Non Earnings Garnishment Templates

Are you facing non-earnings garnishment and need assistance with the necessary paperwork? Our webpage, dedicated to non-earnings garnishment, is here to help.

Non-earnings garnishment, also known as non-earnings attachment or non-earnings levy, refers to the process of collecting a debt by seizing a portion of a debtor's income or assets other than their wages or salary. This legal procedure allows creditors to recover the money owed to them.

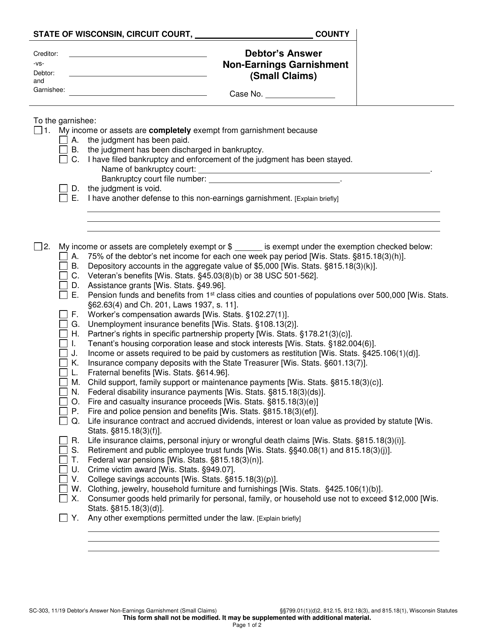

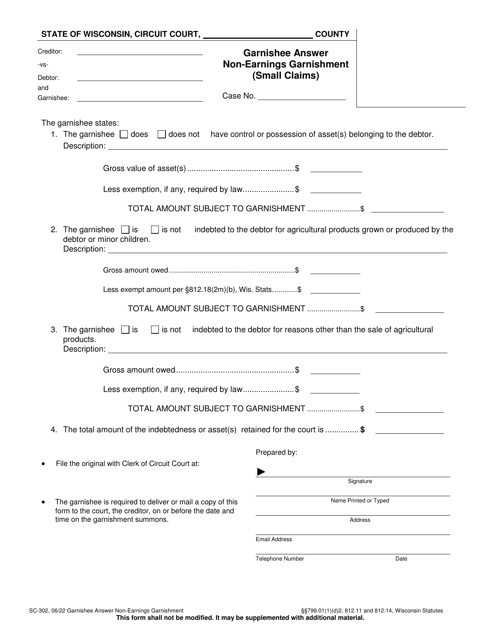

On our website, you will find a range of helpful documents related to non-earnings garnishment. Whether you are a debtor or a creditor, we have forms that cater to your needs. For debtors, we offer Form SC-303 Debtor's Answer Non-earnings Garnishment (Small Claims) and Form CV-302 Garnishee Answer Non-earnings Garnishment. These forms will guide you in responding to a non-earnings garnishment and asserting your rights.

