Retirement Savings Templates

Retirement Savings: Secure Your Future Financially

Planning for retirement is crucial for a secure and fulfilling future. It is never too early to start saving, and our retirement savings resources can help you navigate this process with ease. Whether you refer to it as retirement savings or retirement saving, the goal remains the same – to build a nest egg that will support you during your golden years.

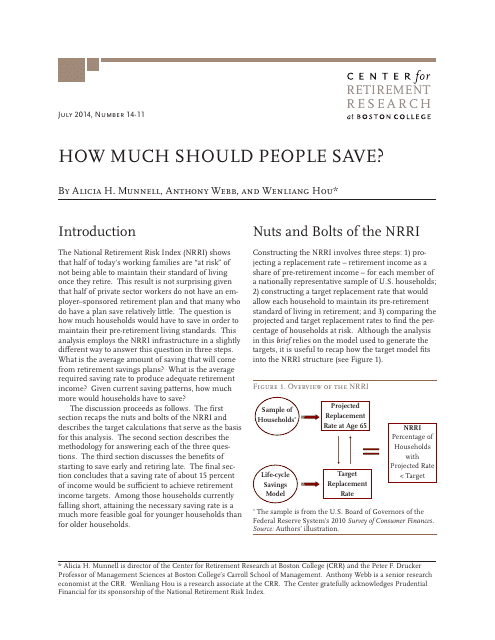

One essential resource in understanding retirement savings is the publication "How Much Should People Save?" authored by Alicia H. Munnell, Anthony Webb, and Wenliang Hou. This comprehensive guide provides valuable insights and recommendations on how to determine the ideal amount one should save for retirement.

