Tax Updates Templates

Stay up to date with the latest tax updates, forms, and regulations with our comprehensive collection of tax update documents. Our documents provide vital information and updates on various tax-related topics, ensuring that you have the most accurate and current information at your fingertips.

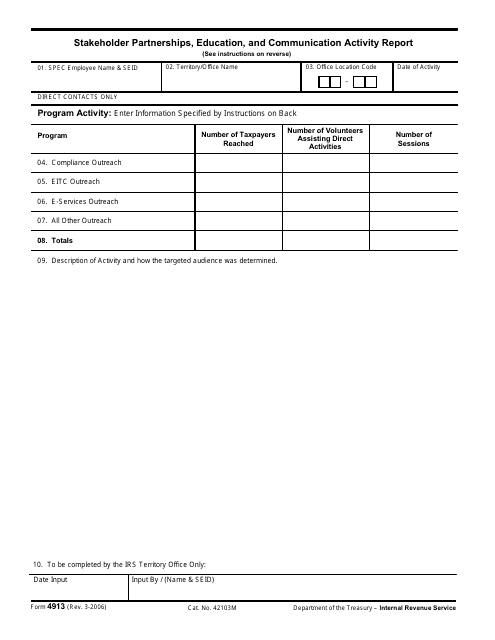

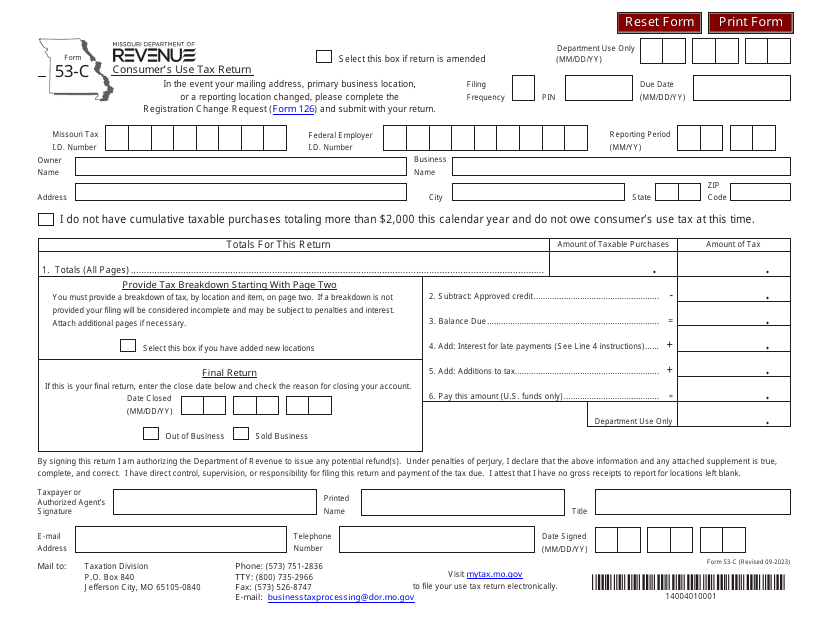

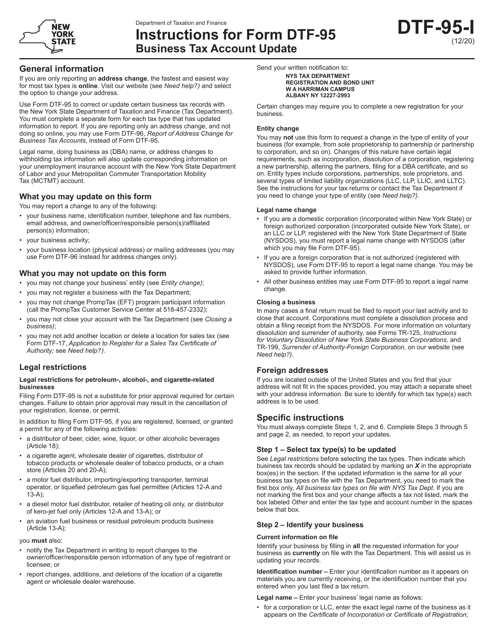

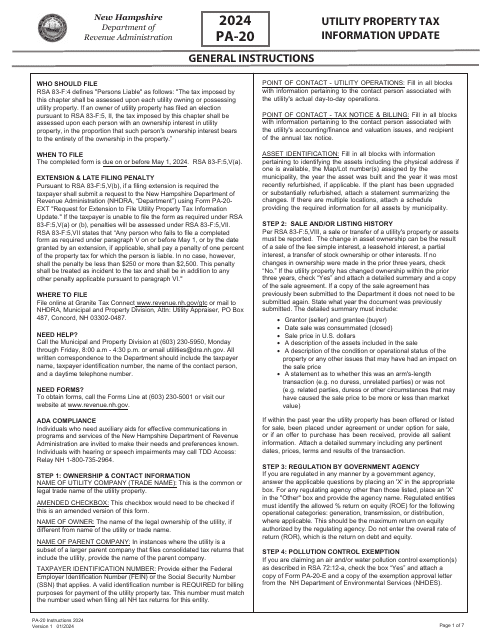

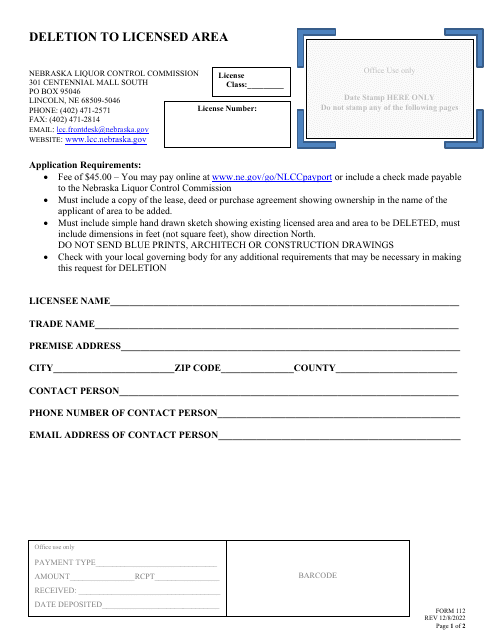

Our tax update collection includes a wide range of documents such as IRS Form 4913 Taxpayer Education Statistical Report, IRS Form 2441 Child and Dependent Care Expenses, Form 53-C Consumer's Use Tax Return - Missouri, Instructions for Form DTF-95 Business Tax Account Update - New York, and Form 112 Deletion to Licensed Area - Nebraska, among many others.

