Tax Templates

Documents:

2882

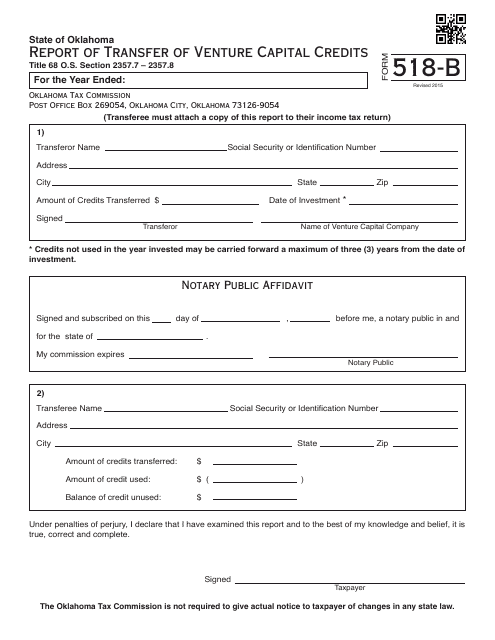

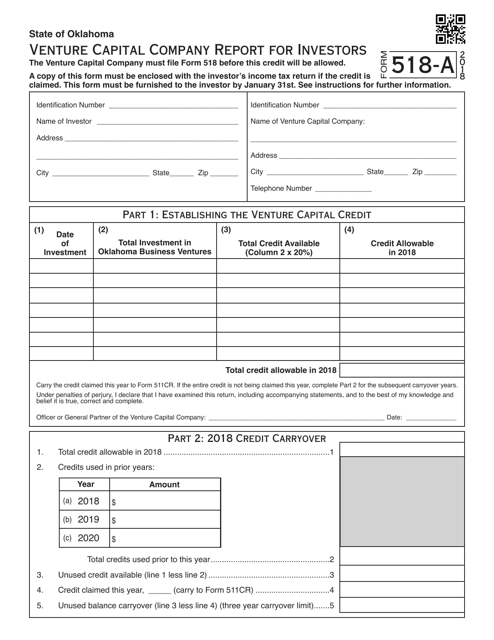

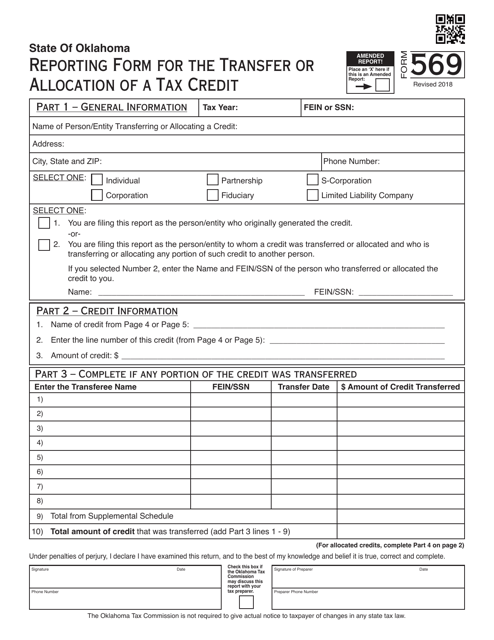

This Form is used for reporting the transfer of venture capital credits in Oklahoma.

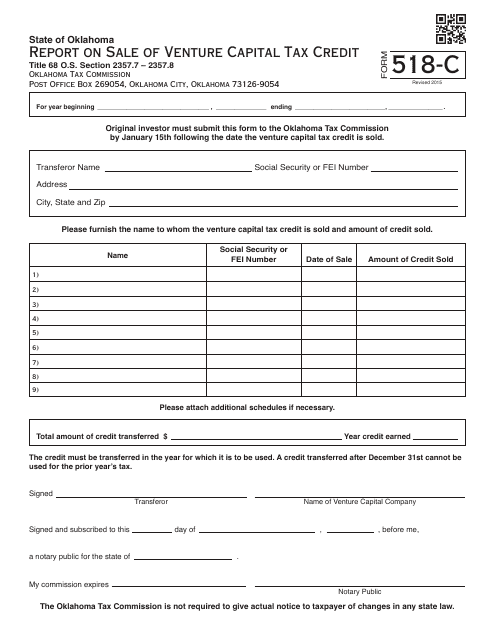

This form is used for reporting the sale of Venture Capital Tax Credit in Oklahoma.

