Tax Templates

Documents:

2882

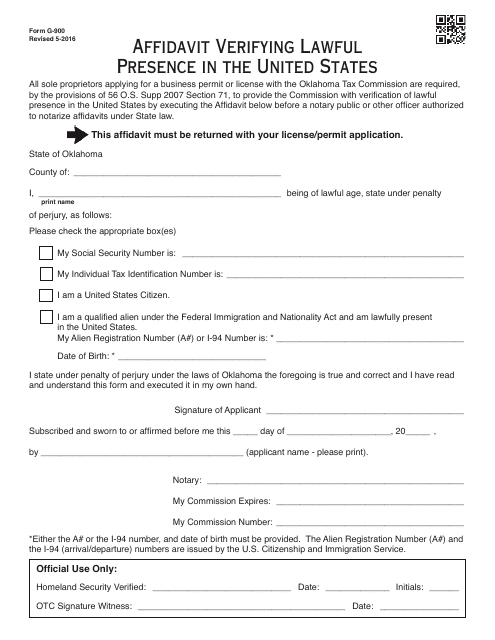

This form is used for verifying the lawful presence of an individual in the United States, specifically in the state of Oklahoma.

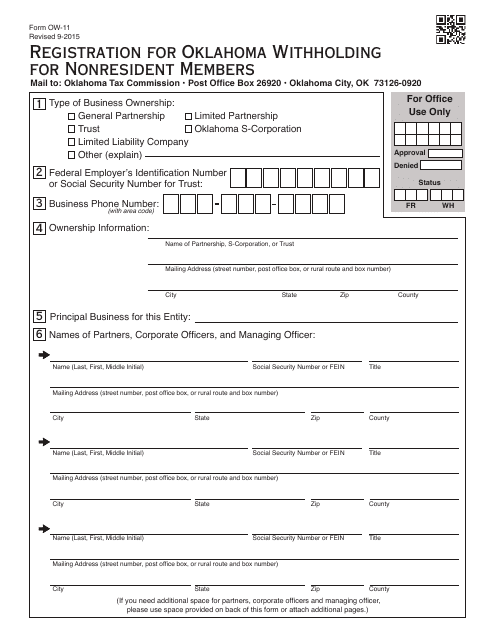

This Form is used for nonresident members to register for Oklahoma withholding for their income earned in Oklahoma. It is required for those who are not Oklahoma residents but have income sources within the state.

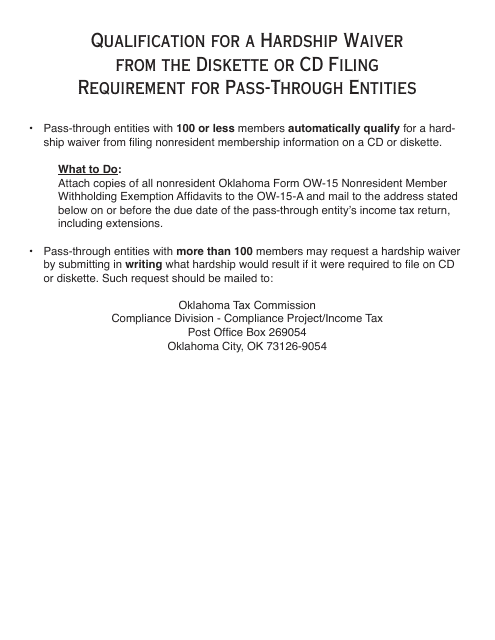

This Form is used for nonresident members to claim withholding exemption in Oklahoma. It allows nonresidents to request exemption from income tax withholding on their share of income from an Oklahoma partnership or limited liability company (LLC).

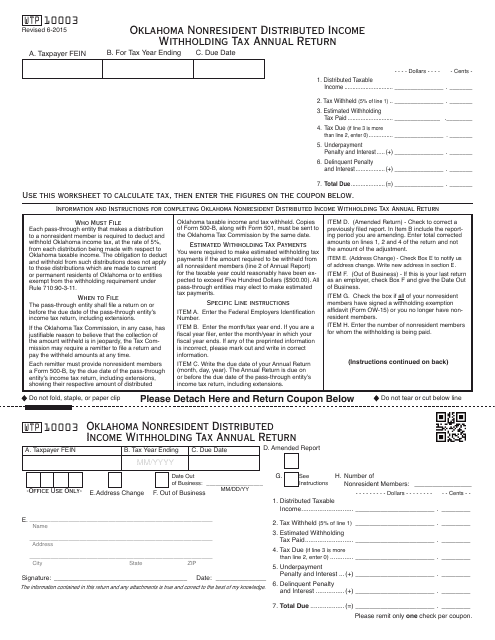

This Form is used for reporting and paying nonresident distributed income withholding tax in Oklahoma for the tax year.

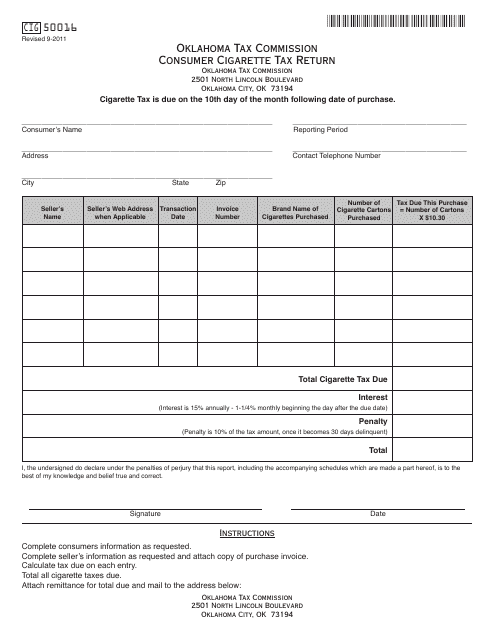

This Form is used for reporting and paying consumer cigarette tax in Oklahoma.

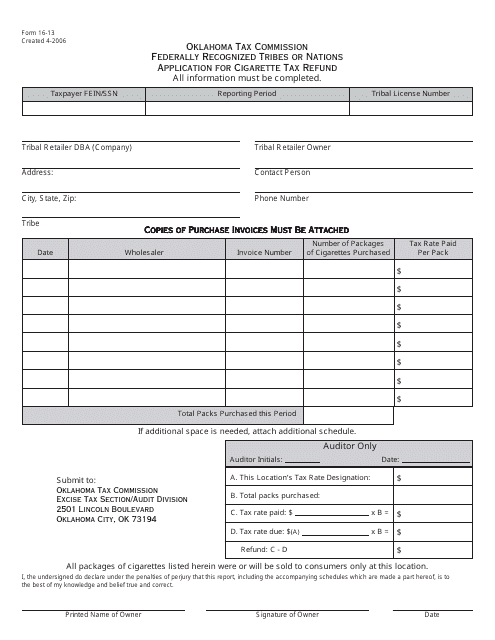

This form is used for applying for a cigarette tax refund in Oklahoma for Federally Recognized Tribes or Nations.

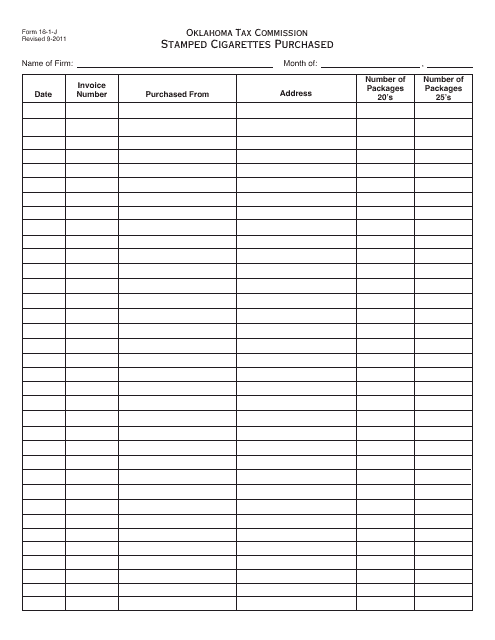

This form is used for reporting the purchase of stamped cigarettes in Oklahoma.

