Impuesto Sobre La Renta Templates

Are you looking for information on impuesto sobre la renta? Look no further! We have all the information you need about this important tax document. Whether you are referring to impuesto sobre la renta or impuestos sobre la renta, we've got you covered.

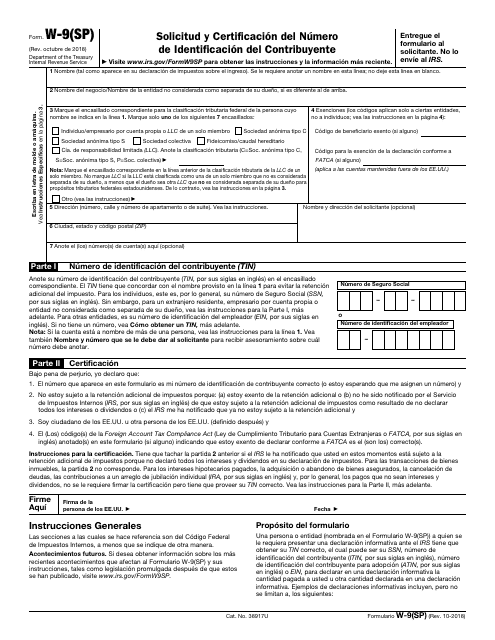

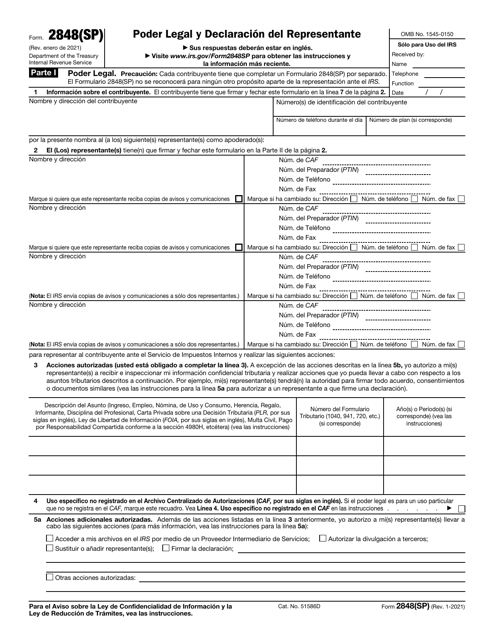

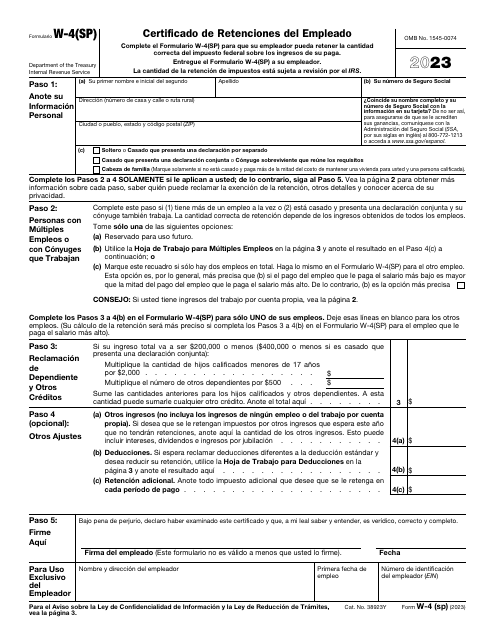

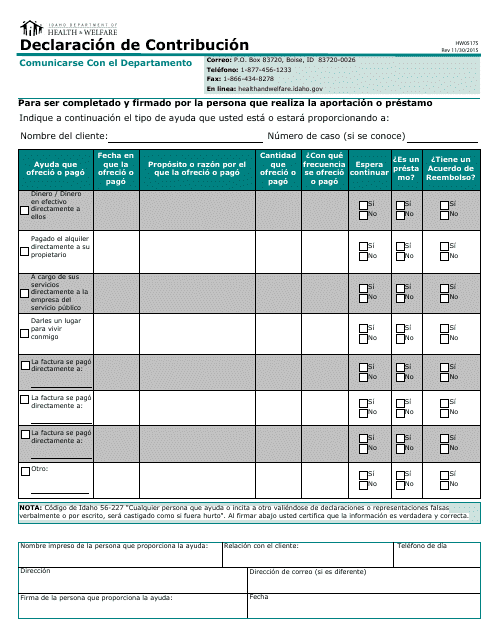

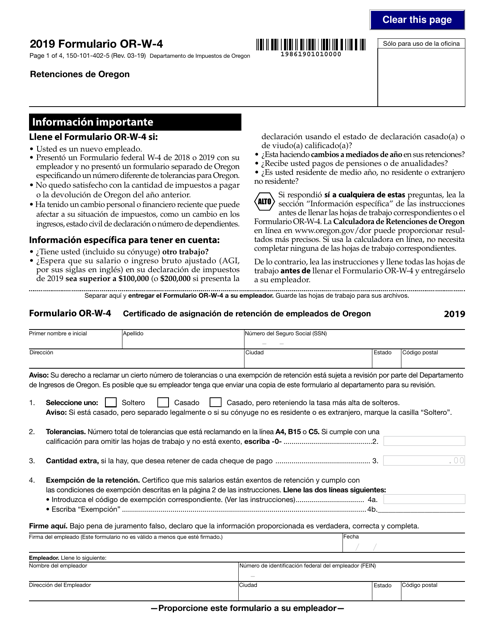