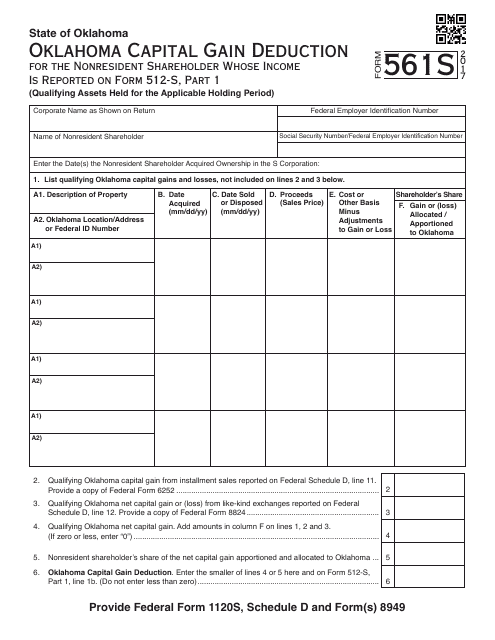

This OTC Form 561S is used for capital gain deduction for nonresident shareholders whose income is reported on Form 512-s, Part 1 in the state of Oklahoma.

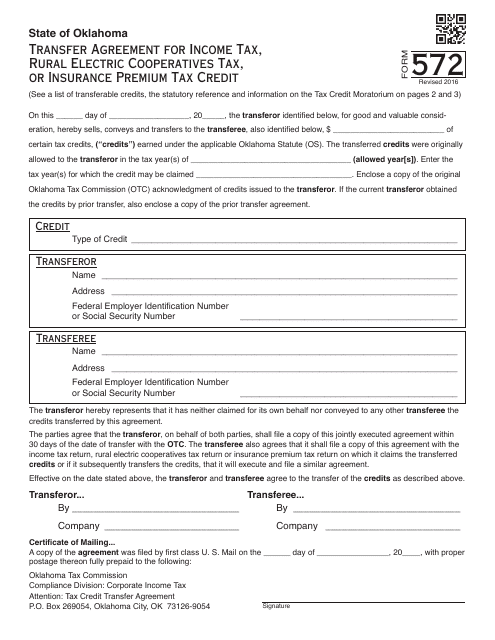

This document is used for transferring agreement related to income tax, rural electric cooperatives tax, or insurance premium tax credit in Oklahoma.

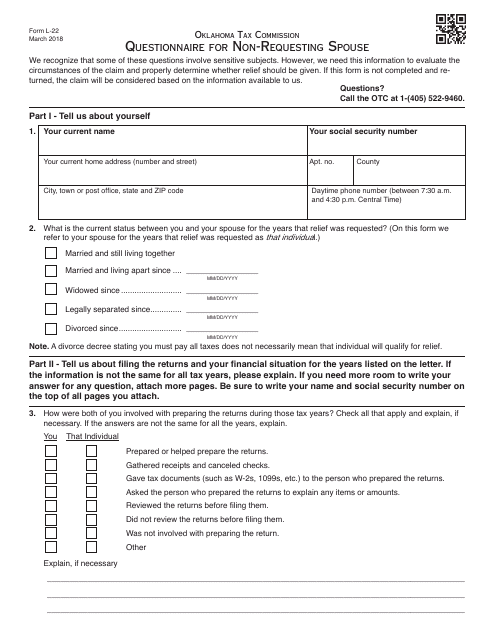

This form is used for non-requesting spouses in Oklahoma to complete a questionnaire as part of the OTC Form L-22 process.

