Tax Exempt Income Templates

Are you looking to understand tax-exempt income and the benefits it offers? Look no further. Our comprehensive collection of documents on tax exempt income provides all you need to know about this topic. From Veteran Income Tax Exemption Submission Forms to IRS Form 990 for Organizations Exempt From Income Tax, you'll find a wide range of resources to help you navigate the complexities of tax-exempt income.

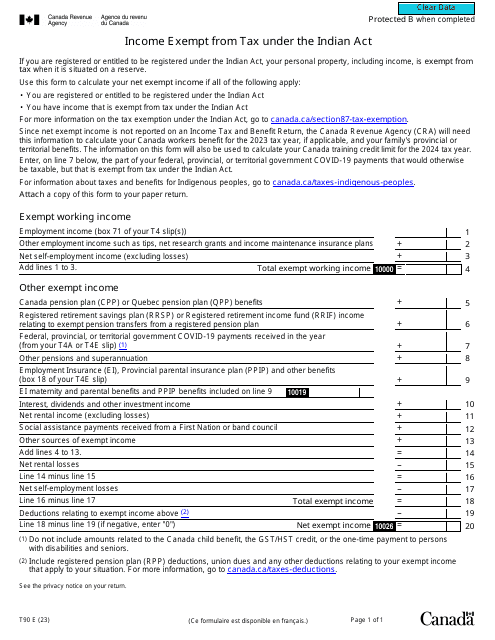

Also known as income tax exemption, this collection covers various aspects of tax-exempt income, including forms and schedules for filing tax-exempt income claims. Whether you're a veteran seeking tax exemptions in New Jersey, an organization looking to file IRS Form 990, or an individual with income exempted from tax under the Indian Act in Canada, our collection has got you covered.

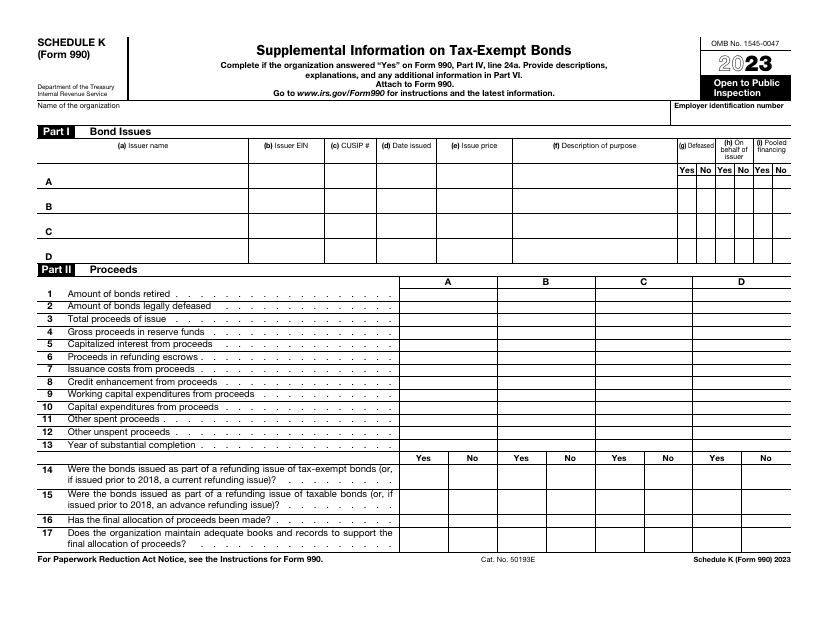

Our documents cover not only the basics but also provide supplemental information on tax-exempt bonds, giving you a comprehensive understanding of this specialized area. With our tax-exempt income documents, you'll have the knowledge you need to maximize your tax savings and make informed financial decisions.

So, explore our collection of tax-exempt income documents today and ensure you're taking advantage of all available tax benefits. Don't miss out on potential savings - browse our collection now!

Documents:

9

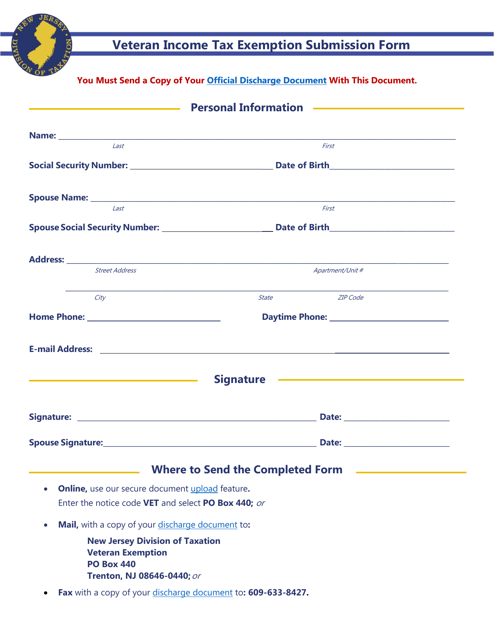

This form is used for veterans in New Jersey to submit their income tax exemption.

