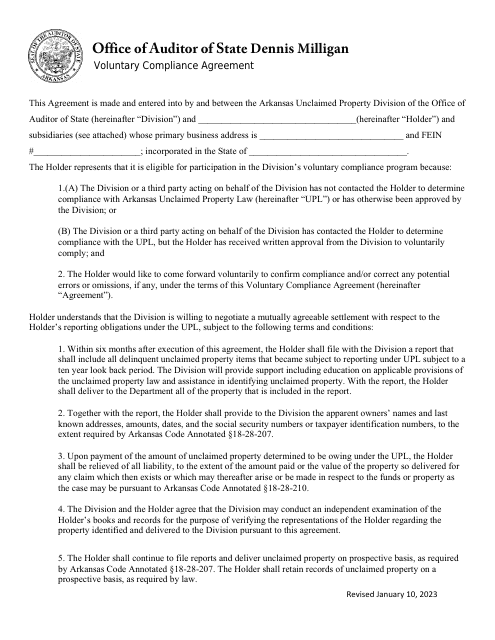

Explore our extensive library of taxpayer rights resources, offering guidance and information on various aspects of tax-related matters. Whether you're facing an issue with the Internal Revenue Code (IRC) violations or need to contest a decision with the Illinois Department of Revenue, our collection has you covered. We provide detailed instructions on filing a protest and requesting an administrative hearing, as well as offer forms for participation in voluntary disclosure agreements in states such as Arkansas and Utah.

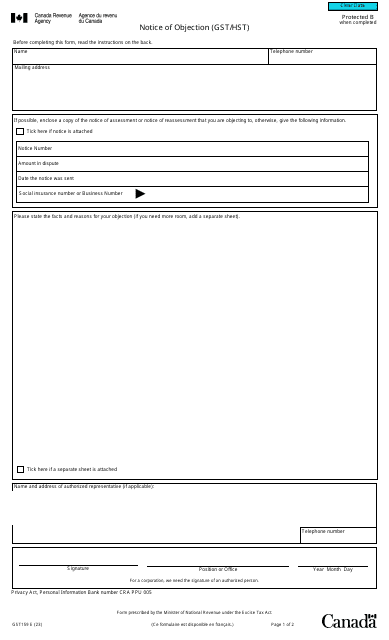

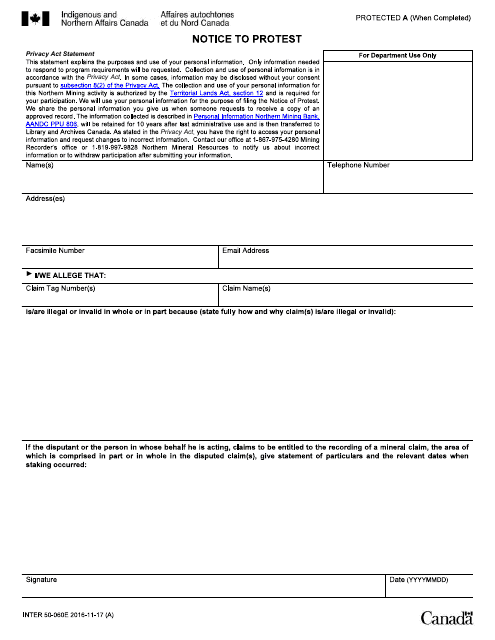

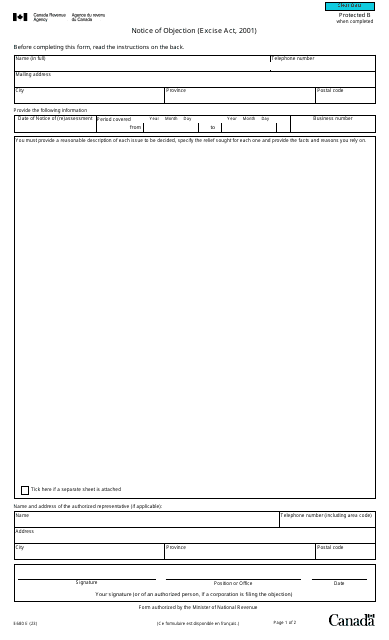

Our collection is not limited to the United States; we also provide documents pertaining to taxpayer rights in Canada. If you find yourself needing to object to an excise act violation, we have the appropriate form for you. Additionally, if you wish to participate in Canada's voluntary disclosure program, we offer the necessary resources to guide you through the application process seamlessly.

