Payment Guarantee Templates

Are you worried about making payments without any guarantee? Look no further because we have the perfect solution for you - payment guarantees. Also known as guarantee payments or guaranteeing payment, payment guarantees provide assurance and security to individuals and businesses alike.

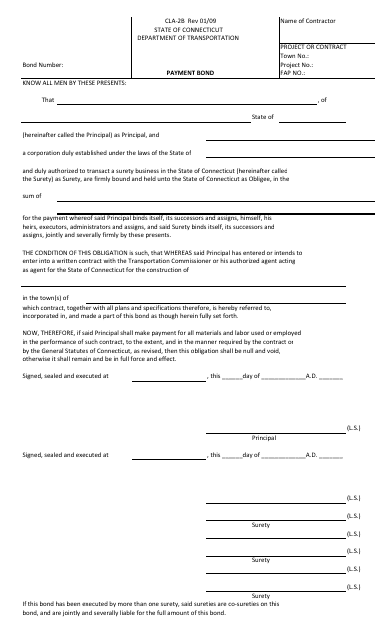

Our collection of documents relating to payment guarantees is extensive and diverse. For example, one document in this collection is the Form CLA-2B Payment Bond from Connecticut. This bond serves as a guarantee that payment will be made to contractors and suppliers for their work and materials. Another document you'll find is the Standby Letter of Credit Template. This document acts as a guarantee from a bank that they will honor payments on behalf of their client if they fail to do so.

