Foreign Partnership Templates

Are you a US citizen or entity who has entered into a partnership with a foreign entity? If so, it is important to understand the requirements and obligations associated with this business relationship. Our foreign partnership documentation collection provides you with the necessary forms and information to properly report and manage your partnership.

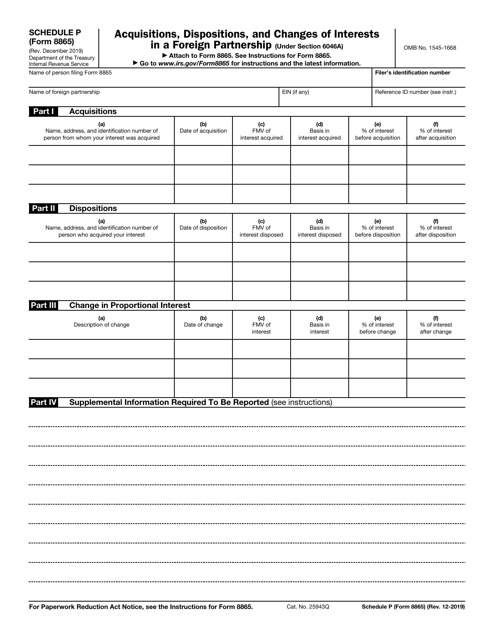

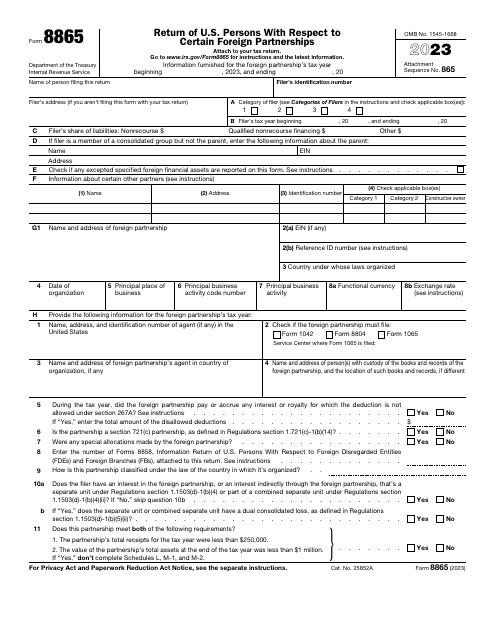

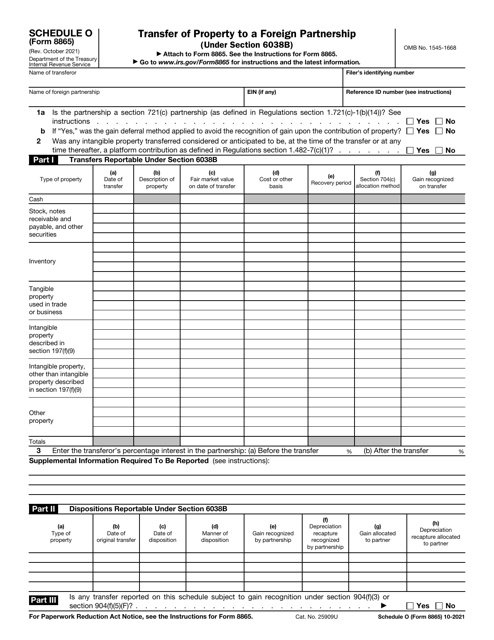

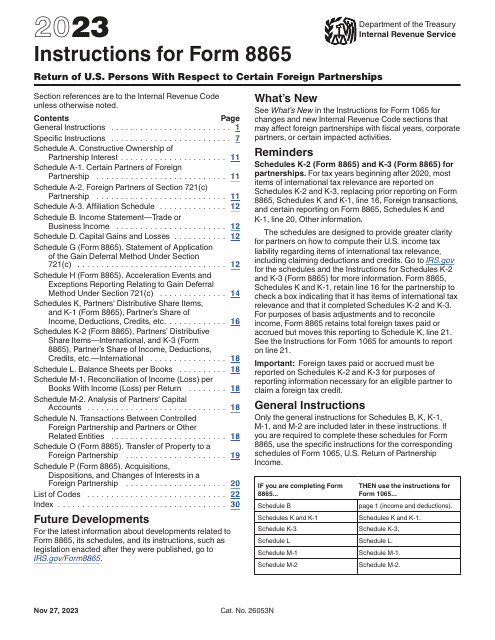

One of the key documents is the IRS Form 8865 - Return of U.S. Persons With Respect to Certain Foreign Partnerships. This form allows you to report your share of income, deductions, and credits from the foreign partnership. It is crucial to accurately complete this form to ensure compliance with the Internal Revenue Service.

