Employee Benefits Templates

Documents:

484

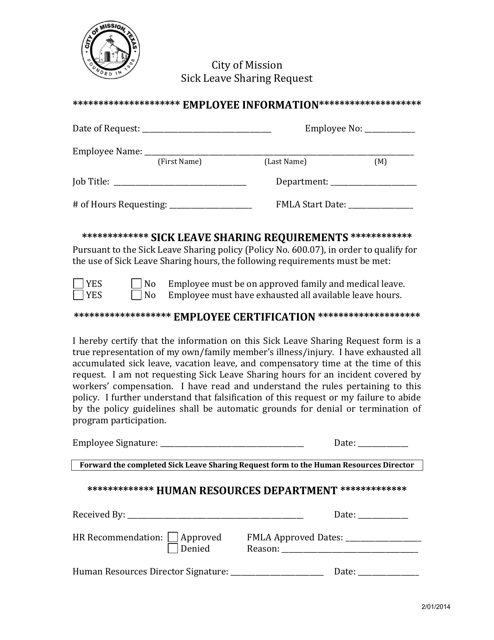

This document is used for requesting sick leave sharing in the City of Mission, Texas.

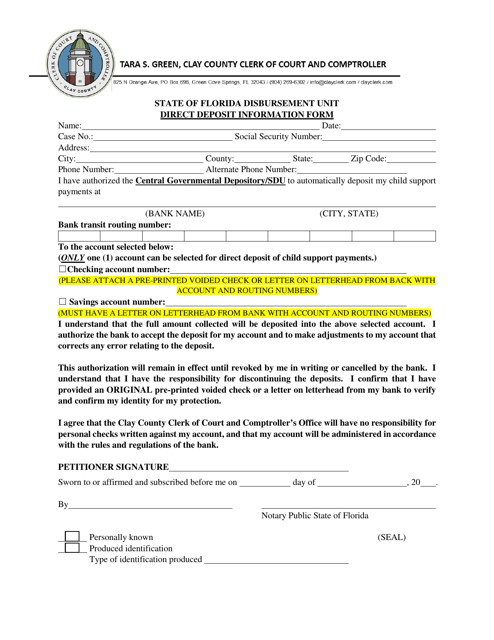

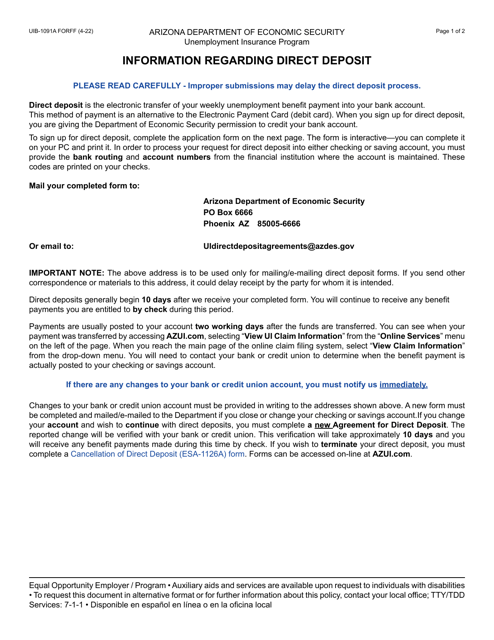

This type of document enables Clay County, Florida residents to provide their direct deposit information to receive payments electronically.

