Tax Statement Templates

Documents:

109

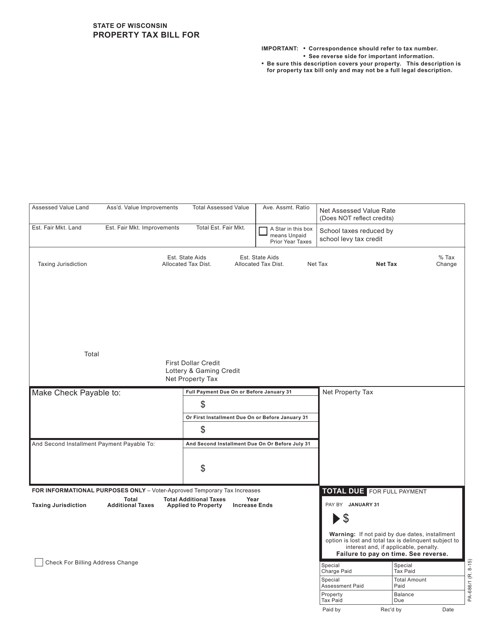

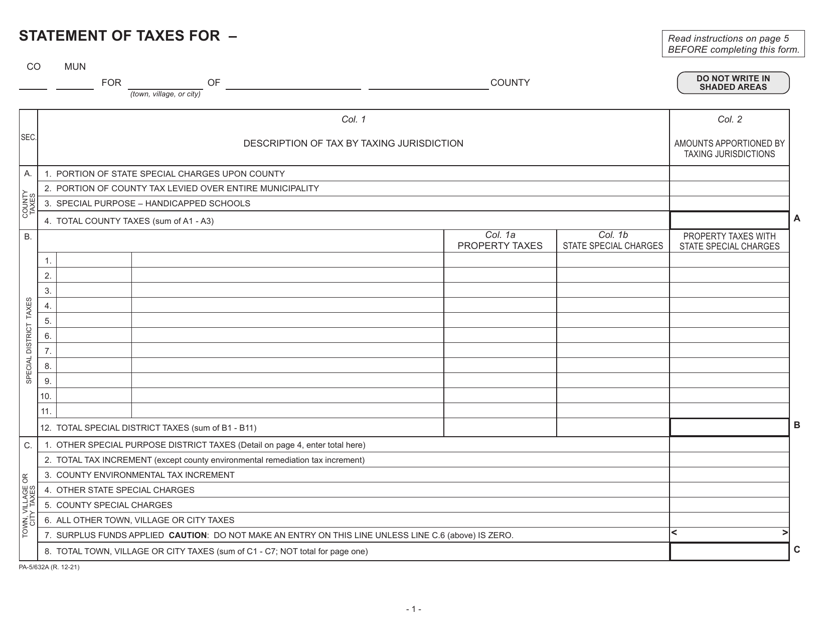

This form is used to send property tax bills to residents in Wisconsin.

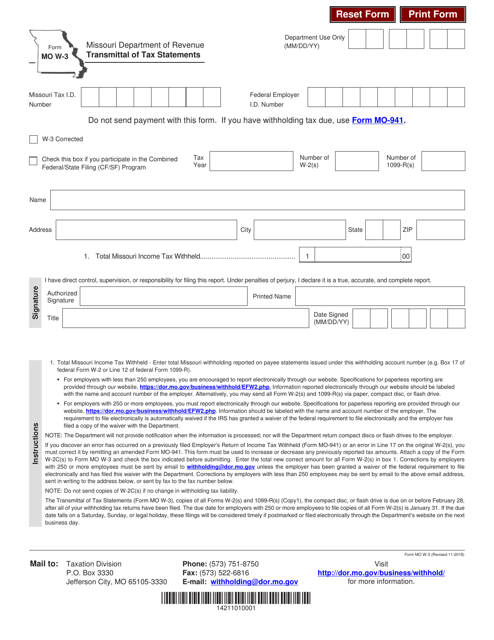

This form is used for transmitting tax statements to the state of Missouri.