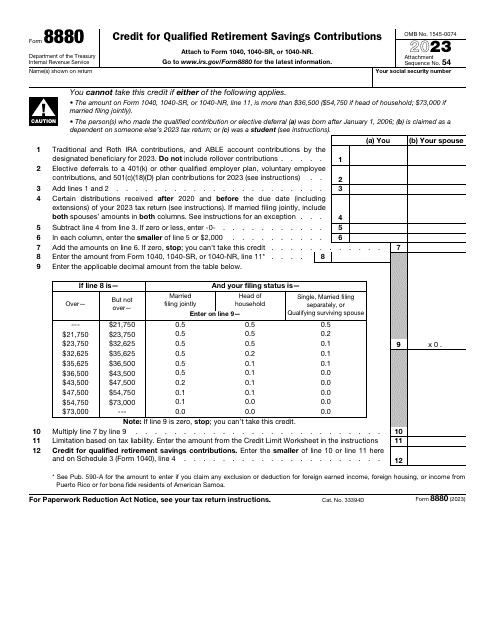

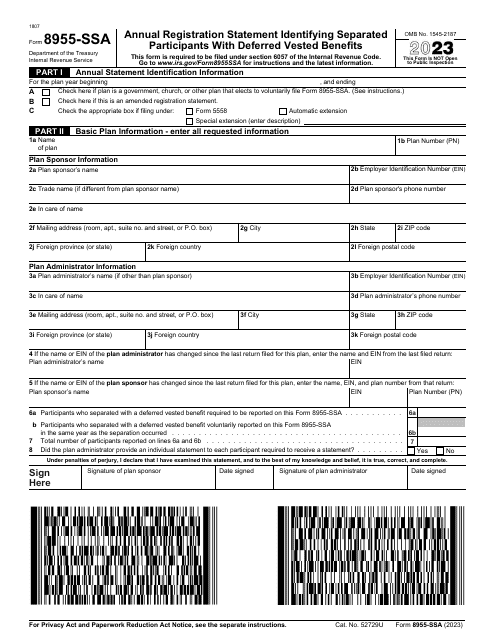

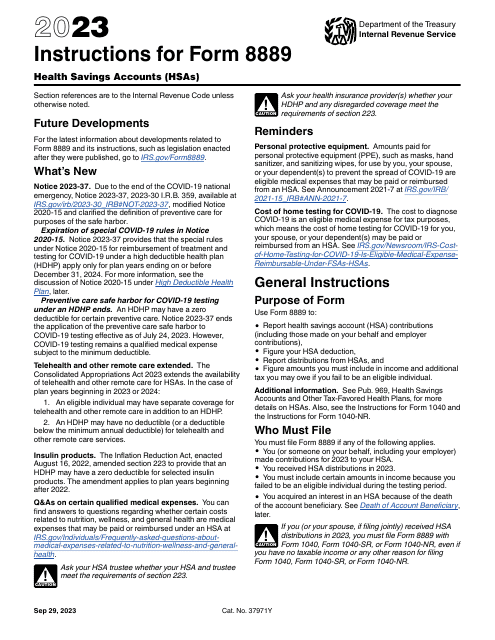

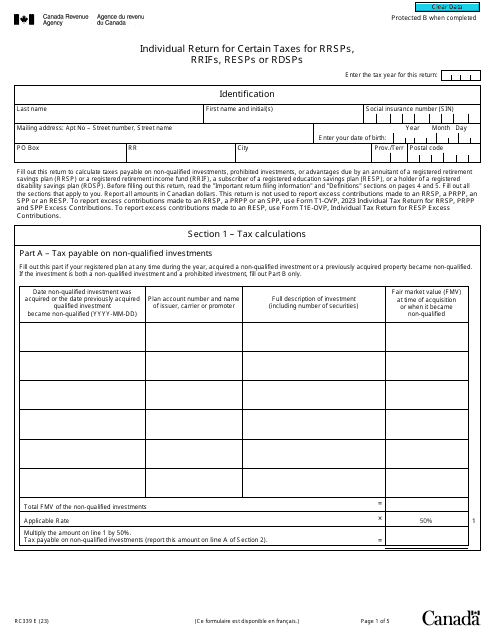

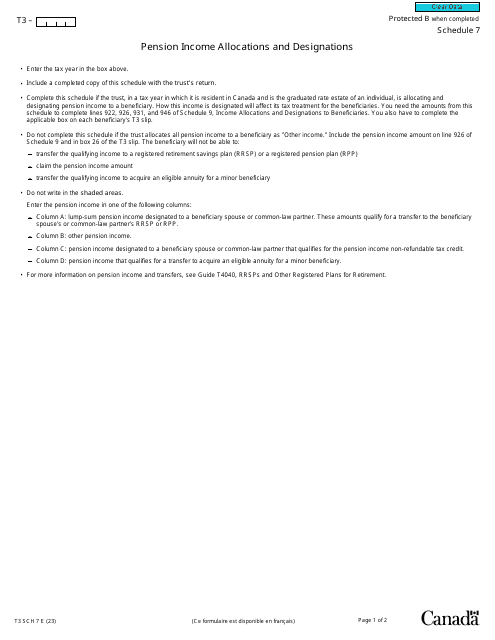

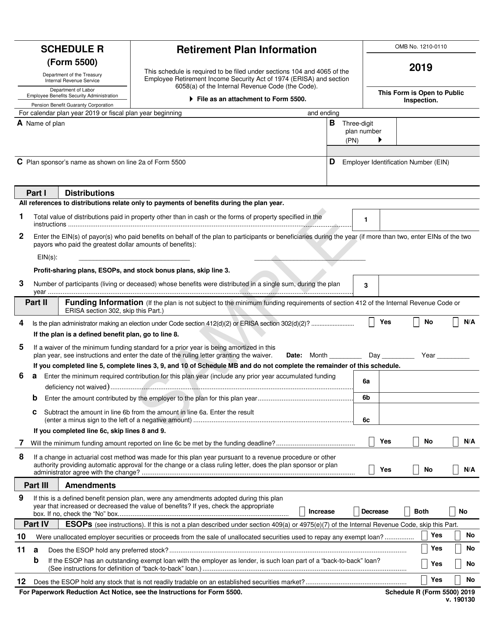

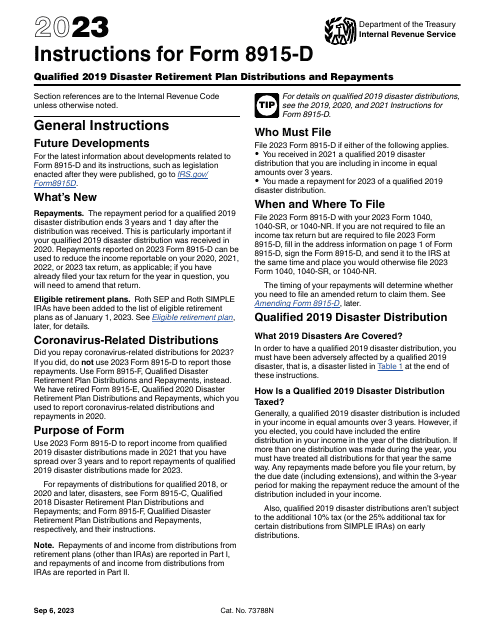

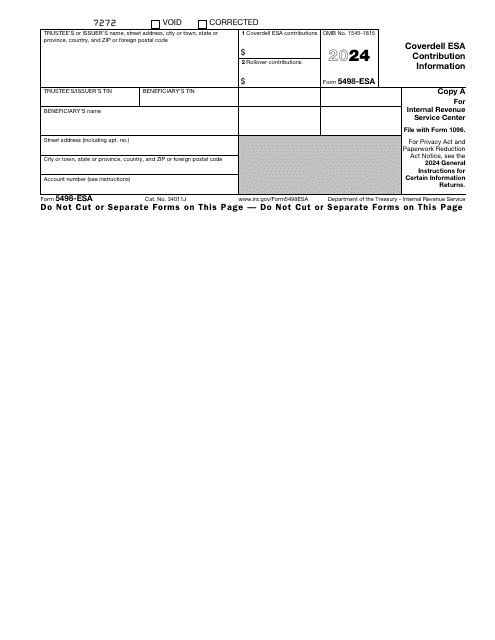

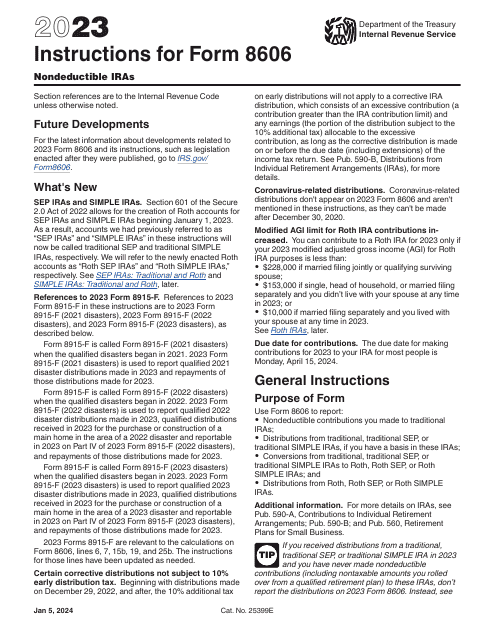

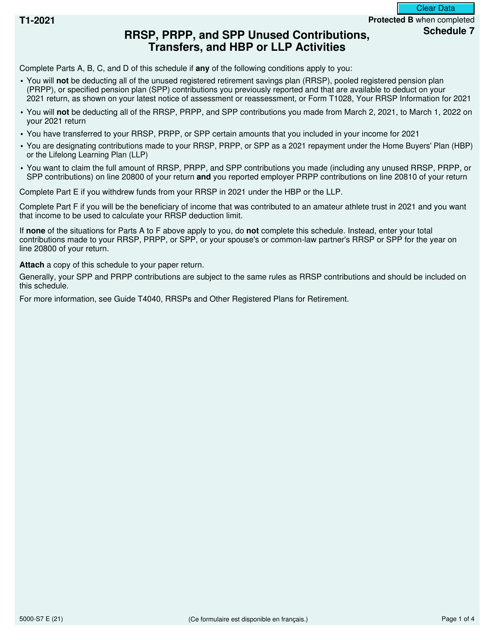

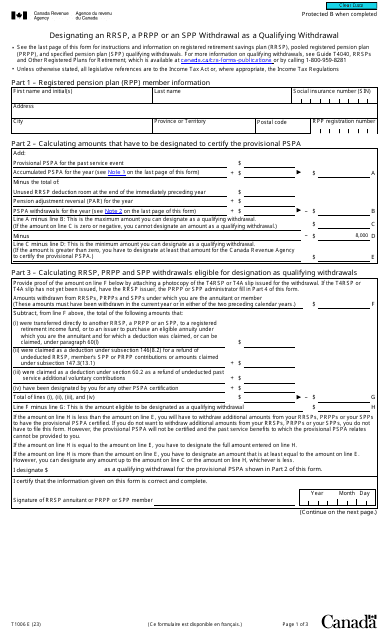

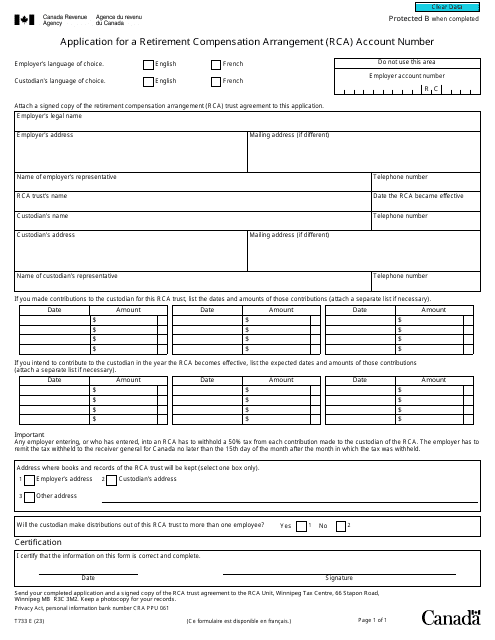