Additionally, we provide forms specific to certain states such as Form LPA-73.57 - Amended Application for Registration as a Foreign Limited Partnership in Virginia. This form is essential if you need to make changes or updates to your registration as a foreign limited partnership within the state.

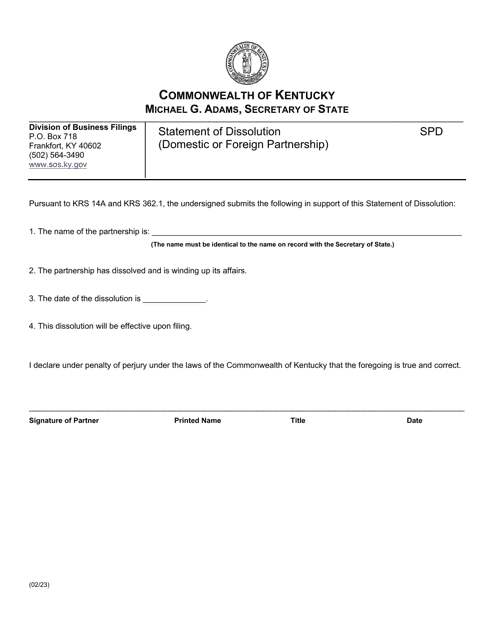

If your partnership is dissolving, you will need the Form SPD - Statement of Partnership Dissolution for either a domestic or foreign partnership in Kentucky. This form allows you to officially dissolve your partnership and address any remaining obligations.

Furthermore, if your partnership changes its registered agent, the Form 643 - Statement of Change of Registered Agent for a Domestic or Foreign Partnership in Rhode Island will need to be filed. This form notifies the state authorities of the new registered agent for your partnership.

Our foreign partnership documentation collection offers a wide range of forms and information to assist you in managing your partnership. Whether you are filing taxes, making amendments, dissolving the partnership, or changing the registered agent, we have the resources you need to properly navigate the legal requirements.

Documents:

84

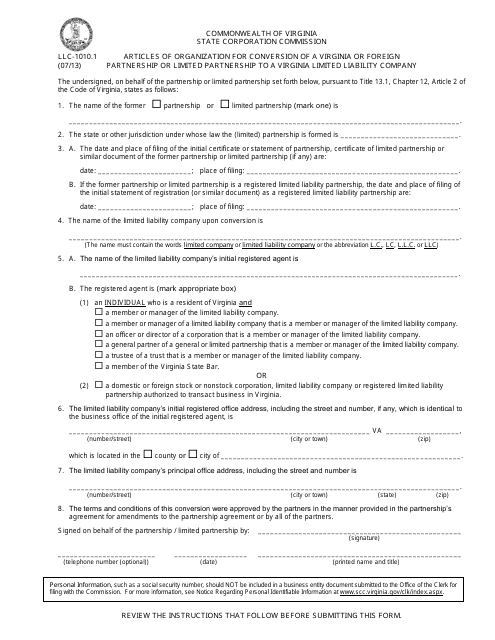

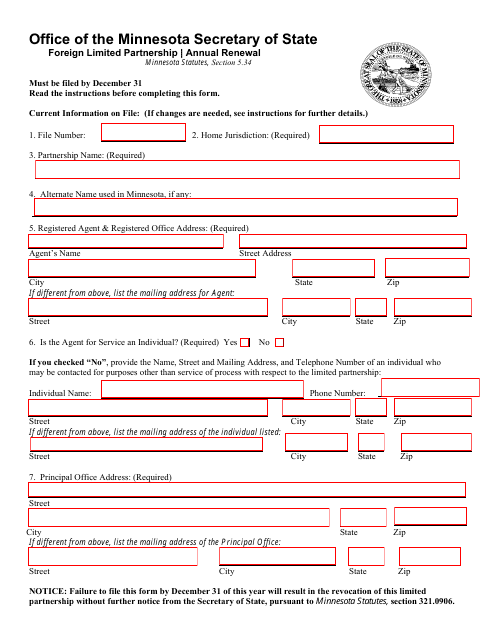

This Form is used for converting a partnership or limited partnership to a Virginia Limited Liability Company (LLC) in Virginia.