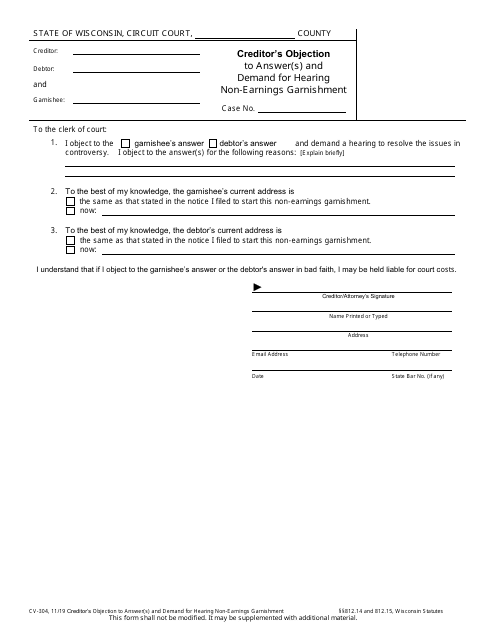

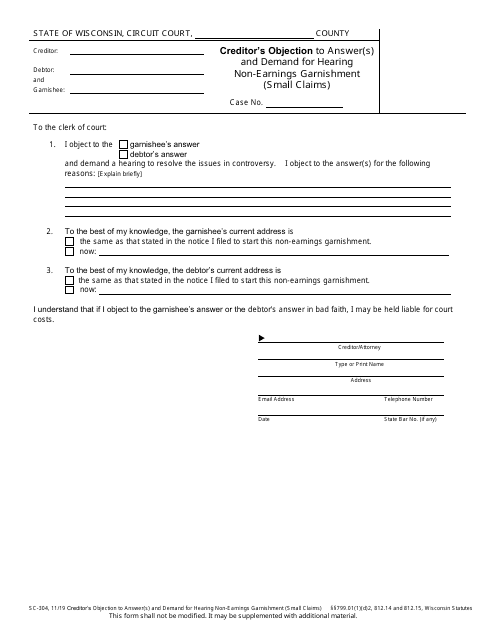

For creditors, we have Form CV-304 Creditor's Objection to Answer(s) and Demand for Hearing Non-earnings Garnishment, as well as Form SC-304 Creditor's Objection to Answer(s) and Demand for Hearing Non-earnings Garnishment (Small Claims). These forms enable creditors to contest a debtor's response and request a hearing to resolve the matter.

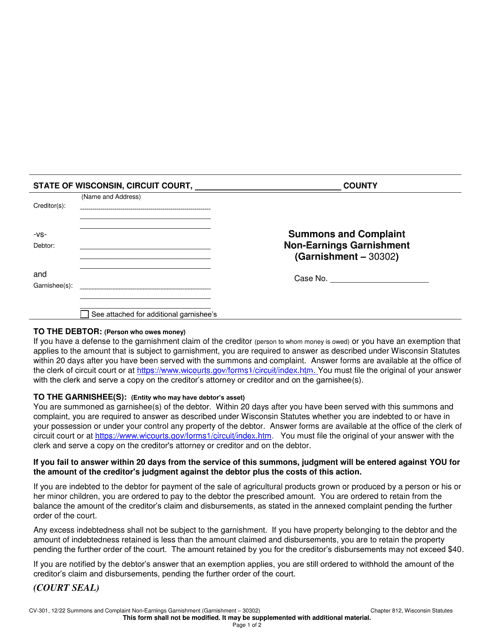

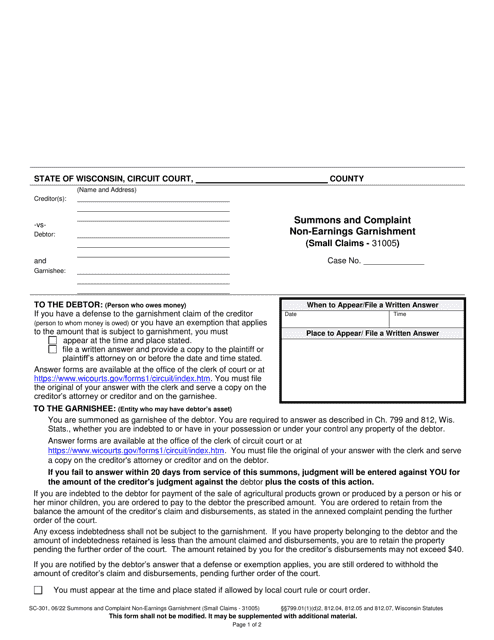

Additionally, we provide Form SC-301 Summons and Complaint Non-earnings Garnishment (Small Claims - 31005) for initiating the non-earnings garnishment process in small claims court.

Visit our webpage today to access these invaluable resources and ensure that you navigate the non-earnings garnishment process effectively. With our user-friendly forms and comprehensive guidance, managing your non-earnings garnishment has never been easier. Take control of your financial situation now.

Documents:

12

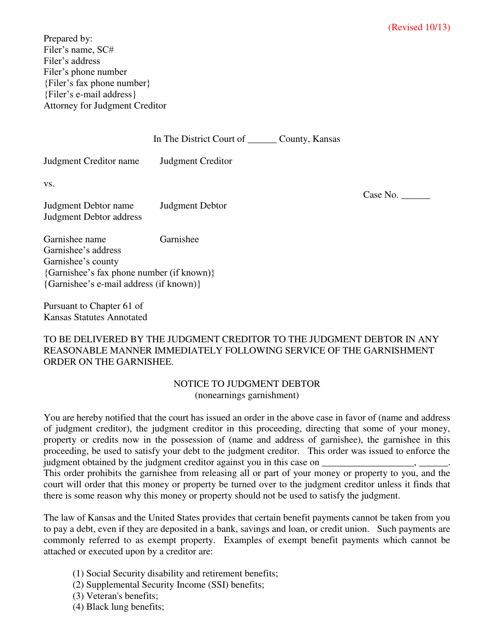

This document informs the judgment debtor in Kansas about a garnishment for unpaid debt that is not related to their earnings.