As you embark on your retirement savings journey, it is also important to be familiar with relevant tax documents. The IRS Form 5500 Schedule R Retirement Plan Information provides a comprehensive overview of retirement plans, ensuring that you comprehend the various options available and can make informed decisions. Similarly, the IRS Form 5498-ESA Coverdell Esa Contribution Information and IRS Form 8880 Credit for Qualified Retirement Savings Contributions shed light on specific tax benefits associated with retirement savings.

For those seeking detailed instructions on IRS-related forms, such as the IRS Form 5307 Application for Determination for Adopters of Modified Nonstandardized Pre-approved Plans, our retirement savings resources offer step-by-step guidance to complete the required documentation accurately.

Secure your financial future with our retirement savings resources. Start saving today and enjoy peace of mind knowing that you have taken the necessary steps to create a comfortable retirement.

Documents:

64

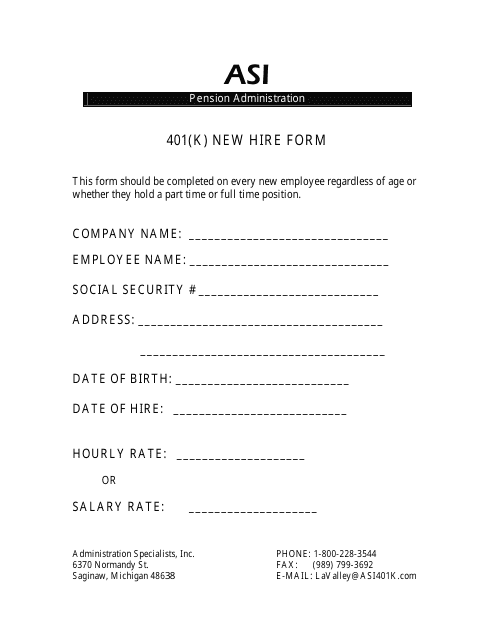

This form is used for new employees to enroll in their employer's 401(k) retirement plan.