With our tax update documents, you can stay informed on the latest changes in tax laws, forms, and regulations. Whether you're an individual taxpayer or a business owner, our collection has a variety of resources to help you navigate the complex world of taxes.

Don't miss out on critical updates or risk non-compliance. Access our tax updates collection today and ensure that you're equipped with the most current information to meet your tax obligations. Stay ahead of the game with our comprehensive tax update resources.

Documents:

12

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

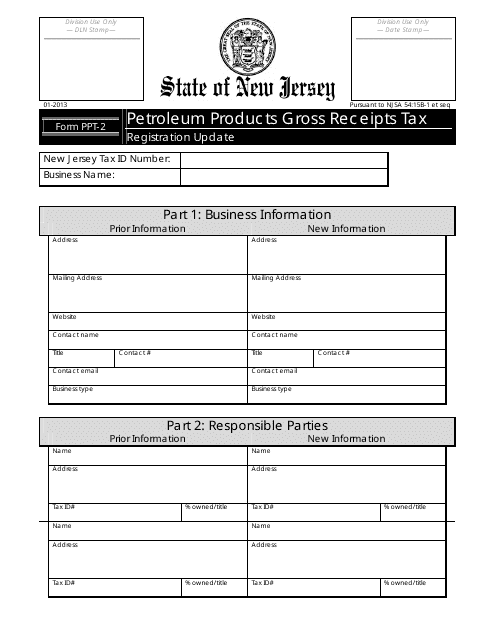

This form is used for updating the registration information for the Petroleum Products Gross Receipts Tax in New Jersey.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