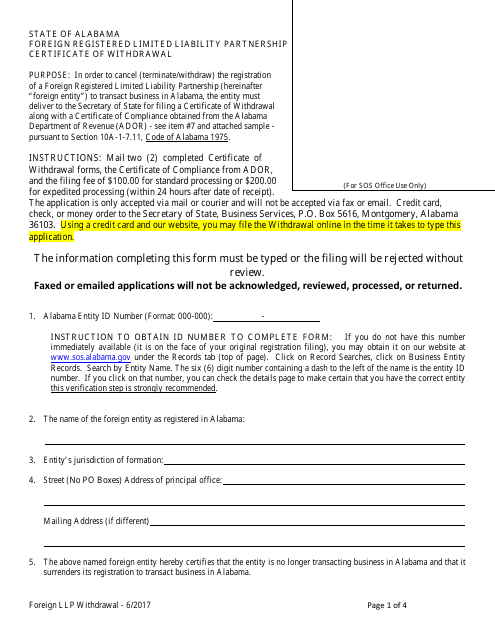

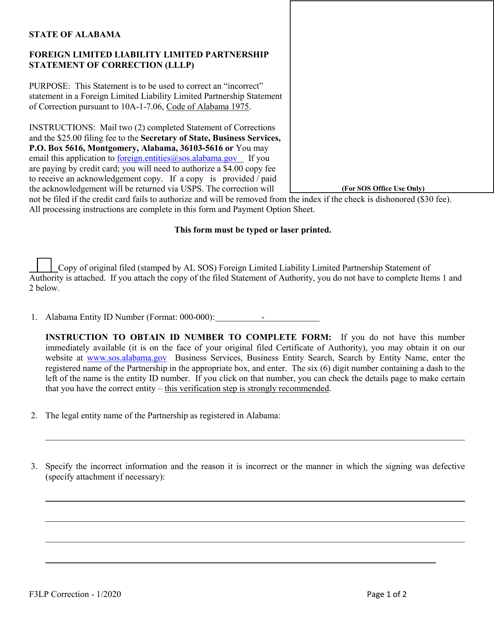

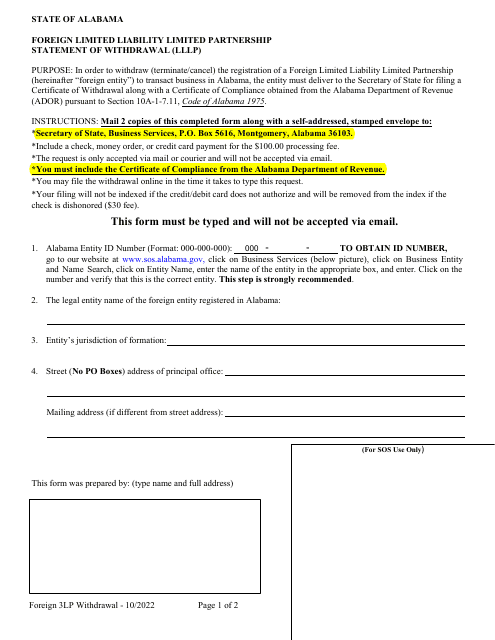

This document is used for withdrawing a foreign registered limited liability partnership in the state of Alabama. It provides certification for the withdrawal process.

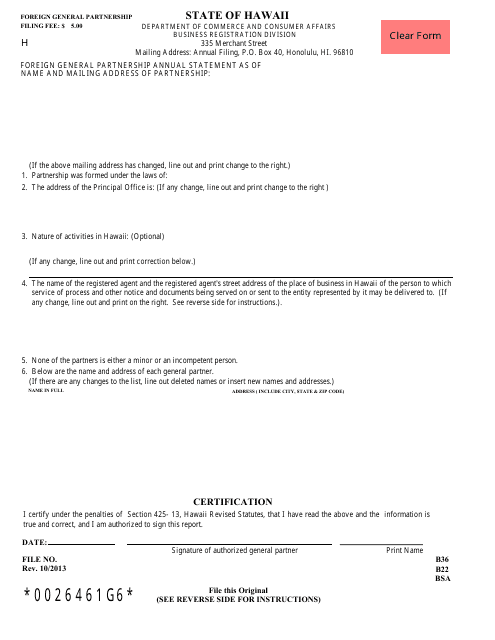

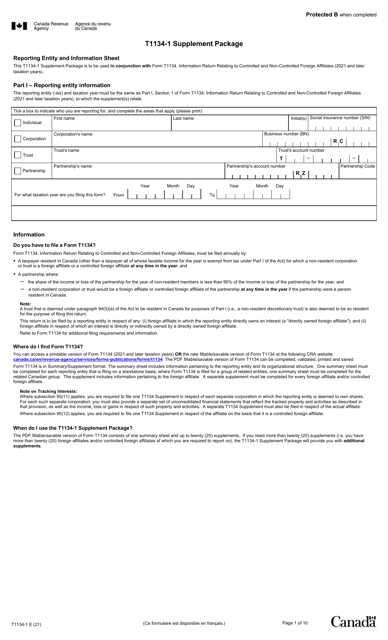

This document is used for submitting the annual statement of a foreign general partnership in the state of Hawaii. It provides information about the partnership's activities and financial status.

