Corporate Tax Credits Templates

Are you a company looking to maximize your tax savings? Look no further than our comprehensive collection of corporate tax credits. Whether you call them corporate tax credits, corporate tax credit, or corporation tax credits, we have all the information you need to claim these valuable incentives.

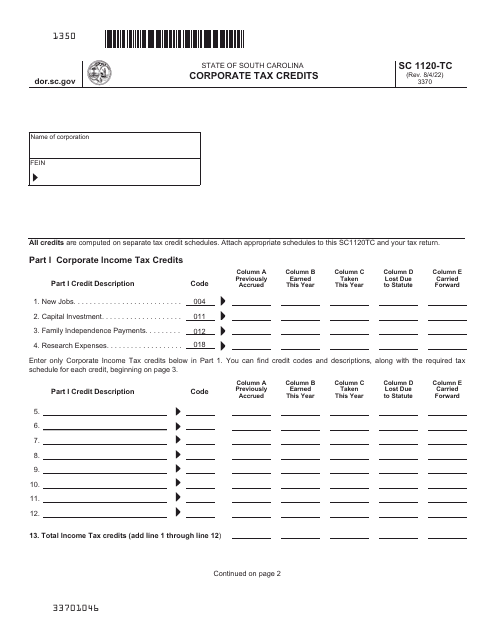

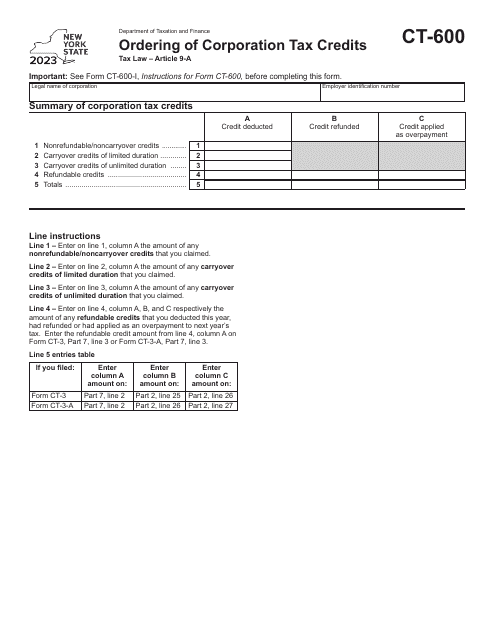

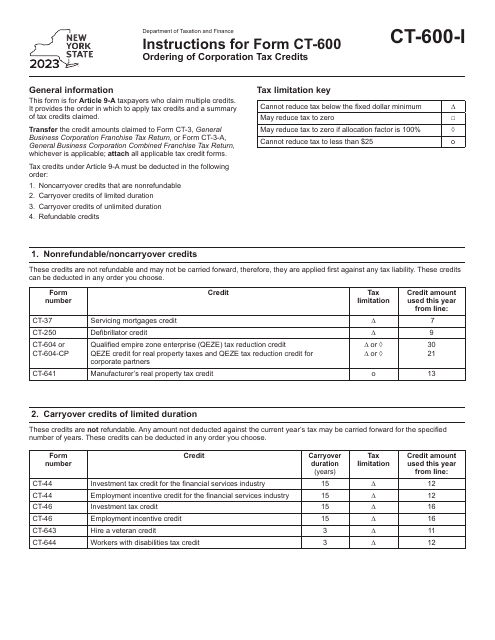

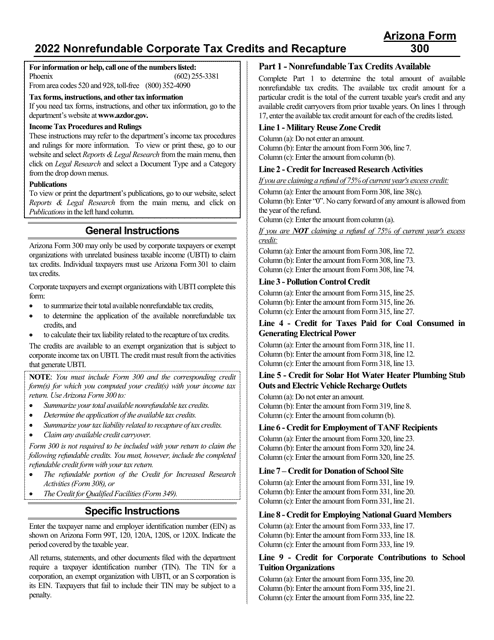

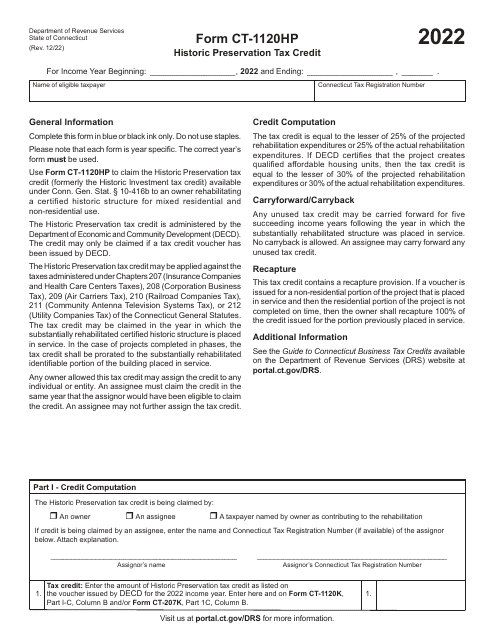

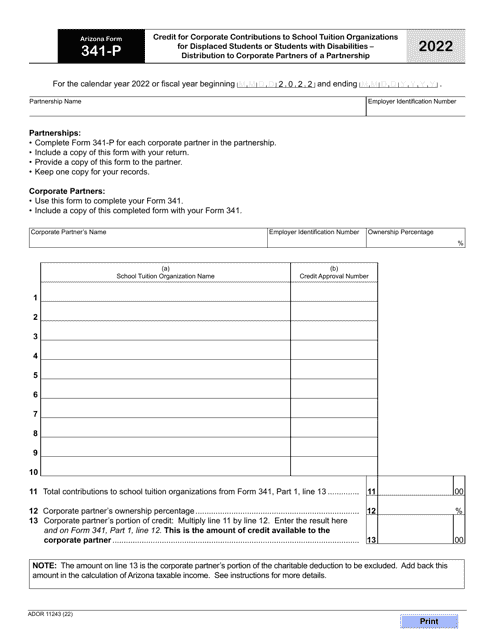

Our database includes a wide range of documents related to corporate tax credits from various states across the country. For instance, we provide the Form SC1120-TC Corporate Tax Credits for South Carolina, as well as the Instructions for Form CT-600 Ordering of Corporation Tax Credits for New York. We also have instructions for Arizona