Claim for Reassessment Exclusion Templates

Are you looking to transfer property between family members and want to avoid a reassessment of the property's value? Look no further than our claim for reassessment exclusion services. We understand the importance of preserving your family's assets and avoiding excessive property taxes. Our team is skilled in preparing the necessary documentation to ensure a smooth and successful transfer process.

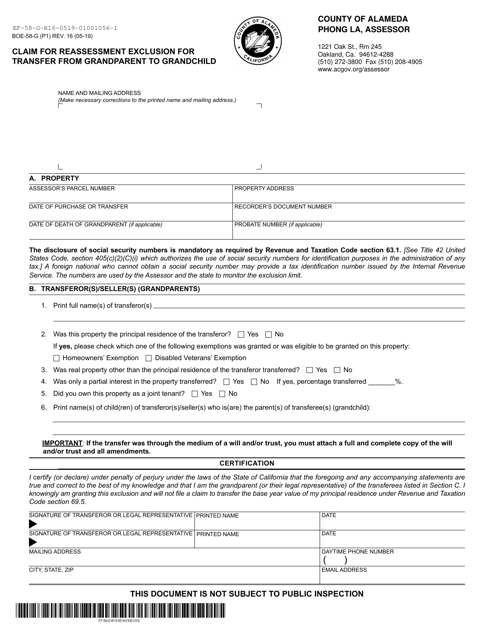

