Capital Property Templates

Capital Property Welcome to our webpage dedicated to capital property documentation. Whether you're in the USA, Canada, or other countries, understanding and complying with the regulations surrounding capital property is crucial. Our collection of documents provides you with the necessary information to handle capital property-related transactions and ensure compliance with tax laws.

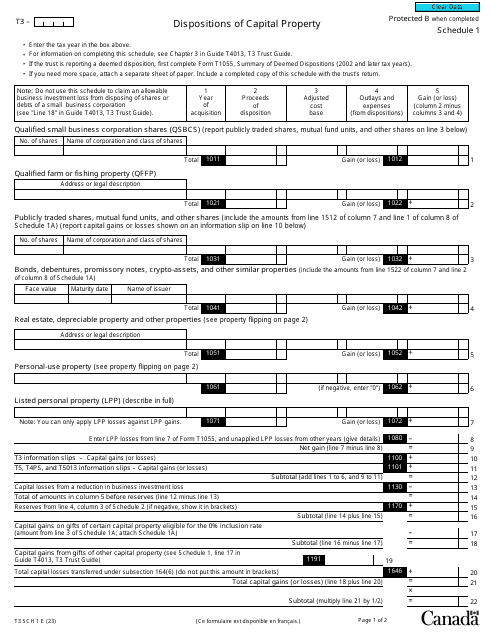

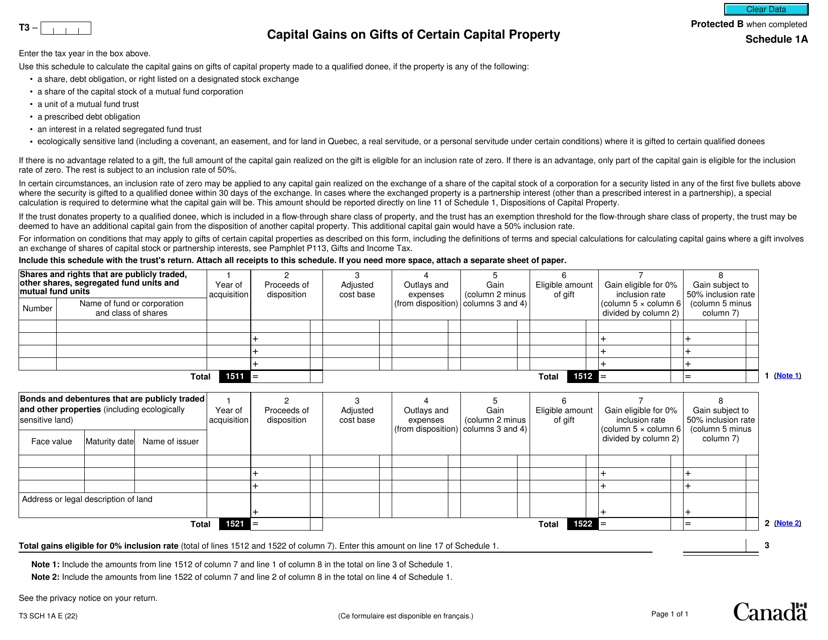

These documents cover a wide range of topics related to capital property, including dispositions, elections, and requests for certificates of compliance. They are designed to assist individuals, businesses, and non-residents in navigating the complexities of capital property transactions.