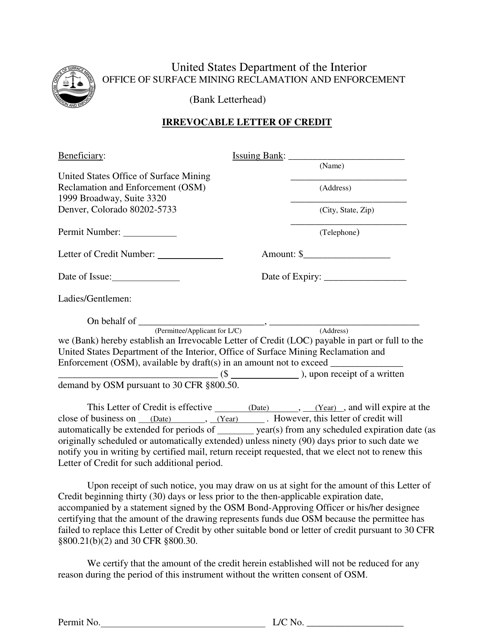

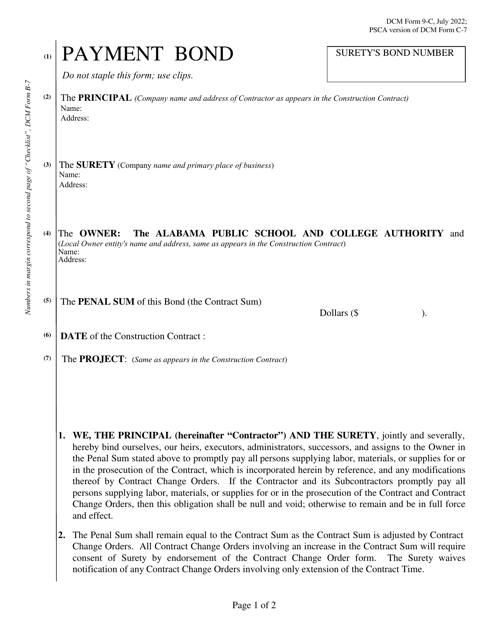

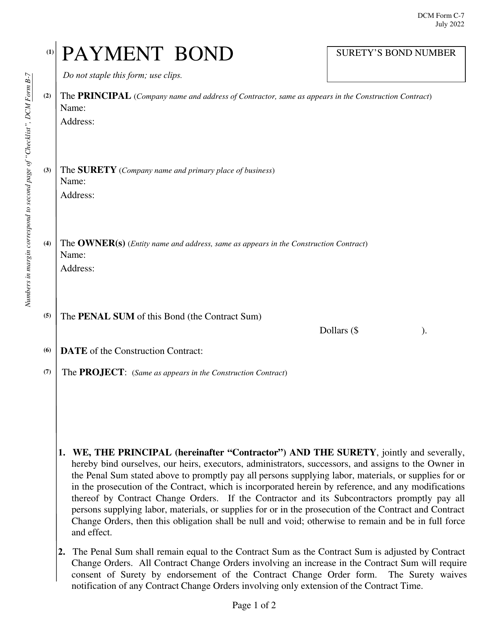

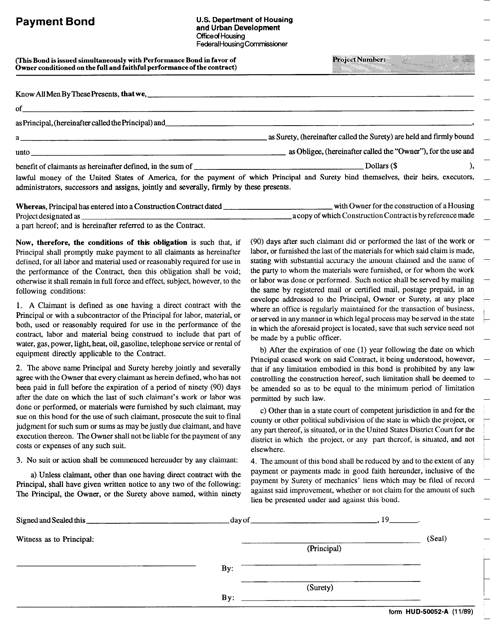

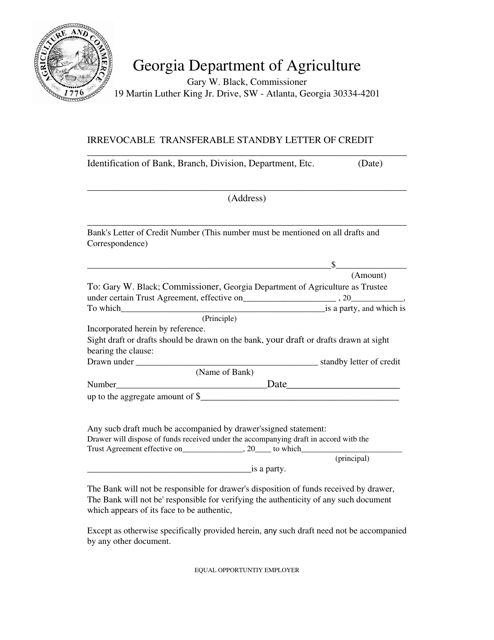

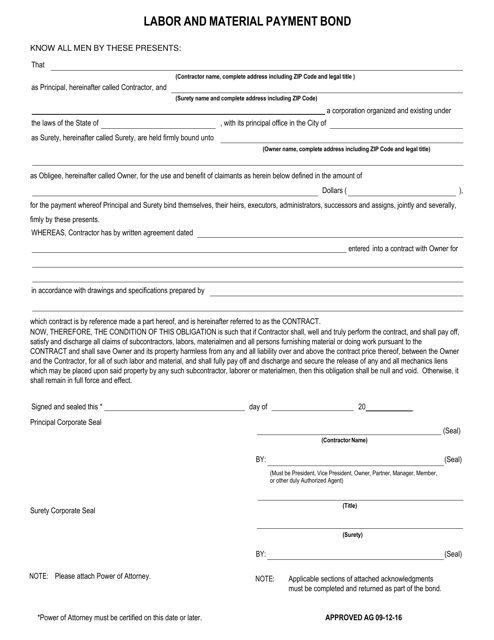

Other documents in our collection include the DCM Form 9-C Payment Bond from Alabama and the Form HUD-50052-A Payment Bond, both of which provide a secure payment guarantee for various types of transactions. And let's not forget the Irrevocable Transferable Standby Letter of Credit from Georgia, a document that guarantees payment between parties involved in a specific transaction.

Whether you're a contractor, supplier, or business owner, having a payment guarantee document in place can provide peace of mind and ensure that you receive the payments you're owed. Our collection of payment guarantee documents is your one-stop-shop for all your payment security needs. So why take the risk when you can guarantee payment? Browse our collection today and protect your financial interests.