This form is used for foreign partnerships that want to withdraw their business from Hawaii.

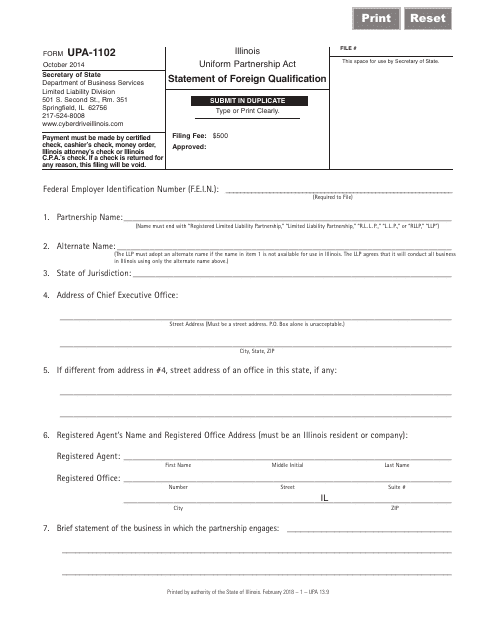

This form is used for filing a Statement of Foreign Qualification in the state of Illinois. It is required for foreign corporations that wish to do business in the state.

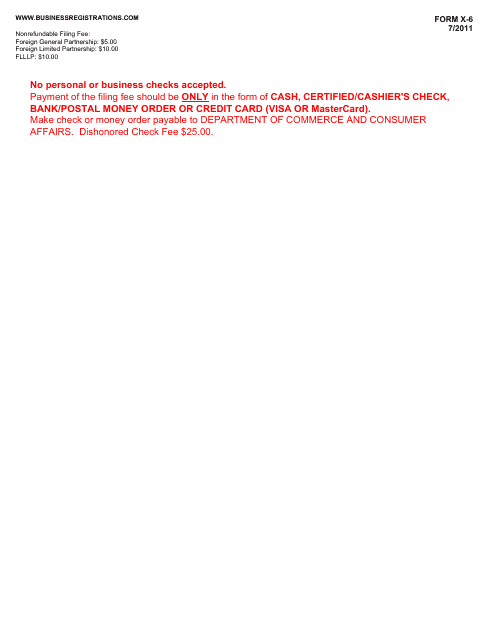

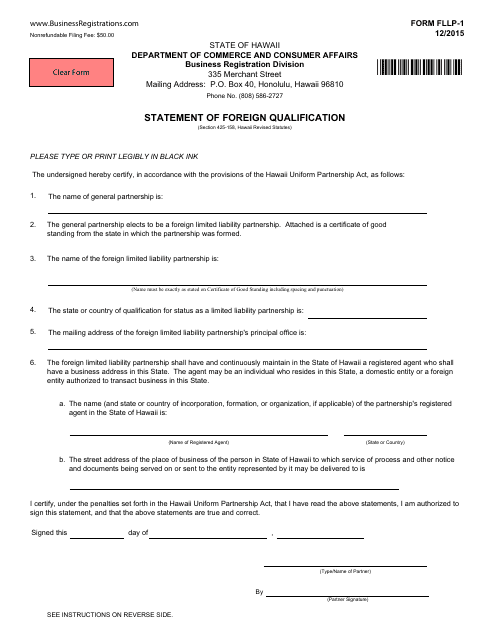

This form is used for filing a Statement of Foreign Qualification in Hawaii for a Foreign Limited Liability Partnership (FLLP). It is required for LLPs from other states or countries to operate in Hawaii.

