Tax Templates

Documents:

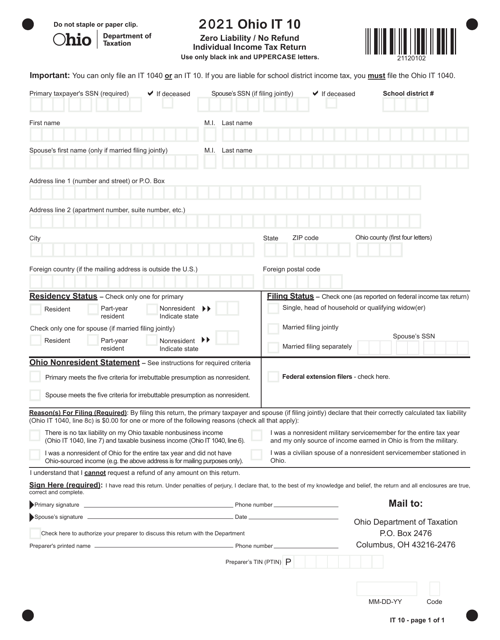

2882

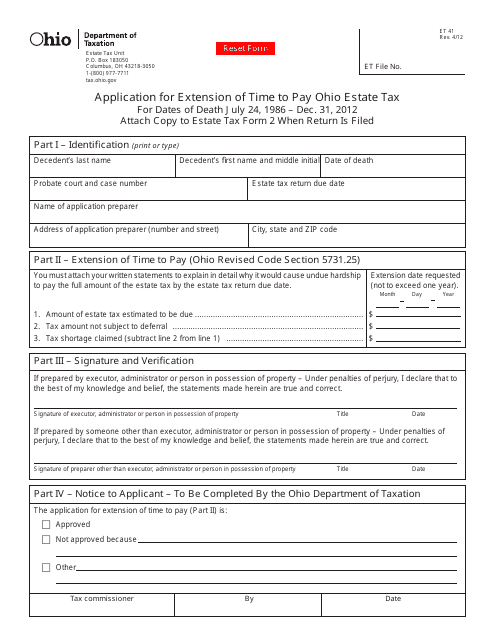

This Form is used for filing an application for extension of time to pay Ohio Estate Tax in the state of Ohio.

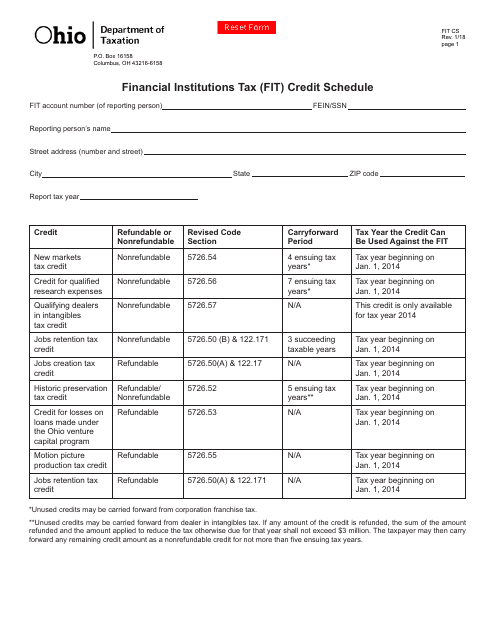

This Form is used for reporting and claiming the Financial Institutions Tax (FIT) Credit in Ohio.

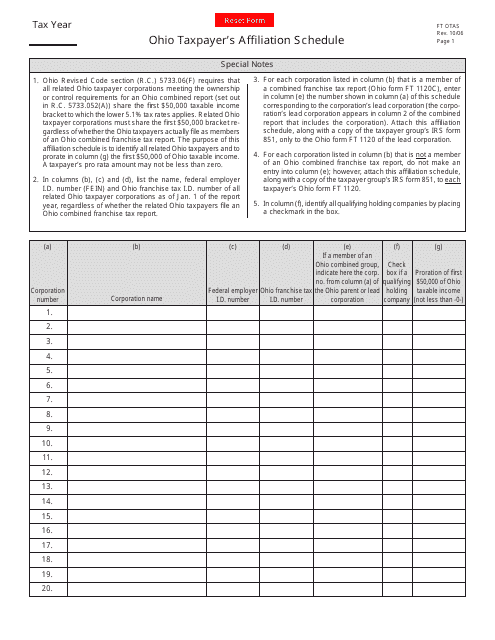

This Form is used for reporting the taxpayer's affiliation in Ohio for tax purposes. It is required by the Ohio Department of Taxation.