Documents:

25

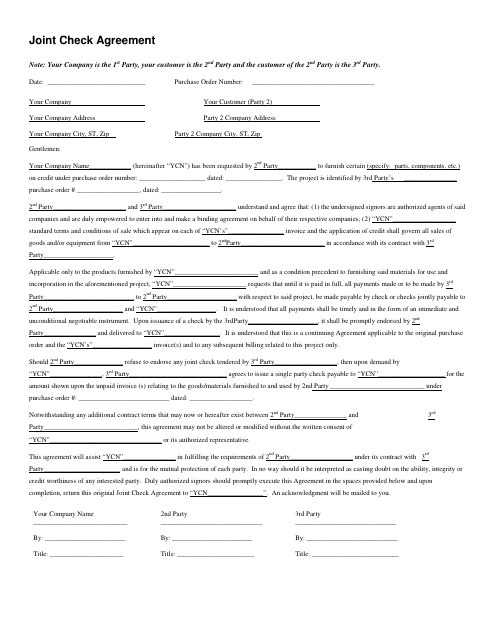

This document is a template for a Joint Check Agreement, which is used when multiple parties are involved in a construction project and want to establish a payment arrangement.

This Form is used for submitting a payment bond in Connecticut. It is a legal document that ensures payment to subcontractors and suppliers for their services and materials used in a construction project.

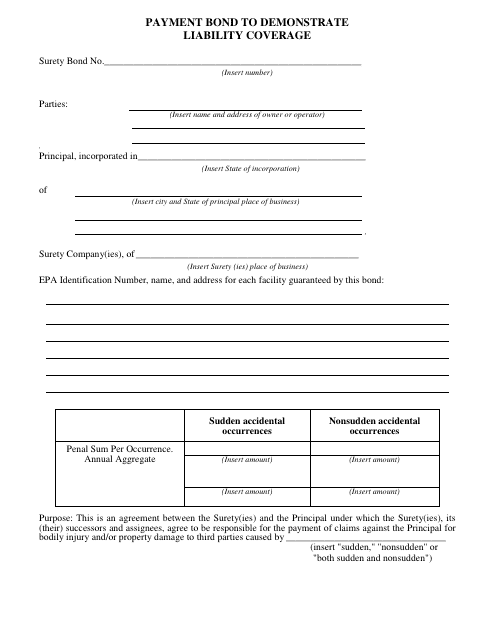

This form is used for submitting a payment bond to demonstrate liability coverage in the state of Kentucky. The payment bond ensures that the contractor will pay all workers, subcontractors, and suppliers involved in a construction project.

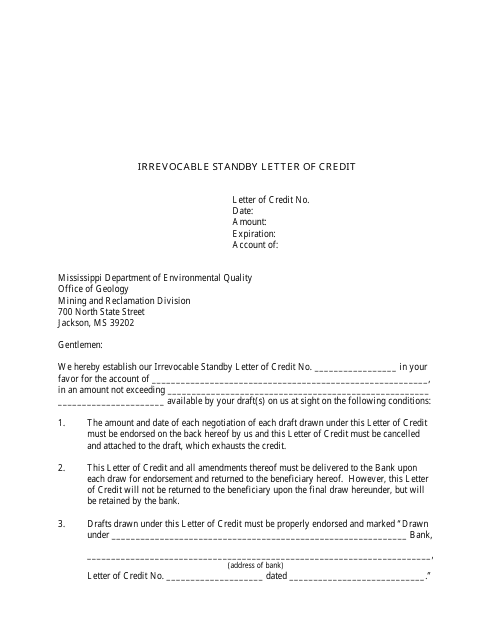

This document guarantees payment to the beneficiary in Mississippi, and is irrevocable, meaning it cannot be cancelled or changed without the consent of all parties involved. It provides a secure form of payment for a specified amount in case the buyer fails to fulfill their obligations.