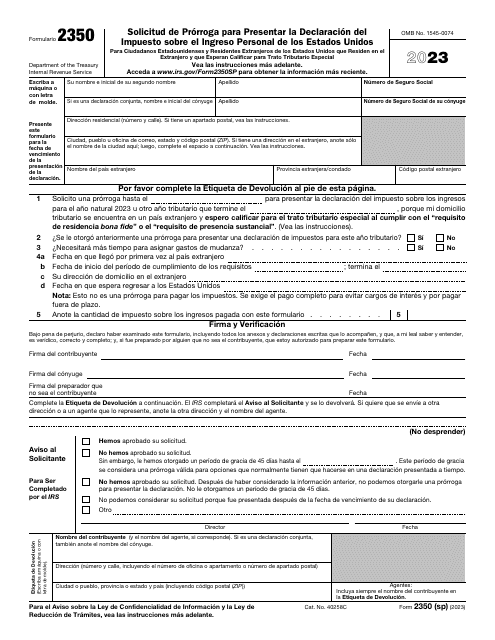

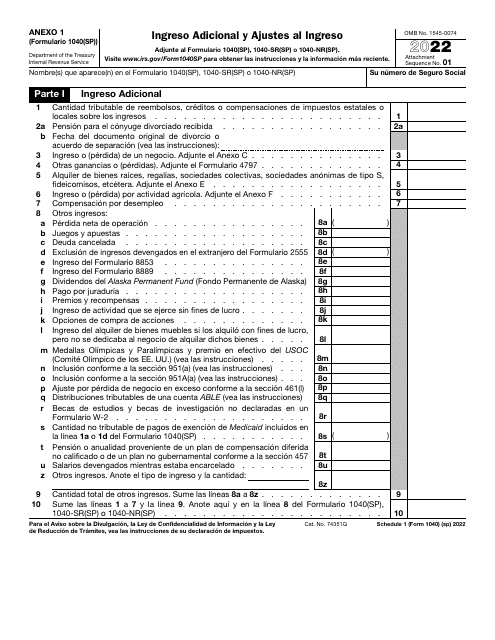

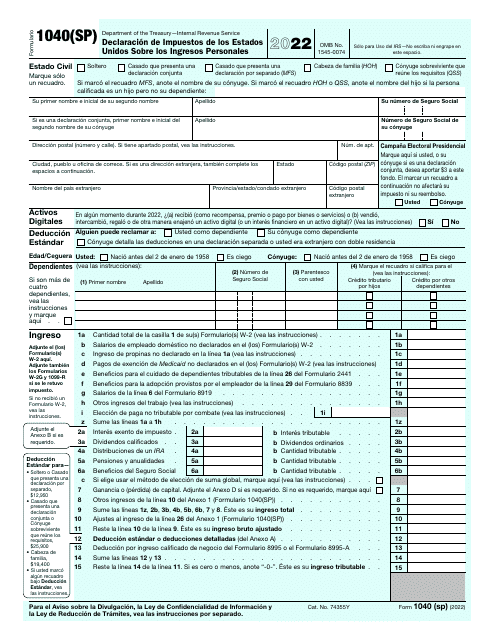

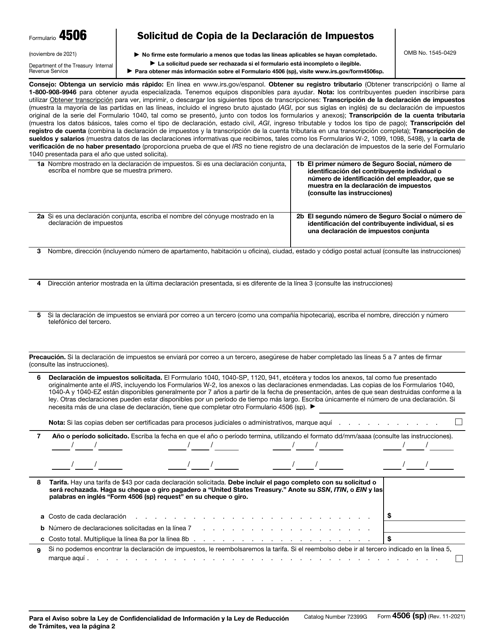

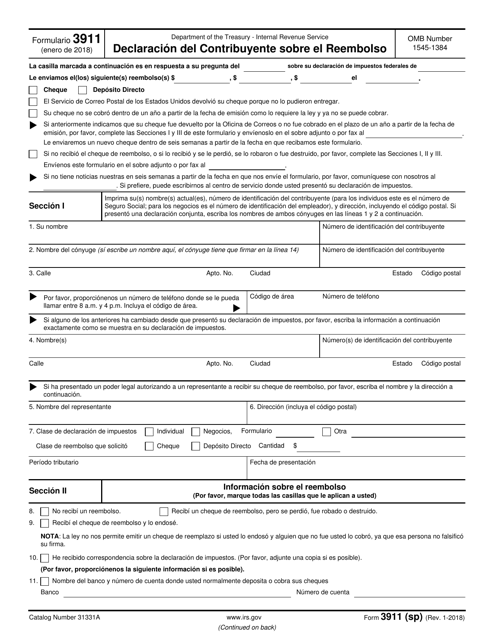

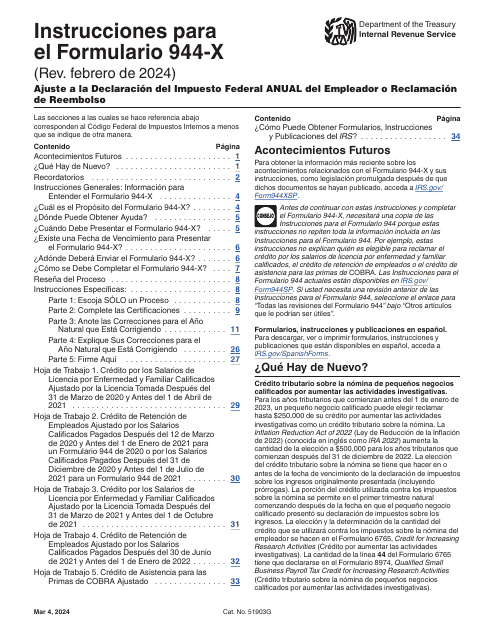

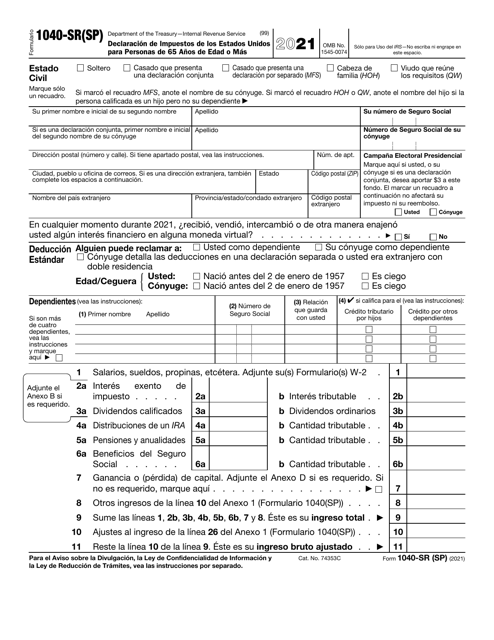

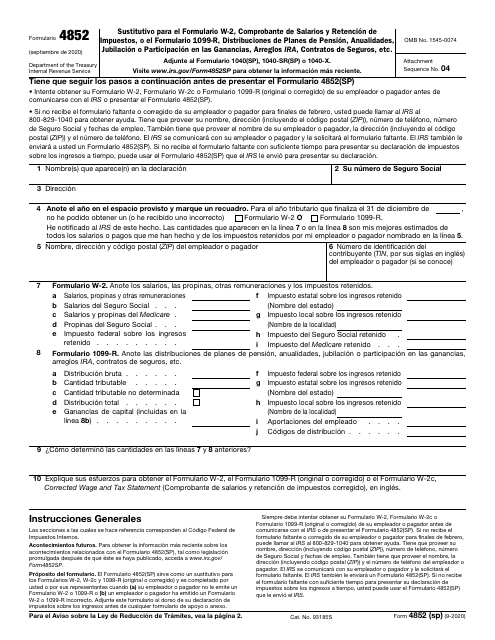

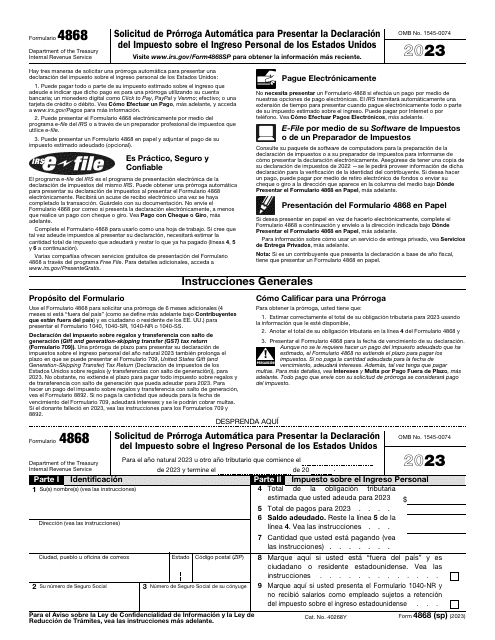

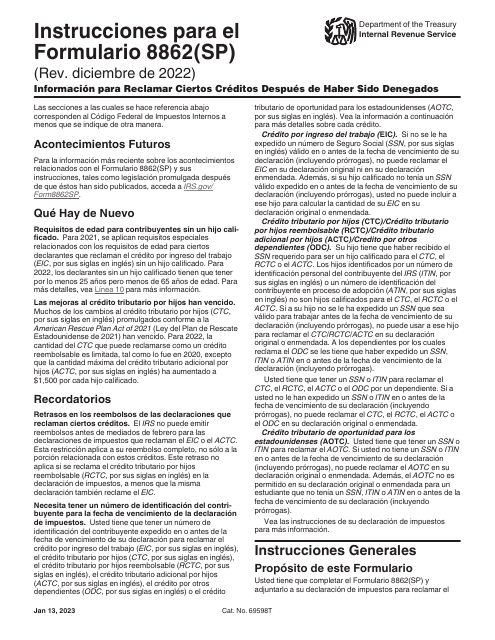

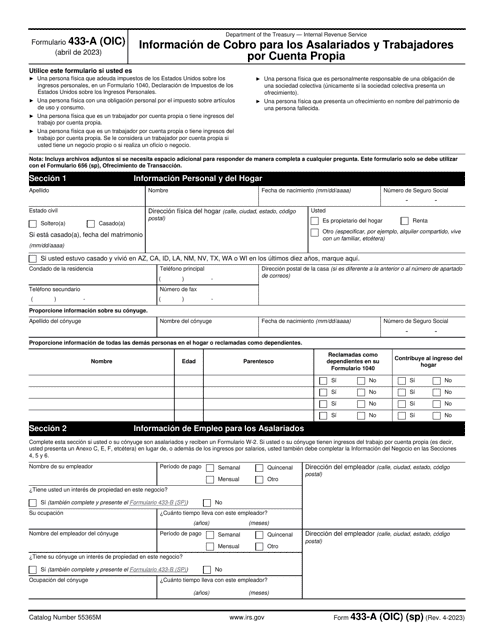

