Shareholder Tax Templates

Are you a shareholder or part-owner of a company? Do you need to understand your tax obligations and responsibilities as a shareholder? Look no further! Our shareholder tax documents collection is the one-stop resource for all your shareholder tax needs.

We understand that navigating the complex world of tax can be challenging, especially when it comes to shareholder-specific tax requirements. That's why we have compiled a comprehensive collection of shareholder tax forms and instructions to simplify the process for you.

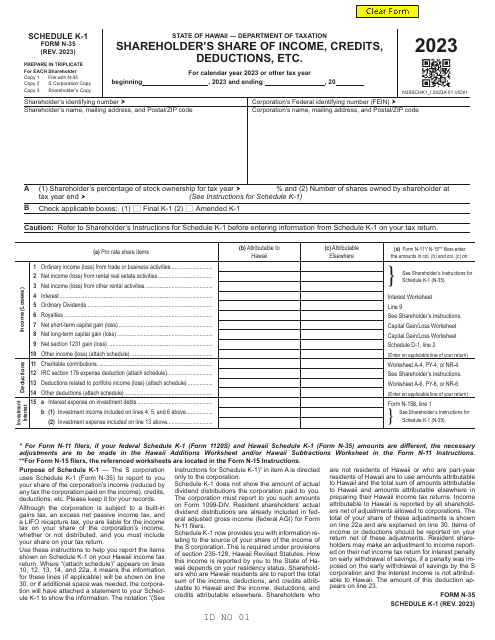

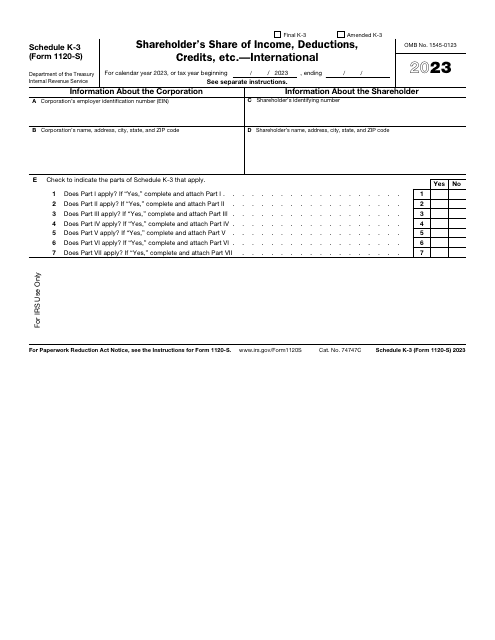

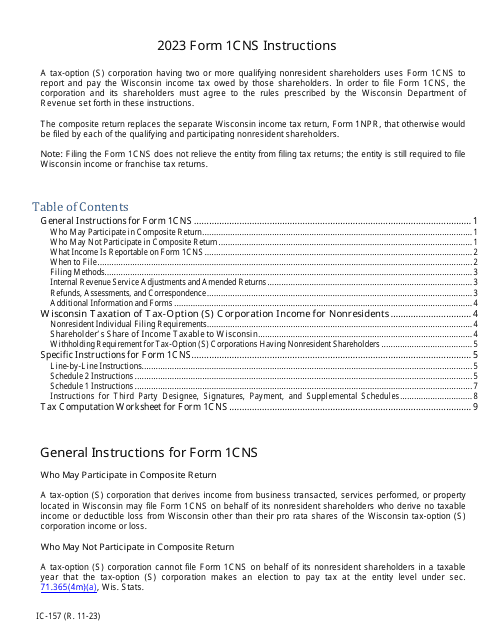

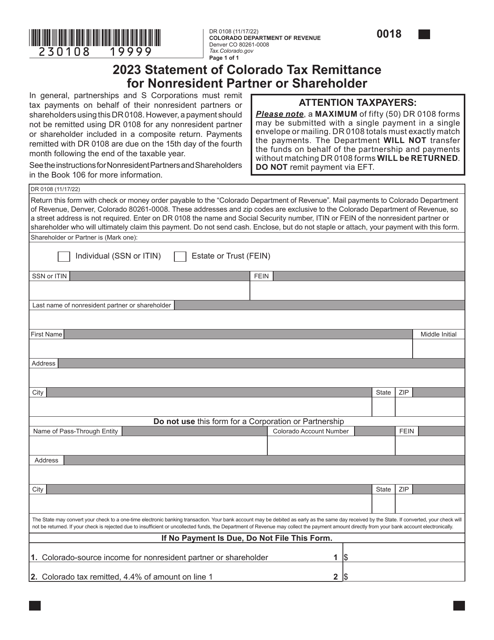

Whether you're a shareholder in Hawaii, an international shareholder, or a nonresident shareholder in Wisconsin or Colorado, we have the relevant tax forms and instructions to meet your specific needs. From Form N-35 Schedule K-1 for Shareholder's share of income, credits, deductions, and more in Hawaii, to Form DR0108 for nonresident partner or shareholder tax remittance in Colorado, our collection covers it all.

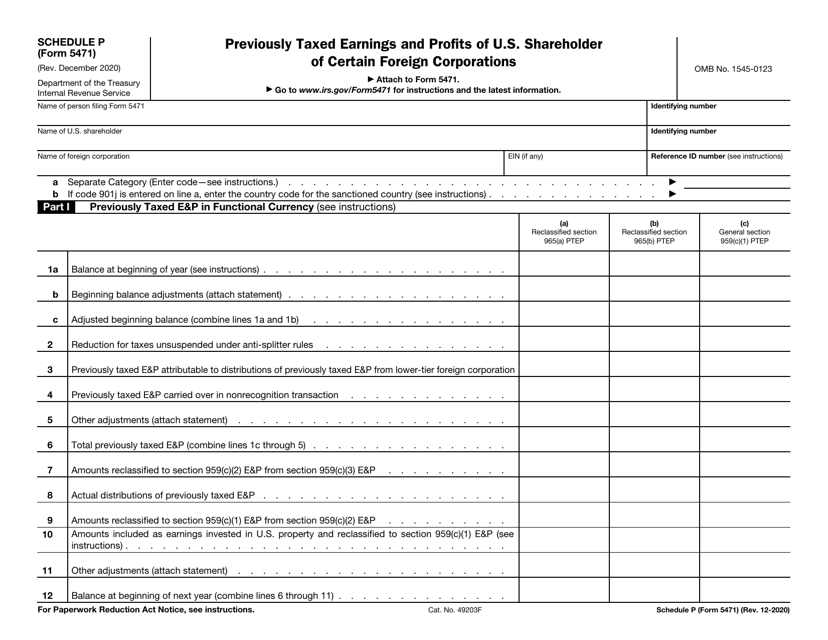

Our shareholder tax documents collection features various forms and schedules required for reporting your income, deductions, credits, and other tax-related information. We also provide detailed instructions to help you complete these forms accurately and efficiently.

Don't let shareholder tax obligations overwhelm you. With our shareholder tax documents collection, you can easily access the forms and instructions you need to fulfill your tax responsibilities. Simplify the process, save time, and ensure compliance by utilizing our comprehensive shareholder tax resources.

Discover the convenience and reliability of our shareholder tax documents collection today. Get started on your tax obligations as a shareholder with ease.

Documents:

5

This is a fiscal form filled out by S corporations to inform the tax authorities about their international operations that are subject to tax.