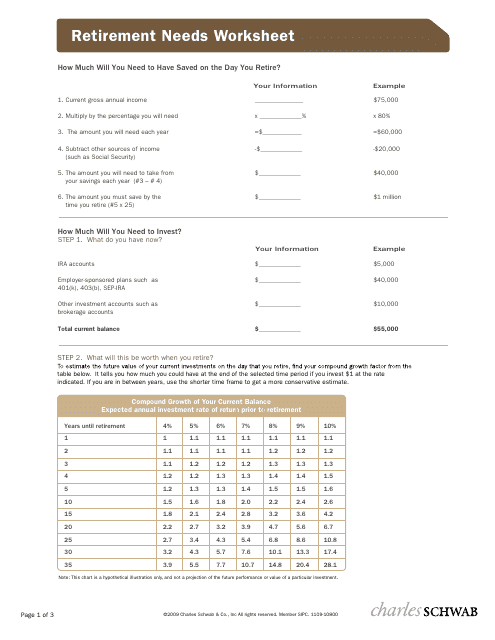

This type of document is a retirement needs worksheet template provided by Charles Schwab. It helps individuals assess their financial goals and estimate how much they need to save for retirement.

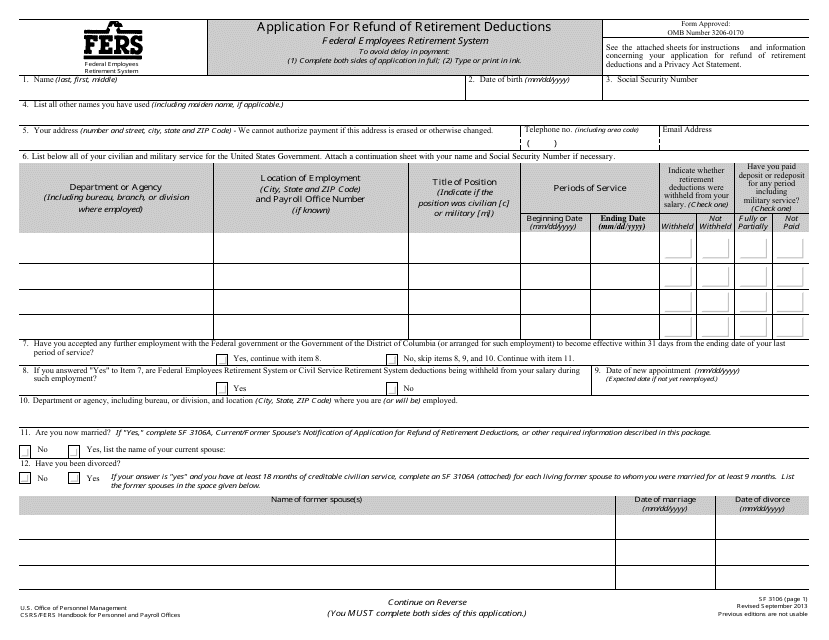

This Form is used for requesting a refund of retirement deductions made from an employee's salary. It is typically used by individuals who are leaving government service and are not eligible for an immediate annuity.

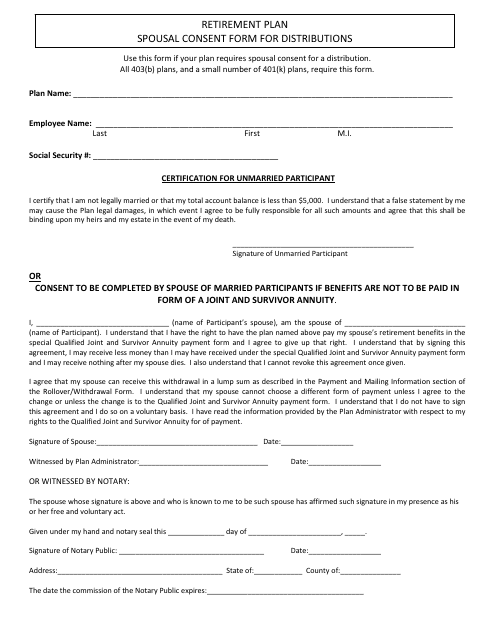

This form is used for obtaining spousal consent for the distribution of retirement plan funds.

This form is used to designate a beneficiary for your Thrift Savings Plan (TSP) account in case of your death.

