Allocated Tips Templates

Allocated Tips (Alternate names: Tip Allocation or Tips Allocation)

Are you an employer or employee in the service industry? If so, you may need to familiarize yourself with allocated tips, also known as tip allocation or tips allocation.

Allocated tips refer to the process of distributing tips among employees in a fair and equitable manner. These tips can include cash tips, credit card tips, and any other gratuities given by customers. Allocated tips are an important aspect of the service industry, ensuring that all employees receive their fair share of the tips earned.

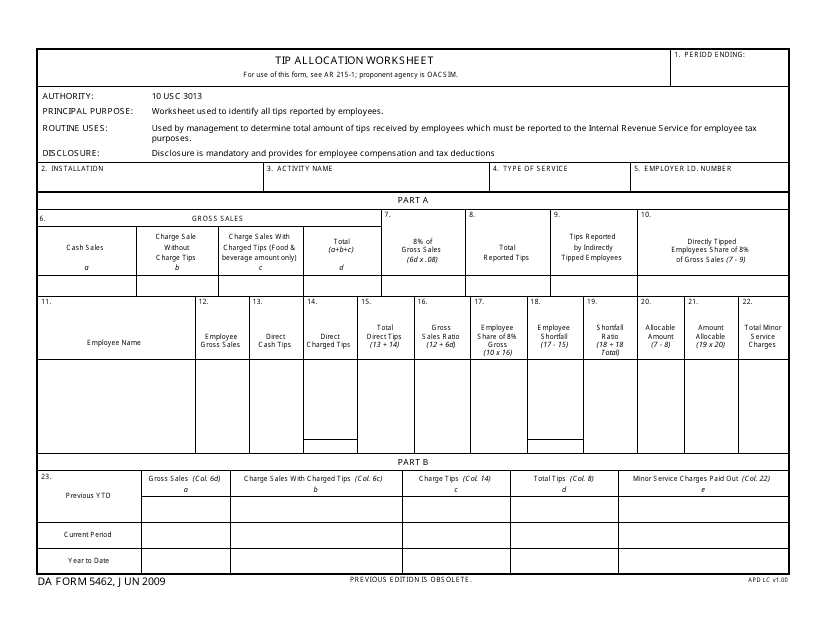

To properly manage allocated tips, there are various documents that may be necessary to complete. For example, employers may need to use the DA Form 5462 Tip Allocation Worksheet to calculate and allocate tips among their employees accurately.