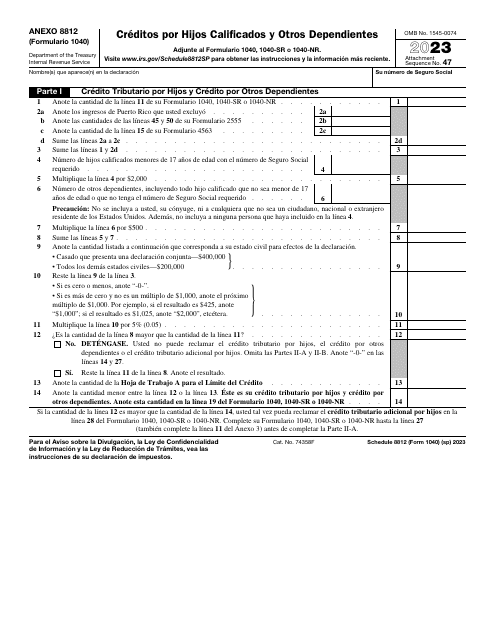

At our website, we provide a comprehensive guide to impuesto sobre la renta, also known as income tax. Our extensive collection of documents includes various forms and declarations in both English and Spanish, such as Formulario HW0517S Declaracion De Contribucion - Idaho (Spanish), IRS Formulario 1040(SP) Anexo 1 Ingreso Adicional Y Ajustes Al Ingreso (Spanish), IRS Formulario 4852 Comprobante De Salarios Y Retencion De Impuestos, O El Formulario 