Payroll System Templates

A payroll system, also known as a payrolling system, is an essential tool for efficiently managing and processing employee payments. This system streamlines the entire payroll process, from calculating wages and deductions to issuing payments and generating reports.

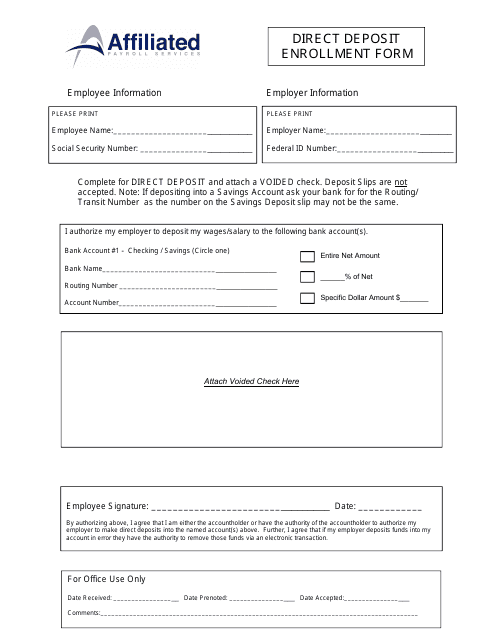

With a payroll system in place, organizations can ensure accurate and timely payments to their employees, reducing errors and saving time. These systems typically include features such as automated calculation of taxes and withholdings, direct deposit capabilities, and the ability to generate detailed reports for auditing and record-keeping purposes.

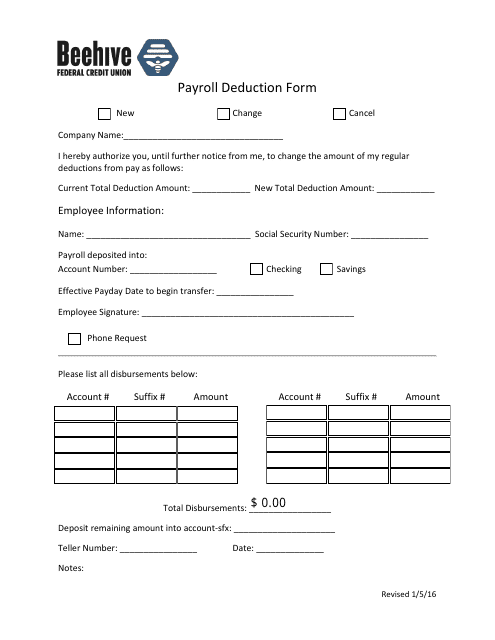

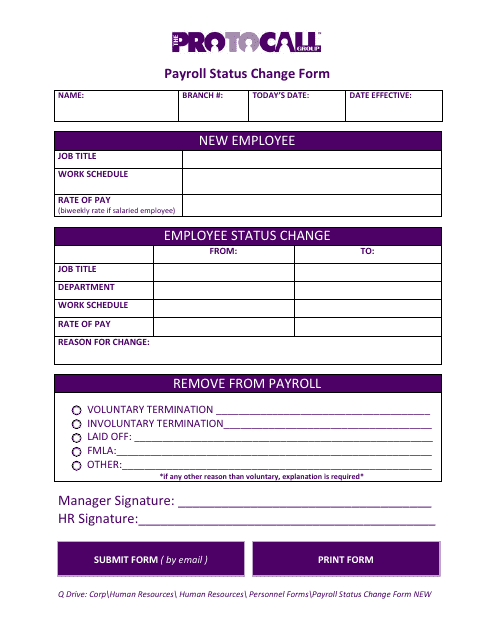

One example of a document within a payroll system is the Payroll Deduction Form, which allows employees to authorize deductions from their paychecks for benefits or other purposes. Another example is the Payroll Status Change Form, which is used to update employee information such as changes in employment status or tax withholdings.