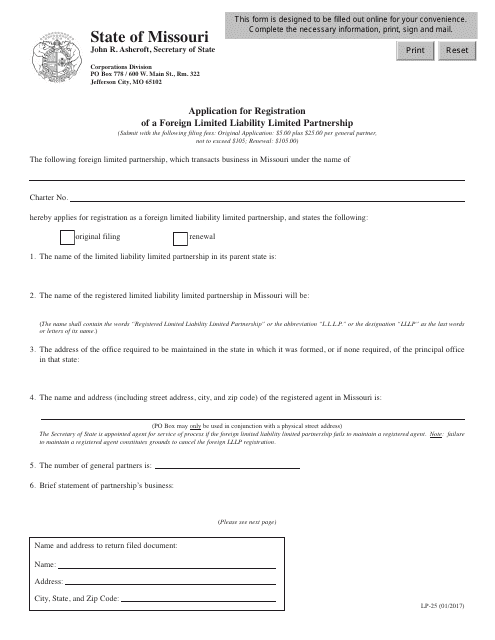

This Form is used for registering a foreign limited liability limited partnership in Missouri. It is required for businesses operating in another state to do business in Missouri.

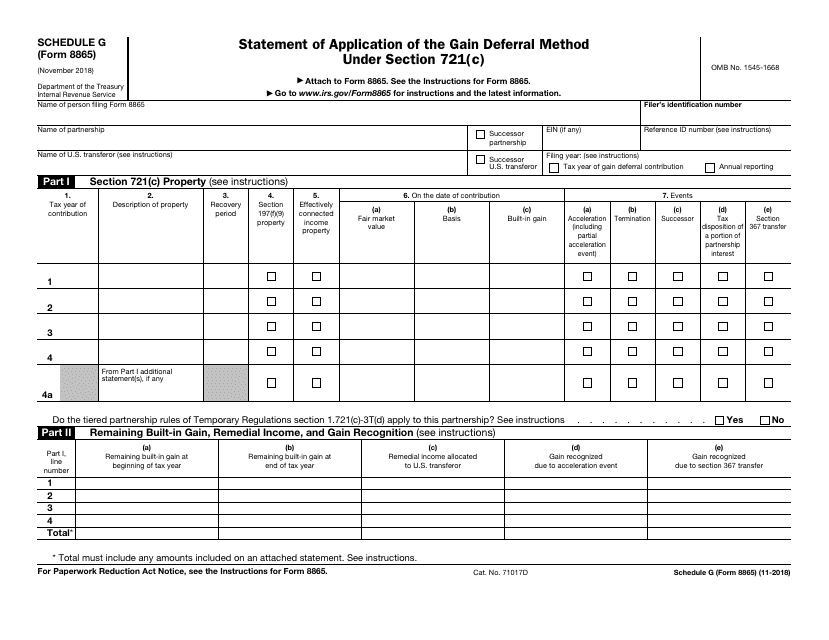

This Form is used for reporting the application of the gain deferral method under Section 721(c) on IRS Form 8865 Schedule G.

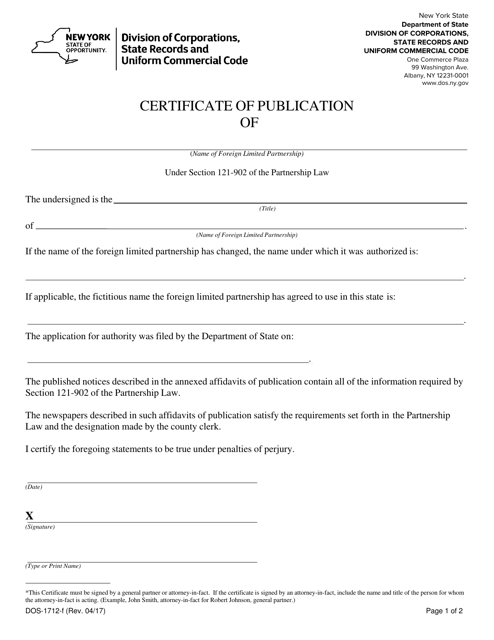

This Form is used for foreign limited partnerships in New York to obtain a Certificate of Publication.

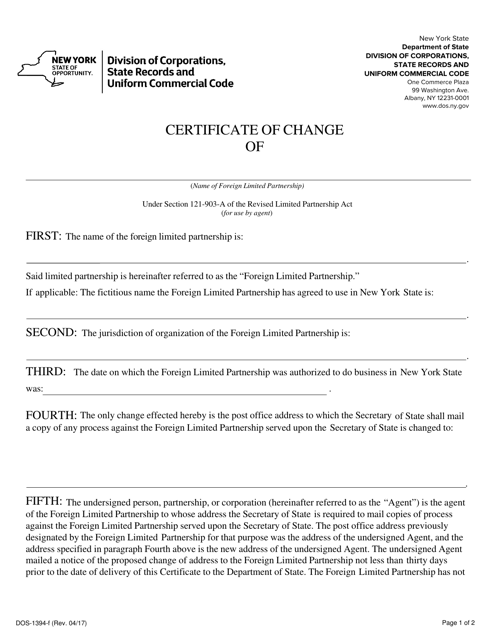

This form is used for filing a certificate of change for a foreign limited partnership in the state of New York. It is used to update or change the information related to the partnership.