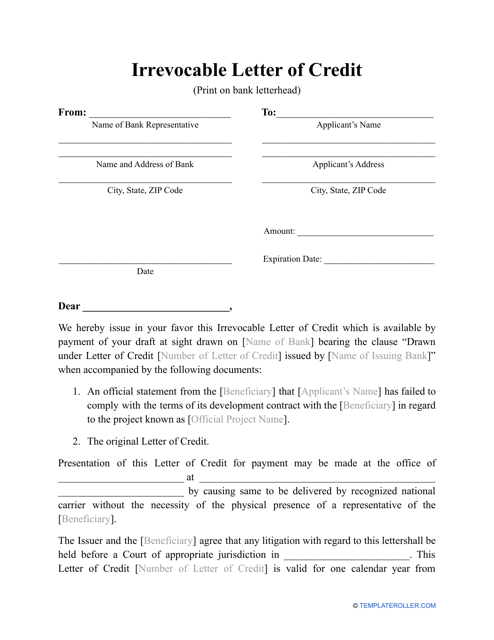

This document is used for guaranteeing payment to a recipient, usually in an international business transaction, that cannot be revoked or canceled by the issuing bank without the recipient's consent.

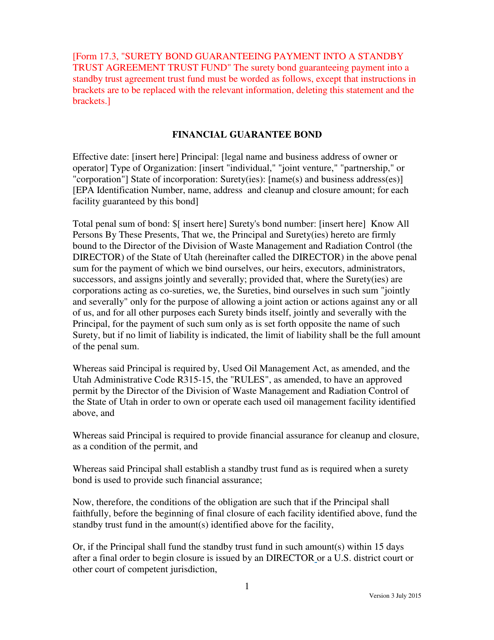

This Form is used for obtaining a surety bond that guarantees payment into a standby trust agreement trust fund in the state of Utah.

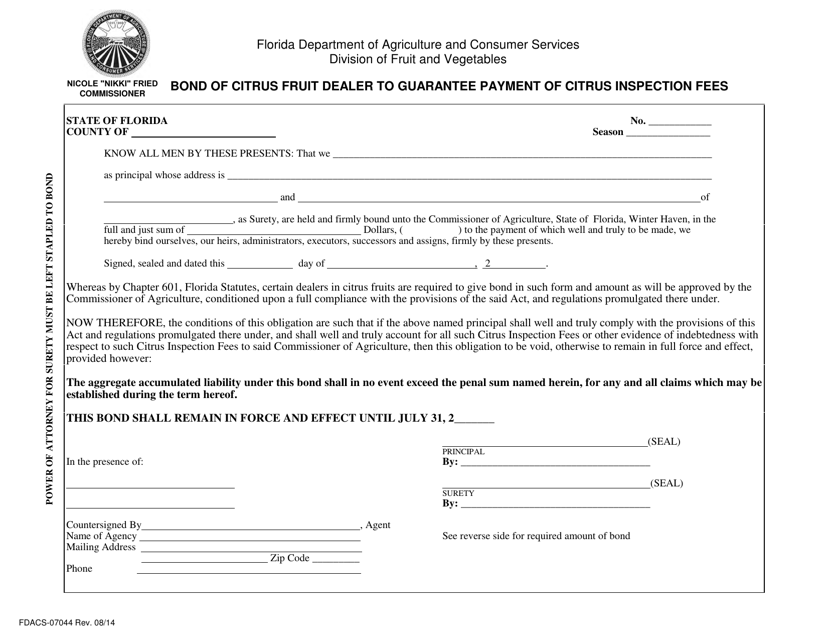

This form is used for citrus fruit dealers in Florida to guarantee payment of citrus inspection fees.