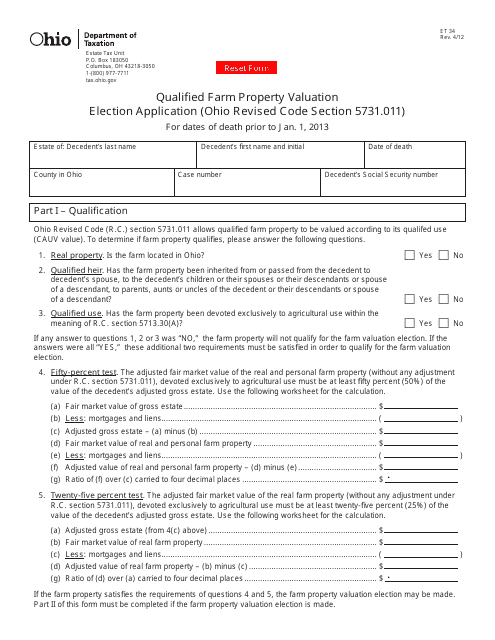

This form is used for applying for the Qualified Farm Property Valuation Election in the state of Ohio.

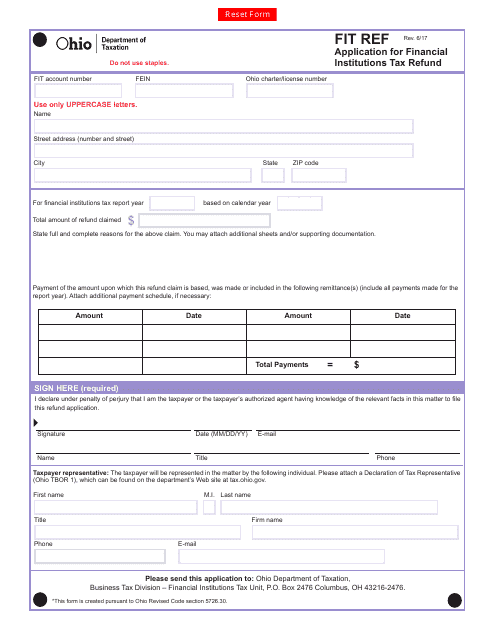

This form is used for financial institutions in Ohio to apply for a tax refund.

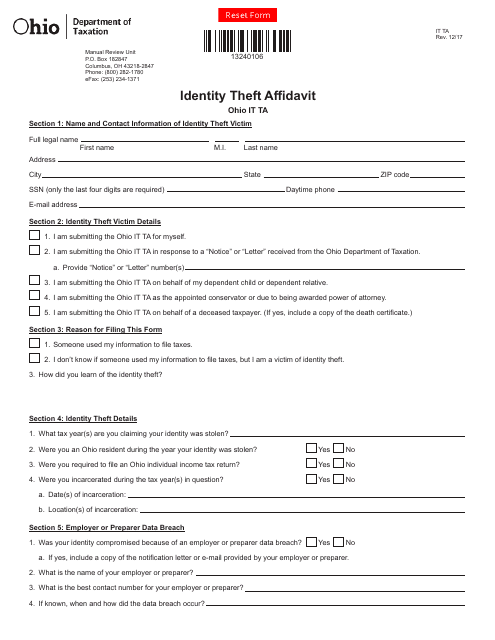

This Form is used for reporting identity theft incidents in the state of Ohio. It allows individuals to provide necessary information and details regarding the theft for further investigation and protection of their identity.

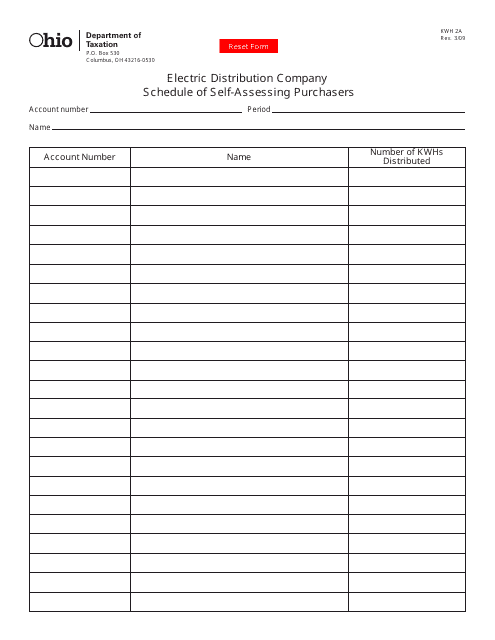

This Form is used for self-assessing purchasers in Ohio to provide information to the Electric Distribution Company.

