Expat Tax Templates

Are you an expat living and working abroad? Do you need to navigate the complex world of expat taxes? Look no further! Our expat tax resources are here to help you understand your obligations and make the filing process as smooth as possible.

Expat Tax is a comprehensive collection of IRS forms, instructions, and resources specifically designed for individuals living outside of their home country. Whether you're a U.S. citizen working overseas or a foreign national living in the U.S., our resources provide the guidance you need to properly report your income and claim any applicable tax benefits.

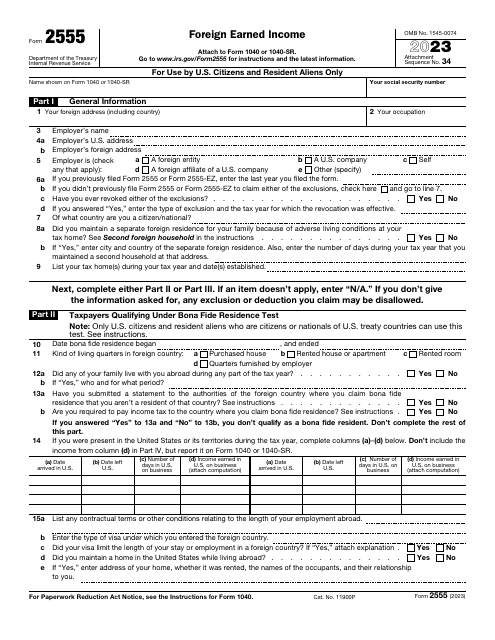

One of the key documents in our collection is IRS Form 2555 Foreign Earned Income. This form allows you to exclude a certain amount of your foreign earned income from U.S. taxation. Our resources include step-by-step instructions on how to complete this form accurately and compliantly.

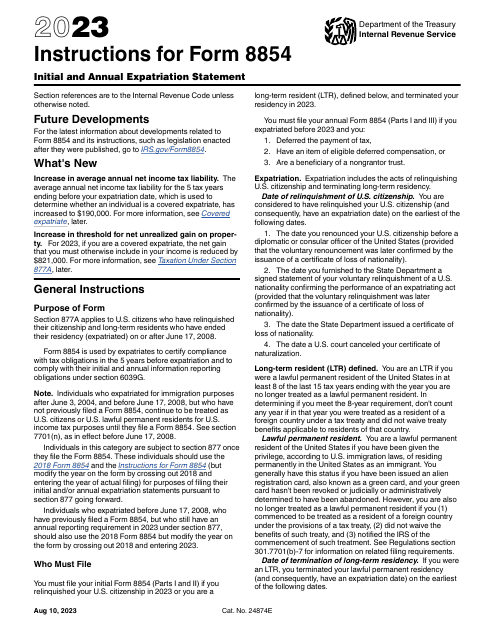

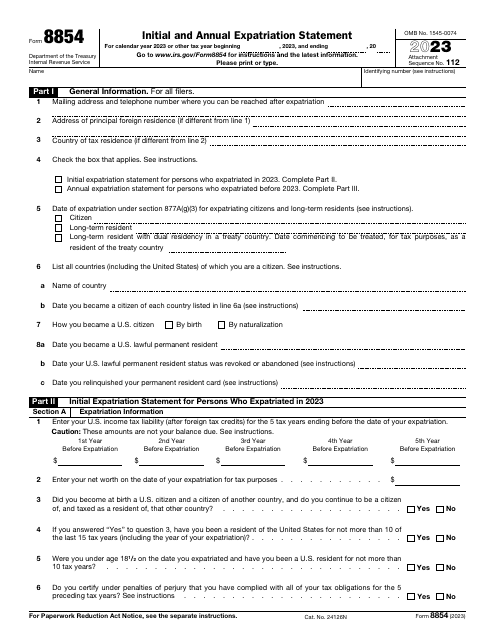

In addition to Form 2555, our collection also includes IRS Form 8854 Initial and Annual Expatriation Statement. This form is required for individuals who have renounced their U.S. citizenship or long-term residents who have ended their U.S. resident status. Our resources provide guidance on how to properly file this form and understand the implications of expatriation.

Navigating expat taxes can be overwhelming, especially with the ever-changing rules and regulations. That's why our resources are regularly updated to reflect the latest tax laws and rulings. We strive to provide you with the most up-to-date information, so you can make informed decisions and stay compliant with your tax obligations.

Whether you're a seasoned expat or new to the world of expat taxes, our comprehensive collection of IRS forms, instructions, and resources is your go-to source for all things related to expat taxation. Simplify your tax filing process and ensure you're taking advantage of any available tax benefits with our trusted expat tax resources.