Pay Taxes Templates

Pay Taxes and Stay Compliant with Tax Laws

When it comes to fulfilling your civic responsibility and contributing to the development of your community and country, paying taxes is of utmost importance. Paying taxes is not just an obligation, but it is also a way to ensure a fair and equitable distribution of resources for the benefit of all citizens. Whether you are an individual, an estate executor, a domestic employer, or a business owner, understanding and fulfilling your tax obligations is essential.

Our collection of documents includes a variety of forms that will guide you in the process of paying your taxes accurately and on time. From withholding coupons to applications for extensions, these documents cover various tax-related scenarios.

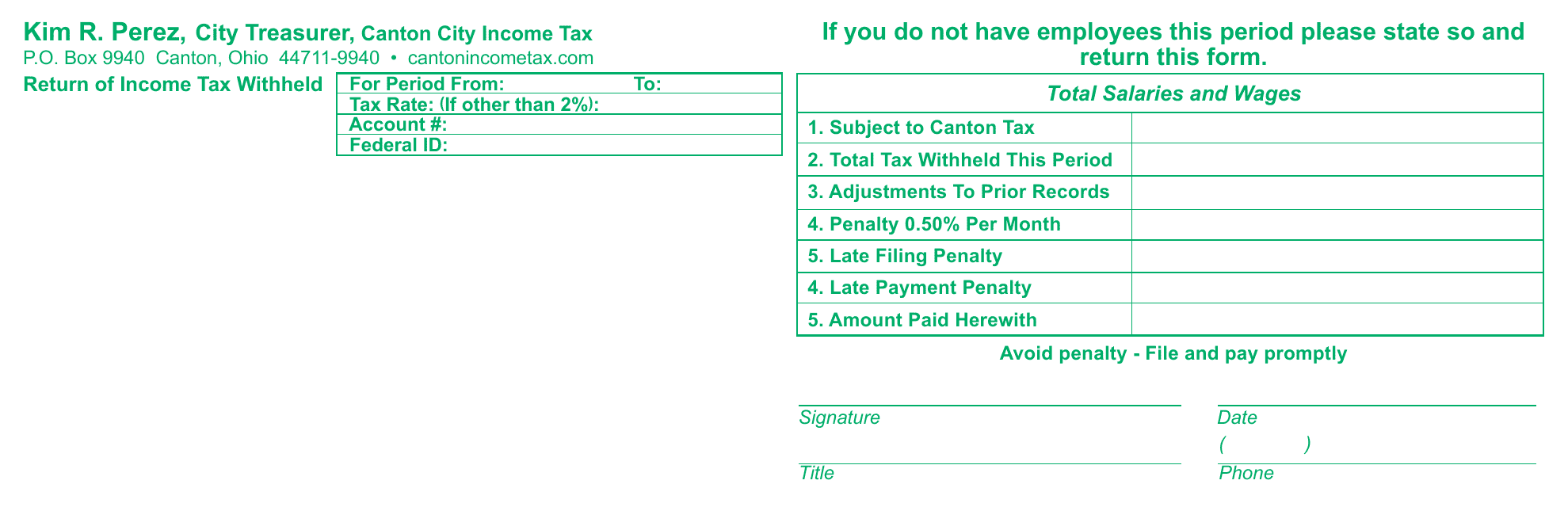

The Withholding Coupon, provided by the City of Canton, Ohio, allows employers to accurately report and remit the required amount of taxes withheld from employees' wages. By doing so, employers contribute to the funding of essential services and infrastructure in their community.

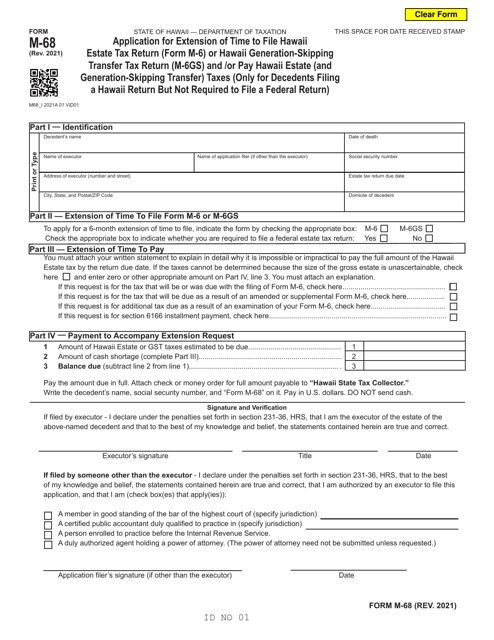

The Form M-68 Application for Extension of Time to File Hawaii Estate Tax Return or Hawaii Generation-Skipping Transfer Tax Return is crucial for estate executors who need additional time to complete their tax obligations. This form ensures compliance with the specific requirements set forth by the state of Hawaii.

