Rent Rebate Templates

Are you a resident of Pennsylvania who is currently renting property? If so, you may be eligible for a rent rebate. A rent rebate is a form of financial assistance provided by the state government to help offset the cost of renting.

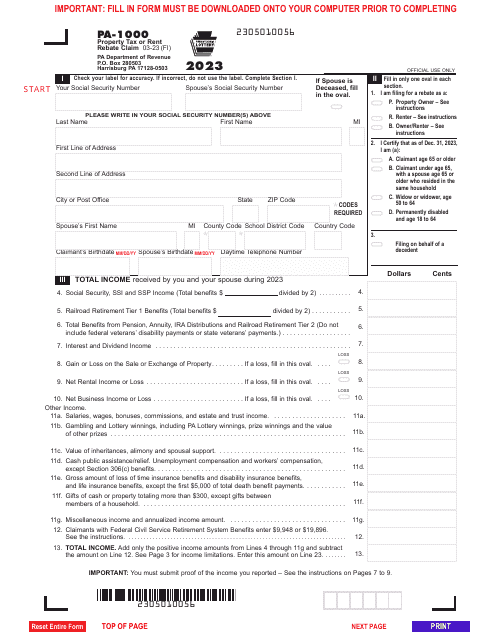

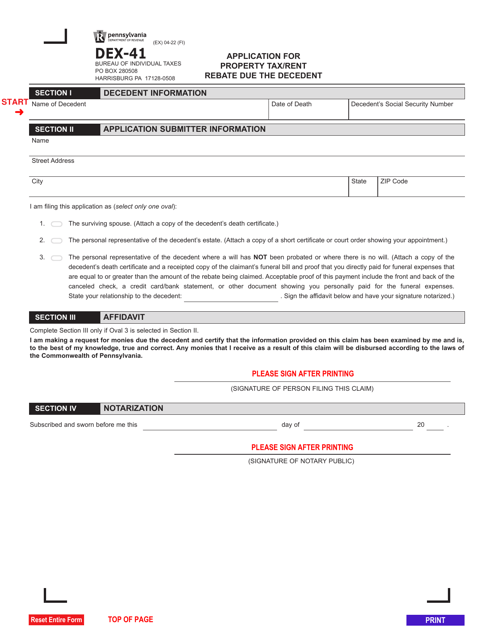

At times referred to as a property tax or rent rebate claim, this program offers eligible individuals the opportunity to receive a refund on a portion of their rent. The process begins by completing the required paperwork, such as the Form PA-1000 Property Tax or Rent Rebate Claim.

To assist you in filing your claim accurately, the state provides a helpful resource called the Form DFO-03 (EX) Property Tax/Rent Rebate Preparation Guide. This guide outlines the necessary steps to ensure your claim is complete and accurate, making it easier for you to receive the rebate you deserve.

Whether you're a senior citizen, a person with disabilities, or a low-income individual, the rent rebate program in Pennsylvania provides financial relief. So, if you're struggling to make ends meet due to the high cost of rent, take advantage of this opportunity and explore the possibility of receiving a rent rebate.

Documents:

7

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

This guide provides instructions for preparing the Property Tax/Rent Rebate application in Pennsylvania. It explains the eligibility criteria and necessary documentation required for the rebate.