At our taxpayer rights knowledge center, we make it a priority to empower taxpayers with the information they need to navigate the complex world of taxes. By accessing our collection, you can arm yourself with the knowledge and tools necessary to protect your rights, ensuring fair treatment and minimizing unnecessary penalties or disputes.

Trust our taxpayer rights documents to shed light on your rights and help you find the appropriate solutions to your tax-related issues. Explore our collection today and take control of your tax matters.

Documents:

30

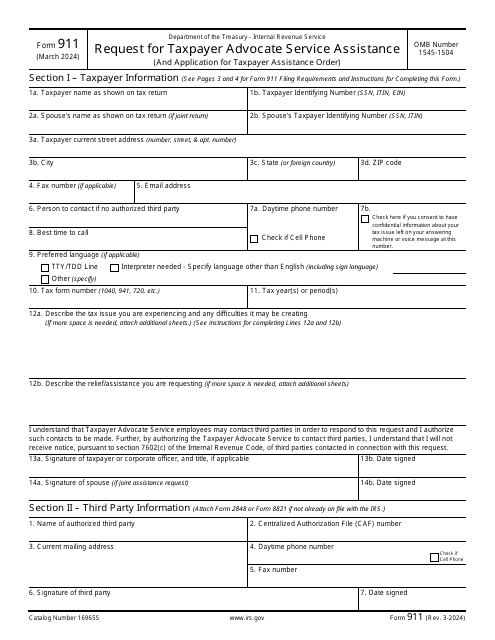

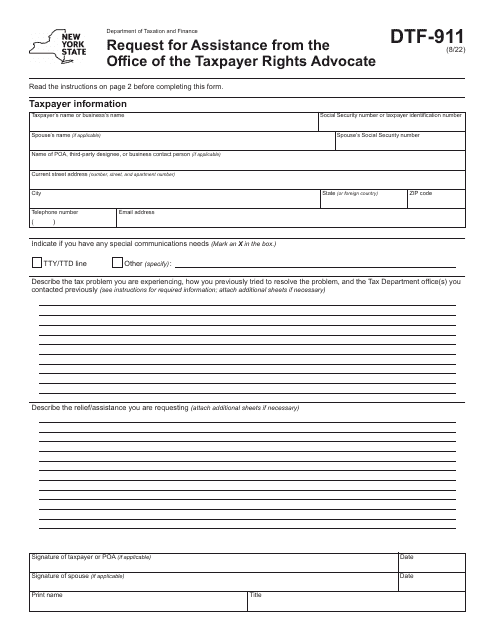

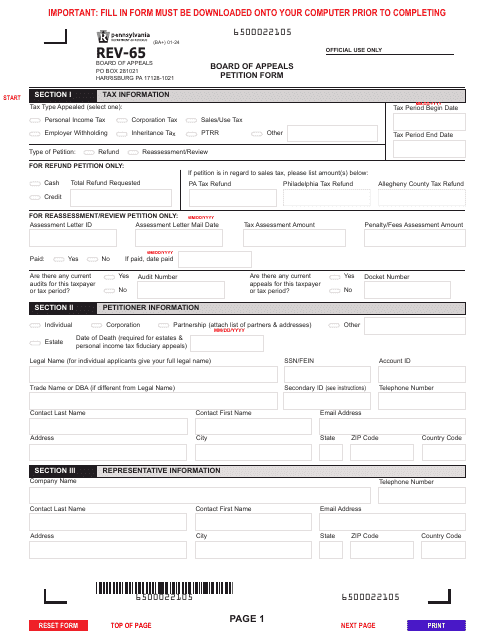

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

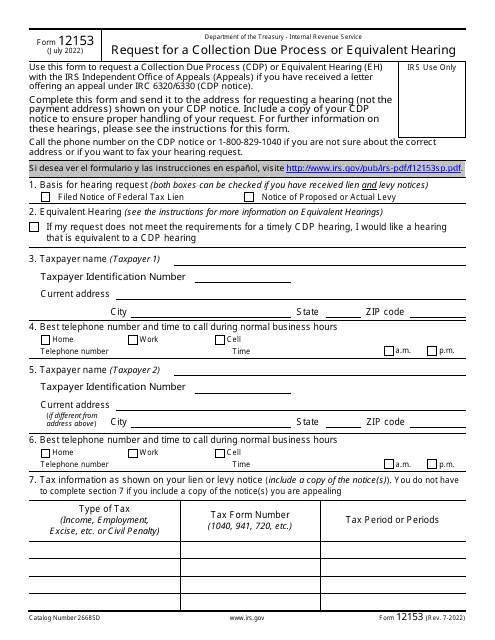

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

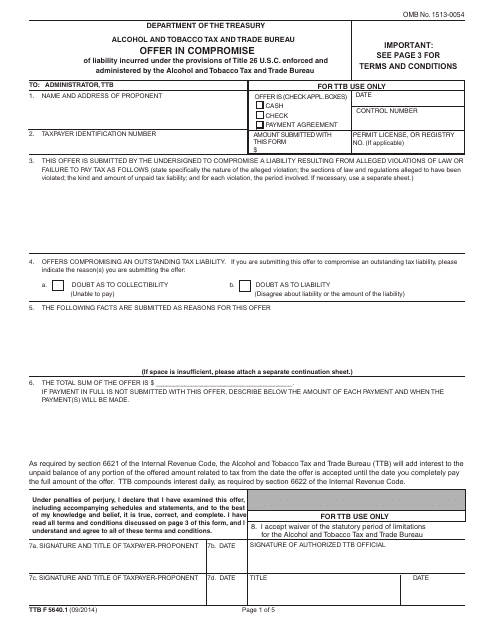