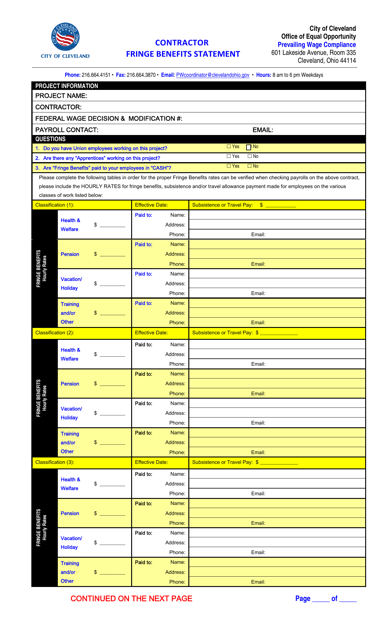

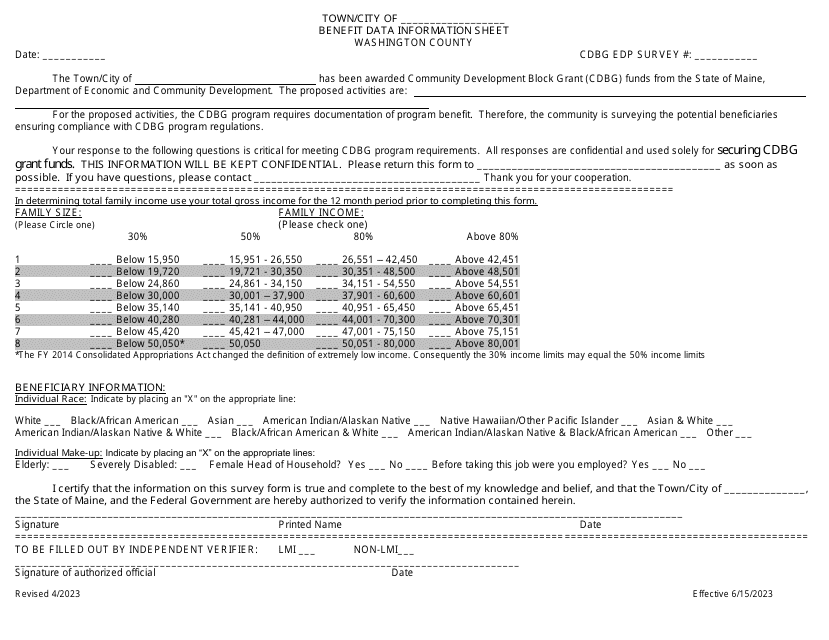

This form is used for contractors to report fringe benefits provided to employees for projects with the City of Cleveland, Ohio.

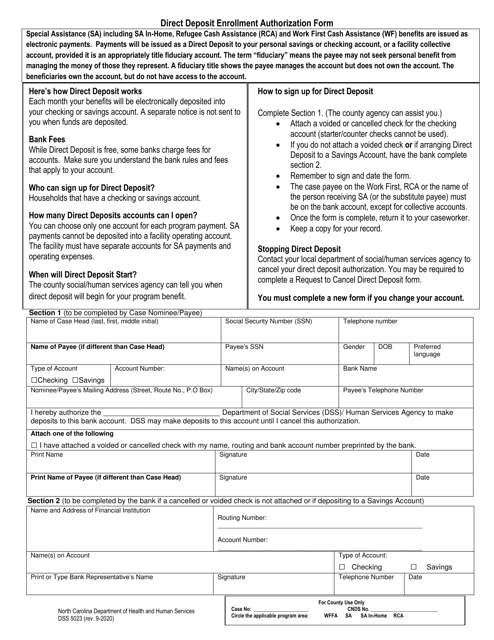

This Form is used for authorizing direct deposit of funds in North Carolina.