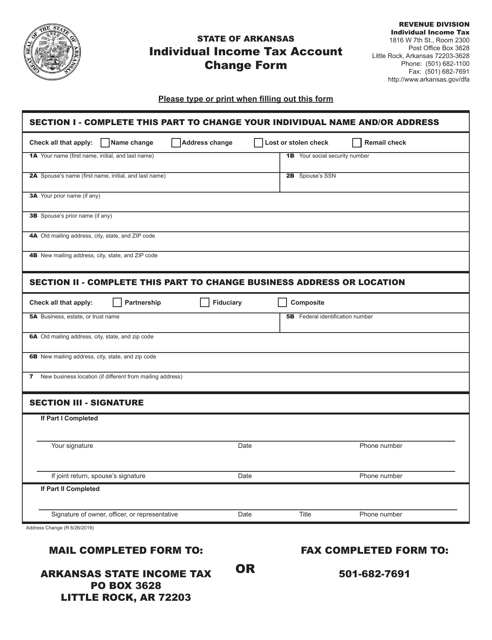

This form is used for making changes to an individual's income tax account in the state of Arkansas.

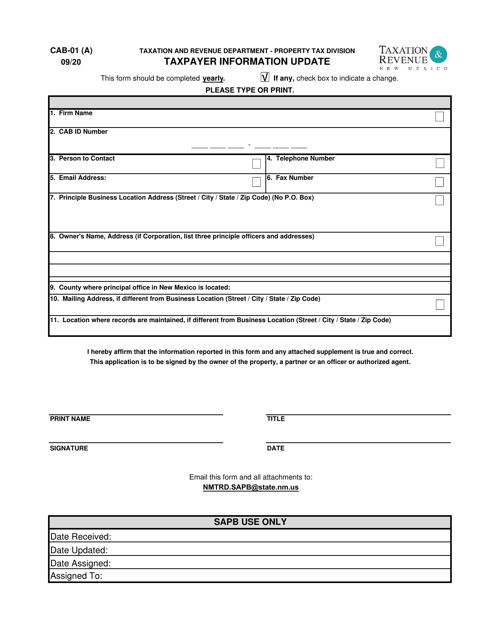

This Form is used for updating taxpayer information in the state of New Mexico

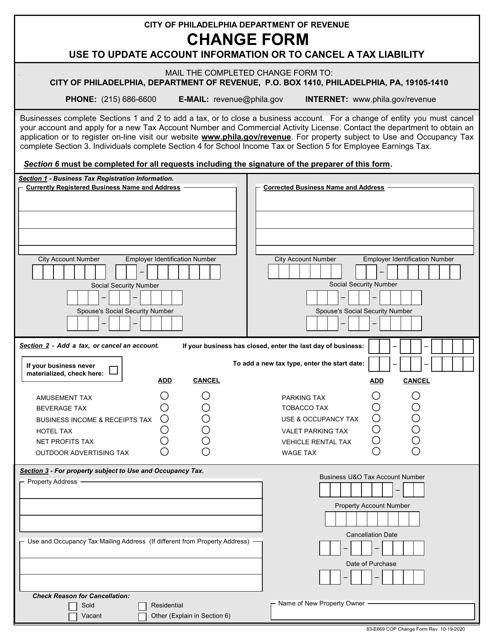

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

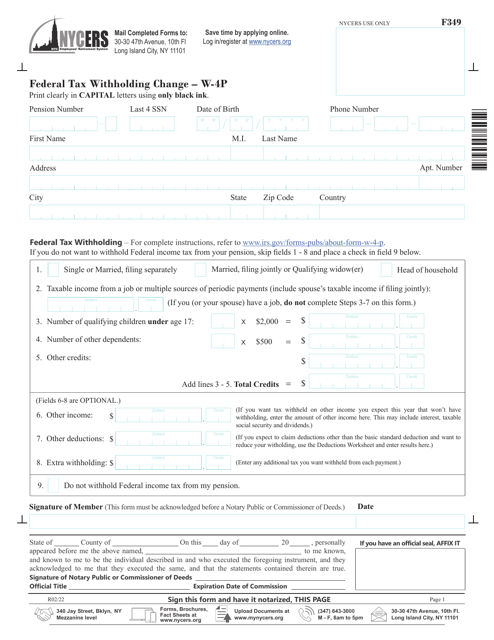

This form is used for making changes to federal tax withholding in New York City.