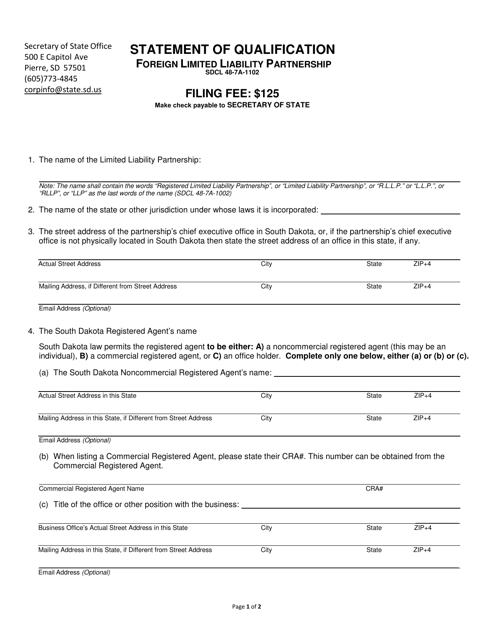

This document is used for disclosing the qualifications of a foreign limited liability partnership operating in the state of South Dakota.

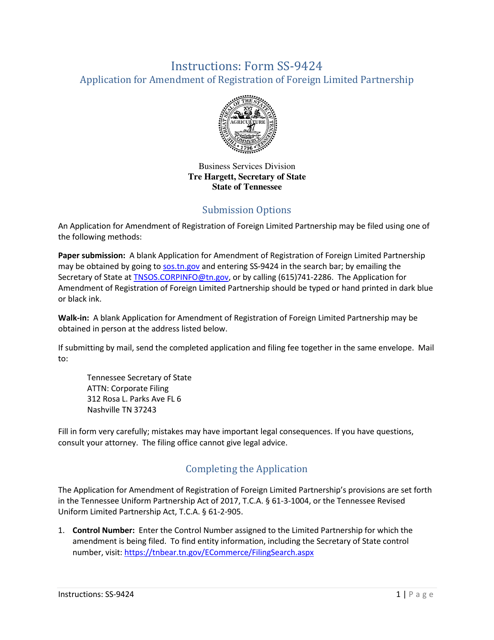

This Form is used for foreign limited partnerships in Tennessee to apply for an amendment of their registration.

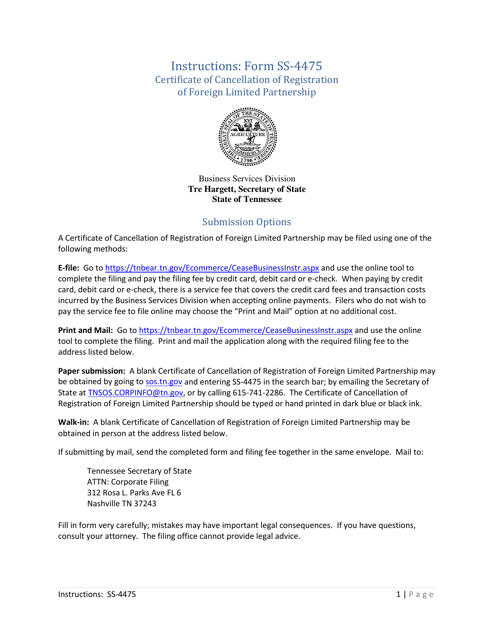

This Form is used for canceling the registration of a foreign limited partnership in the state of Tennessee.