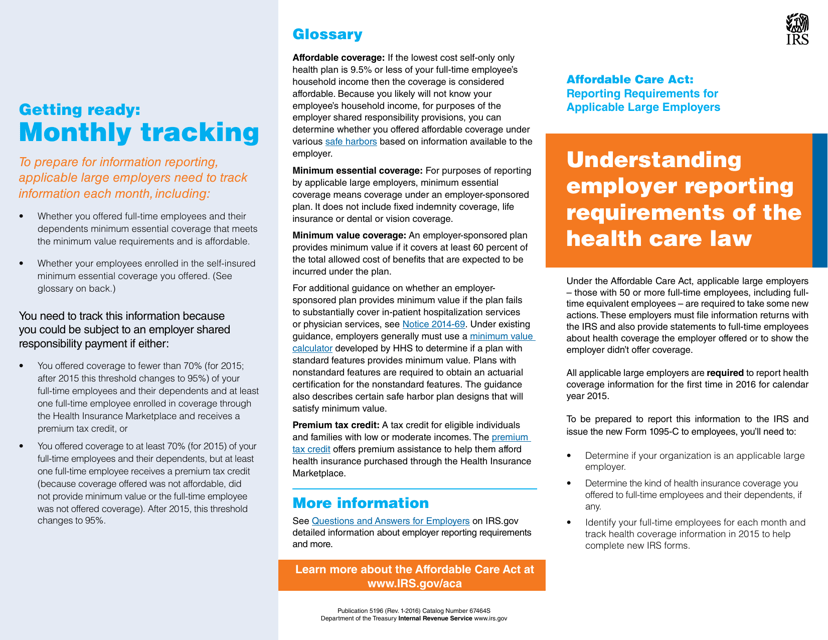

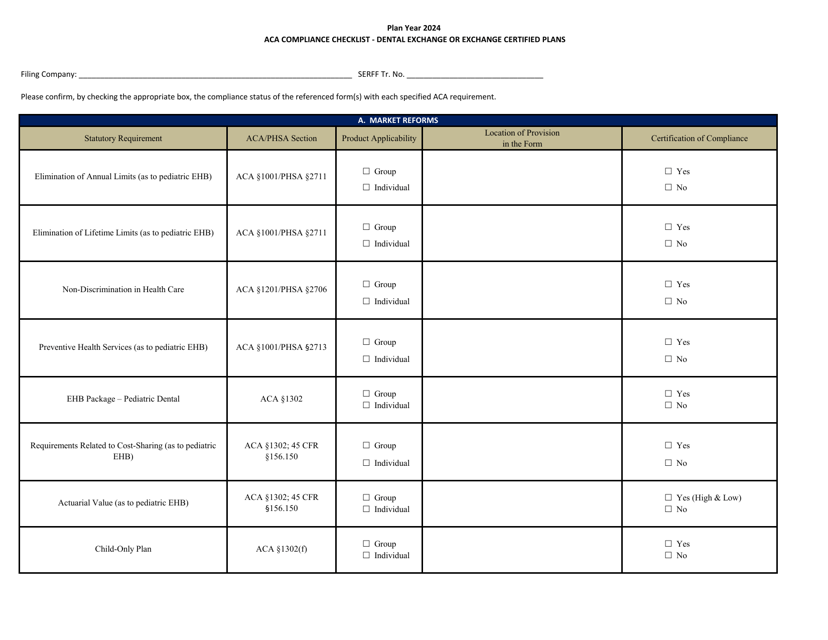

This document outlines the reporting requirements for businesses that are considered "applicable large employers" under the Affordable Care Act. It explains the information that these employers need to provide to the government regarding their health insurance coverage for employees.

If you are a resident in Arkansas and you are seeking new employment, be sure to fill in this type of template with your employer.

This is a legally enforceable template that is used by an employer and employee to define their professional relationship.

This type of template refers to a legally binding document that outlines the terms and conditions of the professional relationship between the employer and employee in the state of Delaware.

This type of template is used in Louisiana and is a written instrument that sets out the conditions of employment between the employer and the employee.

For individuals living in Ohio, this type of template will be needed to document and agree on all of the working conditions related to a concrete job either within a company or for a specific individual.

If you are a resident in South Dakota and you are about to enter new employment, be sure that the job and position is genuine by signing this type of template.

For individuals living in Wyoming, this type of template will be required to note down any conditions agreed upon - mainly concerning working conditions relating to a certain job within a company or for an individual.

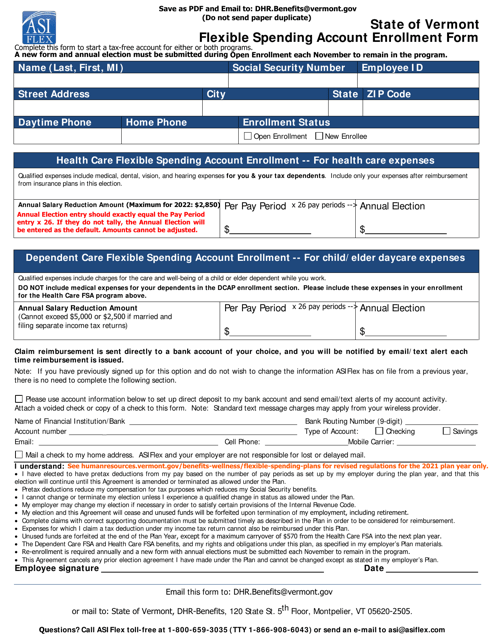

This document is used for enrolling in a Flexible Spending Account (FSA) in the state of Vermont.

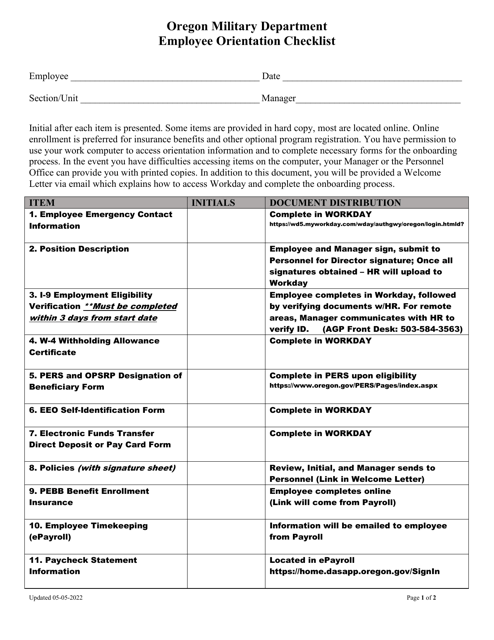

This document is a checklist used during employee orientation in the state of Oregon. It includes essential tasks and information that should be covered when onboarding new employees.