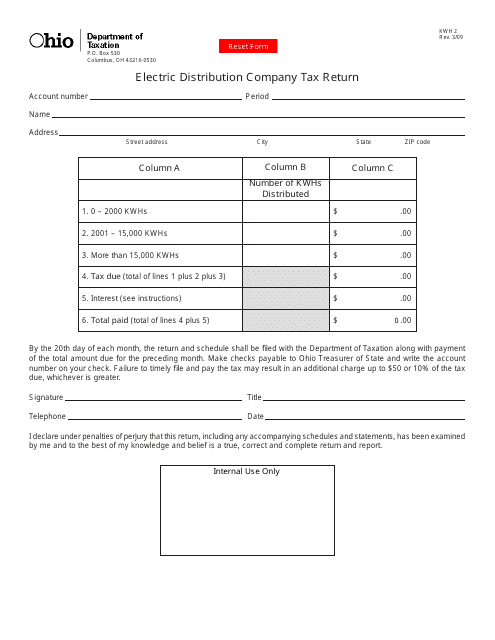

This form is used for filing the Electric Distribution Company Tax Return in Ohio. It is specifically for companies involved in the distribution of electricity.

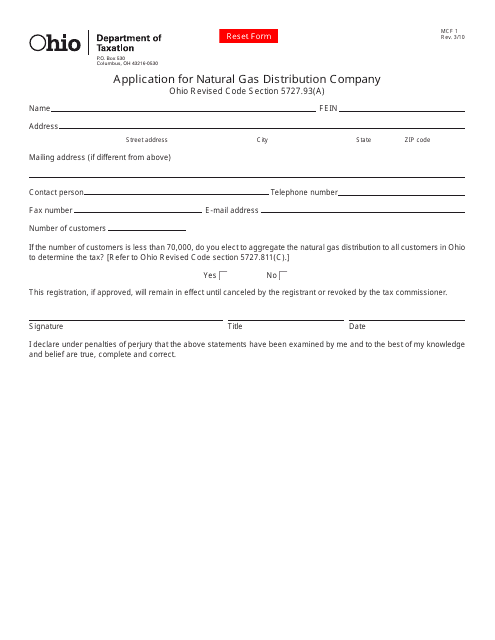

This form is used for applying to become a natural gas distribution company in the state of Ohio.

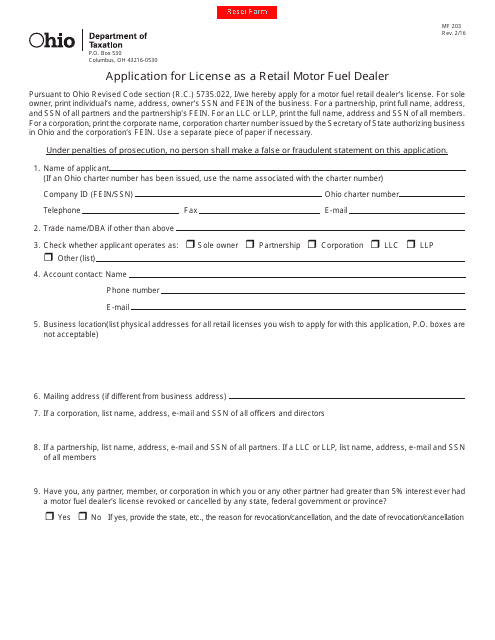

This Form is used for applying for a license as a retail motor fuel dealer in the state of Ohio.

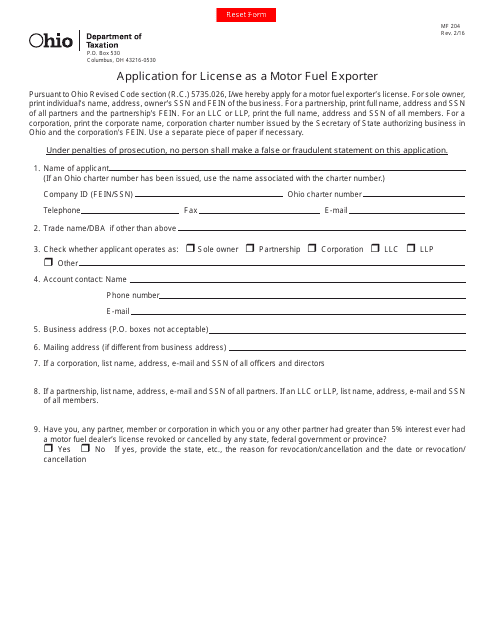

This form is used for applying for a license as a Motor Fuel Exporter in the state of Ohio.