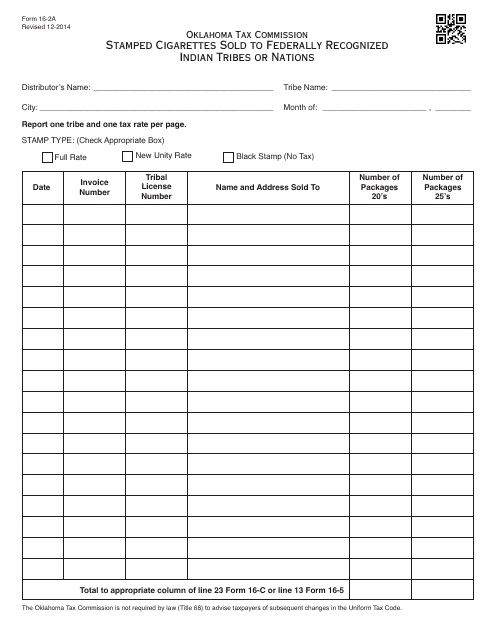

This form is used for reporting the sale of stamped cigarettes to federally recognized Indian tribes or nations in Oklahoma.

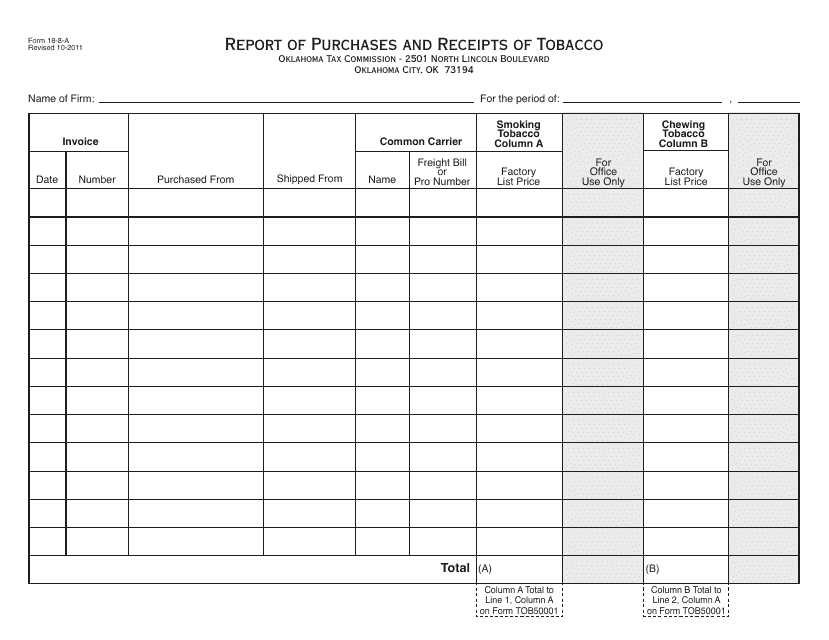

This form is used for reporting purchases and receipts of tobacco in Oklahoma. It is specifically for Over-the-Counter (OTC) transactions.

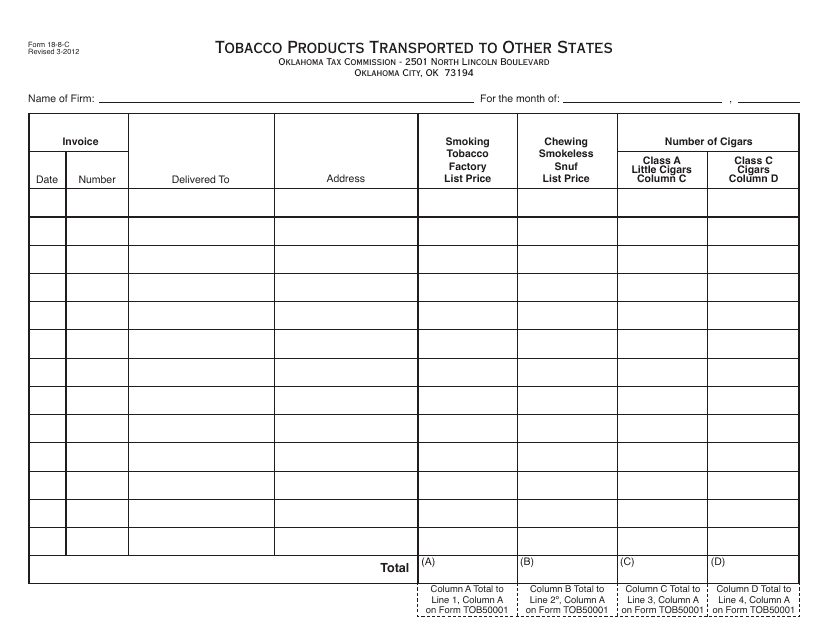

This form is used for reporting the transportation of tobacco products from Oklahoma to other states.

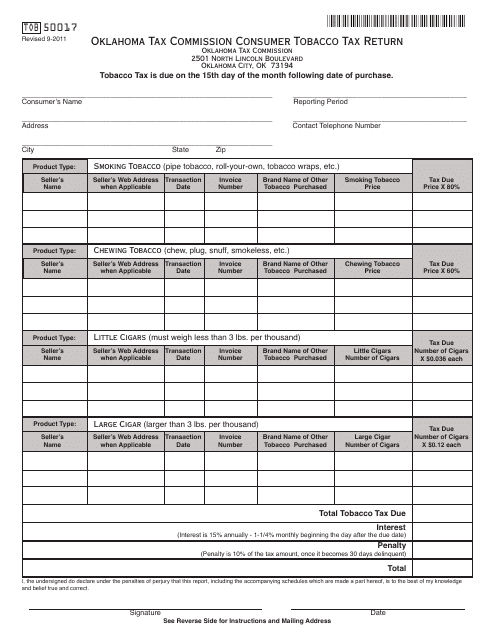

This Form is used for filing the Oklahoma Tax Commission Consumer Tobacco Tax Return for the state of Oklahoma.

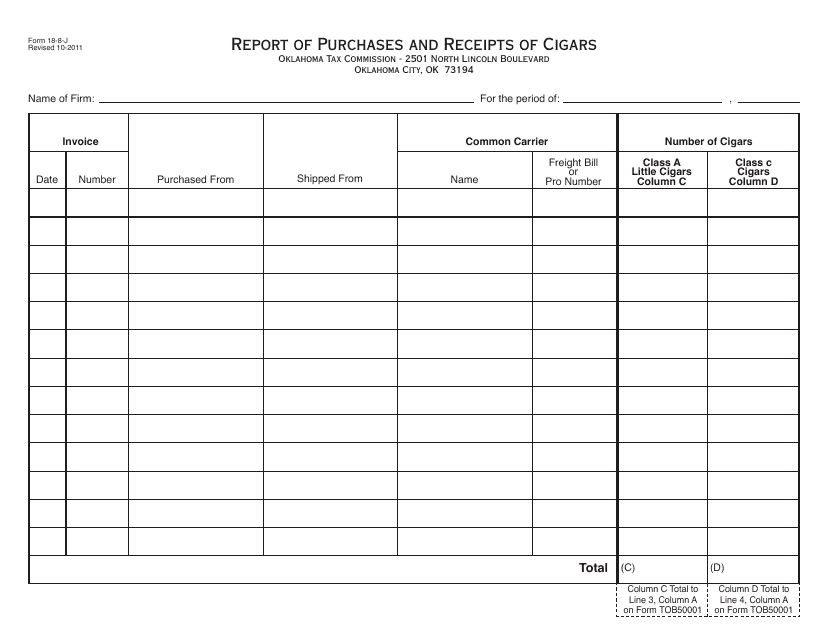

This form is used for reporting purchases and receipts of cigars in the state of Oklahoma.