This document is used for making an offer in compromise to the Internal Revenue Service (IRS) for violations of the Internal Revenue Code (IRC).

This form is used for providing a notice to protest in Canada. It is used to register a formal objection or disagreement regarding a specific matter.

This document provides information about the Taxpayer Advocate Service, a resource available to help individuals with their tax-related issues.

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

This document is for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to resolve their tax debt.

This form is used for making an offer in compromise to the Internal Revenue Service (IRS) in Washington, D.C. It allows taxpayers to settle their tax debt for less than the full amount owed.

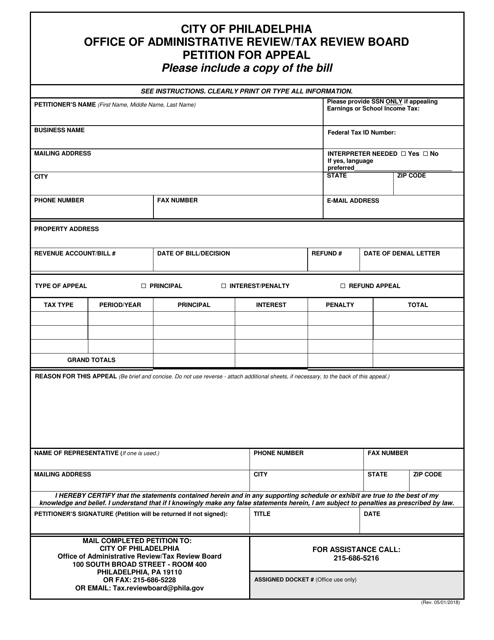

This Form is used for submitting a petition for appeal to the Tax Review Board in the City of Philadelphia, Pennsylvania.