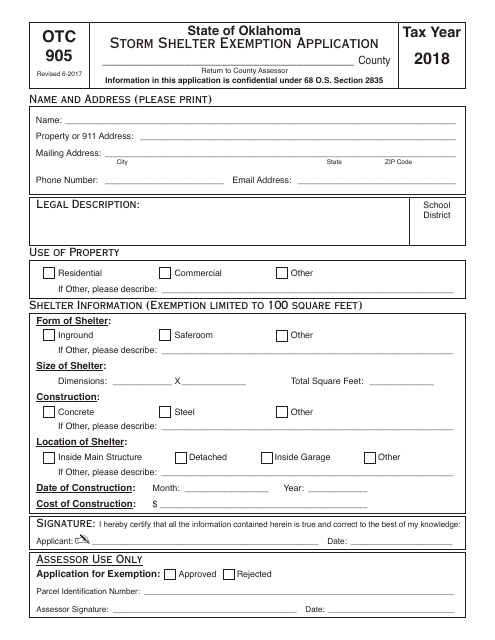

This Form is used for applying for a storm shelter exemption in the state of Oklahoma.

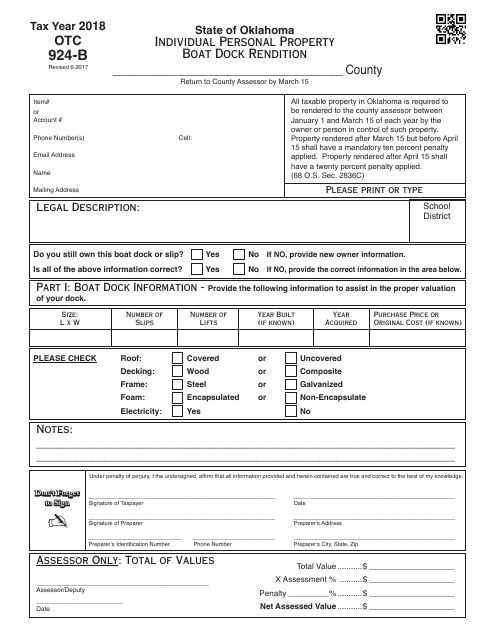

This form is used for individuals in Oklahoma to report their personal property boat dock for tax purposes.