This document provides guidance on how much individuals should save for their financial future. It offers insights and recommendations from experts Alicia H. Munnell, Anthony Webb, and Wenliang Hou.

This form is used for elected officials in Alaska to participate or waive participation in the Pers Defined Benefit Retirement Plan.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

This document examines the impact of conflicting investment advice on retirement savings. It discusses the potential consequences of receiving conflicting information and offers insights on how to navigate this issue.

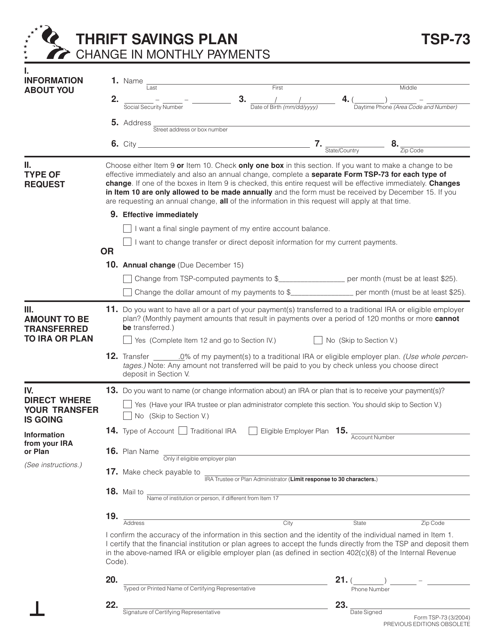

This form is used for making changes to monthly payments for civilian employees participating in the Thrift Savings Plan (TSP).

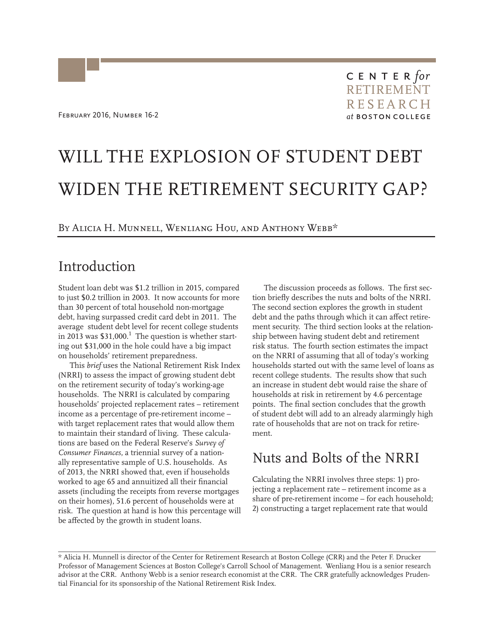

This document examines the potential impact of the growing student debt on retirement security in the United States. It discusses how the increasing amount of student debt could potentially worsen the retirement savings gap.

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

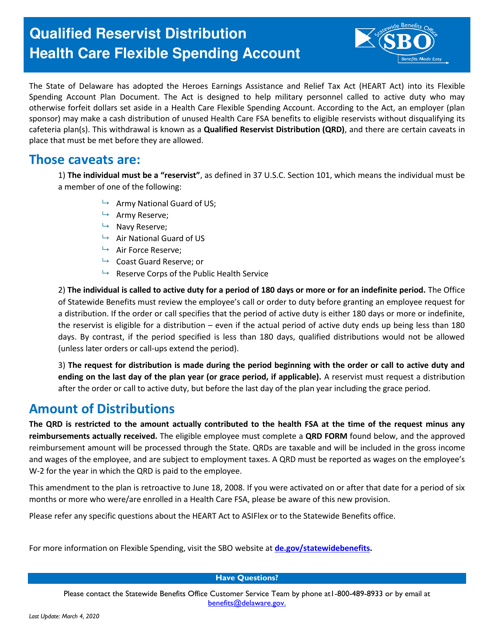

This Form is used for requesting a distribution as a qualified reservist in the state of Delaware.

This document provides a list of the top 10 strategies to prepare for retirement, including saving money, investing, and planning for healthcare costs.