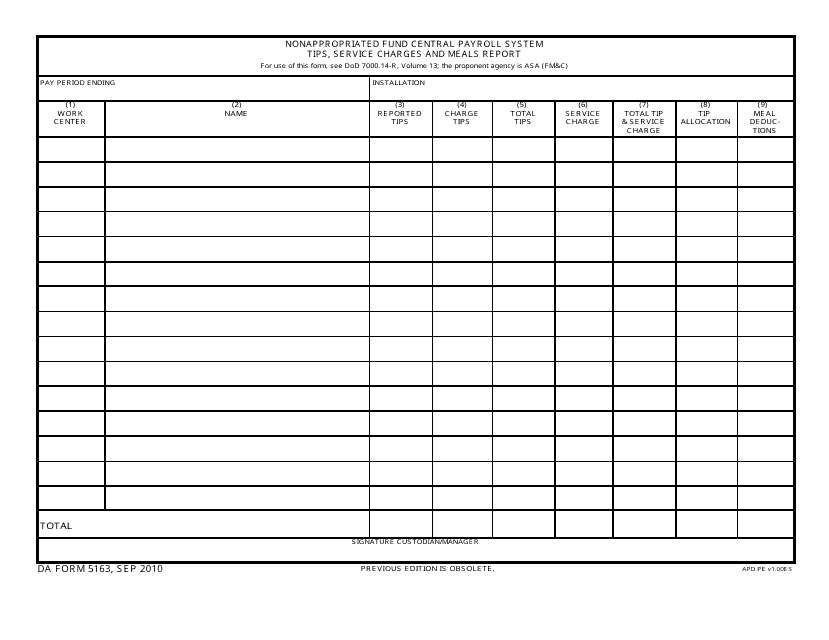

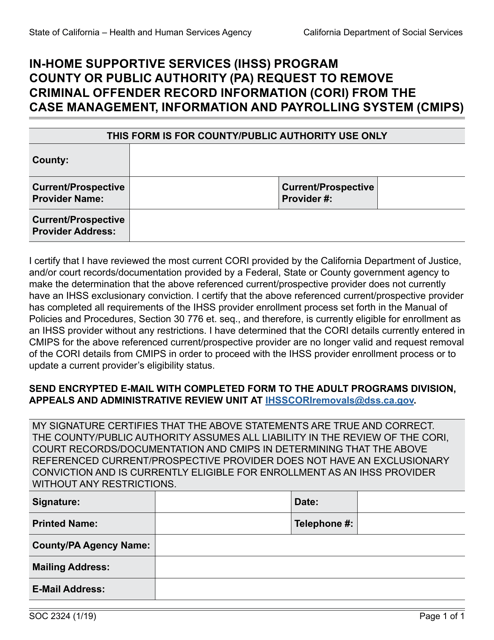

In addition, government agencies may use specialized documents within their payroll systems. For instance, the DA Form 5163 is used by non-appropriated fund employees to report tips, service charges, and meals. On the other hand, the Form SOC2324 is utilized in California's In-home Supportive Services (Ihss) Program to request the removal of criminal offender record information from the Case Management, Information, and Payrolling System (Cmips).

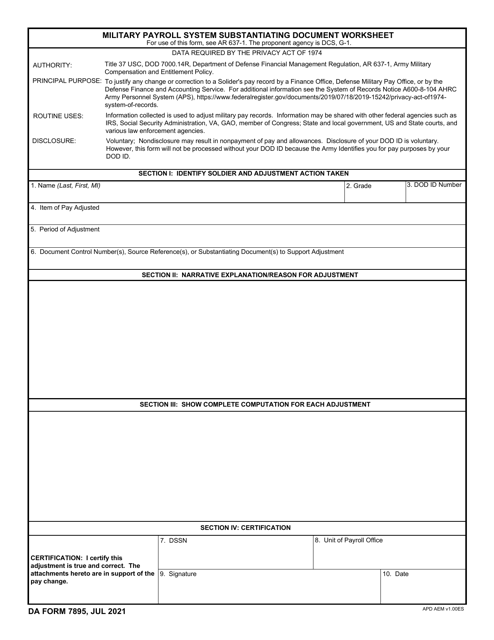

Furthermore, the DA Form 7895 is utilized in military payroll systems to substantiate various payroll transactions and calculations.

To streamline your organization's payroll process and ensure accurate and efficient payment management, consider implementing a reliable and robust payroll system or payrolling system.

By utilizing a payroll system, you can reduce manual errors, save time, and ensure compliance with regulations. Whether you run a small business or a large corporation, a payroll system is crucial for maintaining an organized and efficient payroll process.

Documents:

7

This form is used for authorizing payroll deductions for Beehive Federal Credit Union.

This Form is used for making changes to an employee's payroll status.

This Form is used for enrolling in direct deposit with Affiliated Payroll Services to receive payment electronically.

This Form is used for reporting tips, service charges, and meals in the Nonappropriated Fund Central Payroll System.

This Form is used for requesting the removal of Criminal Offender Record Information (CORI) from the Case Management, Information and Payrolling System (CMIPS) in California's In-home Supportive Services (IHSS) Program, specifically for County or Public Authority (PA) cases.

This document is used for managing and processing military payroll. It serves as a worksheet to substantiate and validate payroll transactions.

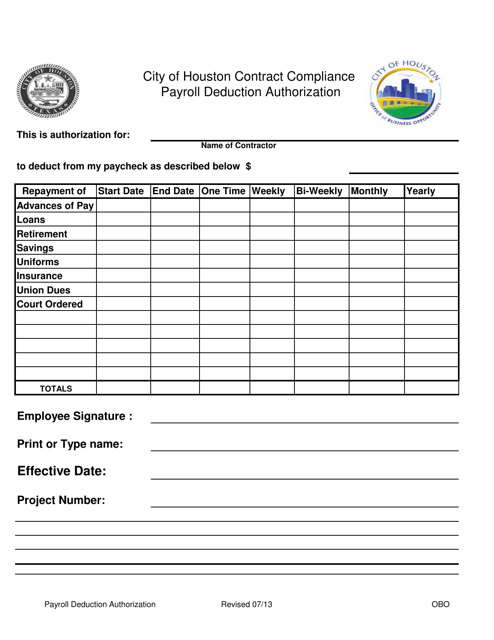

This document is used for authorizing payroll deductions for employees of the City of Houston, Texas. It allows employees to designate a portion of their salary to be deducted for various purposes such as benefits, taxes, or charitable contributions.