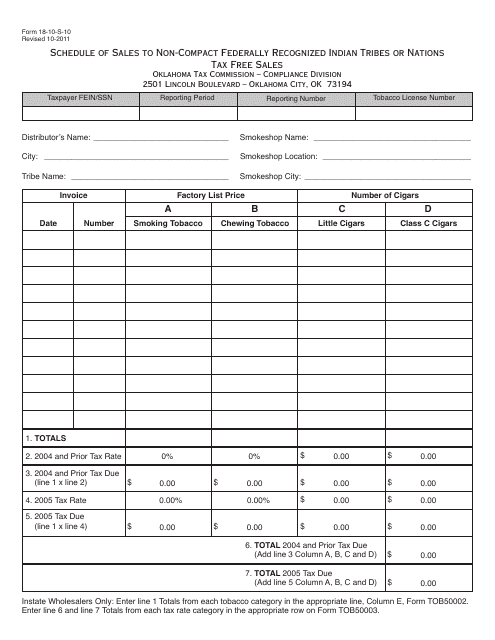

This Form is used for reporting tax-free sales to non-compact federally recognized Indian tribes or nations in Oklahoma.

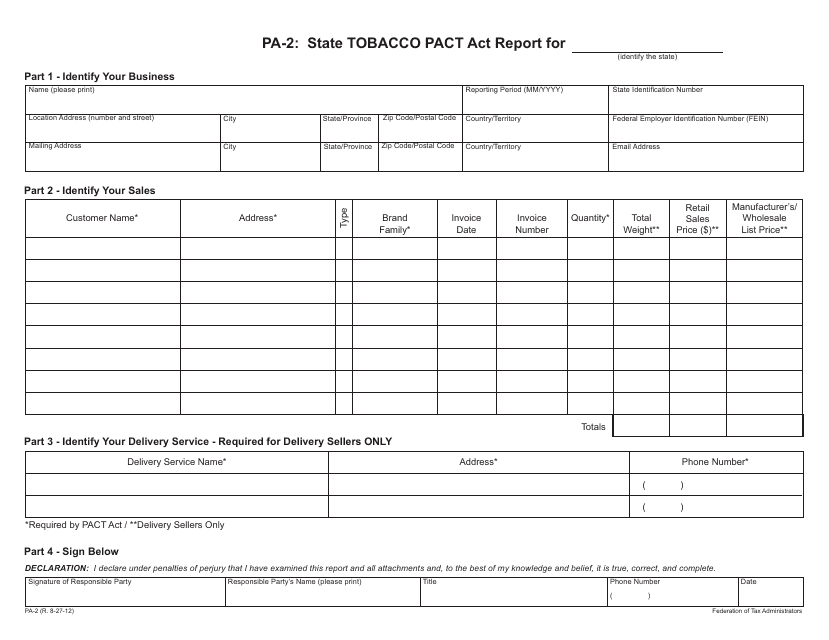

This form is used for reporting compliance with the State Tobacco Pact Act in Oklahoma.

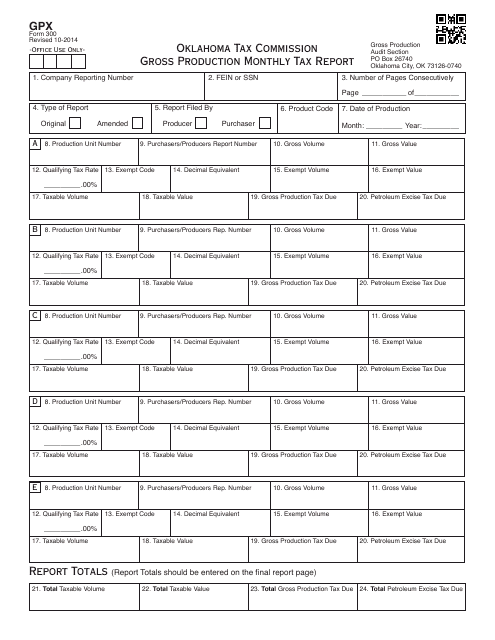

This form is used for reporting monthly gross production tax on oil and gas production in Oklahoma.

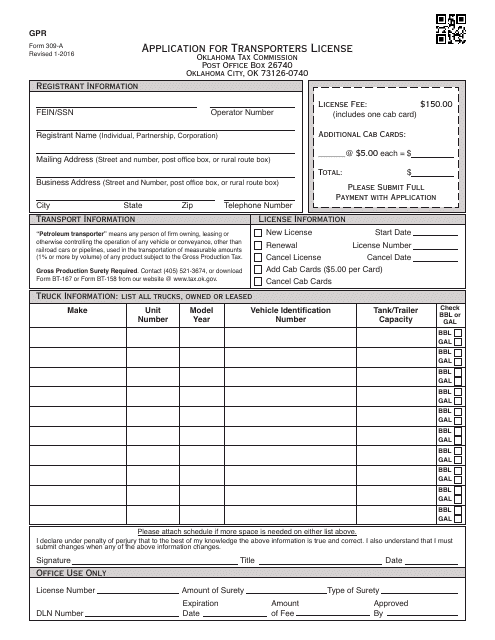

This Form is used for applying for a Transporters License in Oklahoma.

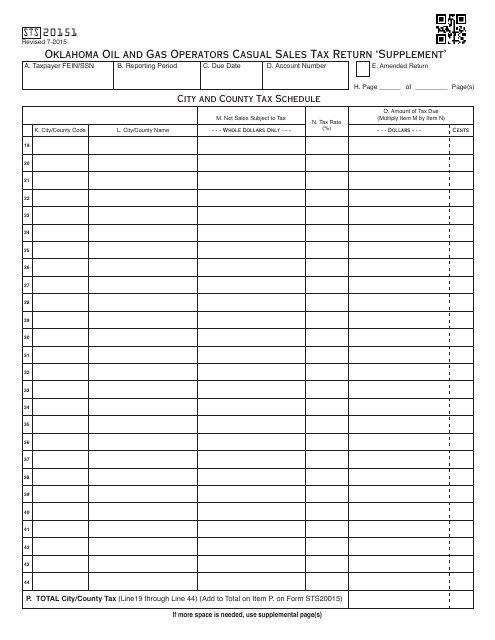

This Form is used for reporting casual sales tax returns by oil and gas operators in Oklahoma. It is a supplementary form for the OTC Form STS20151.

This document is used for reporting and remitting sales tax for casual sales by oil and gas operators in Oklahoma.

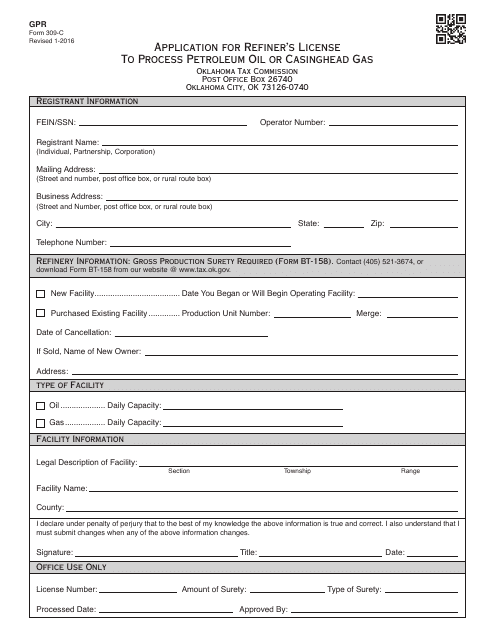

This Form is used for applying for a refiner's license in Oklahoma to process petroleum oil or casinghead gas.