This document provides a list of the top 10 ways to prepare for retirement. It includes helpful tips and strategies for ensuring a secure and comfortable retirement.

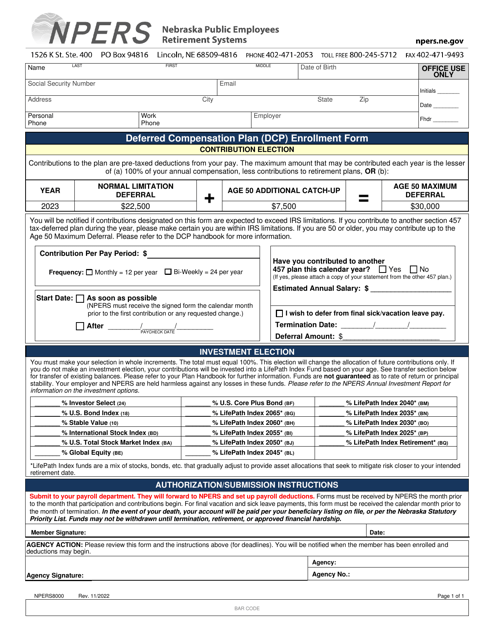

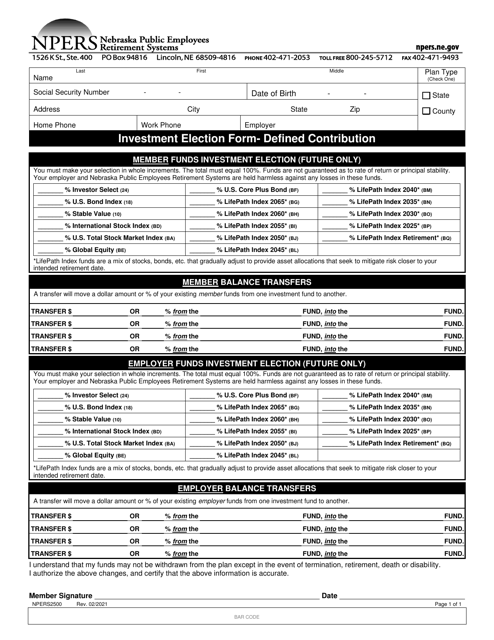

This Form is used for making investment elections for defined contribution plans in Nebraska.

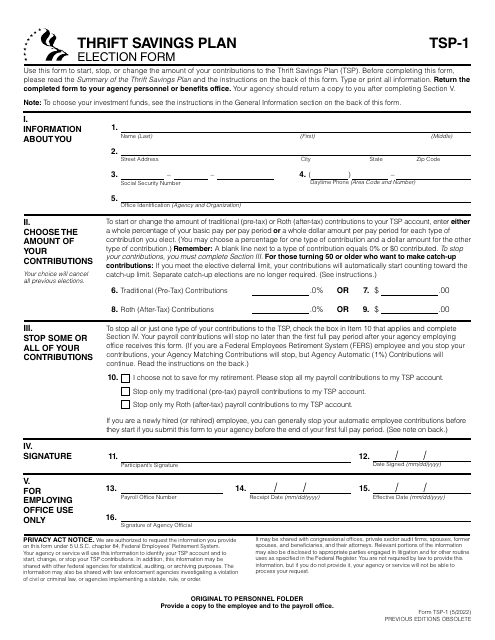

This Form is used for summarizing the Thrift Savings Plan.

This form is used for authorizing the release of retirement account information in the state of Kentucky.

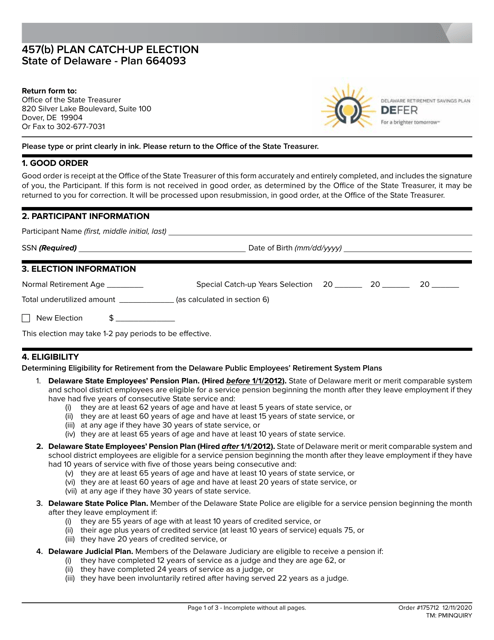

This document is for making catch-up contributions to a 457(b) retirement plan in the state of Delaware. It allows individuals to contribute additional funds to their retirement account to "catch up" on missed contributions.