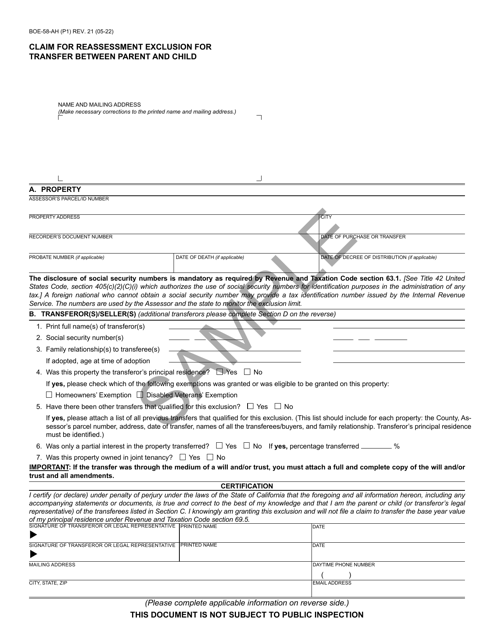

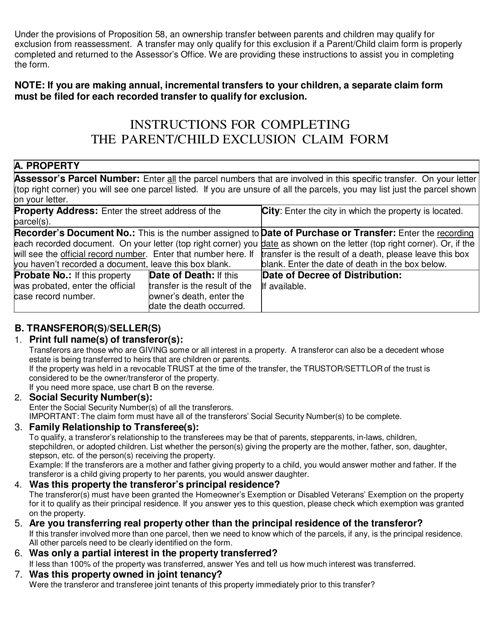

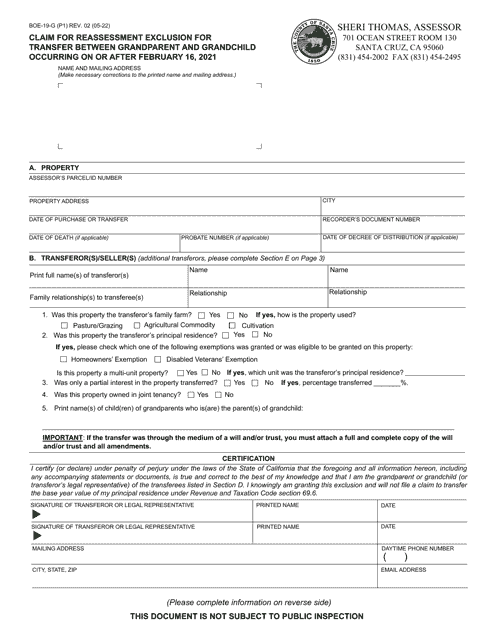

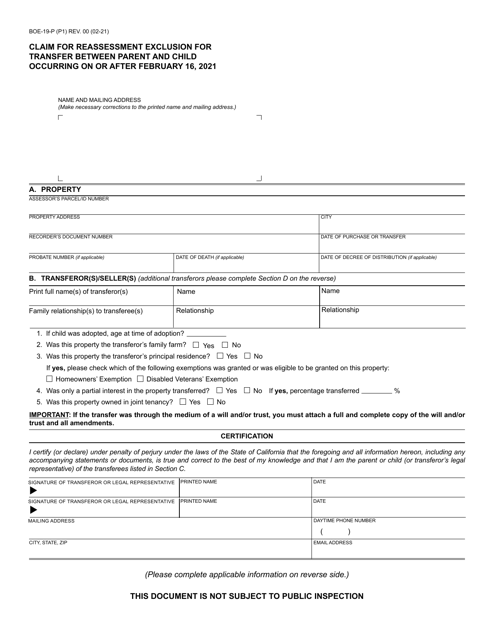

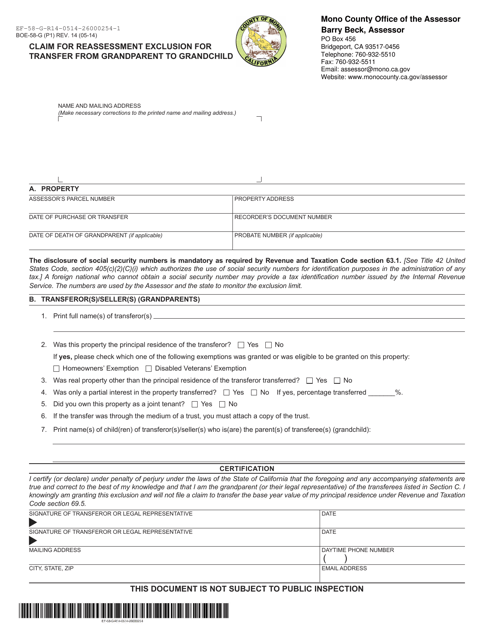

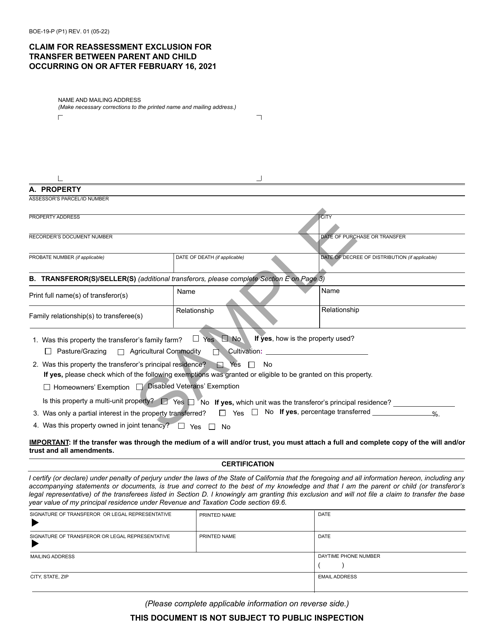

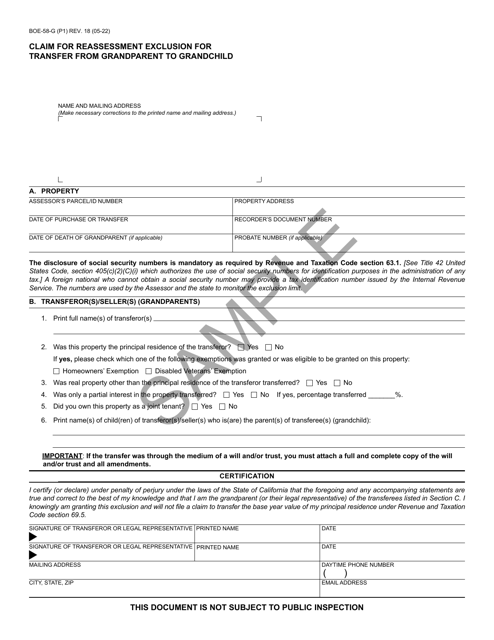

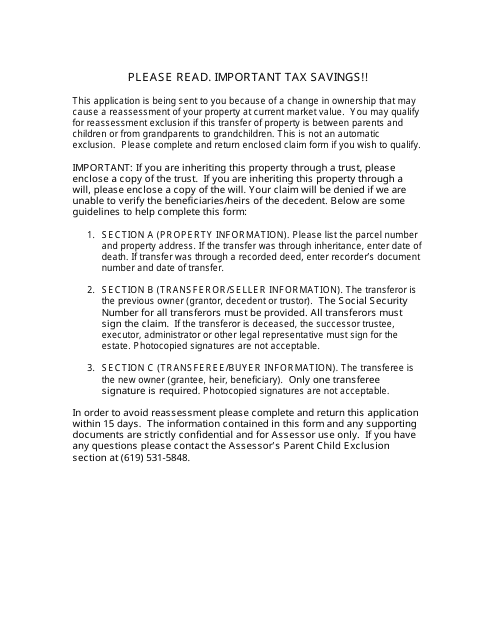

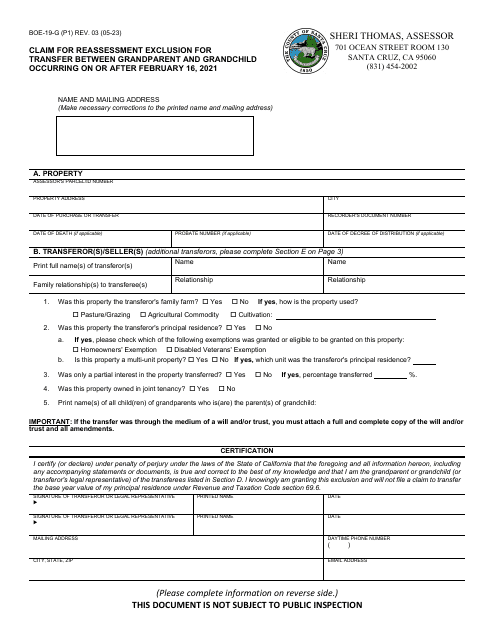

Our claim for reassessment exclusion services provide you with expert guidance and assistance in completing the required forms. Whether you are transferring property from a grandparent to a grandchild or between a parent and child, we have the knowledge and experience to meet your needs. Our extensive collection of sample forms, such as the Form BOE-58-G Claim for Reassessment Exclusion for Transfer From Grandparent to Grandchild and Form BOE-58-AH Claim for Reassessment Exclusion for Transfer Between Parent and Child, will help you navigate the process efficiently.