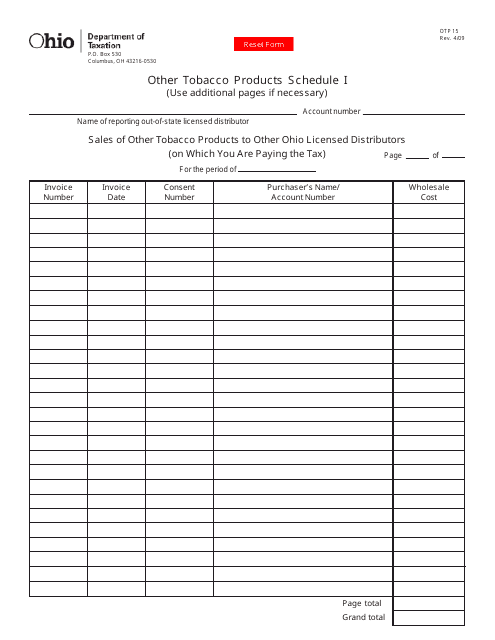

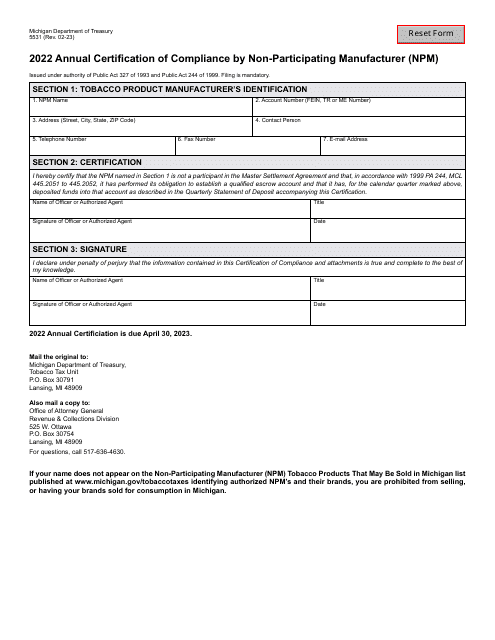

This form is used for reporting and scheduling other tobacco products in Ohio, as required by law. It is part of the state's efforts to regulate the sale and distribution of tobacco products.

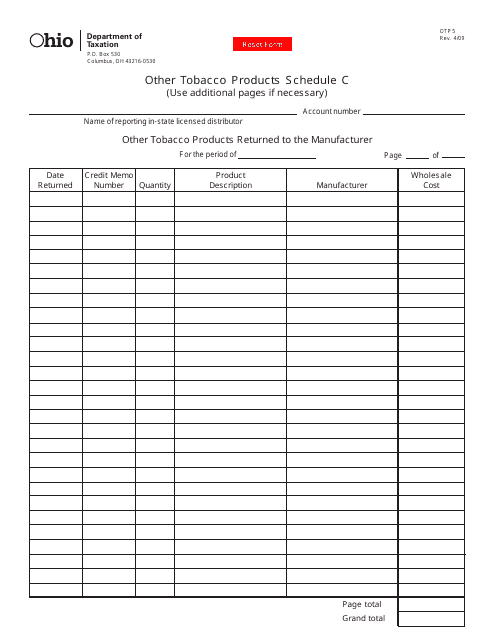

This form is used for reporting other tobacco products sales in Ohio. It is specifically for Schedule C of the OTP5 form.

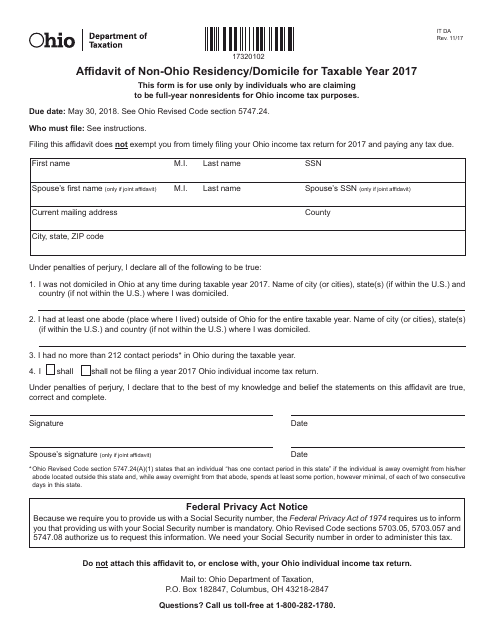

This form is used for declaring non-Ohio residency or domicile. It is meant for individuals who are not residents of Ohio for tax purposes.