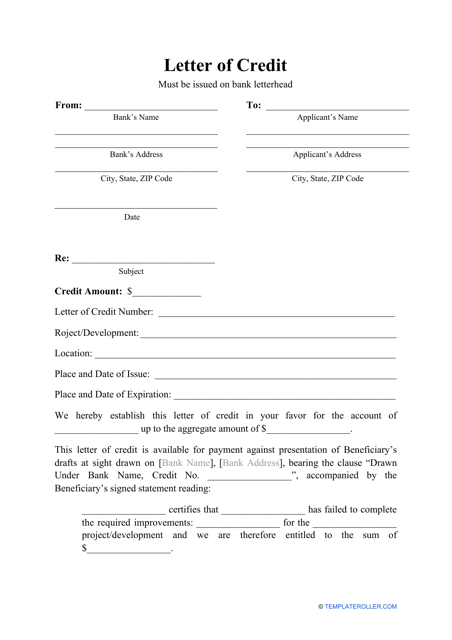

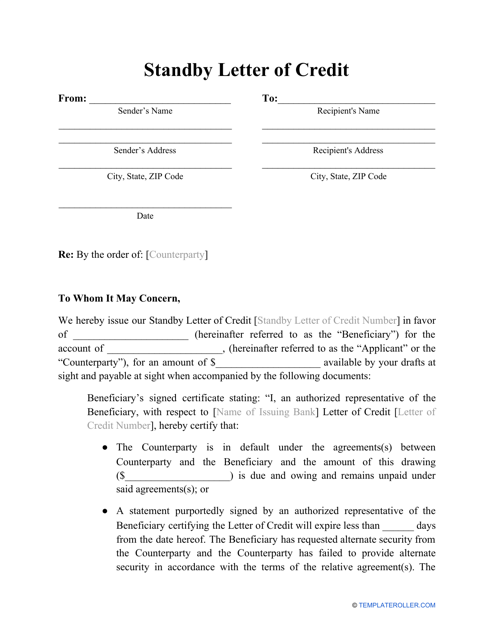

This letter, issued primarily by banks, is used in trade finance and provides an irrevocable payment undertaking.

This is an irrevocable agreement completed by a buyer and the buyer's bank in which the bank agrees to pay the seller as soon as certain conditions are met.

This letter is a legal instrument that secures a bank's commitment to pay the seller in the event that the buyer (the client of the bank) defaults on the agreement.

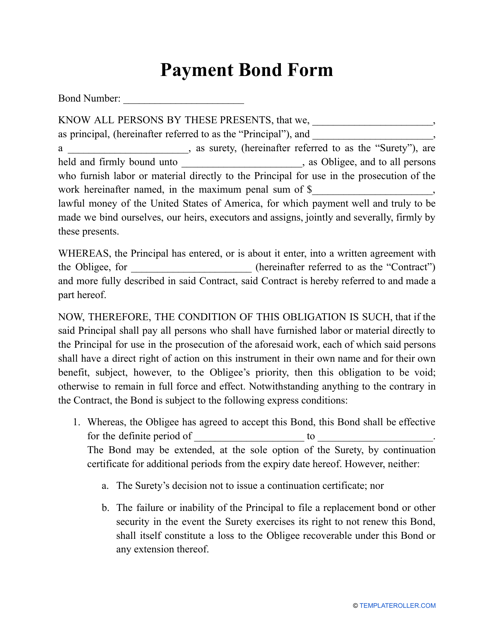

You may use this document to protect the interests of subcontractors and suppliers that are working on a specific project.

This form is used for submitting a payment bond to the U.S. Department of Housing and Urban Development (HUD). The payment bond ensures that contractors and suppliers will be paid for their services and materials used in HUD-funded construction projects.

This document is a legally binding agreement used in Georgia (United States) for guaranteeing payment in a business transaction.

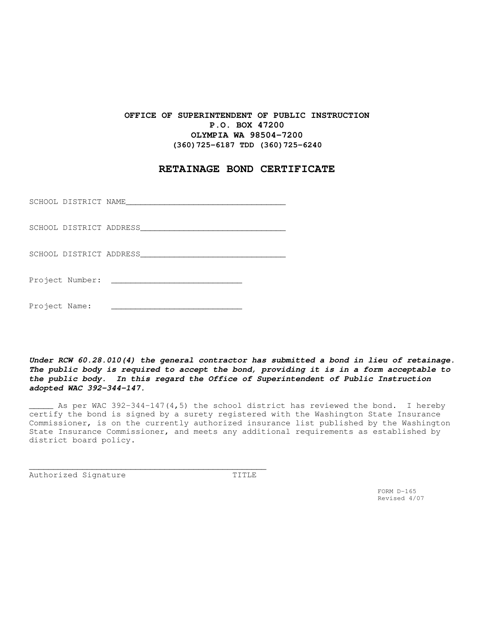

This form is used for obtaining a retainage bond certificate in the state of Washington. It is typically required in construction contracts to ensure that the contractor will complete the project as specified. The bond serves as a financial guarantee for the property owner or project owner.