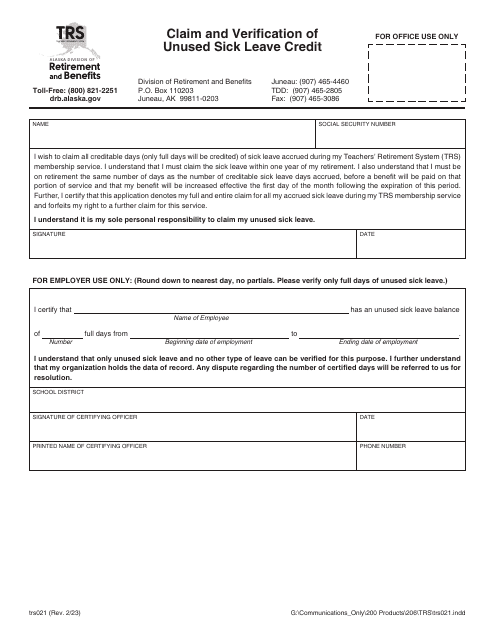

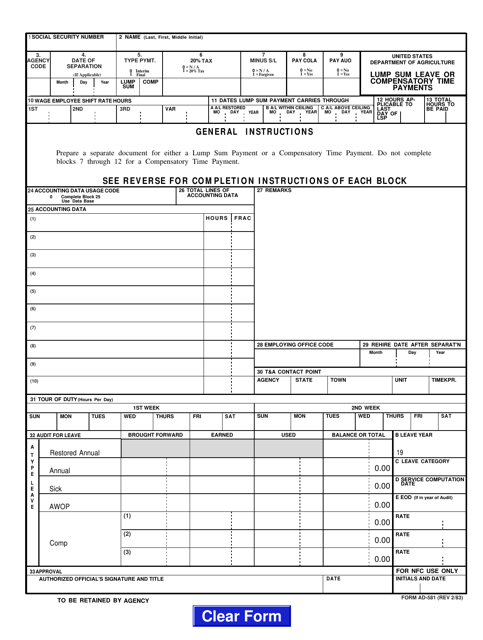

This form is used for making lump sum leave or compensatory time payments in the United States. It is typically used by federal employees to request payment for unused leave or overtime.

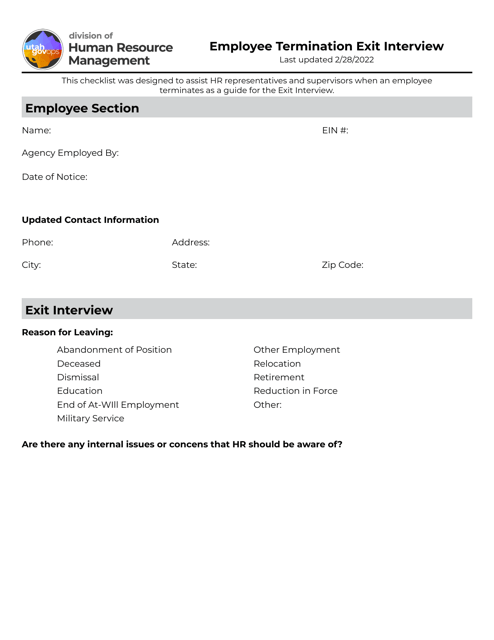

This document is used for conducting an exit interview with an employee who is being terminated in the state of Utah. The purpose of the interview is to gather feedback from the employee and address any concerns they may have.