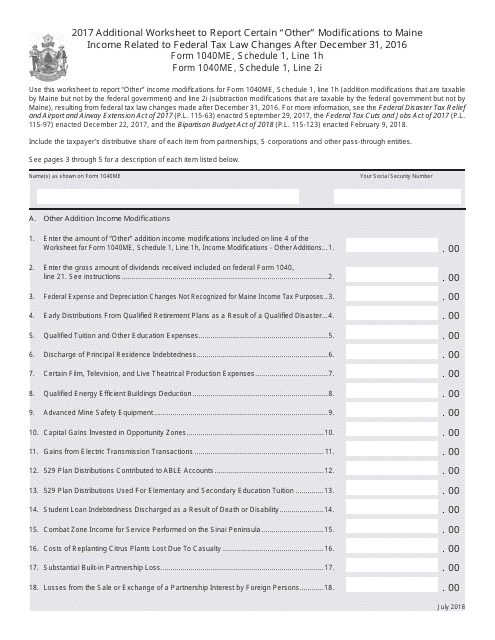

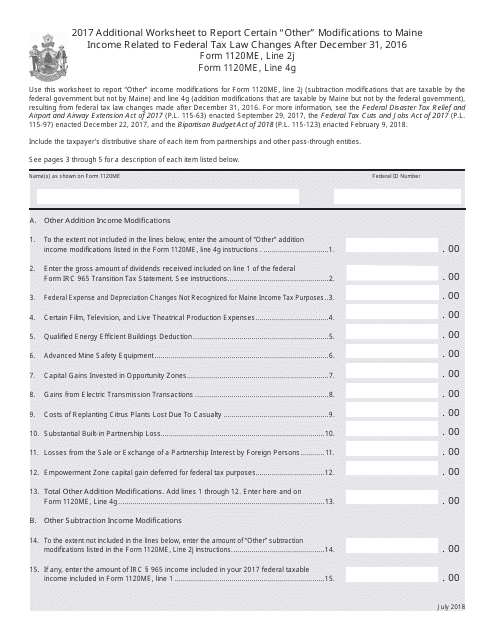

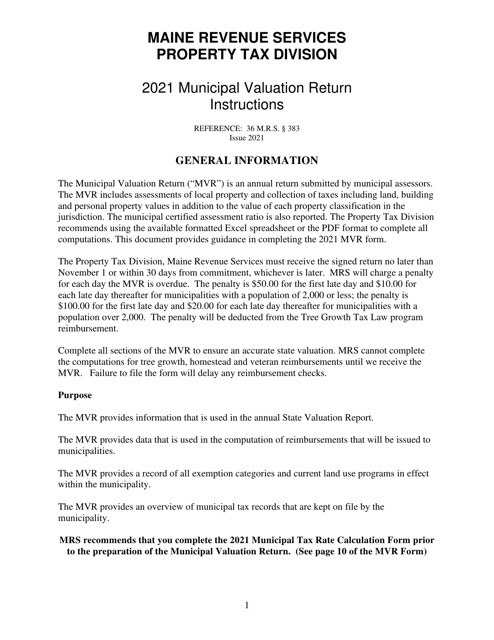

This document for reporting modifications to Maine income due to federal tax law changes after December 31, 2016 in Form 1040ME.

This form is used to report certain modifications to Maine income related to federal tax law changes that occurred after December 31, 2016.

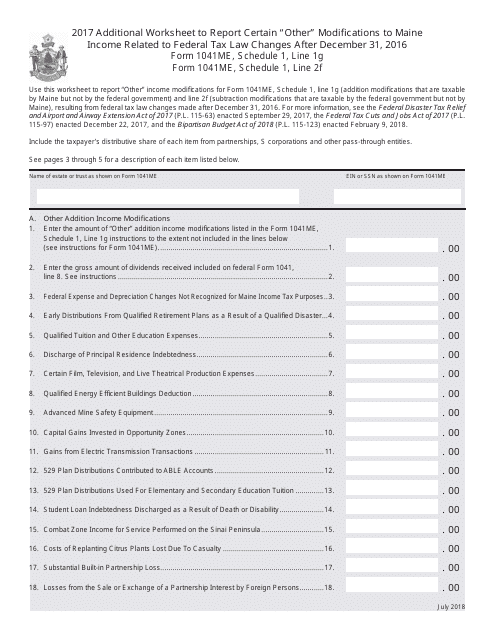

This Form is used for reporting certain modifications to Maine income related to federal tax law changes after December 31, 2016 in addition to Form 1041ME.

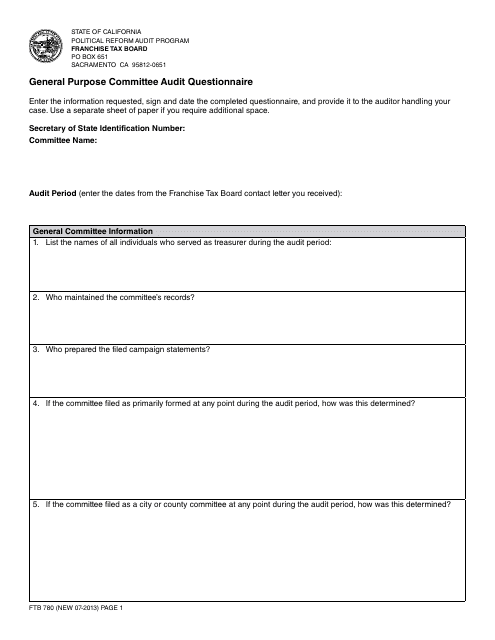

This form is used for conducting an audit of general purpose committees in California. It includes a questionnaire to gather information and ensure compliance with campaign finance laws.