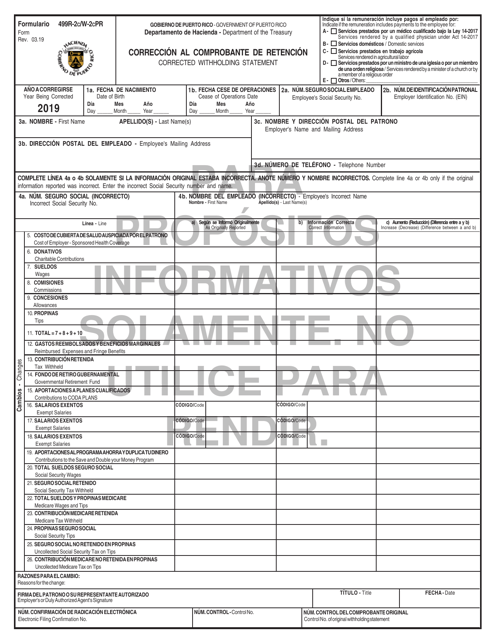

This Form is used for submitting corrected withholding statements for Puerto Rico in both English and Puerto Rican Spanish.

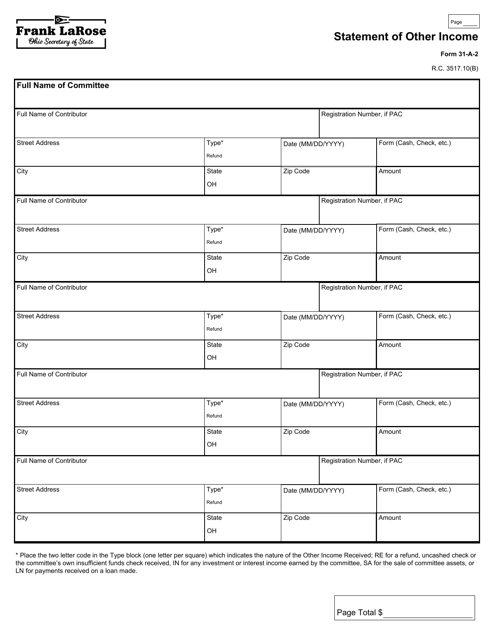

This form is used for reporting other sources of income in the state of Ohio.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