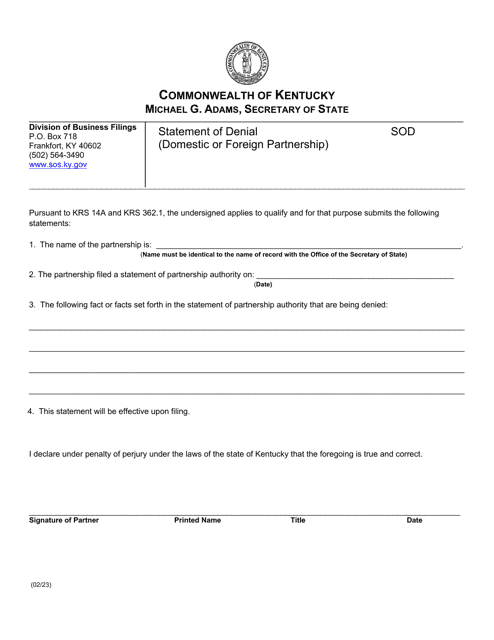

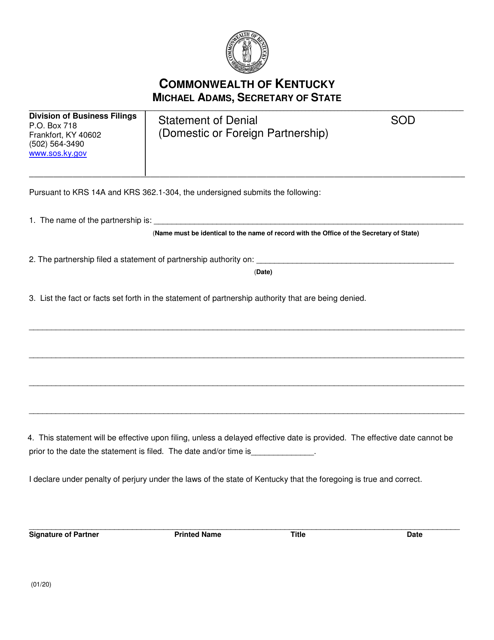

This document is used for a partnership in Kentucky to formally deny any claims or allegations made against them, whether the partnership is domestic or foreign.

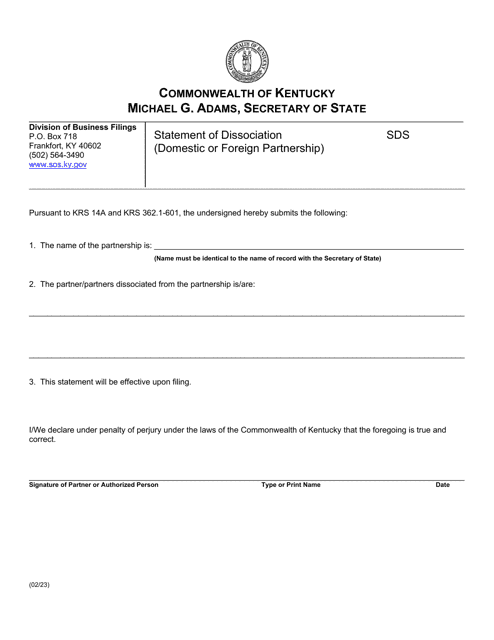

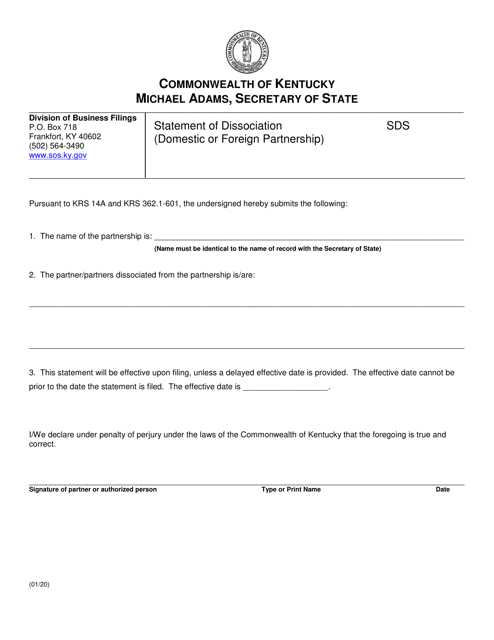

This document is used for officially dissociating from a domestic or foreign partnership in the state of Kentucky.

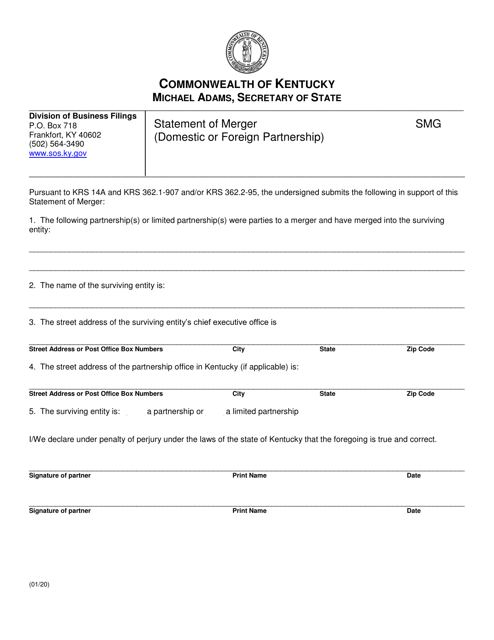

This document is used for recording the merger of a domestic or foreign partnership in the state of Kentucky.