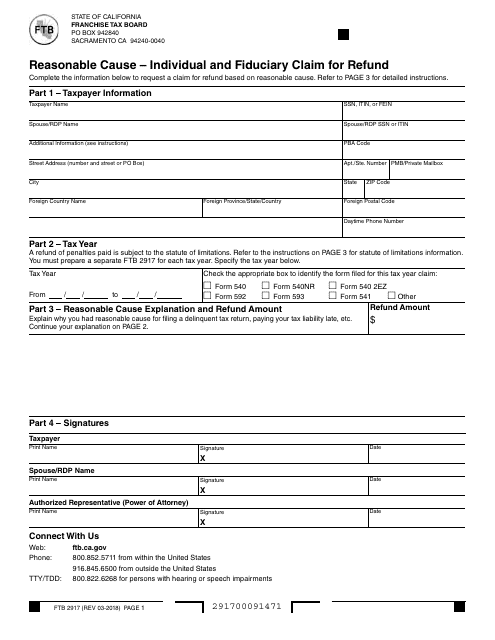

This form is used for individuals and fiduciaries in California to claim a refund and provide a reasonable cause for doing so.

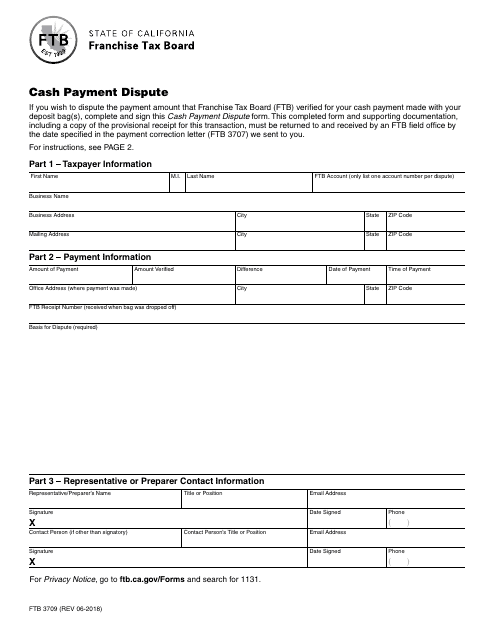

This form is used for disputing cash payments made to the Franchise Tax Board (FTB) in California.

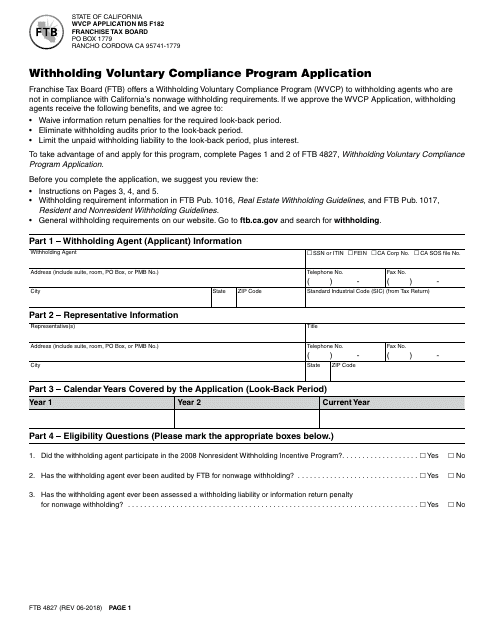

This form is used for applying to the Withholding Voluntary Compliance Program (WVCP) in California. It allows taxpayers to voluntarily come into compliance with their withholding obligations.

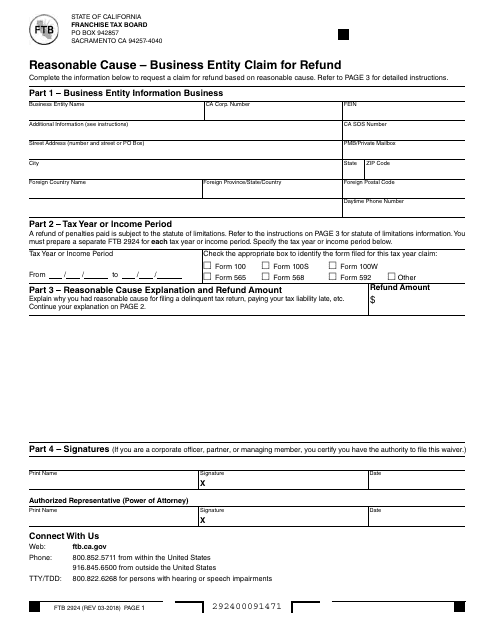

This form is used for claiming a refund for a business entity in California if there is a reasonable cause for the refund.