This form is used for debtors in Wisconsin to provide their answer to a non-earnings garnishment in a small claims case.

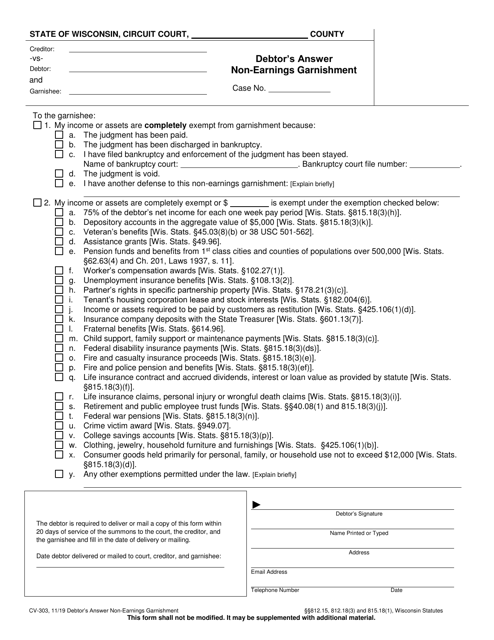

This Form is used for debtors in Wisconsin to respond to a non-earnings garnishment.

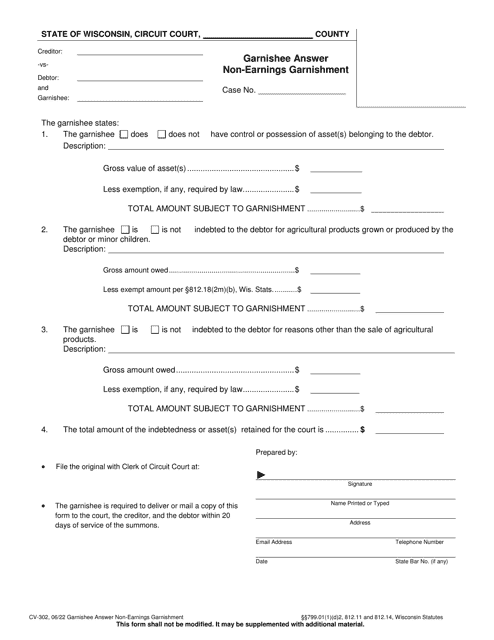

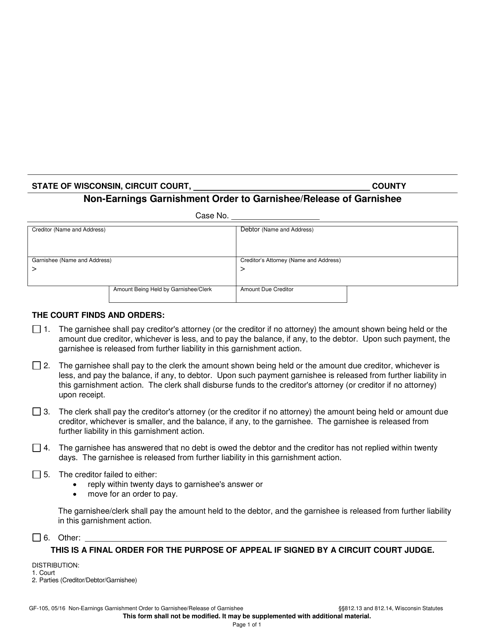

This form is used for obtaining a non-earning garnishment order in Wisconsin, which allows the creditor to collect money from a third party (garnishee) to pay off a debt. It also serves as a release of the garnishee once the debt has been satisfied.

This form is used for creditors in Wisconsin to object to the debtor's answers and request a hearing regarding non-earnings garnishment.

This form is used for creditors to object to a debtor's answer and request a hearing in cases of non-earnings garnishment in small claims court in Wisconsin.

This form is used for responding to a non-earnings garnishment in a small claims case in Wisconsin.

This document is for initiating a non-earnings garnishment in small claims court in Wisconsin. It involves serving a summons and filing a complaint to collect a debt.