1099-r, Distribuciones De Planes De Pension, Anualidades, Jubilacion O Participacion En Las Ganancias, Arreglos Ira, Contratos De Seguros, Etc. (Spanish), IRS Formulario W-4(SP) Certificado De Retenciones Del Empleado (Spanish), and IRS Formulario 433-A (OIC) Informacion De Cobro Para Los Asalariados Y Trabajadores Por Cuenta Propia (Spanish).

Our goal is to provide clear and concise information about impuesto sobre la renta to help you navigate the complex world of income taxation. Whether you have questions about filling out specific forms or need guidance on calculating your income tax, our website is the ultimate resource.

Don't let impuesto sobre la renta overwhelm you. Visit our website today to access our comprehensive collection of income tax documents and get the information you need to file your taxes with confidence.

Documents:

30

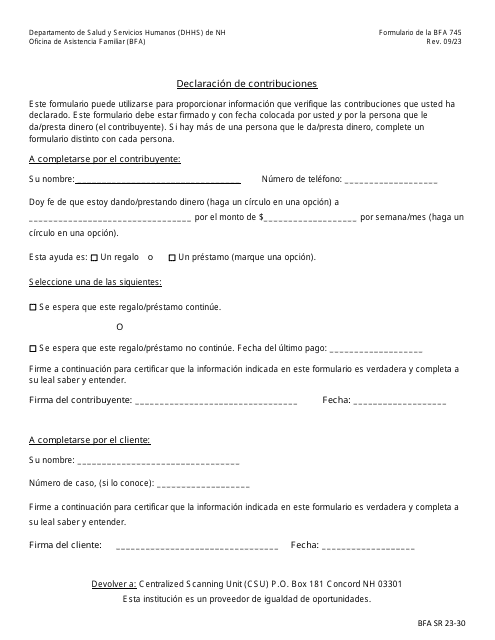

This Form is used for declaring contributions in the state of Idaho.