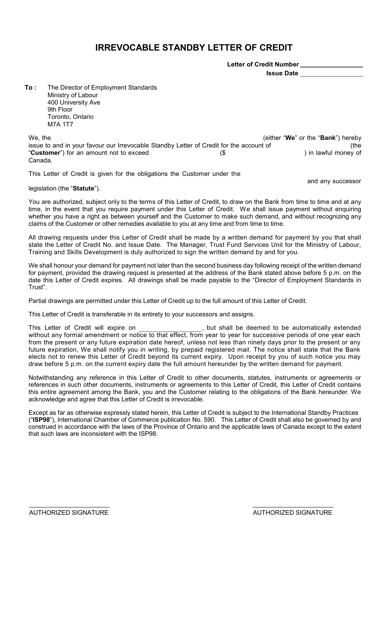

This document is used for ensuring payment between a buyer and seller in Ontario, Canada. It is a form of guarantee that the seller will be paid if certain conditions are met.

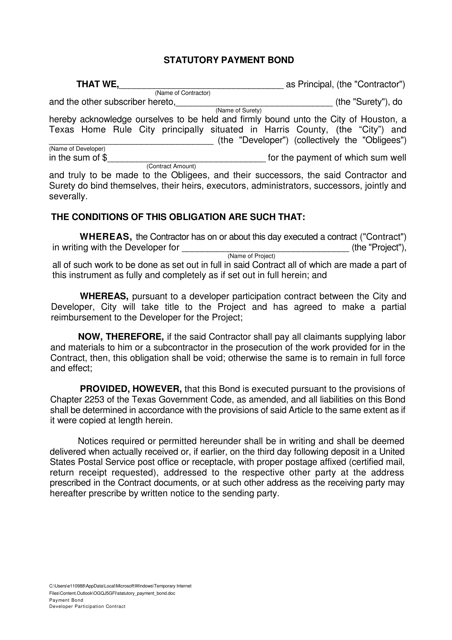

This document is a statutory payment bond specific to the City of Houston, Texas. It provides protection to subcontractors and suppliers in the event that the principal contractor fails to pay them for their work or supply of materials on a construction project.

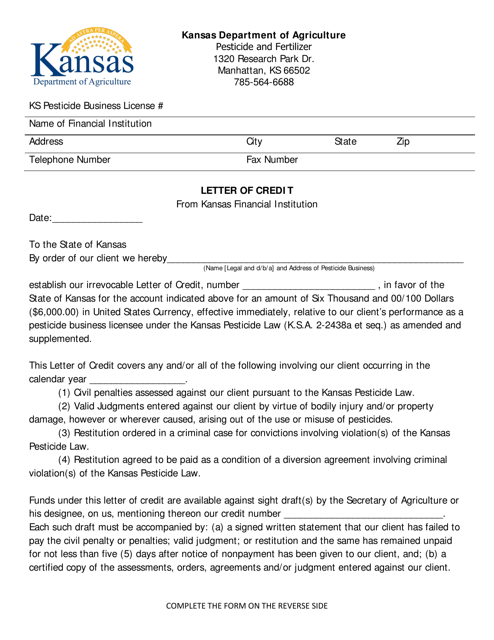

This document is used for establishing a financial guarantee for trade transactions between a buyer and a seller in Kansas. It ensures that the seller will be paid once the buyer meets the specified conditions.