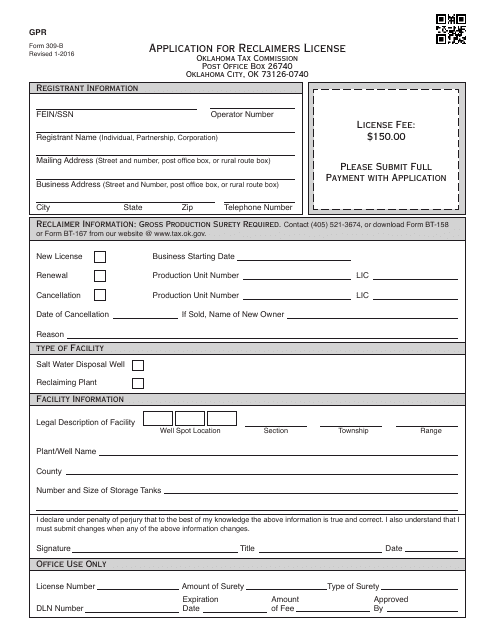

This form is used for applying for a reclaimers license in Oklahoma.

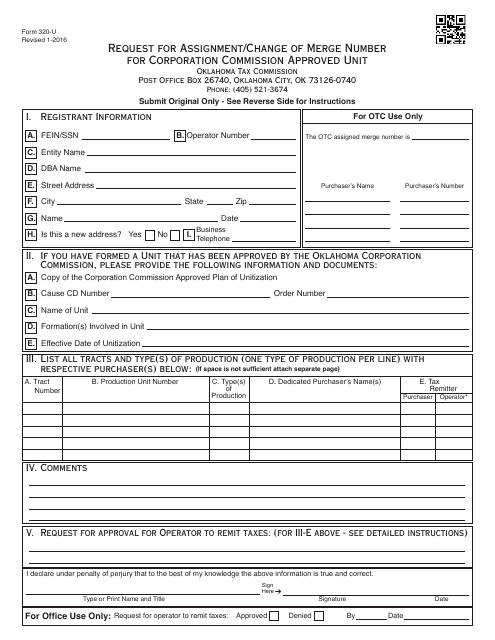

This form is used for requesting an assignment or change of merge number for Corporation Commission approved unit in Oklahoma.

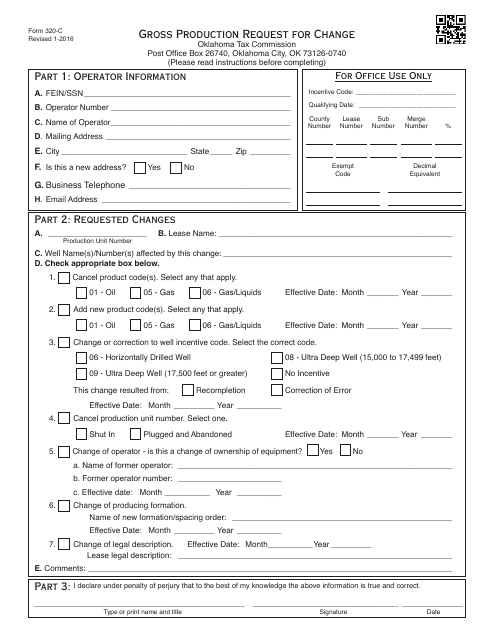

This form is used for requesting a change in gross production for oil and gas operations in Oklahoma.

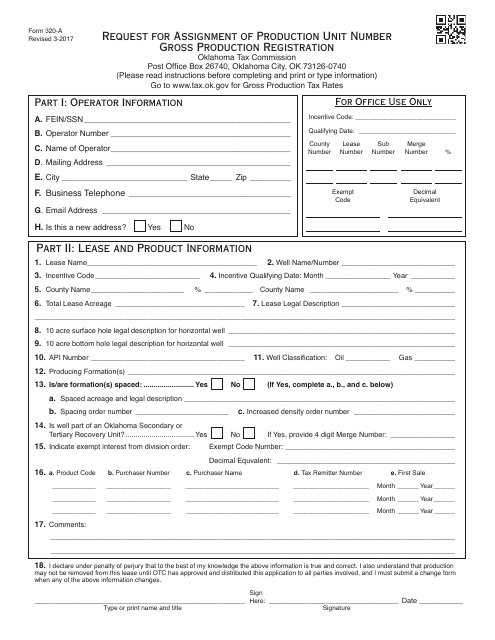

This form is used for requesting the assignment of a production unit number for registering gross production in Oklahoma.

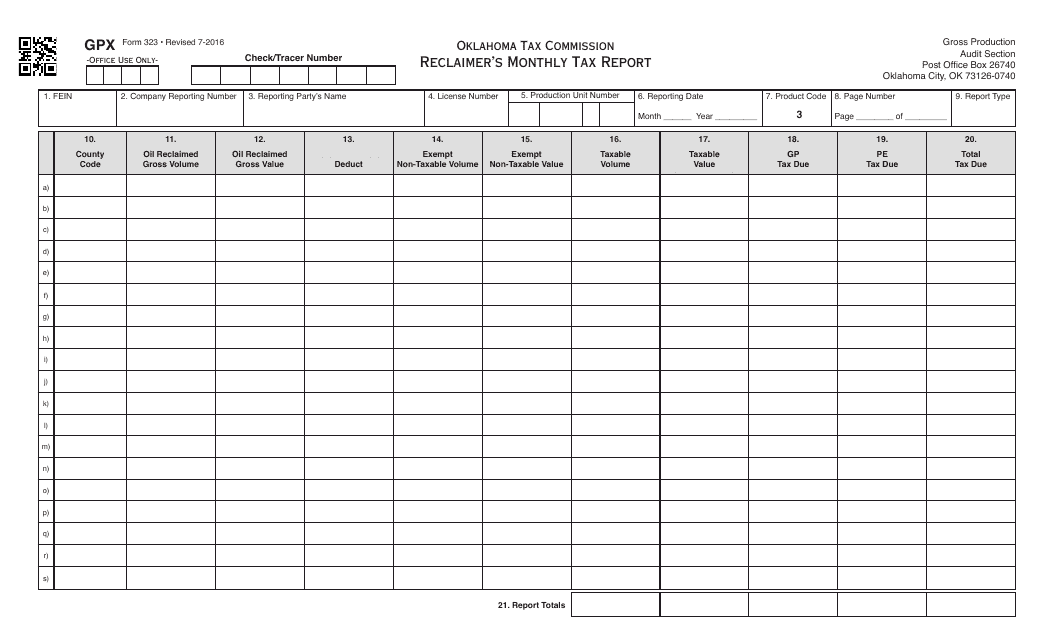

This form is used for the monthly tax report for reclaimers in Oklahoma. It is required to report and pay taxes on reclaimed items in the state.

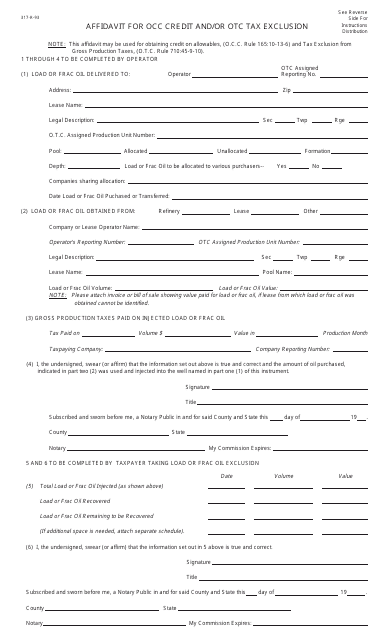

This document is used for filing an affidavit for Oklahoma tax exclusion related to occupational credit.