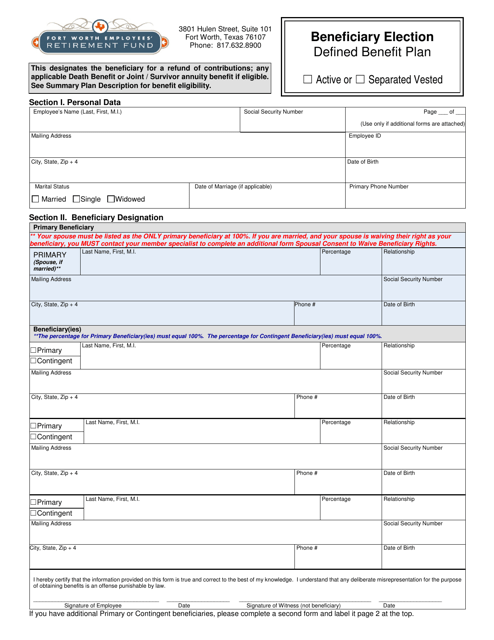

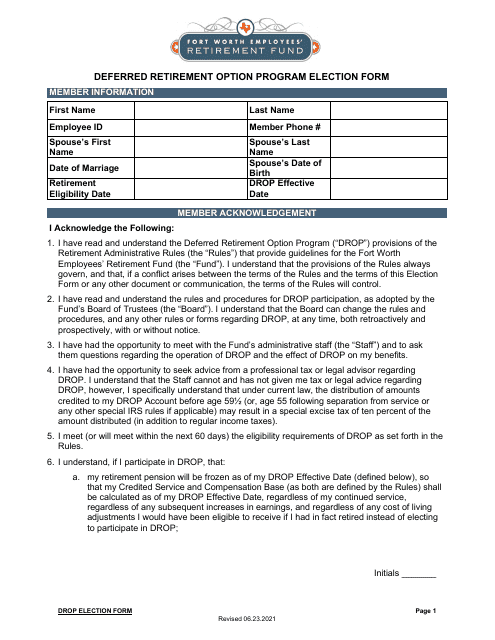

This document provides information and instructions for active employees of the City of Fort Worth, Texas, to make beneficiary elections for the Defined Benefit Plan.

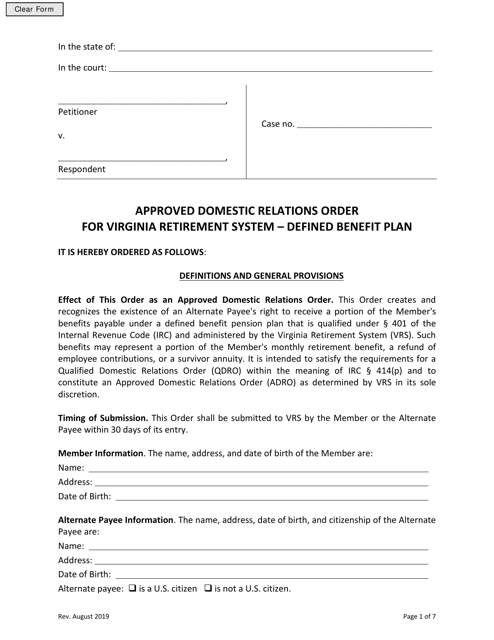

This document is used for an Approved Domestic Relations Order (ADRO) specific to a Defined Benefit Plan in the state of Virginia. It outlines the division of retirement benefits between divorcing spouses.