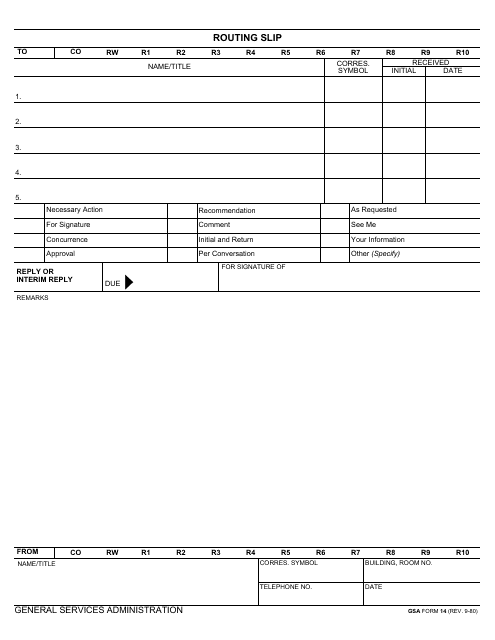

This document is used for routing official correspondence within the General Services Administration (GSA). It helps ensure that important information reaches the appropriate individuals or departments.

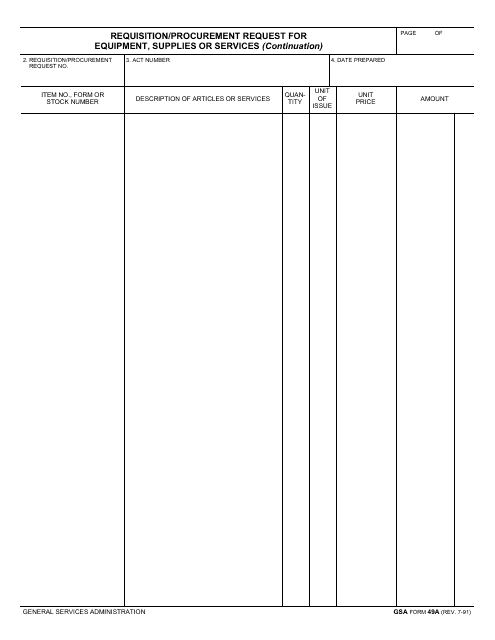

This Form is used for requesting equipment, supplies, or services on an ongoing basis. It is a continuation of the original requisition/procurement request form.

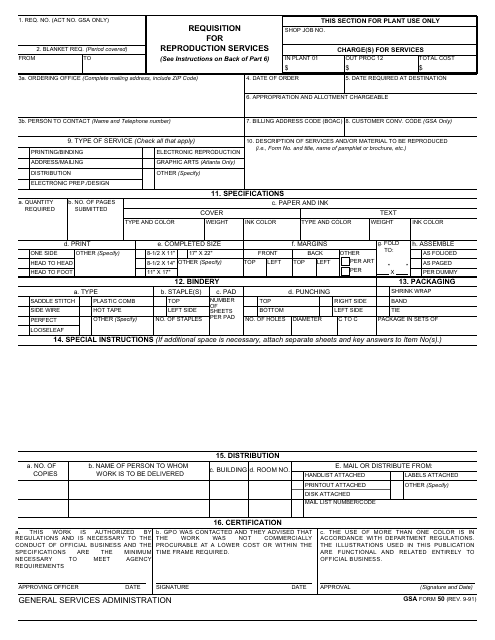

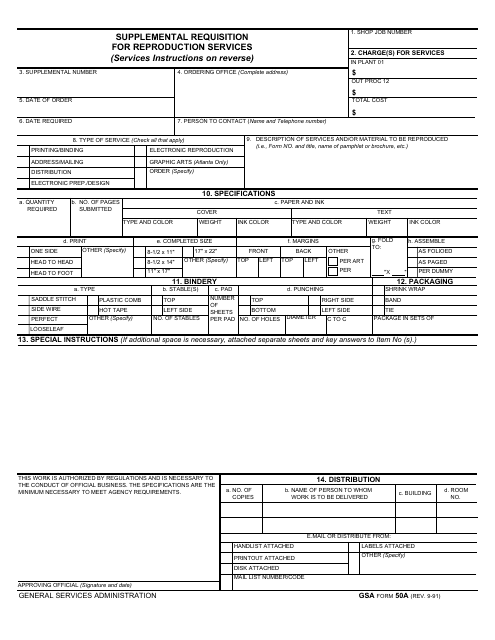

This form is used for requesting reproduction services through the General Services Administration (GSA).