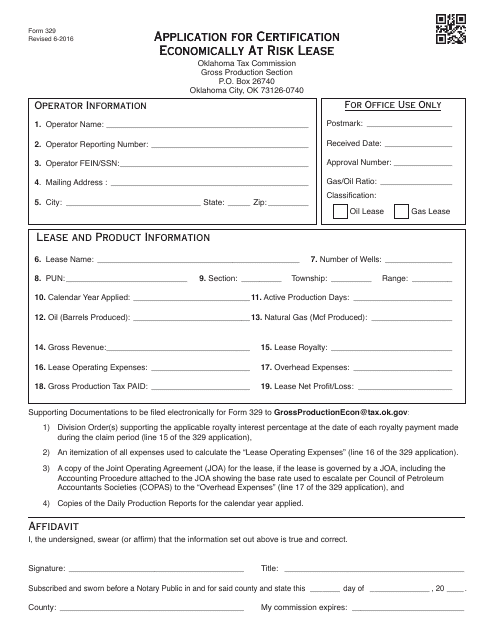

This form is used for applying for certification of an economically at-risk lease in Oklahoma.

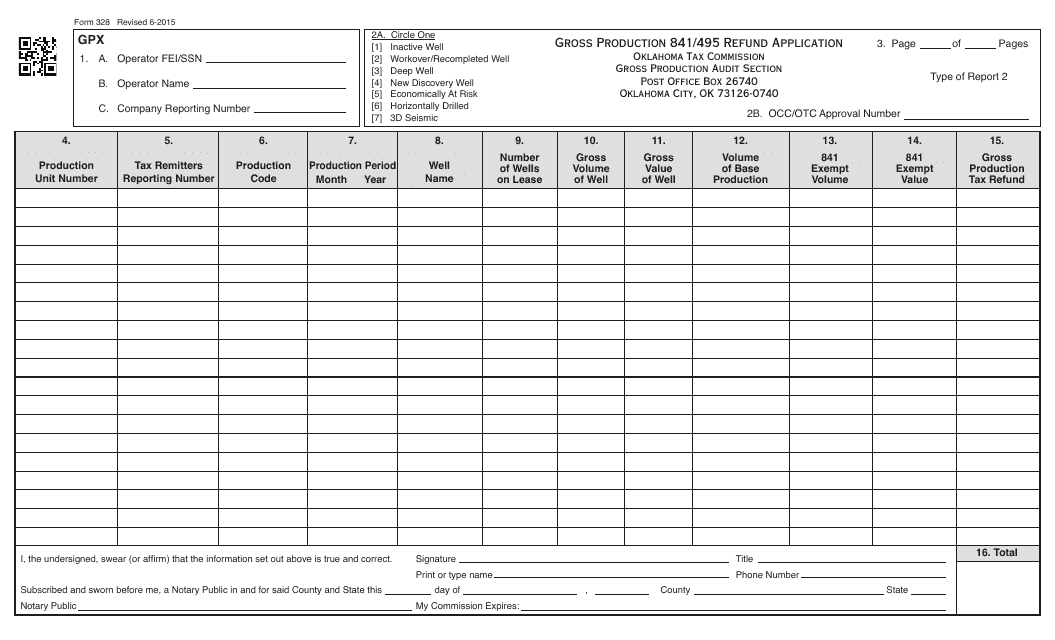

This form is used for applying for a refund in Oklahoma related to gross production of OTC Form 328 with the numbers 841/495.

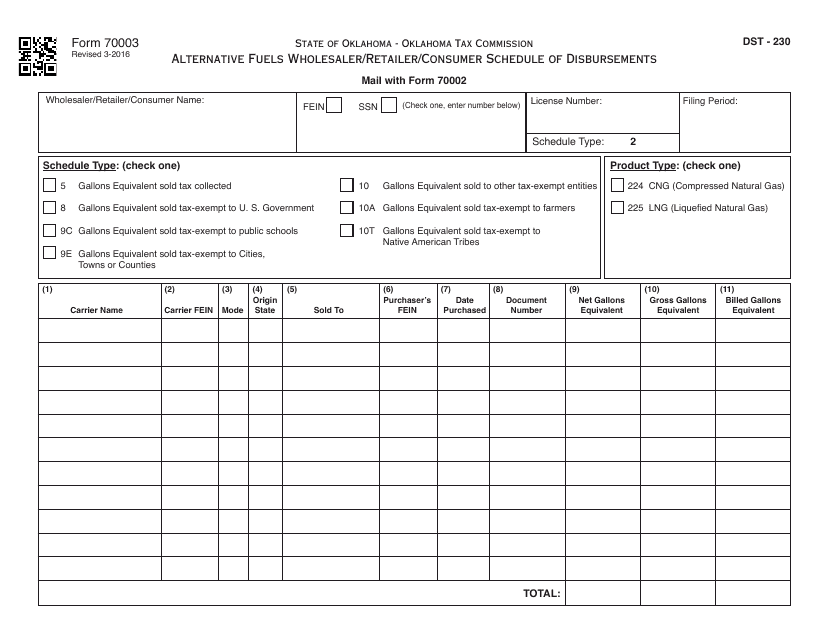

This Form is used for reporting the disbursements made by Alternative Fuels Wholesalers, Retailers, and Consumers in Oklahoma.

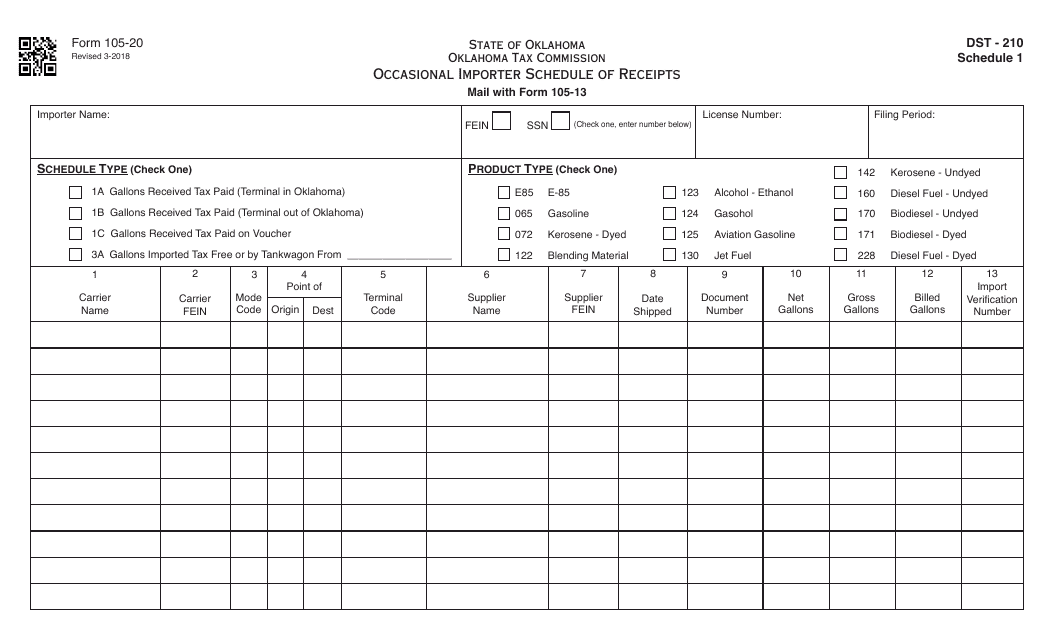

This Form is used for reporting the schedule of receipts for occasional importers in Oklahoma.