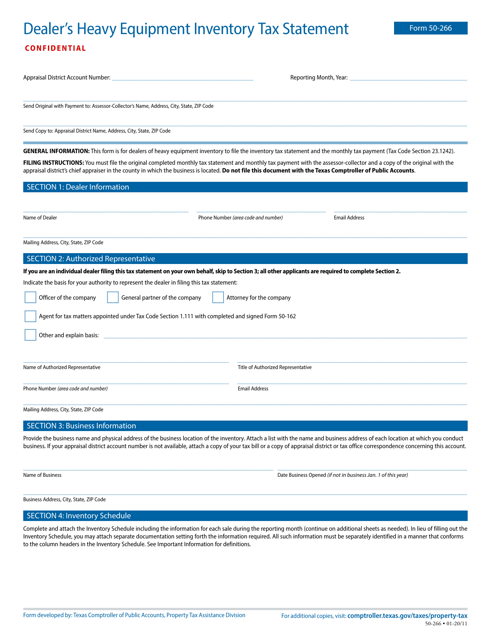

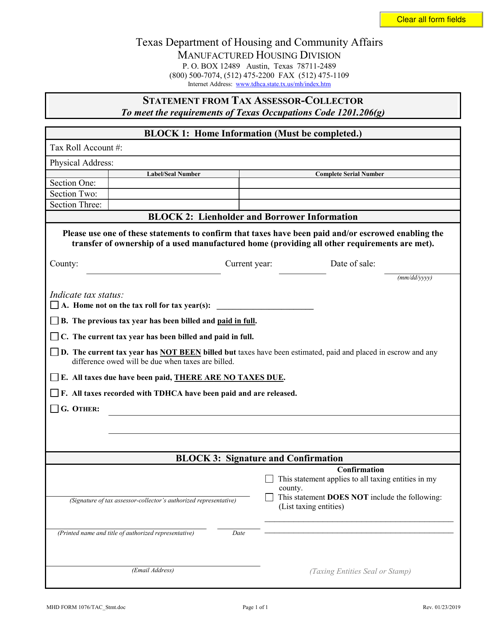

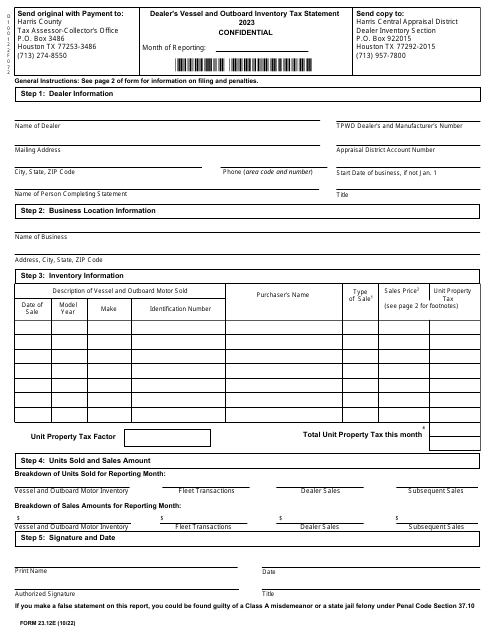

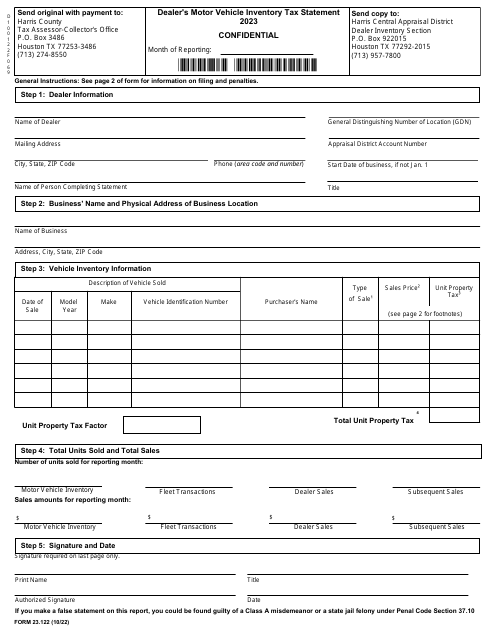

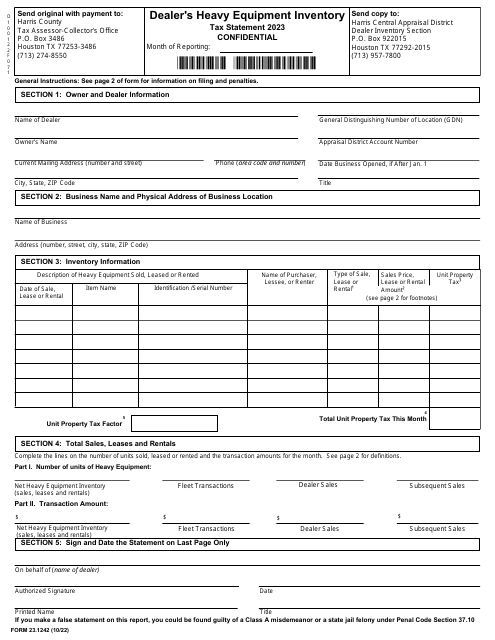

This Form is used for tax assessors and collectors in Texas to provide a statement of their taxes.