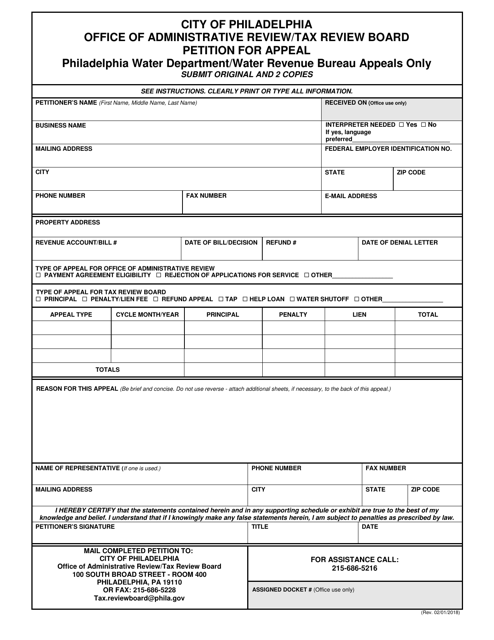

This document is used to appeal a water bill or penalty in the City of Philadelphia, Pennsylvania. It allows residents to contest and request a review of their water charges or penalties.

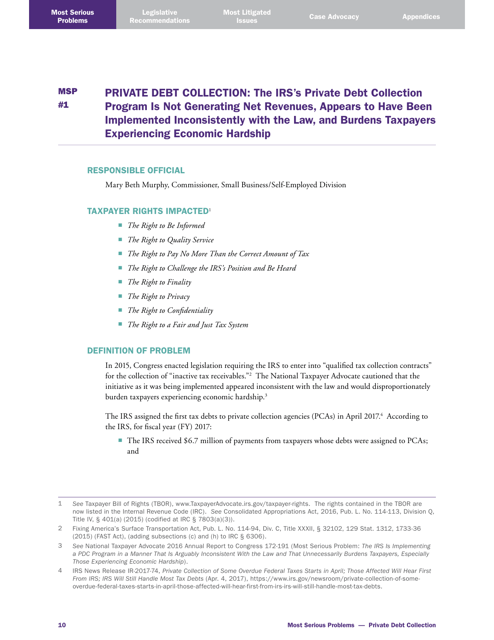

This document provides the Annual Report to Congress from the Taxpayer Advocate Service. It addresses various issues and concerns related to taxpayer rights and offers recommendations for improvement.

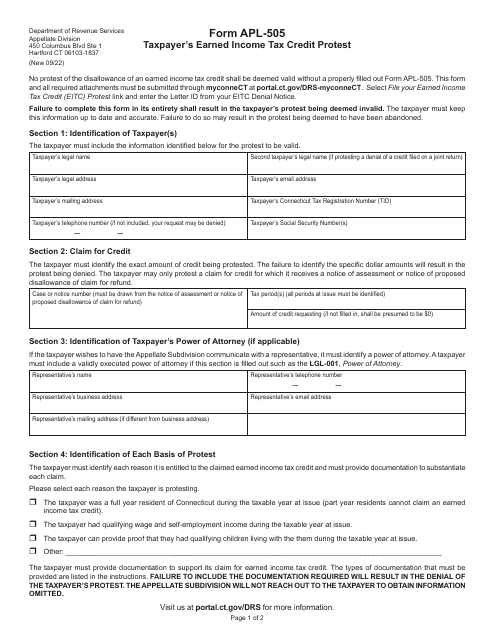

This form is used for taxpayers in Connecticut to protest their eligibility for the Earned Income Tax Credit.

This document provides instructions for completing the Local Board of Appeal and Equalization Meeting and Certification Form in Minnesota. It outlines the steps to follow and the information required to ensure accurate completion of the form.