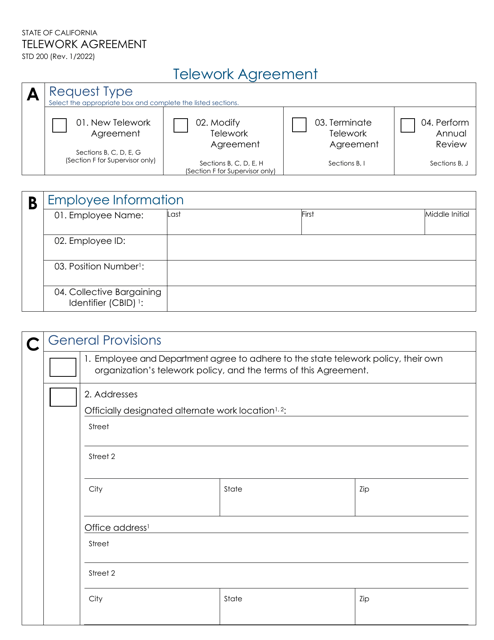

This form is used for creating a telework agreement in the state of California. It outlines the terms and conditions for remote work arrangements between an employer and an employee.

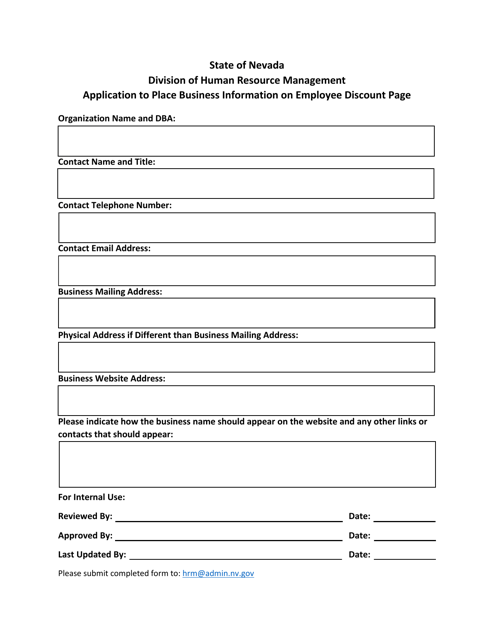

This form is used to apply for placing business information on the employee discount page in Nevada.

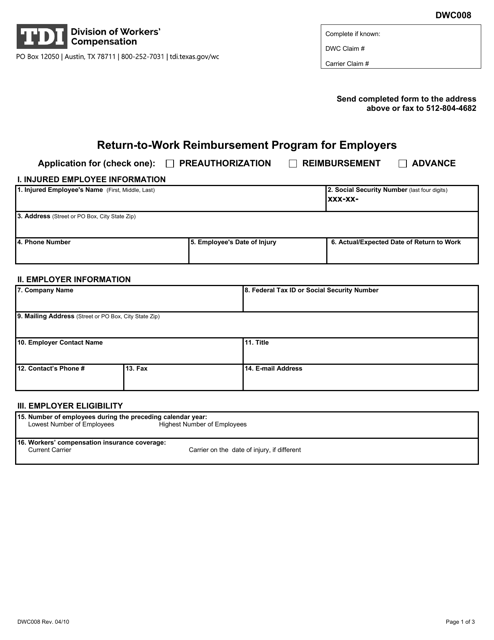

This Form is used for employers in Texas to apply for reimbursement under the Return-To-Work program.

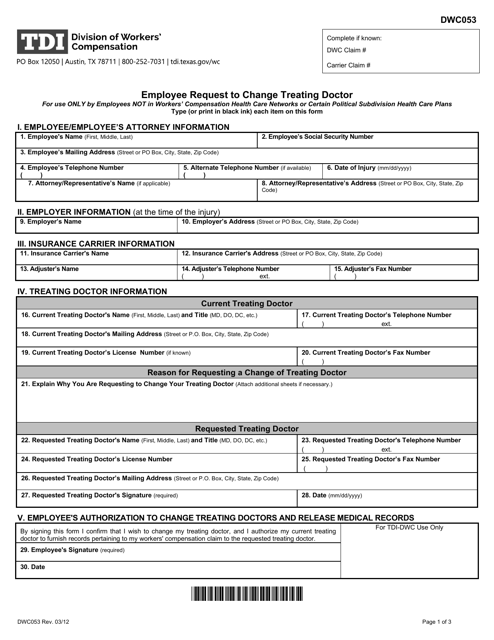

This form is used for Texas employees to request a change of their treating doctor.

