Income Tax Filing Templates

Are you looking for guidance on filing your income tax return? Look no further! We have a comprehensive collection of documents that will help you navigate the sometimes complex world of income tax filing. Our collection includes everything from state-specific tax forms to important questionnaires that determine your income tax nexus.

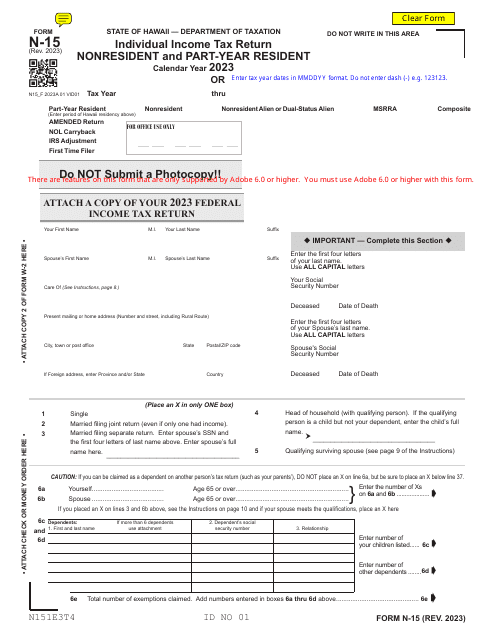

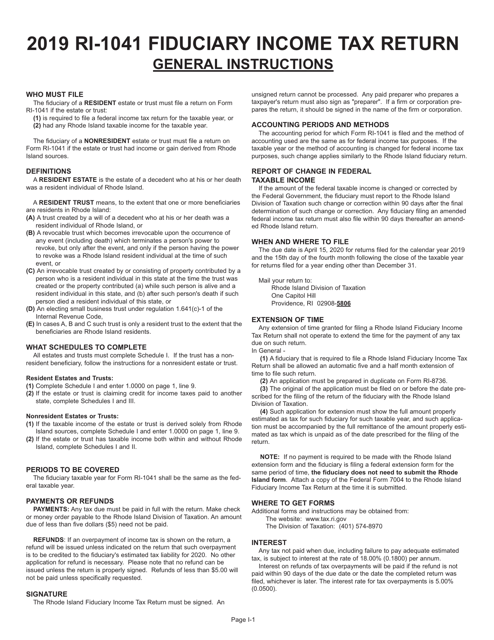

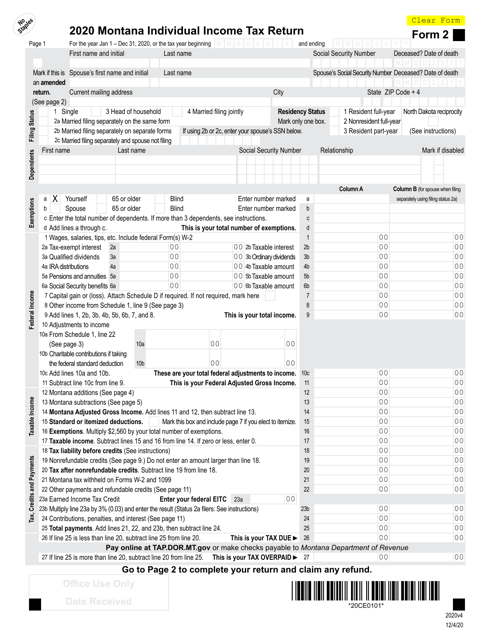

Whether you are a nonresident or a part-year resident, we have the appropriate forms for you to file your income tax return accurately and efficiently. For example, if you reside in Hawaii, you'll need to fill out Form N-15, which caters specifically to nonresidents and part-year residents. Similarly, if you call Montana home, Form 2 will be your go-to document for filing your individual income tax return.

