Tax Preparer Templates

Documents:

1288

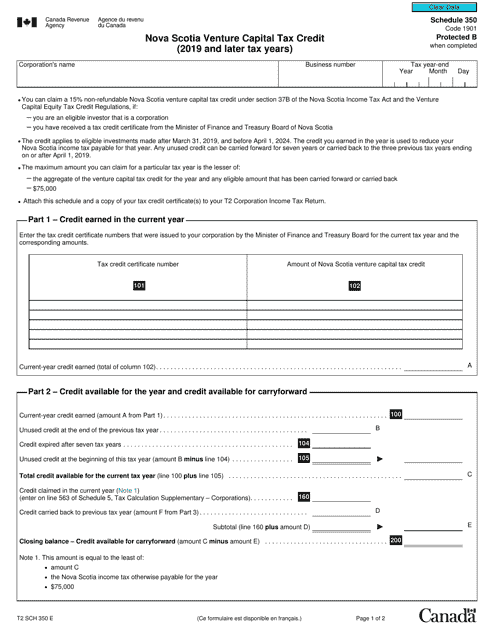

This form is used for claiming the Nova Scotia Venture Capital Tax Credit on the T2 corporate tax return for the 2019 and later tax years in Canada.

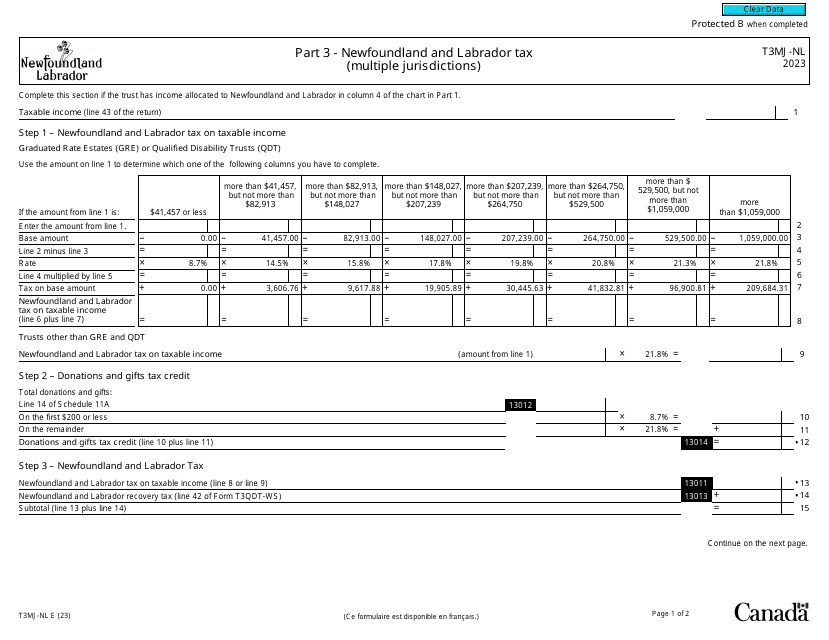

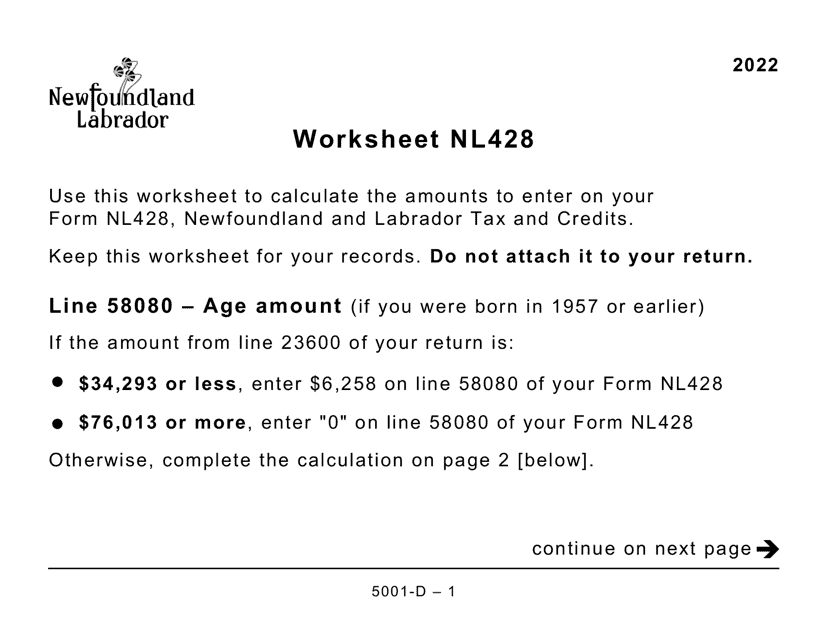

This Form is used for completing the Worksheet NL428 for residents of Newfoundland and Labrador in Canada. It is designed in large print format to assist those with visual impairments.

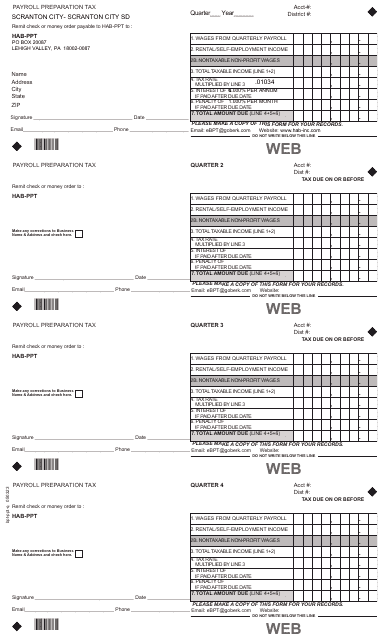

This form is used for preparing payroll and calculating taxes for employees in the City of Scranton, Pennsylvania.