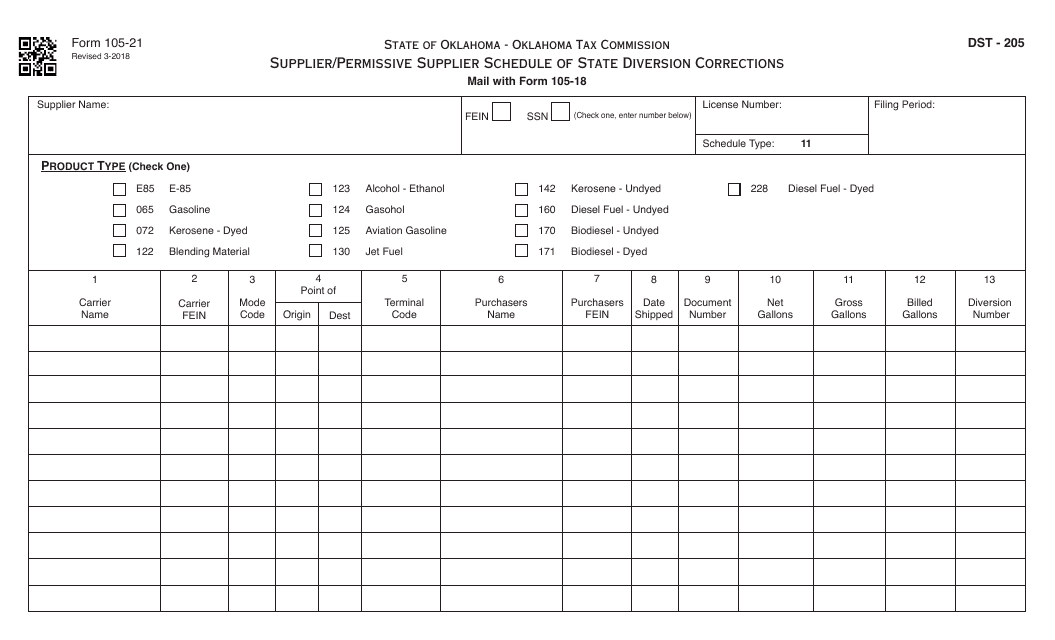

This Form is used for suppliers and permissive suppliers in Oklahoma to report their schedule of state diversion corrections.

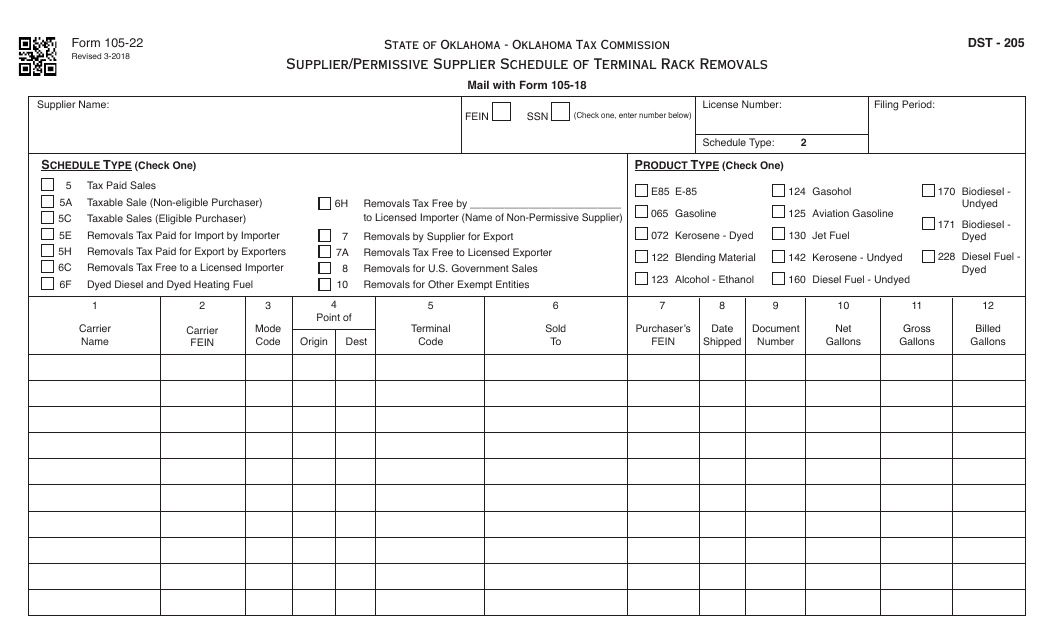

This form is used for submitting a schedule of terminal rack removals for suppliers and permissive suppliers in Oklahoma.

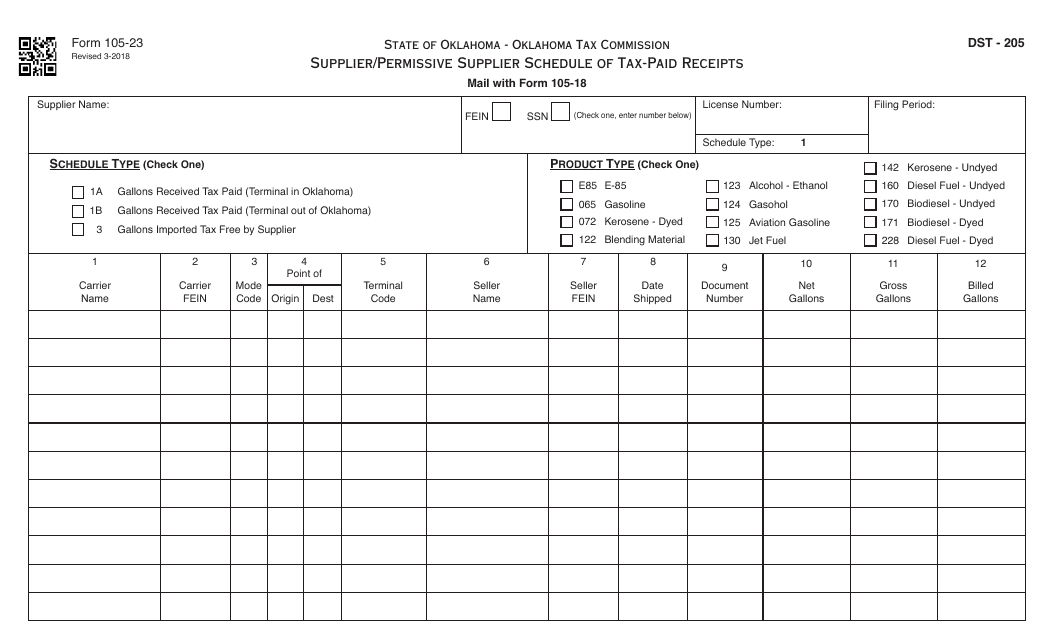

This form is used for reporting tax-paid receipts by suppliers and permissive suppliers in Oklahoma.

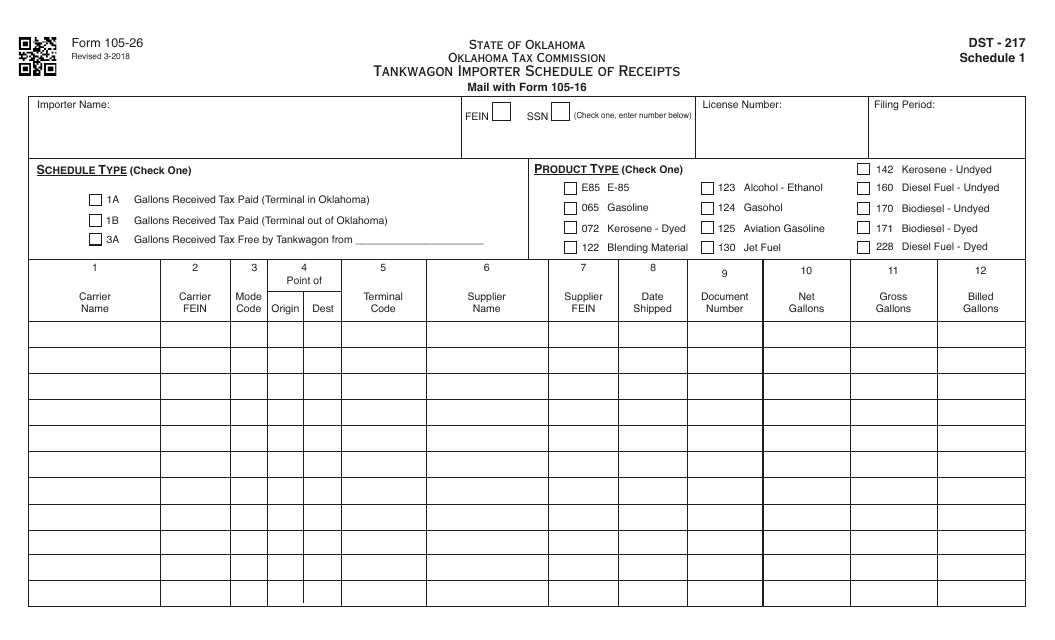

This form is used by tankwagon importers in Oklahoma to report their schedule of receipts.