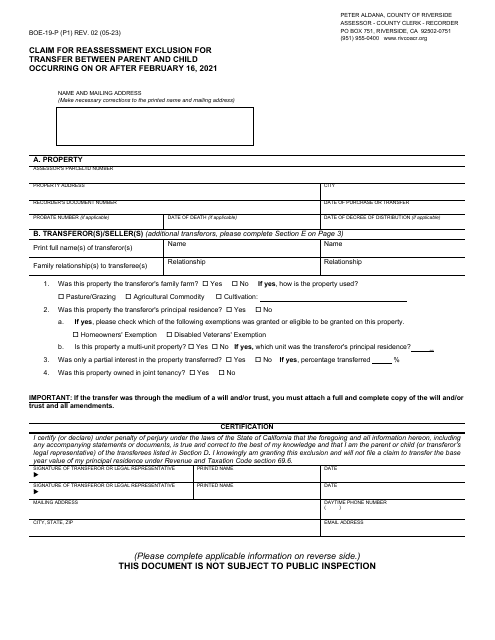

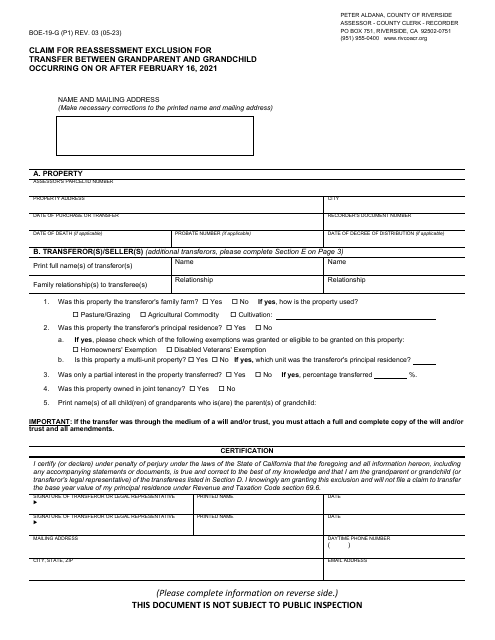

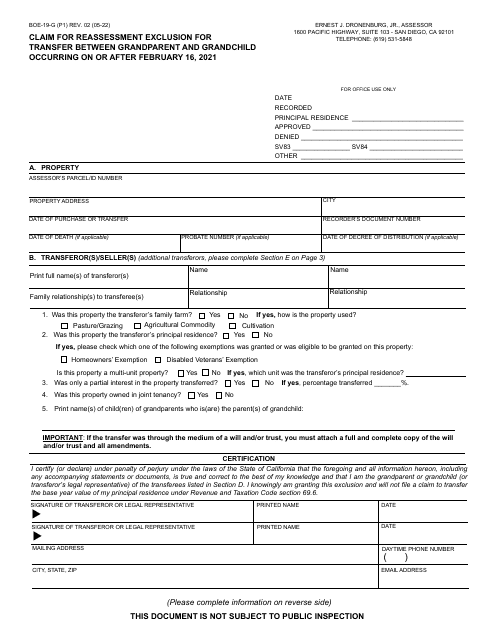

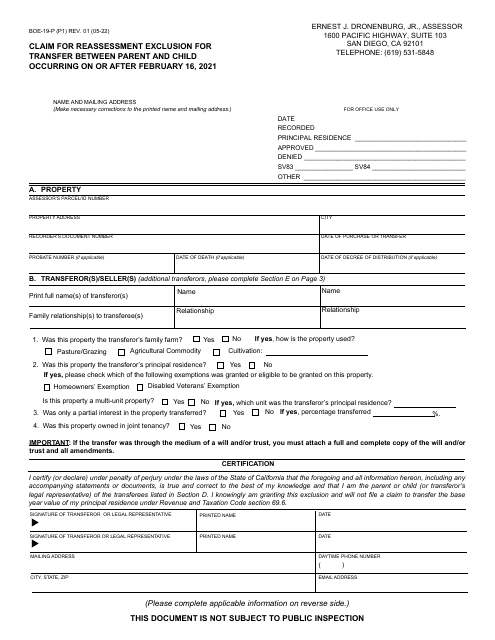

Our services are tailored to the specific requirements of different regions, such as California. We offer specialized forms like the Form BOE-19-P Claim for Reassessment Exclusion for Transfer Between Parent and Child Occurring on or After February 16, 2021 - California, which is designed to meet the latest regulations. Additionally, if you are in the County of Riverside, we have the Form BOE-19-P Claim for Reassessment Exclusion for Transfer Between Parent and Child Occurring on or After February 16, 2021 - County of Riverside, California, and the Form BOE-58-AH Claim for Reassessment Exclusion for Transfer Between Parent and Child - County of San Diego, California for your specific needs.

With our claim for reassessment exclusion services, you can have peace of mind knowing that your property transfer will be handled efficiently and accurately. Our knowledgeable team is ready to assist you in completing the necessary forms and ensuring a successful outcome. Contact us today to learn more about our claim for reassessment exclusion services and how we can help you preserve your family's financial future.

Note: Write proper names of documents, and "claim for reassessment exclusion" and alternate names naturally, do not separate redundant noun phrase into two words.