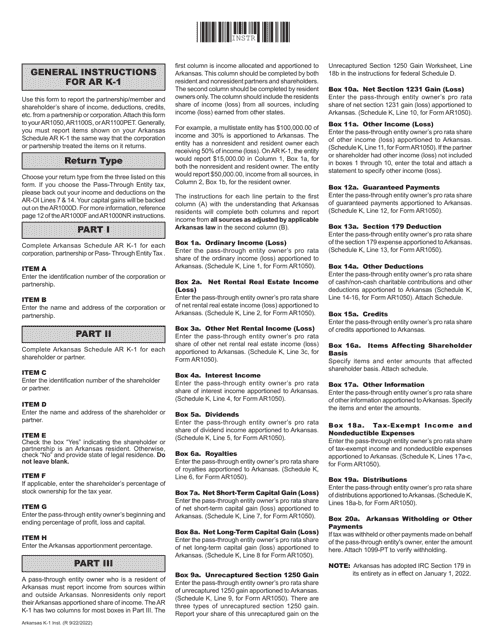

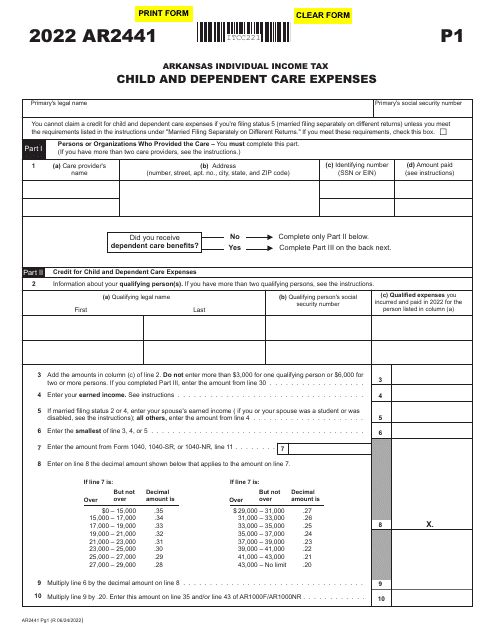

This form is used for reporting an individual's share of income, deductions, credits, and other financial information for tax purposes in the state of Arkansas.

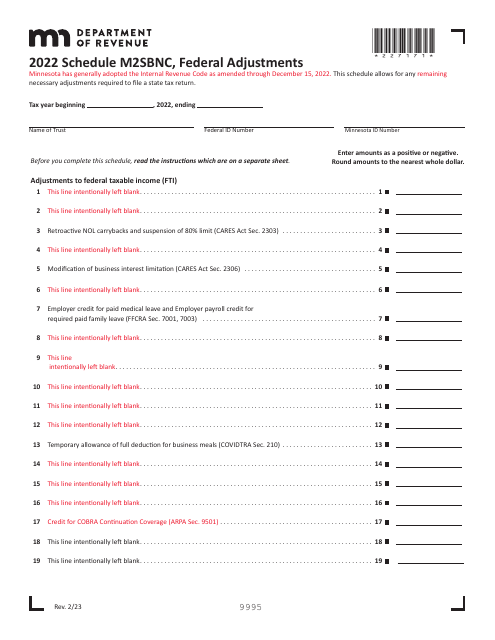

This document is used for reporting federal adjustments made on the Minnesota state tax return. It is specifically for businesses (M2SBNC) in Minnesota.

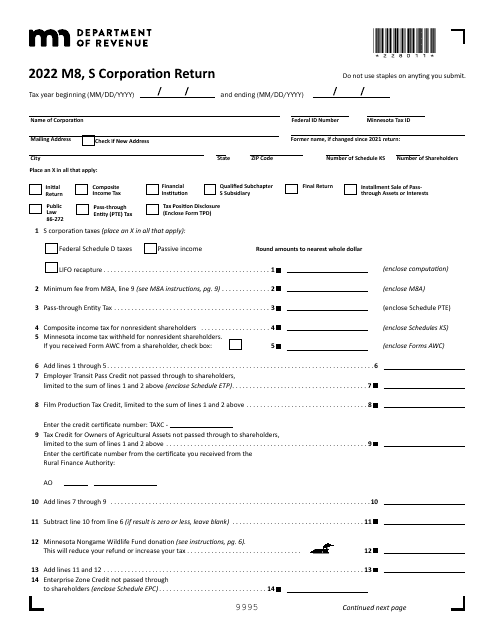

This form is used for filing the S Corporation tax return in the state of Minnesota.

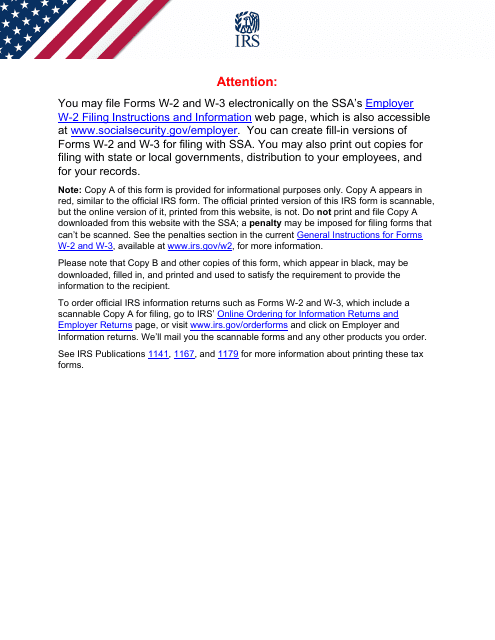

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.