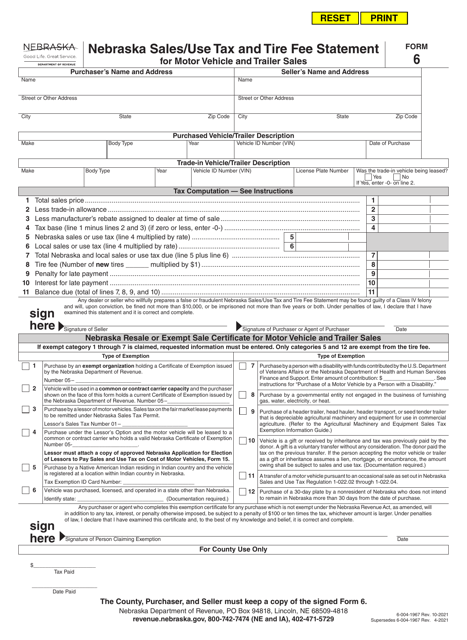

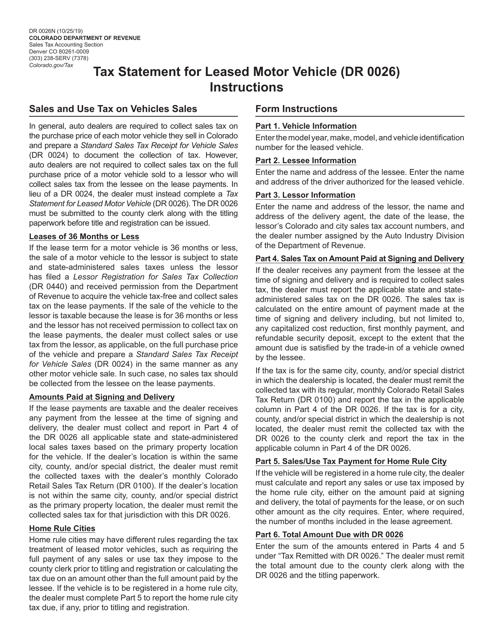

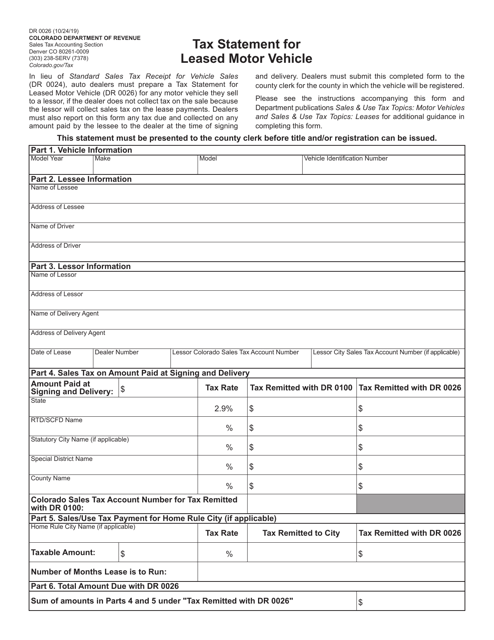

This document is used for reporting leased motor vehicle expenses on your tax statement in Colorado.

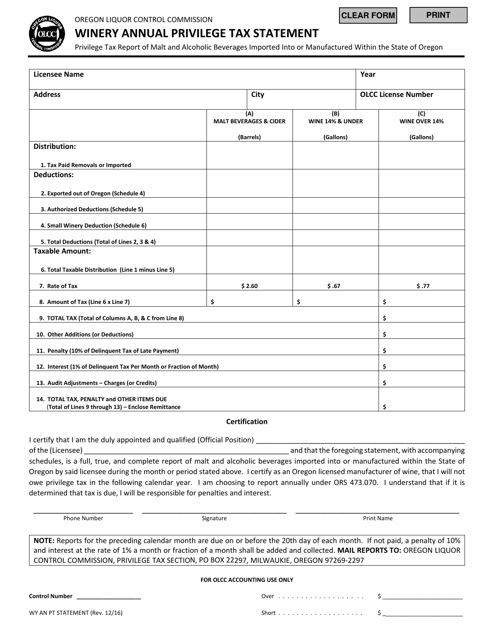

This document is used for reporting and paying the annual privilege tax for wineries in Oregon.

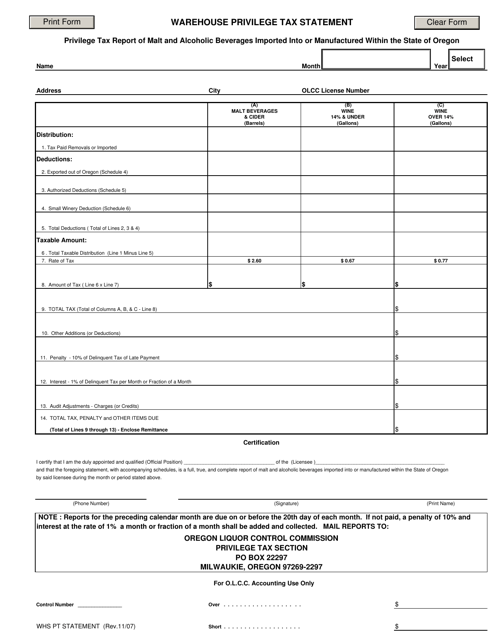

This document is used for reporting and paying the Warehouse Privilege Tax in the state of Oregon.

