Casualties and Thefts Templates

Casualties and Thefts Documents

Welcome to our comprehensive collection of documents related to casualties and thefts. Whether you are an individual or a business entity, dealing with unexpected losses due to casualties or thefts can be overwhelming. That's why we have gathered a comprehensive selection of resources to help you navigate through the necessary procedures and requirements.

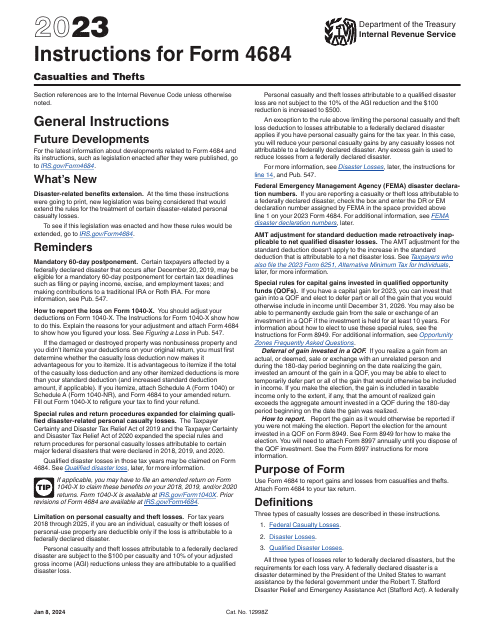

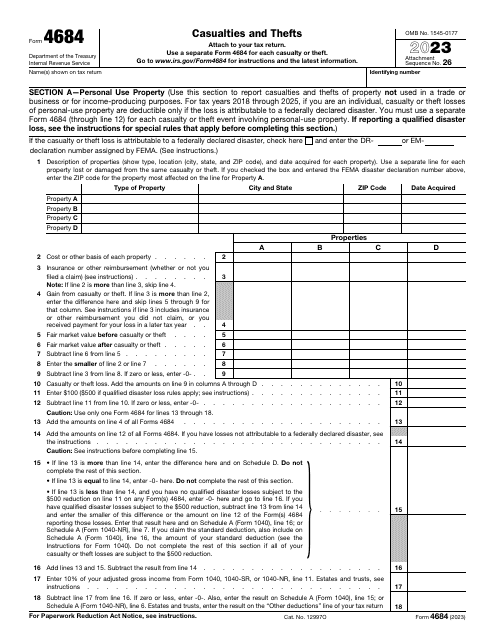

Our collection includes a variety of documents, including instructions for IRS Form 4684 Casualties and Thefts. These instructions provide detailed guidance on how to accurately report and claim losses associated with casualties and thefts on your tax returns. We understand that tax matters can be complex, but our aim is to simplify the process for you with clear and concise instructions.

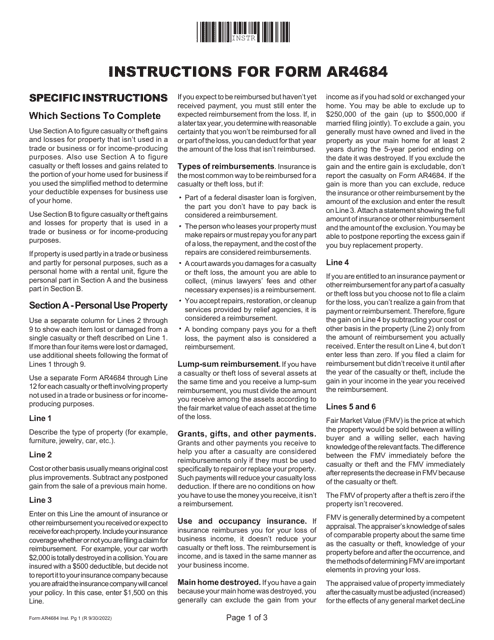

In addition to the IRS forms and instructions, we also offer resources specific to certain states, such as the Instructions for Form AR4684 Casualties and Thefts - Arkansas. This ensures that you have access to state-specific guidelines and requirements if you are filing taxes or dealing with losses in Arkansas.

Our alternate names for this document group, "casualties and thefts", reflect the nature of the documents contained within our collection. We understand the importance of finding accurate and reliable information when you need it the most. That's why our documents are regularly updated to reflect any changes in regulations or procedures.

Whether you are a taxpayer, tax professional, or someone who has suffered from casualties or thefts, our collection of casualties and thefts documents aims to provide you with the necessary resources to navigate through the process with ease. Empower yourself with knowledge and ensure that you are taking the right steps to address your losses effectively.

Please note that while our collection is extensive, it is always recommended to consult with a tax professional or seek legal advice specific to your situation. Our documents are meant to serve as a starting point and provide general guidance, but individual circumstances may vary.

Browse through our casualties and thefts documents today and access the information you need to effectively address your losses.

Documents:

5

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

This Form is used for reporting casualties and thefts in the state of Arkansas. It provides instructions on how to document and claim losses resulting from these events.