Documents:

22

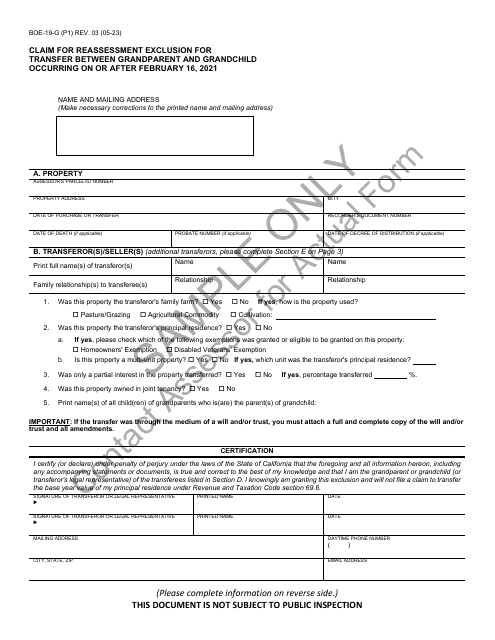

This Form is used for claiming reassessment exclusion for property transfers between grandparents and grandchildren in Alameda County, California.

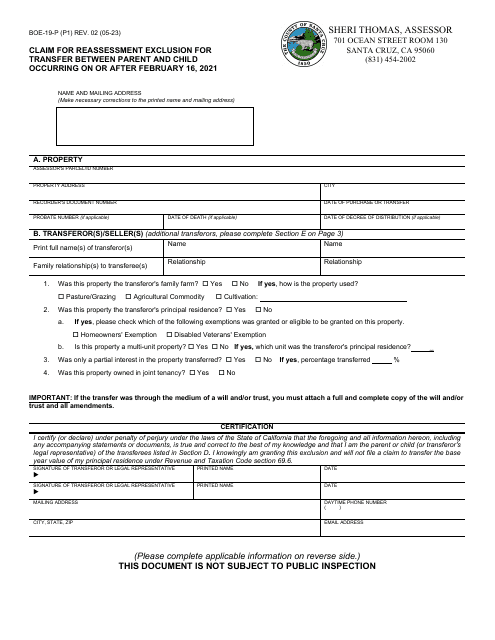

This Form is used for claiming reassessment exclusion for property transfers between parents and children in Santa Cruz County, California.

This form is used for claiming reassessment exclusion for transfers between parents and children in California that occurred on or after February 16, 2021.

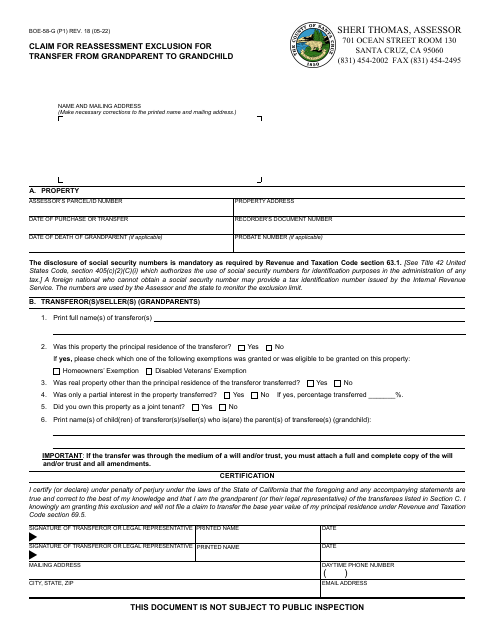

This Form is used for claiming a reassessment exclusion when transferring property from a grandparent to a grandchild in Mono County, California.

This form is used for claiming a reassessment exclusion for property transfers between a parent and child in California that occurred on or after February 16, 2021. It provides a sample of the required documentation for this claim.

This form is used for claiming a reassessment exclusion for property transfers between a grandparent and grandchild in San Diego County, California. It allows for a potential exclusion from property tax reassessment.

This form is used for claiming reassessment exclusion for property transfers between a parent and child in San Diego County, California that occurred on or after February 16, 2021.

This form is used for claiming reassessment exclusion for property transfers between parent and child in San Diego County, California.