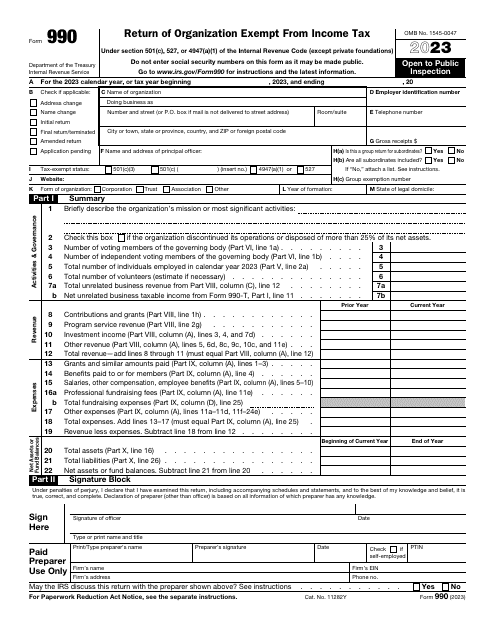

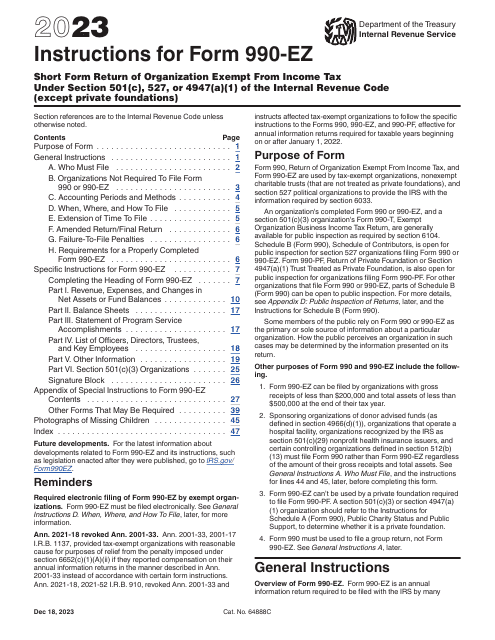

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

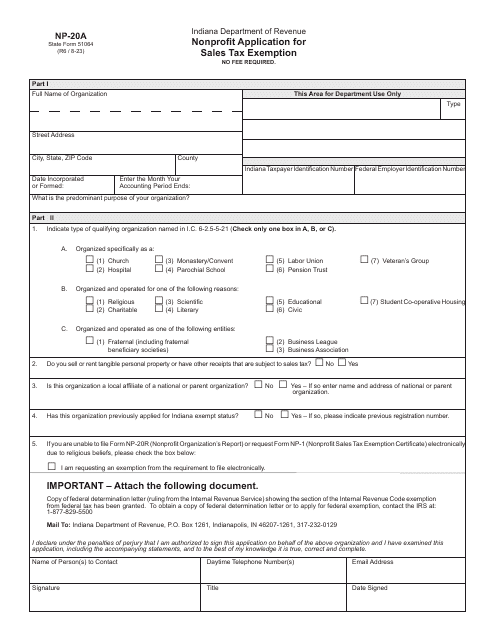

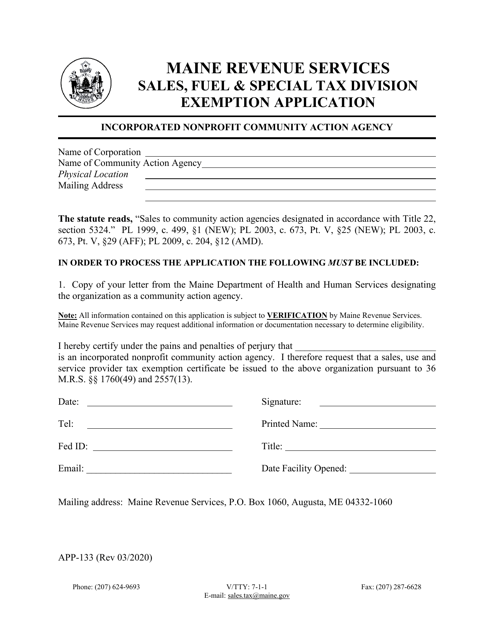

This form is used by incorporated nonprofit community action agencies in Maine to apply for an exemption.

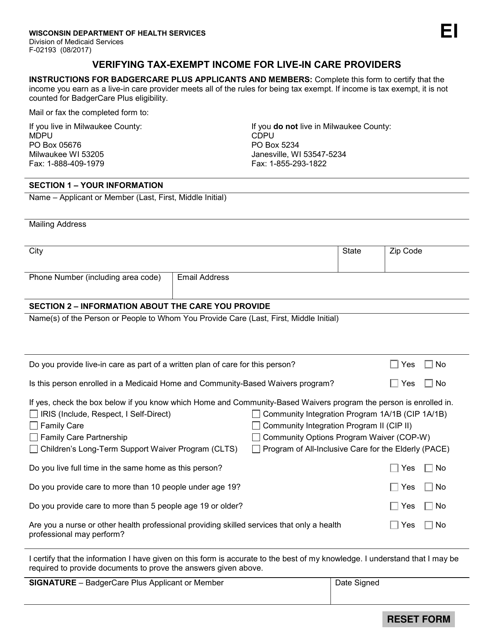

This form is used for verifying tax-exempt income for live-in care providers in Wisconsin.