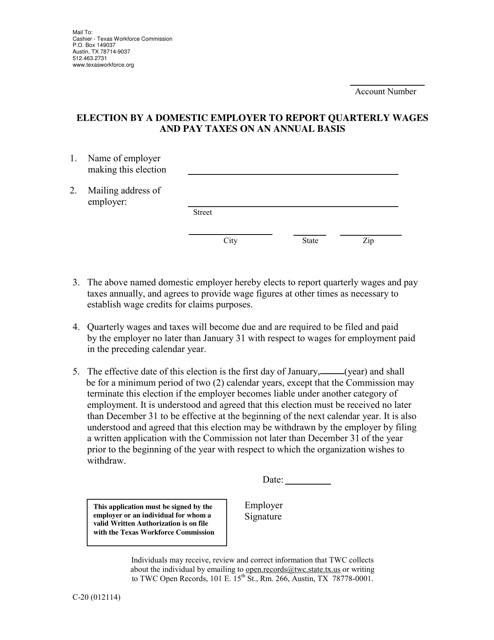

For domestic employers in Texas, the Form C-20 Election allows for the reporting of quarterly wages and the option to pay taxes on an annual basis. This form simplifies the tax reporting process, reducing administrative burdens for employers and ensuring timely payments.

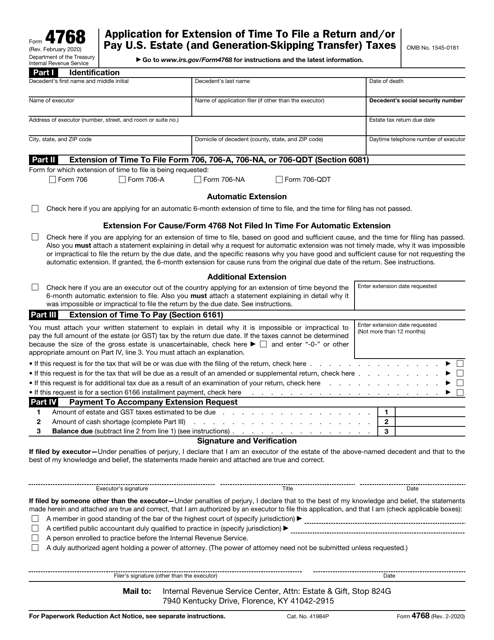

If you are dealing with U.S. Estate and Generation-Skipping Transfer Taxes, the IRS Form 4768 Application for Extension of Time to File a Return provides a way to request an extension. This form is vital for individuals who require extra time to compile the necessary financial information accurately.

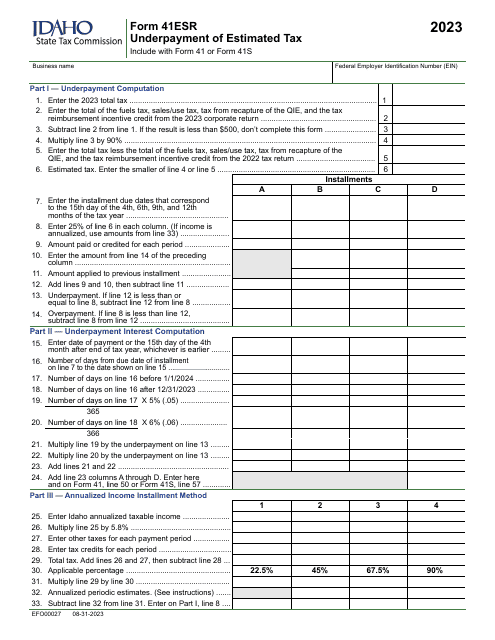

Lastly, the Form 41ESR (EFO00027) Underpayment of Estimated Tax is designed for individuals and businesses in Idaho who have miscalculated their estimated tax payments. This form enables taxpayers to address any underpayment and remain in compliance with tax regulations.

Navigating the intricacies of tax laws can be daunting, but with our comprehensive collection of tax-related documents, you can ensure that your tax obligations are met efficiently and accurately. Whether you're an individual taxpayer or a business owner, our documents will assist you in understanding and fulfilling your tax responsibilities, promoting financial stability, and contributing to the growth and well-being of your community.

Documents:

8

This Form is used for obtaining a withholding coupon from the City of Canton, Ohio.

This form is used by domestic employers in Texas to elect to report their quarterly wages and pay taxes on an annual basis.

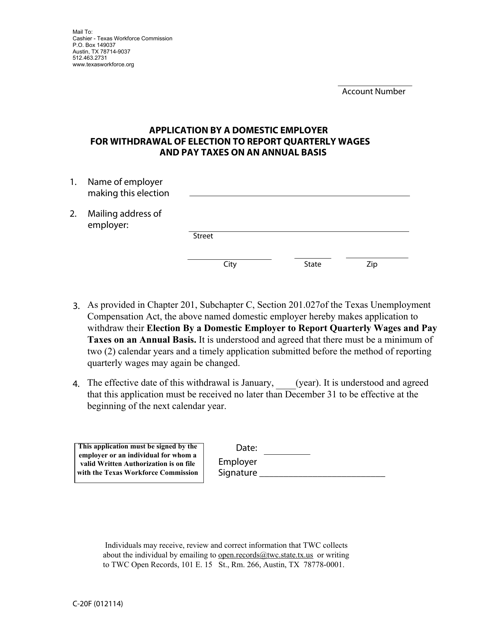

This Form is used for domestic employers in Texas to withdraw their election to report quarterly wages and pay taxes on an annual basis.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.