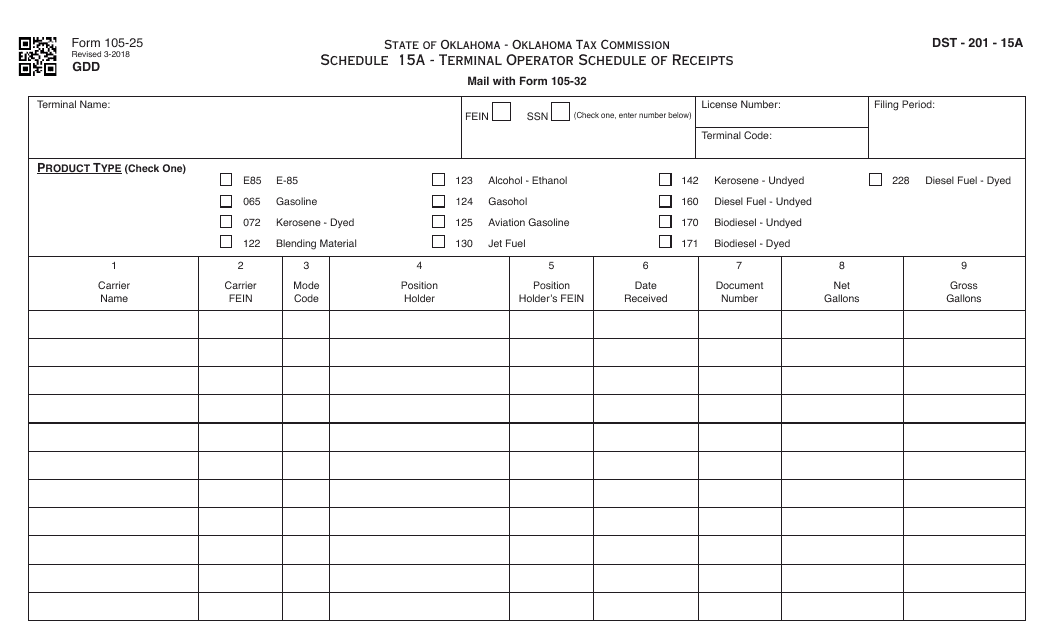

This form is used for reporting the receipts of a terminal operator in Oklahoma.

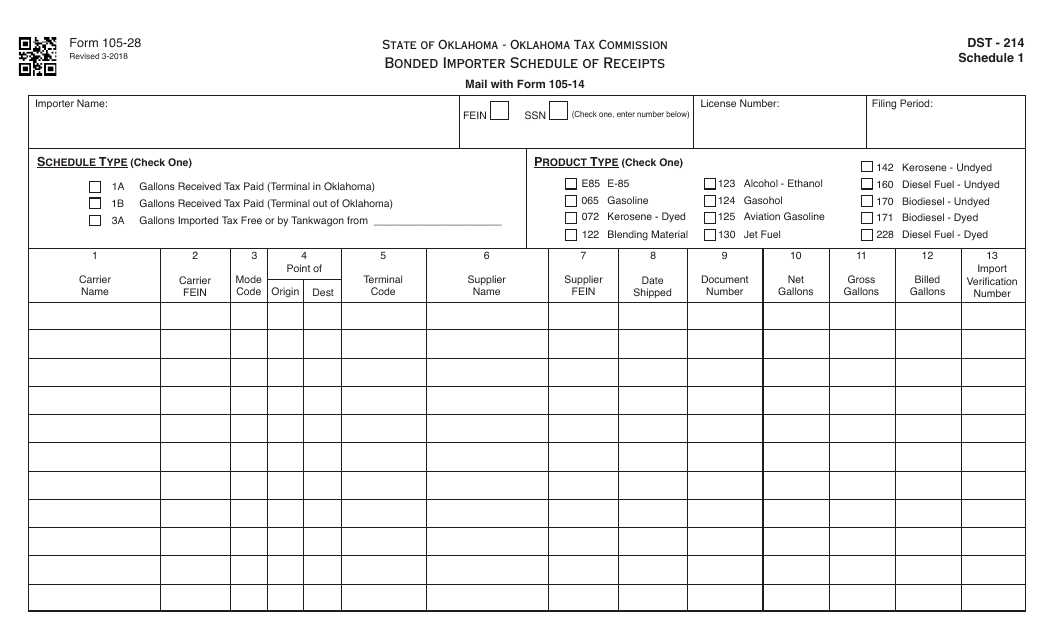

This Form is used for recording and reporting the receipts of a bonded importer in Oklahoma. It provides information on imported goods received by the importer.

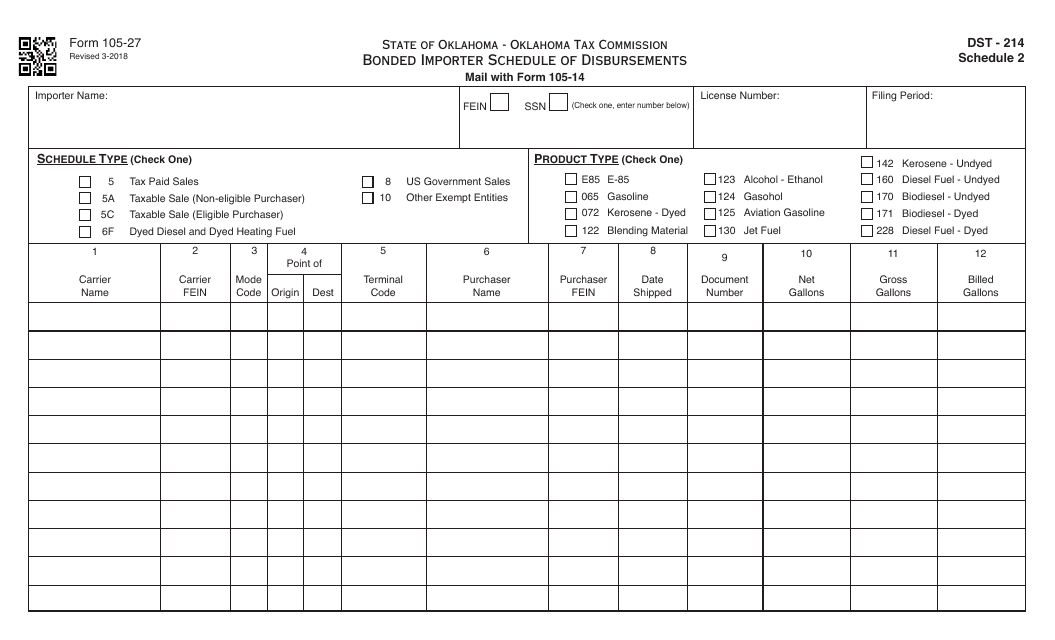

This form is used by bonded importers in Oklahoma to report their schedule of disbursements.