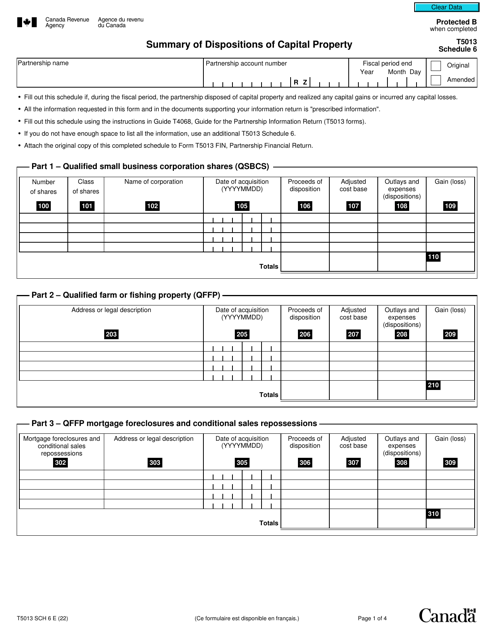

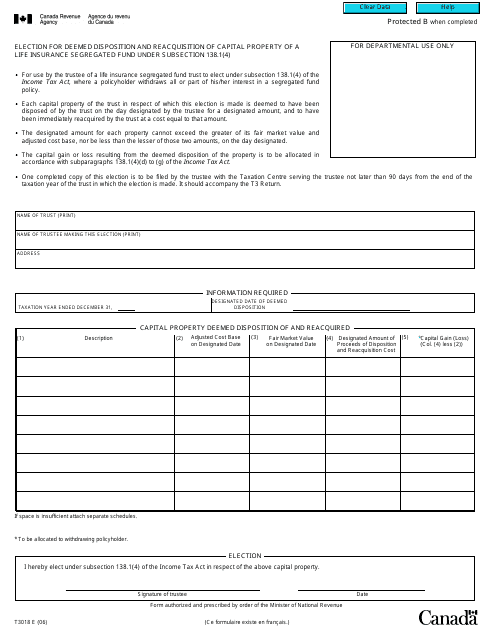

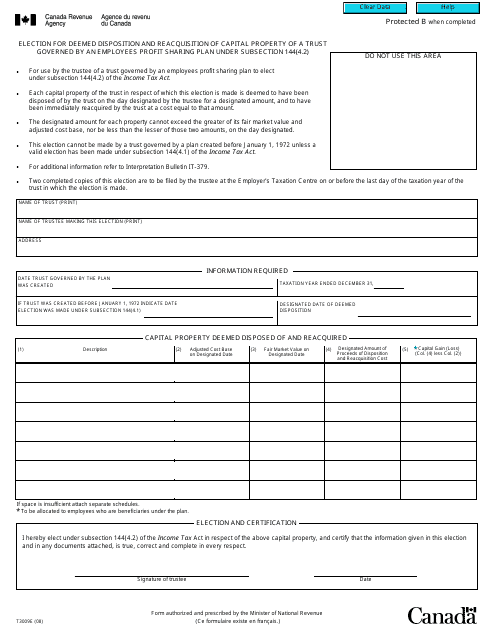

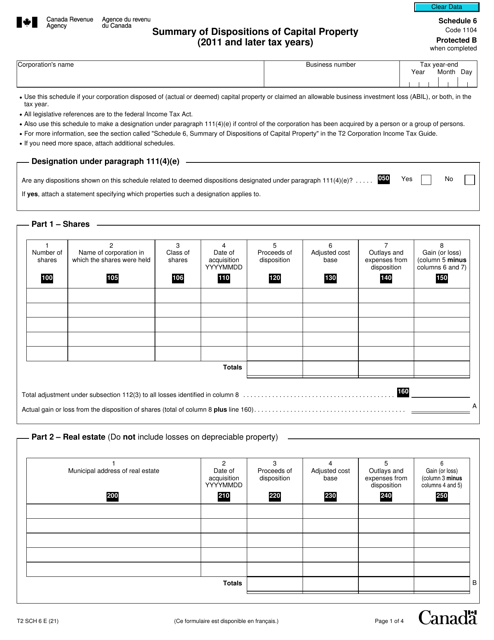

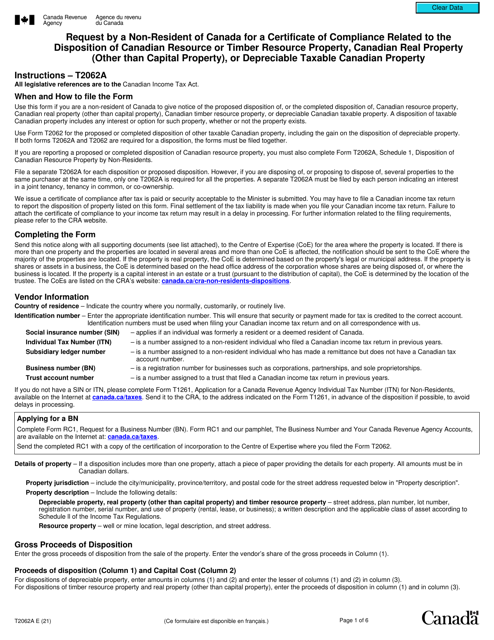

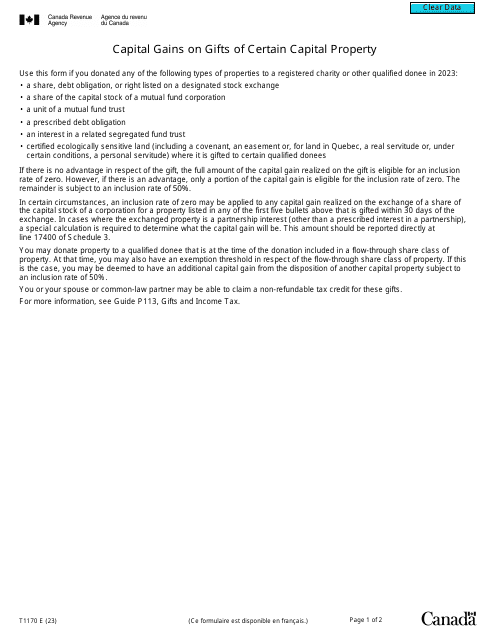

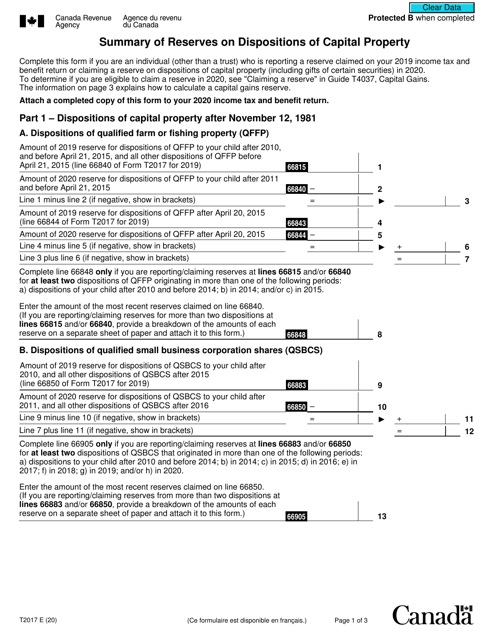

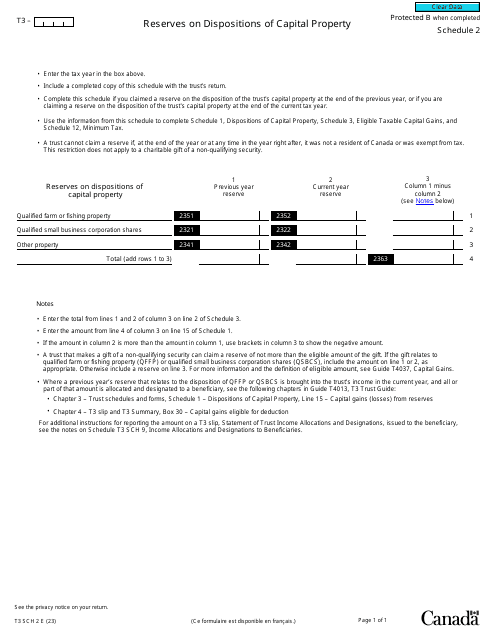

Our collection includes forms such as Form T5013 Schedule 6 Summary of Dispositions of Capital Property, Form T3018 Election Under Subsection 138.1(4) of the Deemed Disposition of Capital Property of a Life Insurance Segregated Fund, Form T2062A Request by a Non-resident of Canada for a Certificate of Compliance Related to the Disposition of Canadian Resource or Timber Resource Property, Canadian Real Property (Other Than Capital Property), or Depreciable Taxable Canadian Property, and Form T2 Schedule 6 Summary of Dispositions of Capital Property (2011 and Later Tax Years), among others.