Form 300, which covers nonrefundable corporate tax credits and recapture in Arizona, and Arizona Form 341-P, which focuses on the credit for corporate contributions to school tuition organizations for displaced students or students with disabilities.

Don't let the complexities of corporate tax credits overwhelm you. With our specialized collection of documents, you can navigate the world of tax savings with ease. Whether you're a large corporation or a small business, these credits can make a significant impact on your bottom line.

Take advantage of the various corporate tax credits available to you. Our website is your one-stop shop for all the information and resources you need to understand and claim these credits. Start maximizing your tax savings today!

Documents:

14

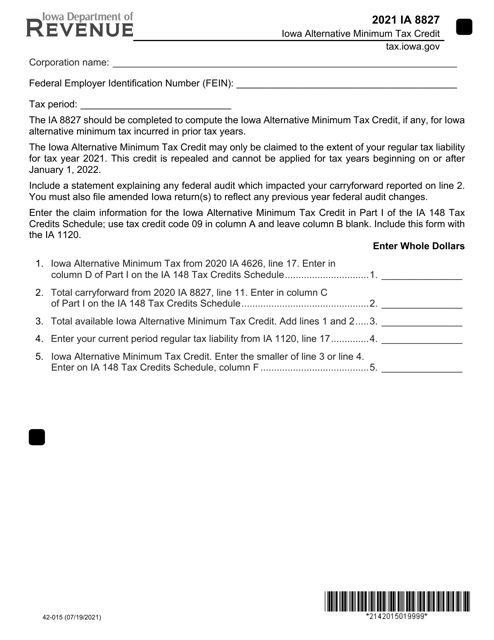

This form is used for claiming the Corporate Iowa Alternative Minimum Tax Credit in Iowa.