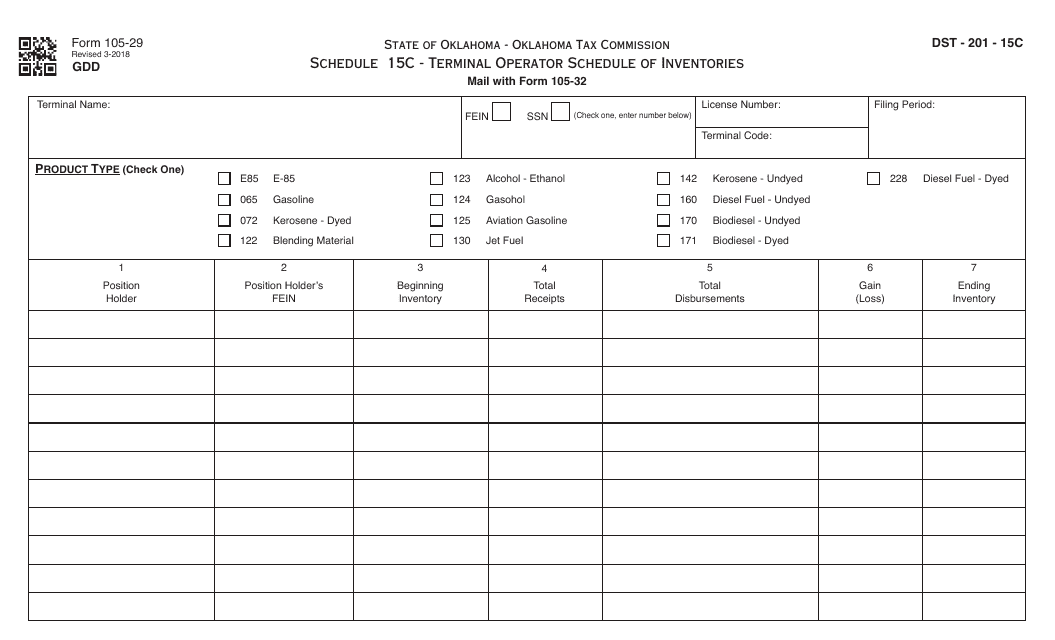

This Form is used for reporting inventory data for terminal operators in Oklahoma.

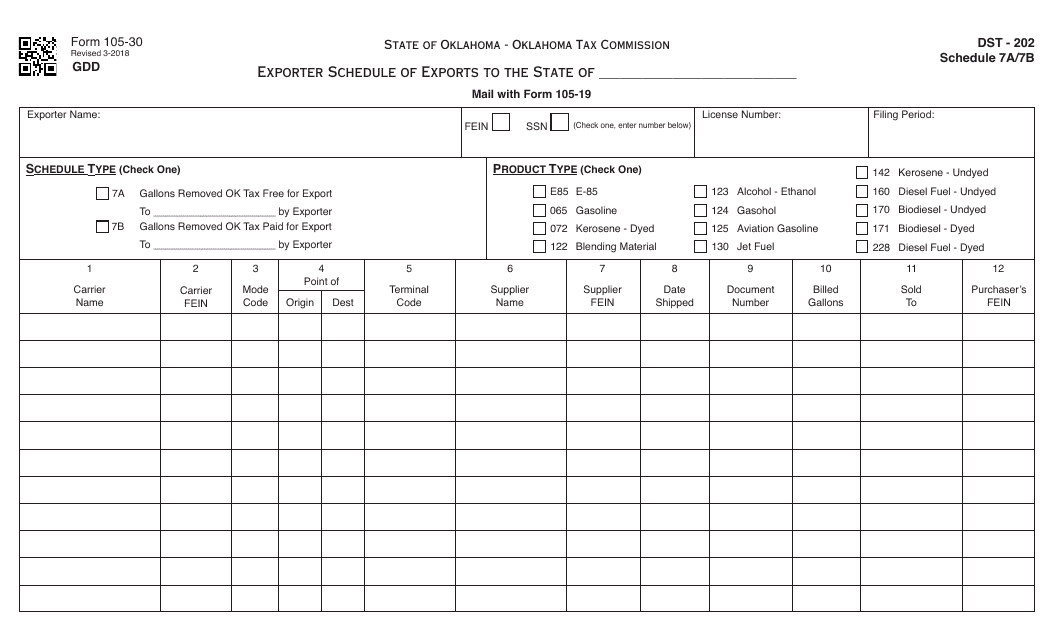

This document is used for reporting exports from Oklahoma. It is a schedule for exporters to provide information about their exported goods.

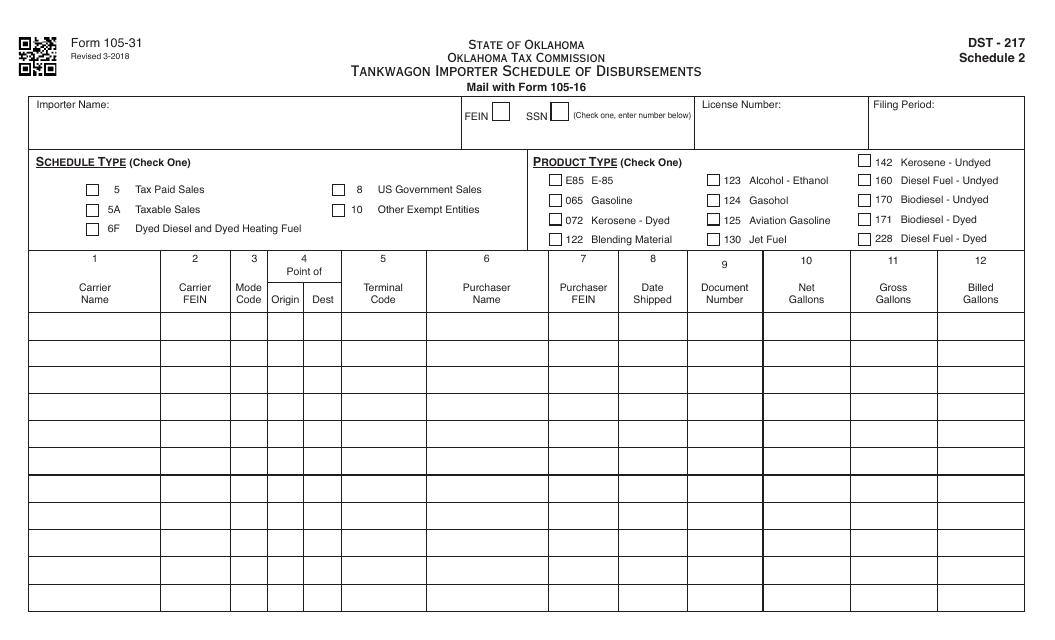

This Form is used for recording the schedule of disbursements made by tankwagon importers in Oklahoma.

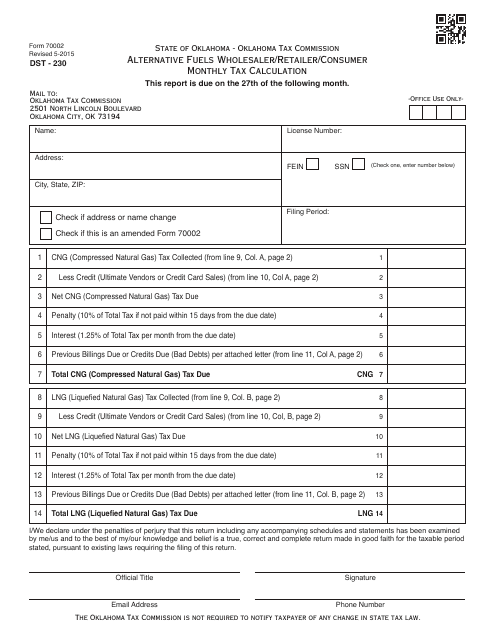

This document is used for calculating the monthly tax for alternative fuels wholesalers, retailers, and consumers in Oklahoma.