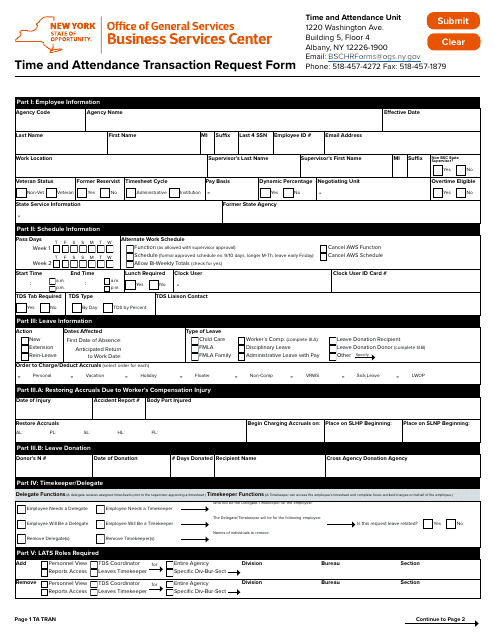

This Form is used for requesting time and attendance transactions in New York.

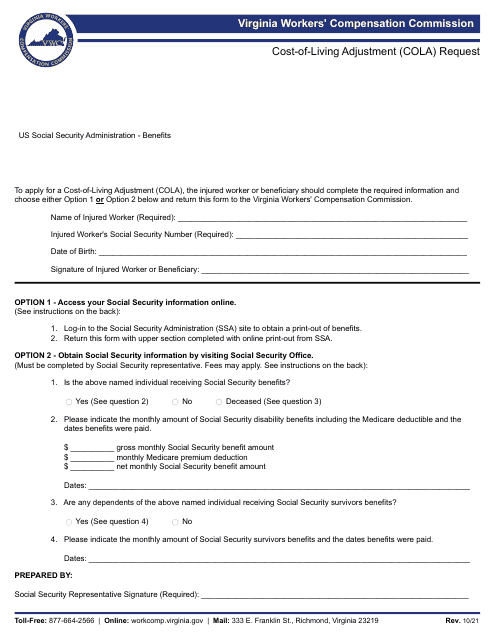

This Form is used to request a Cost-of-Living Adjustment (COLA) in Virginia. It allows individuals to request an increase in their income or benefits to account for changes in the cost of living. This document is important for individuals living in Virginia who need a financial adjustment due to rising expenses.

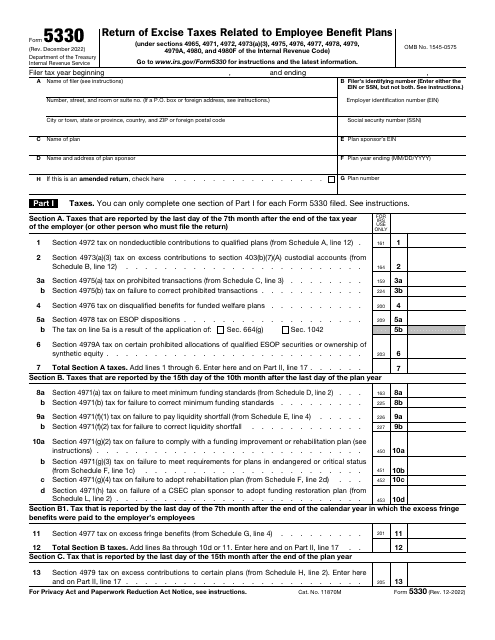

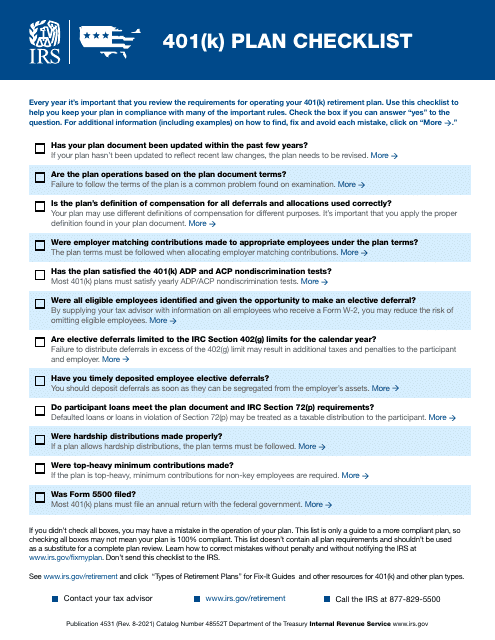

This document is a checklist that outlines the key steps and considerations for setting up and managing a 401(k) retirement plan. It provides guidance on eligibility, contribution limits, investment options, and other important factors to consider when establishing a 401(k) plan for your employees. Use this checklist to ensure compliance and maximize the benefits of your company's retirement plan.