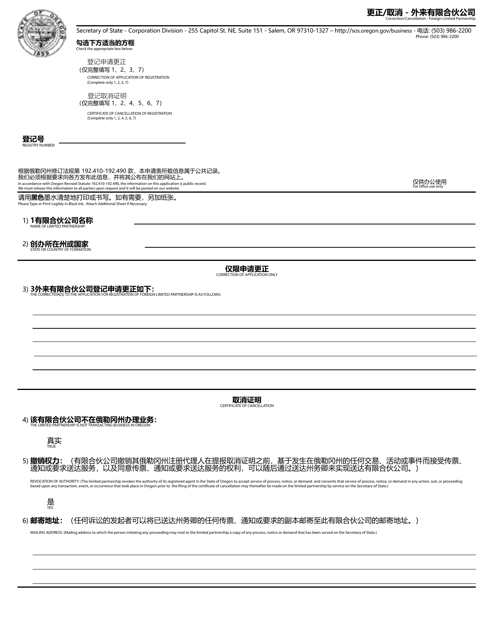

This document is used for correcting or canceling a foreign limited partnership in Oregon. It is available in both English and Chinese languages.

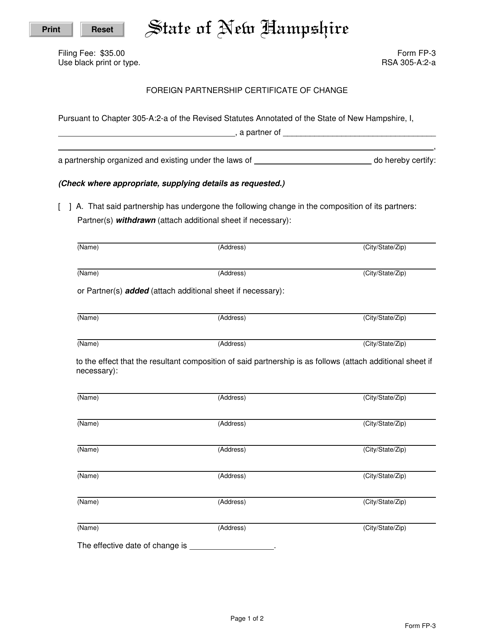

This document is used for making changes to a foreign partnership certificate in the state of New Hampshire.

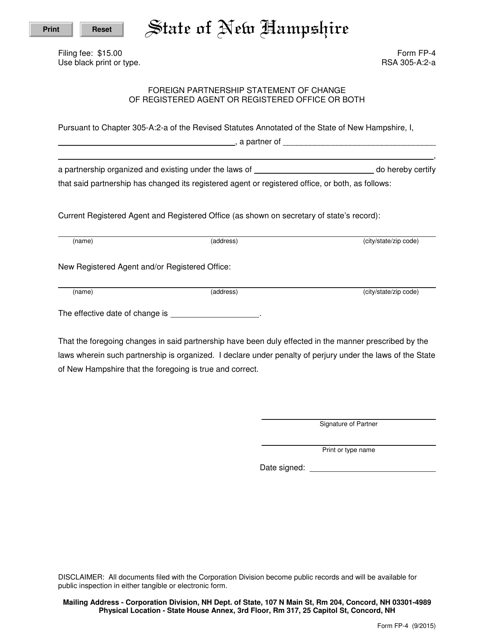

This form is used for foreign partnerships in New Hampshire to notify the state of changes to their registered agent, registered office, or both.

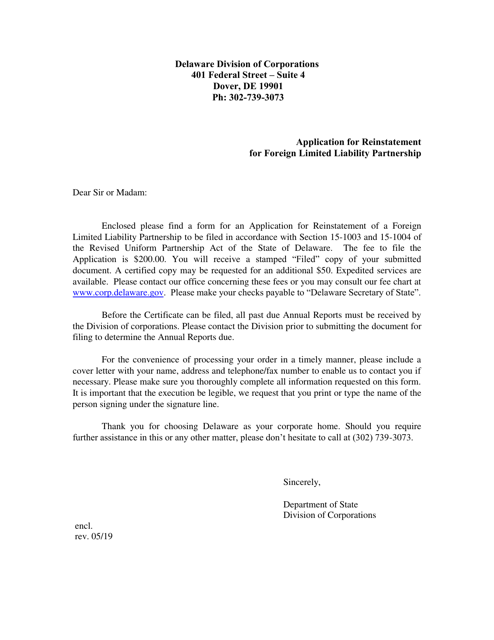

This type of document is used for foreign limited liability partnerships that want to reinstate their status in Delaware.