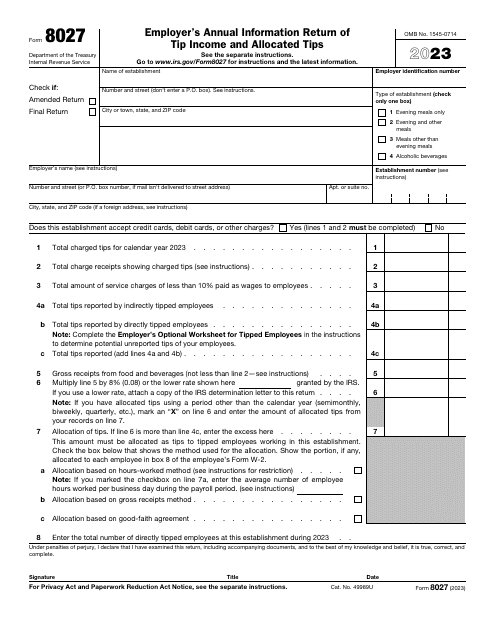

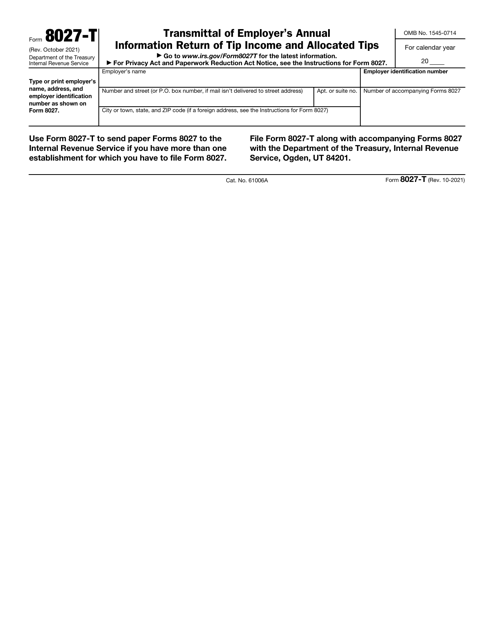

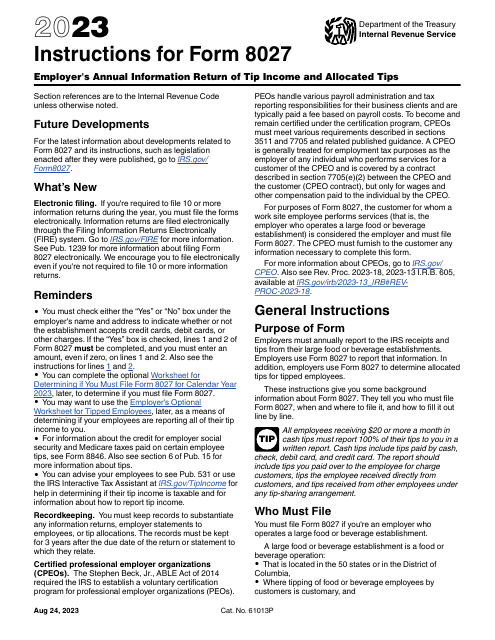

Additionally, employers are required to file the IRS Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips. This form provides the IRS with detailed information about the tip income earned by employees and the allocated tips distributed to them. Employers may also need to submit the IRS Form 8027-T, which is the transmittal form for the Employer's Annual Information Return.

To ensure that you correctly fill out these forms, it is essential to understand the instructions provided by the IRS. The Instructions for IRS Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips will guide you through the process, explaining the various sections and requirements.

By utilizing these allocated tip documents and following the guidelines set by the IRS, employers can accurately allocate tips among their employees and employees can ensure they receive their fair share of the gratuities earned. Stay in compliance with the regulations and streamline your tip allocation process by utilizing these essential allocated tip documents.

Documents:

16

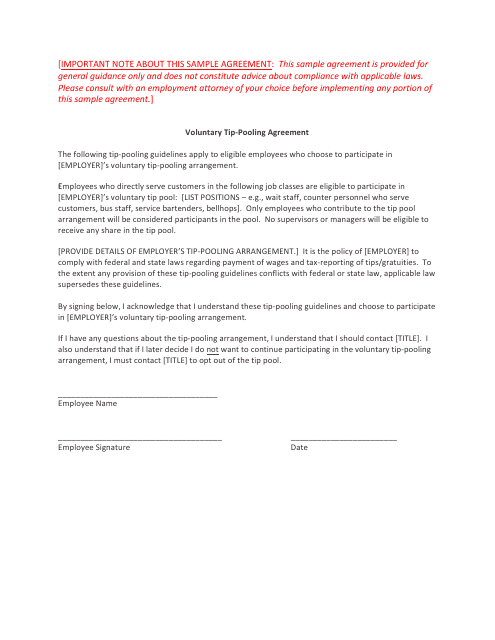

This document is a template for a voluntary tip-pooling agreement, which outlines the guidelines and rules for employees to voluntarily share their tips with each other. It helps employers and employees establish a fair system for distributing tips among the staff.

This form is used for calculating and allocating tips among employees in the military.

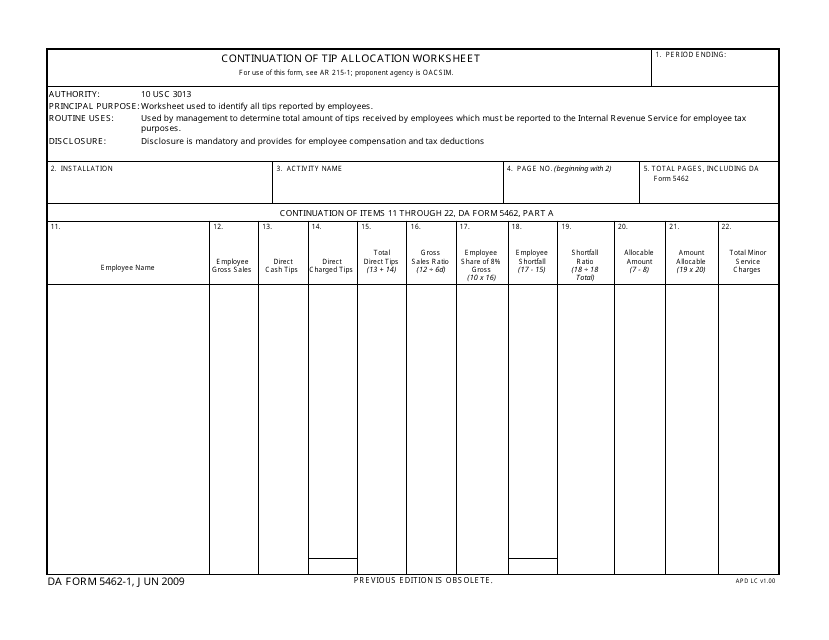

This form is used for continuing the process of tip allocation worksheet for DA Form 5462-1.

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.