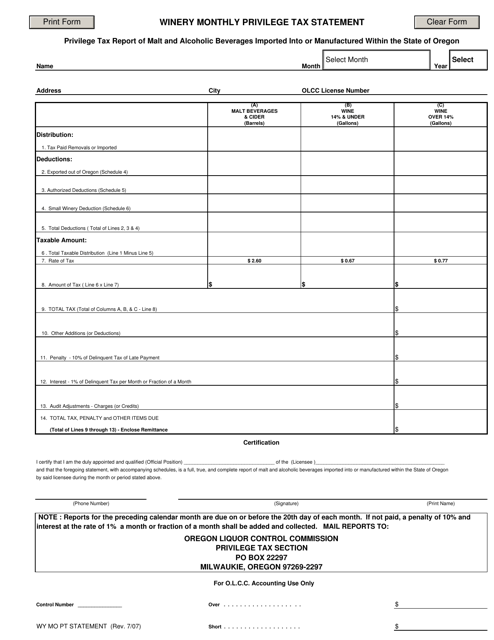

This document is used for reporting and paying monthly privilege tax for wineries in Oregon.

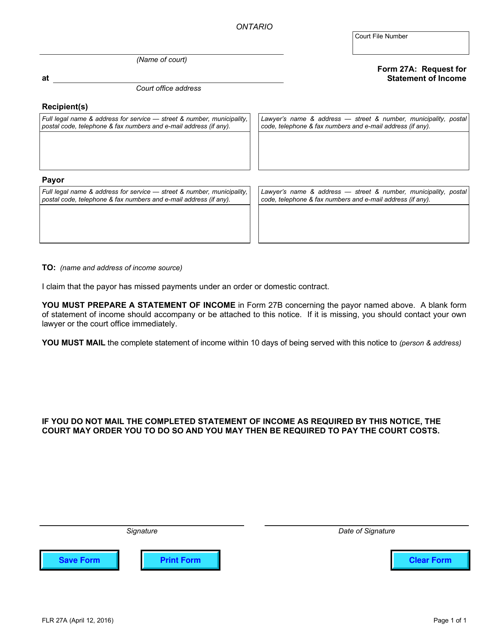

This form is used for requesting a statement of income in the province of Ontario, Canada. It is necessary to fill out this form when you need to obtain an official record of your income for various purposes, such as applying for loans or government assistance programs.

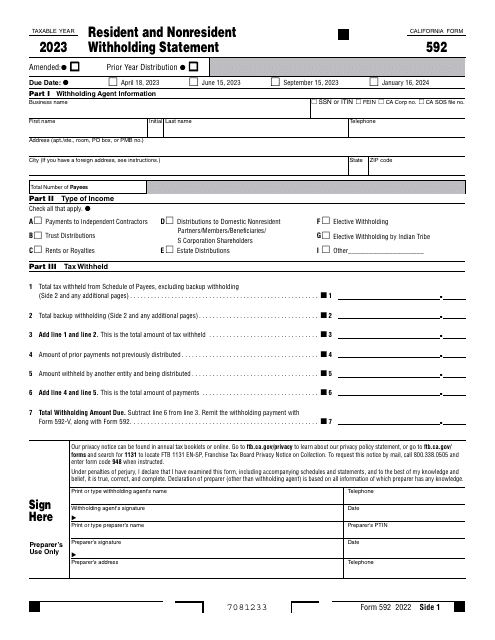

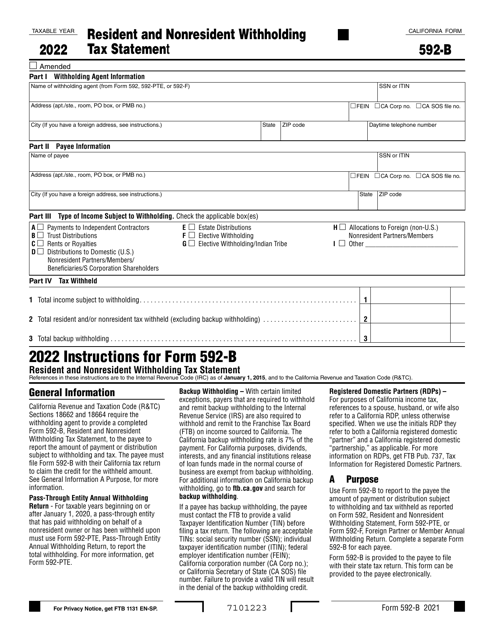

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.