Income Property Templates

Are you looking to invest in income properties? Take advantage of the lucrative opportunities that income properties can offer by understanding the documentation involved. Income properties, also known as property income, are real estate investments specifically purchased with the intention of generating rental income or profit through resale.

Managing an income property portfolio requires careful analysis, research, and financial planning. To ensure the success of your investment, it's crucial to have accurate and comprehensive documentation. These documents serve a variety of purposes, such as assessing the value of the property, managing expenses, and complying with tax requirements.

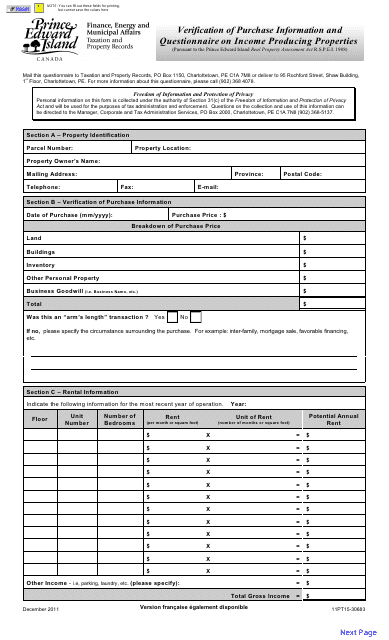

One essential document for income property owners is the Verification of Purchase Information and Questionnaire on Income Producing Properties. This form provides crucial details about the property's purchase, such as the purchase price and financing information. It helps establish the property's value and potential return on investment.

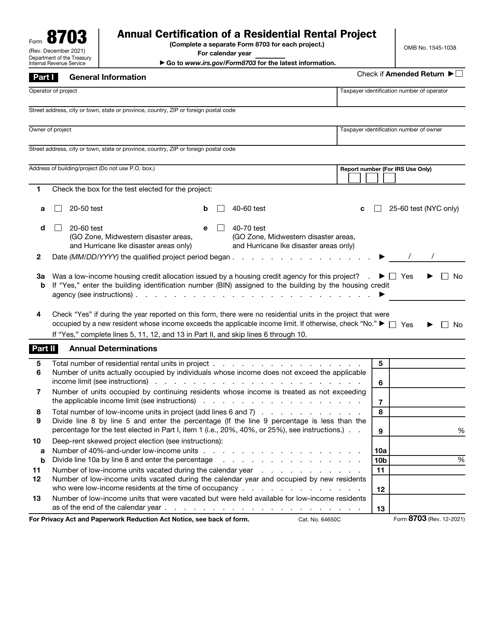

For tax purposes, you'll need to file an Annual Certification of a Residential Rental Project using IRS Form 8703. This form ensures compliance with tax regulations and verifies that your income property qualifies for certain tax benefits.

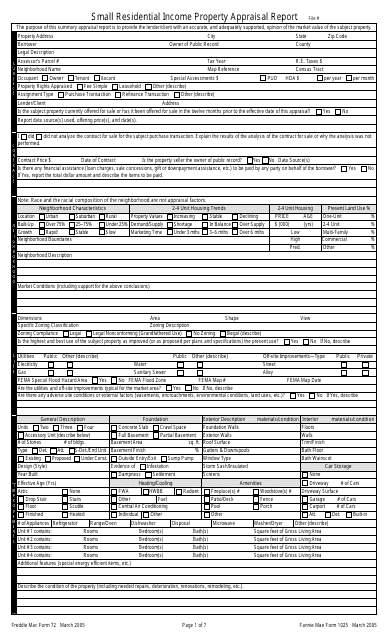

When it comes to appraising your income property, the Fannie Mae Form 1025 Small Residential Income Property Appraisal Report is often used. This report evaluates the property's value, condition, and potential rental income, providing valuable information for potential buyers or lenders.

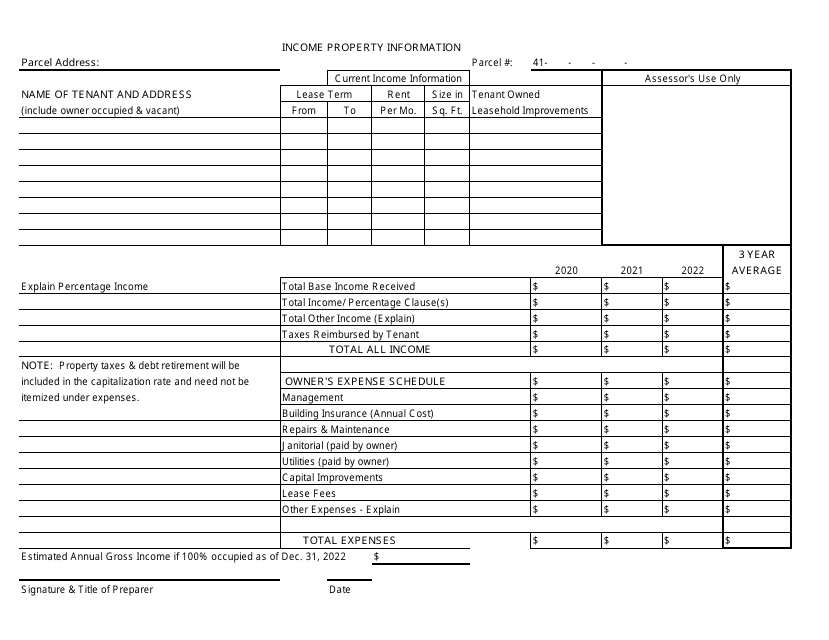

To keep track of expenses related to your income property, the Income Property Expense Worksheet for Assessor's Review is essential. This worksheet helps you itemize and calculate expenses such as maintenance, repairs, and property management costs. It offers a comprehensive overview of your property's financial performance and can be used for tax purposes or when seeking financing.