By utilizing these documents, you can ensure that you are fulfilling your obligations and properly reporting capital property transactions. Stay compliant, save time, and avoid unnecessary penalties by accessing our comprehensive collection of capital property documents.

Trust our expertise and let our documents guide you through the intricacies of capital property. Explore our collection today and empower yourself with the knowledge needed to handle capital property transactions with ease.

Documents:

19

This Form is used for making an election under subsection 138.1(4) of the deemed disposition of capital property of a life insurance segregated fund in Canada.

This form is used for electing the deemed disposition and reacquisition of any capital property of an employee's profit sharing plan under subsection 144.(4.2) in Canada.

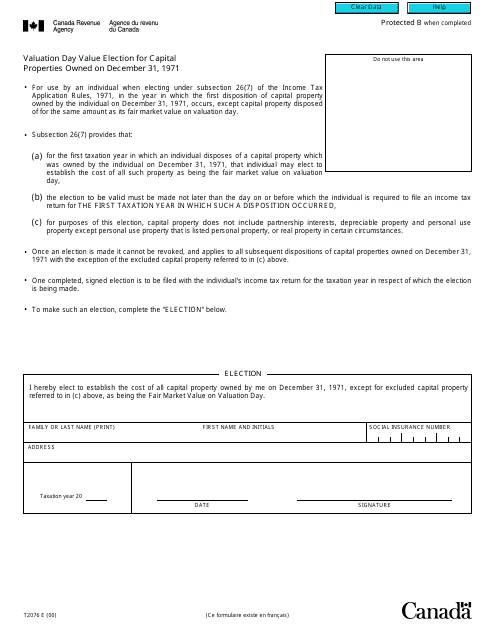

This form is used for electing the valuation day value of capital properties owned on December 31, 1971 in Canada. It is used for determining the cost base of these properties for tax purposes.