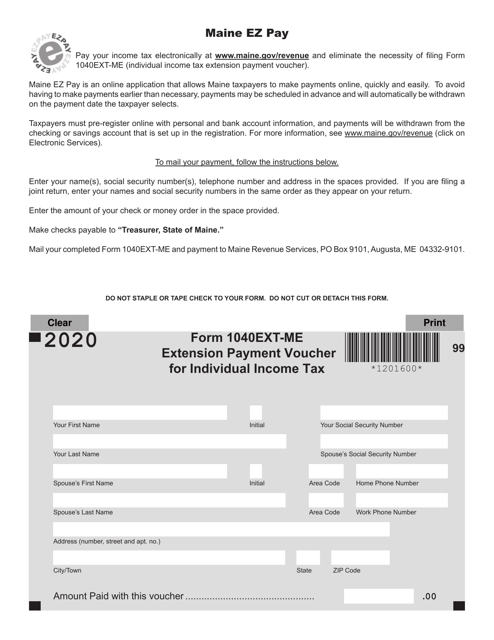

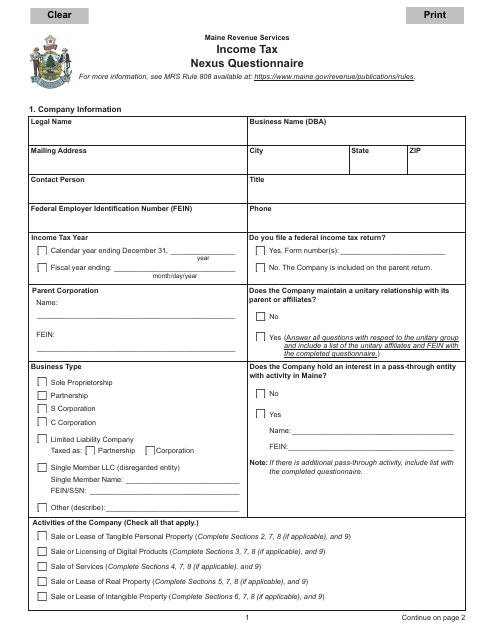

We understand that tax laws vary from state to state, which is why we have included documents from various jurisdictions. For North Carolina residents, Form D-400 will help you report your income and deductions accurately. And if you are a resident of Maine, the Income Tax Nexus Questionnaire is an important document to fill out to determine your tax liability.

We also cater to those who still prefer to file their income tax returns using paper filing methods. In Massachusetts, the Form EFO Personal Income Tax Declaration of Paper Filing is ideal for individuals who wish to file their taxes physically.

No matter your situation or residency, our expansive collection of income tax filing documents is here to guide you. With our easy-to-use forms and questionnaires, you can rest assured that your income tax return will be spot-on and compliant with the relevant state laws. Take the stress out of income tax filing and trust our documents collection to streamline the process for you. Start your tax preparations today and file your income tax return with confidence using our comprehensive collection of income tax filing documents.

Documents:

13

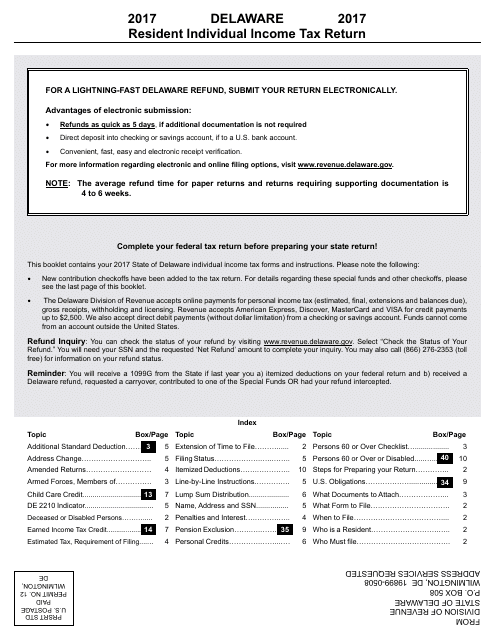

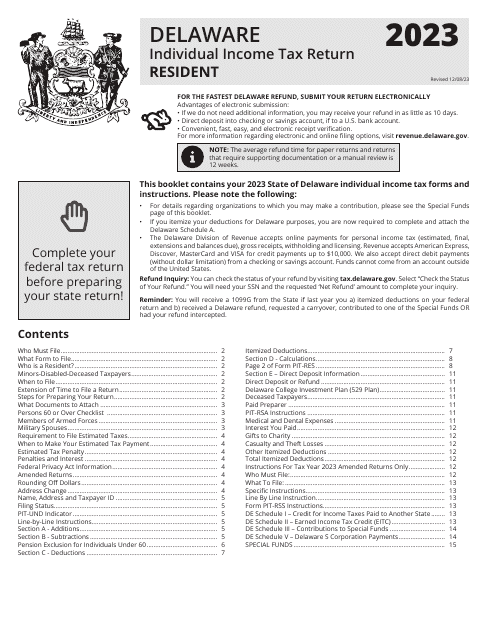

This Form is used for reporting and paying individual income taxes for residents of Delaware.

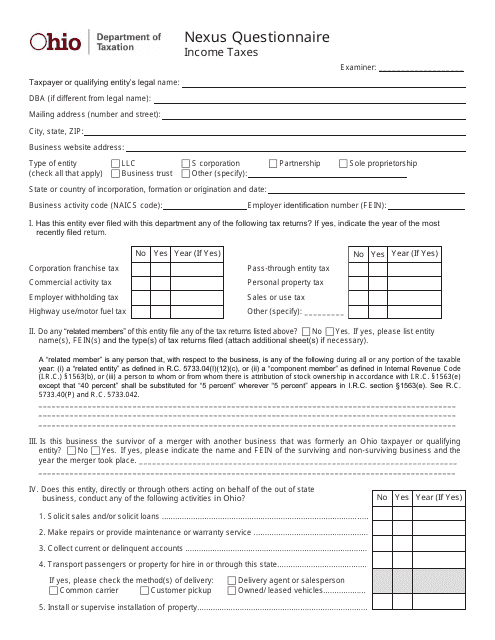

This document is a questionnaire specifically for Ohio residents to determine their income tax obligations. It helps individuals gather and provide the necessary information for completing their tax returns.