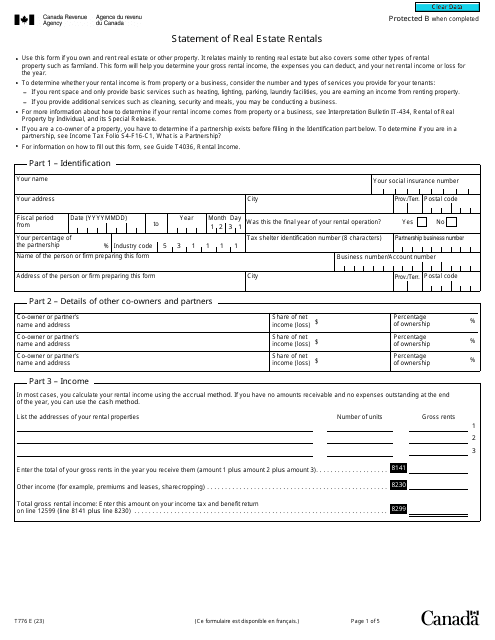

For Canadian income property owners, the Form T776 Statement of Real Estate Rentals is a must-have document. This form is required by the Canada Revenue Agency and allows you to report your rental income and claim eligible expenses, ensuring compliance with Canadian tax regulations.

Investing in income properties can be a profitable venture, but it requires careful management and documentation. Whether you're a seasoned investor or just starting, having the right paperwork is crucial for success. Ensure you have the necessary documentation to assess your property's value, manage expenses, and stay compliant with tax regulations. Trust the expertise of USA, Canada, and other countries document knowledge system to guide you through the intricacies of income property documentation.

Documents:

8

This form is used for verifying purchase information and gathering income-related details for properties in Prince Edward Island, Canada. It helps establish the accuracy of property purchase data and provides information on the income potential of the property.

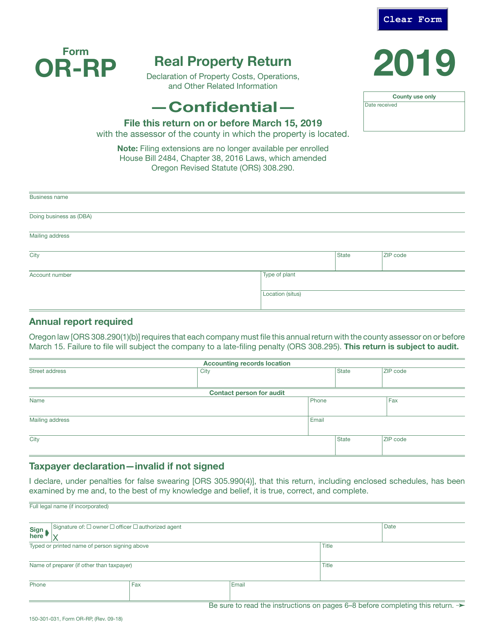

This form is used for filing a real property return in the state of Oregon. It is required by the Oregon Department of Revenue and must be completed by property owners to report their real estate holdings.

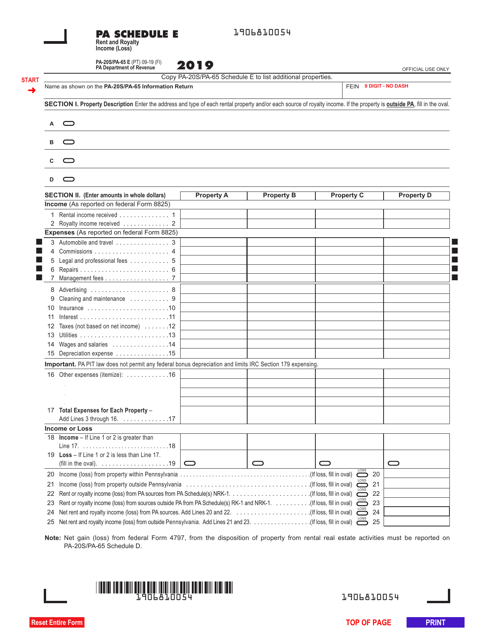

This form is used for reporting rental and royalty income or losses in the state of Pennsylvania. It is called Form PA-20S (PA-65) Schedule E.

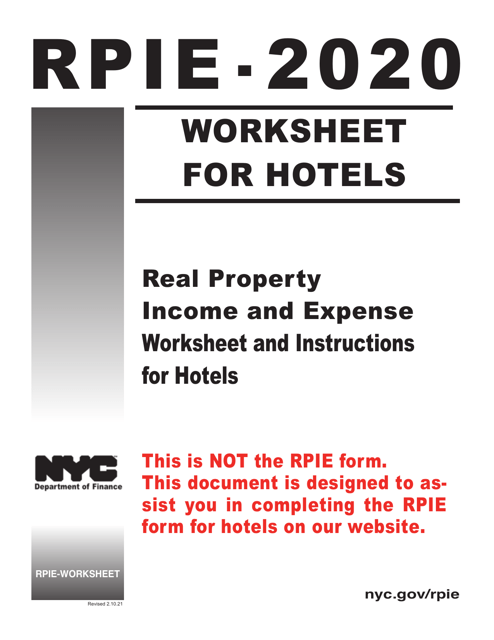

This document provides instructions for completing the Real Property Income and Expense (RPIE) Statement for hotels in New York City. The RPIE Statement is used to report income and expenses for the property. It is a requirement for hotel owners in the city.

This document is used to assess the value of a small residential income property. It is typically used by lenders to make informed decisions about loans related to such properties.

This document is used for reporting income and expenses related to a property in Grand Rapids, Michigan. It is used for assessment purposes by the city's assessor.