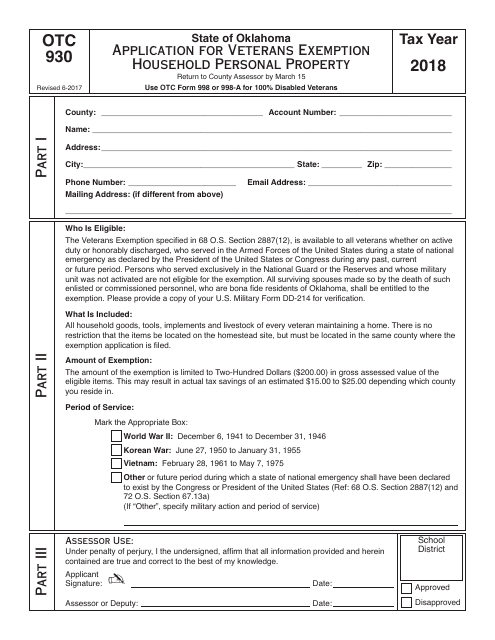

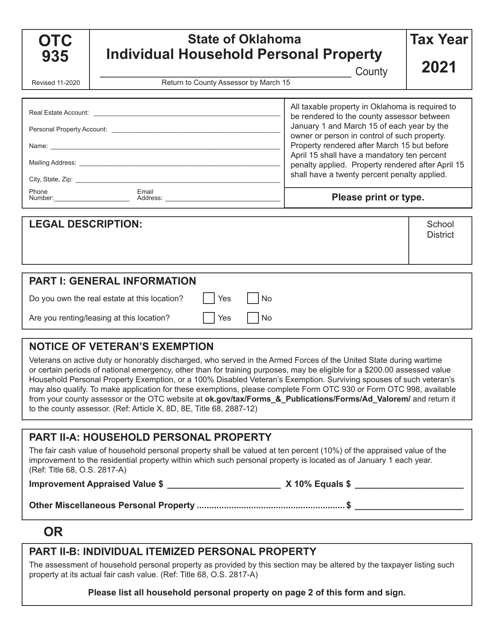

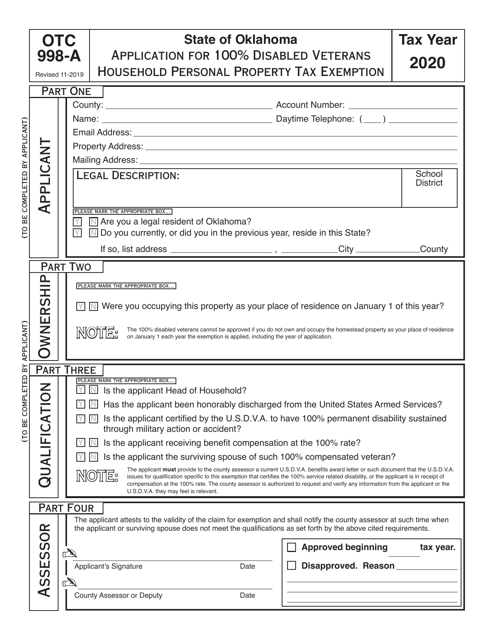

This form is used for residents of Oklahoma to apply for a veterans exemption for household personal property.

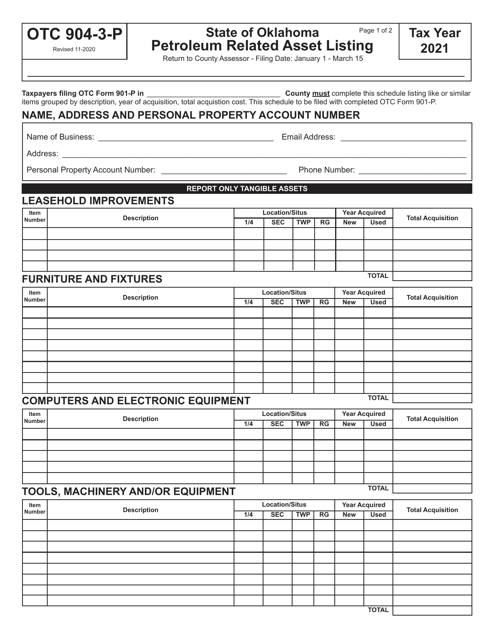

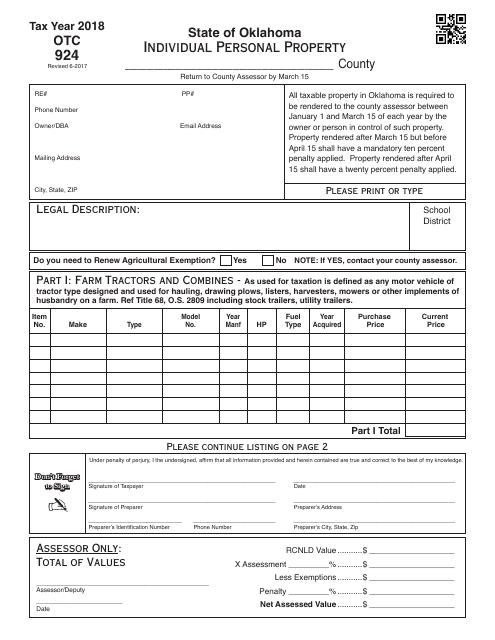

This Form is used for reporting individual personal property in Oklahoma.

This form is used for applying for tax exemption on manufacturing in Oklahoma.

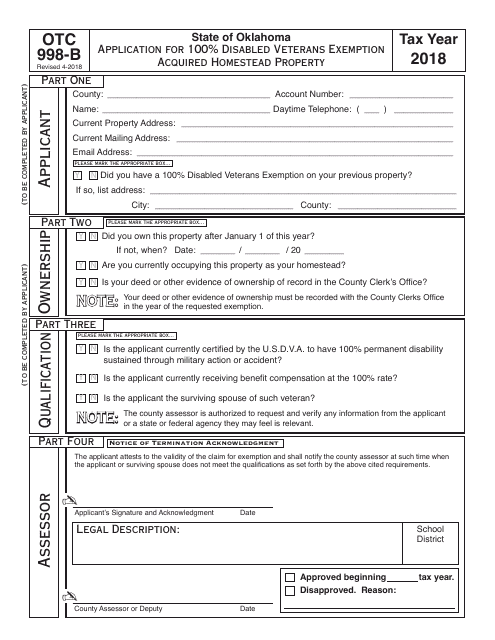

This Form is used for applying for the 100% Disabled Veterans Exemption for acquired homestead property in Oklahoma.