Unreported Tip Income Templates

Are you a worker in the service industry who earns tips as part of your income? If so, it's important to understand the regulations regarding unreported tip income. This collection of documents, also known as unreported tip income, provides detailed information and guidelines on how to accurately report and account for your tipping earnings.

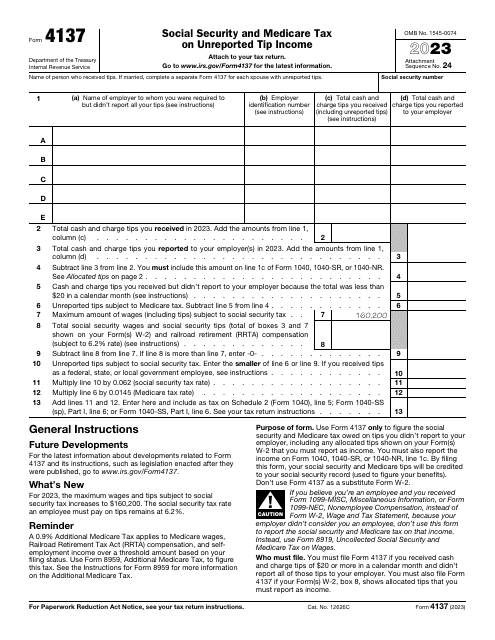

One of the key documents in this collection is the IRS Form 4137, Social Security and Medicare Tax on Unreported Tip Income. This form is specifically designed to help individuals in the service industry calculate and report their unreported tips for tax purposes. By accurately filling out this form, you can ensure compliance with tax laws and avoid potential penalties.

The unreported tip income collection covers various aspects and scenarios related to tipping earnings. It provides guidance on how to keep track of your tips, how to allocate the income correctly, and how to accurately report it on your tax return. Additionally, the collection delves into the specific tax obligations and requirements for different types of service industry workers, such as waitstaff, bartenders, and delivery drivers.

Understanding and complying with the regulations surrounding unreported tip income is crucial for both individuals and businesses in the service industry. Failure to accurately report and pay taxes on your tipping earnings can result in penalties, audits, and legal consequences. By utilizing the resources in this collection, you can ensure that you are correctly reporting your unreported tip income and maintaining compliance with the relevant tax laws.

So, whether you need guidance on filling out IRS Form 4137 or want to learn more about your obligations as a tipped employee, the unreported tip income collection is an invaluable resource. Stay informed, stay compliant, and protect your financial future.