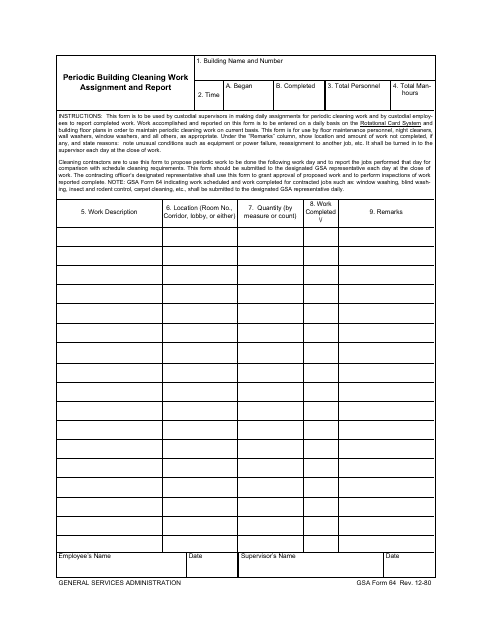

This document is for assigning and reporting periodic building cleaning work.

This document is used for requesting additional reproduction services through the GSA (General Services Administration).

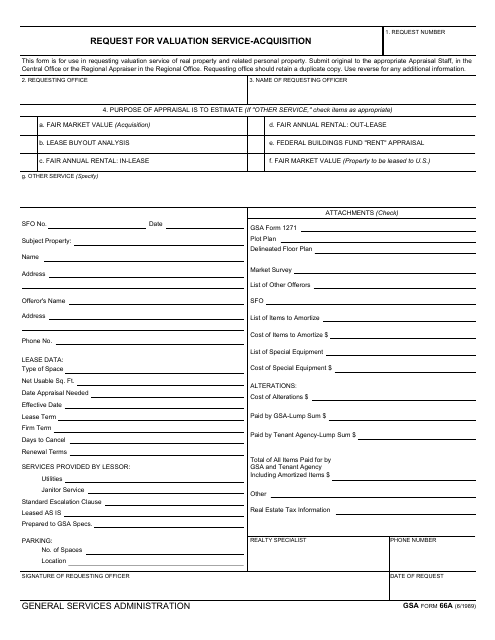

This document is used for requesting a valuation service for an acquisition through GSA (General Services Administration).

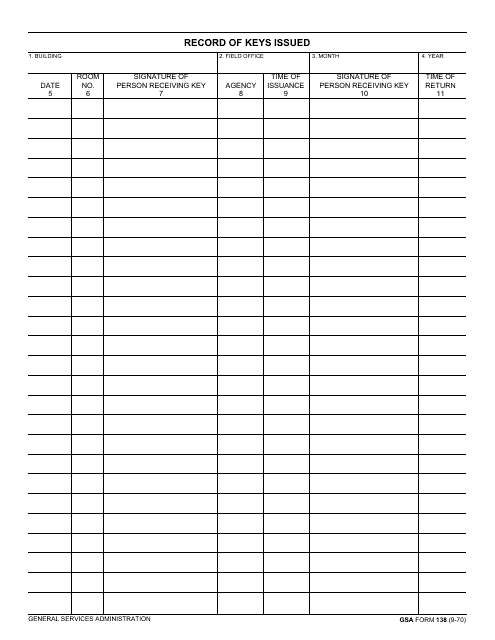

This document is used to keep a record of keys that have been issued by the General Services Administration (GSA).

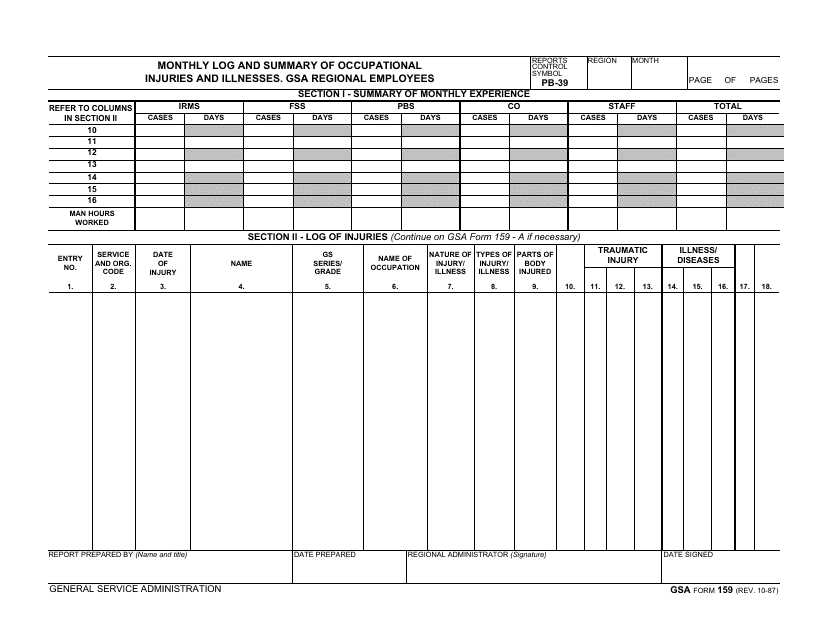

This Form is used for recording and summarizing the occupational injuries and illnesses of GSA regional employees on a monthly basis.