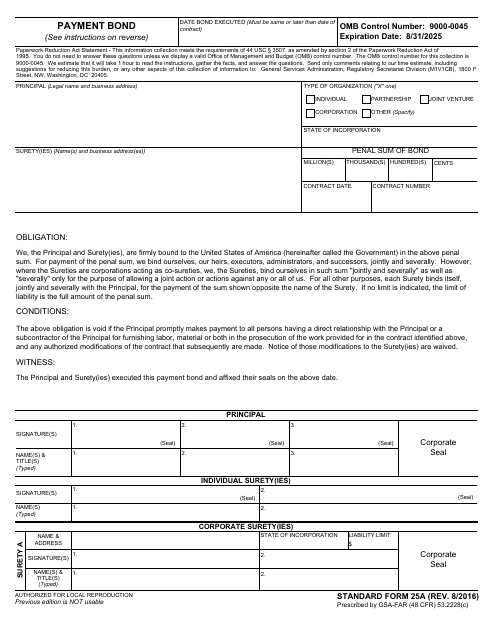

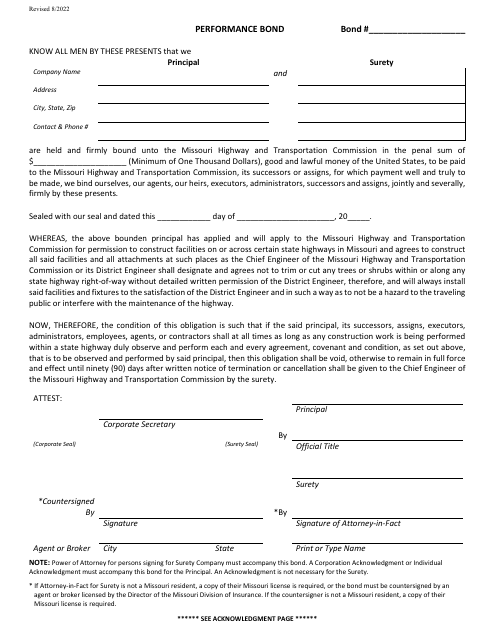

This document is used for submitting a payment bond for construction projects. It serves as a guarantee that contractors will pay subcontractors and suppliers for their work on the project.

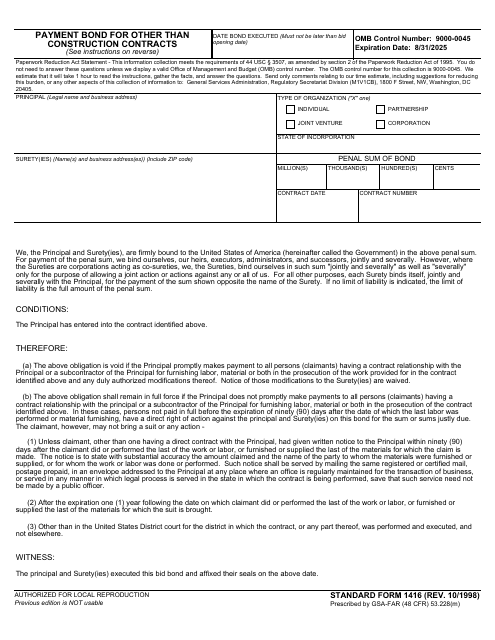

This form is used for payment bonds related to contracts that are not for construction purposes. The SF-1416 form ensures that the contractor is financially responsible for making payments to subcontractors and suppliers.

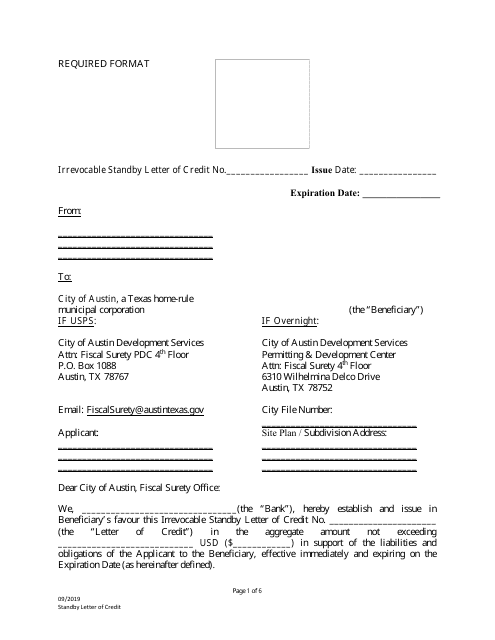

This type of document is used for a standby letter of credit issued by the City of Austin, Texas.