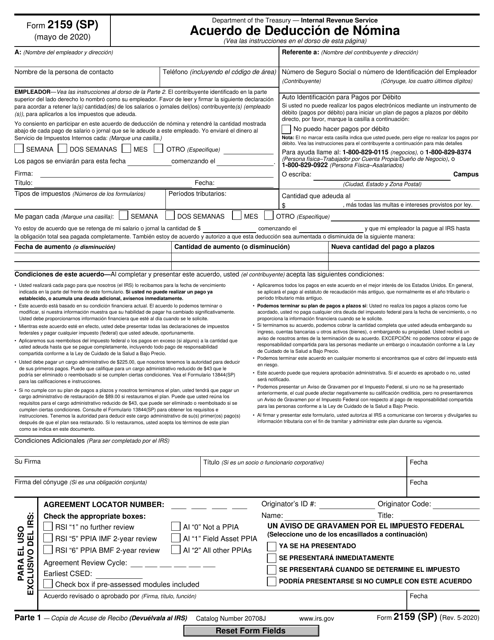

This Form is used for Spanish-speaking taxpayers to agree to a payroll deduction agreement.

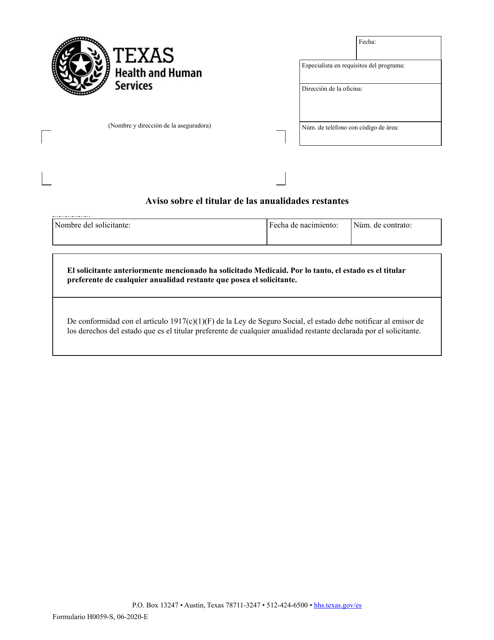

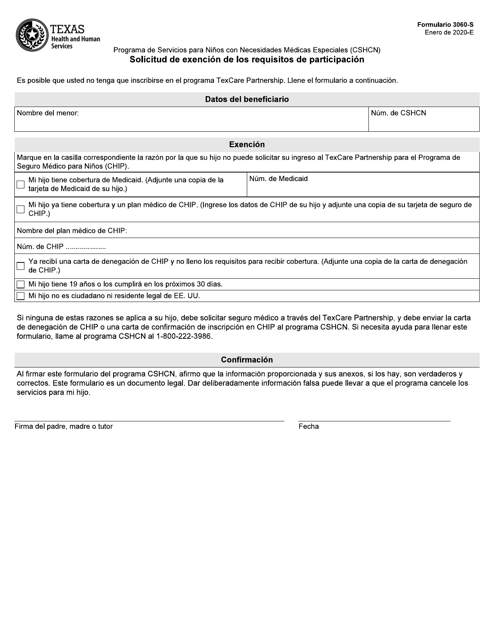

This form is used for requesting an exemption from participation requirements in Texas.

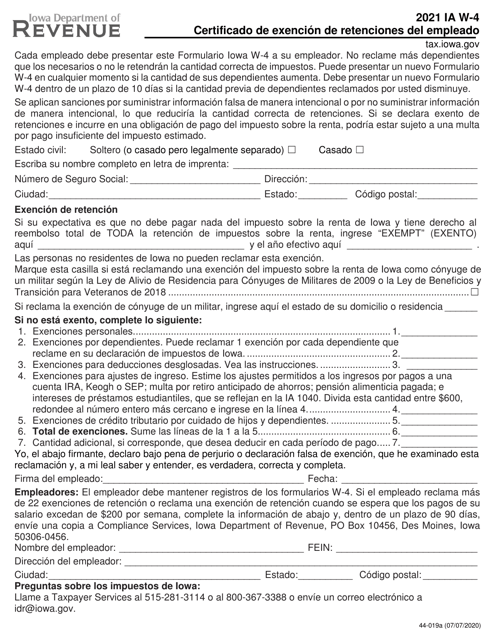

This type of document is used for certifying employee exemptions from withholding taxes and reporting employee information in Iowa. (Spanish version)

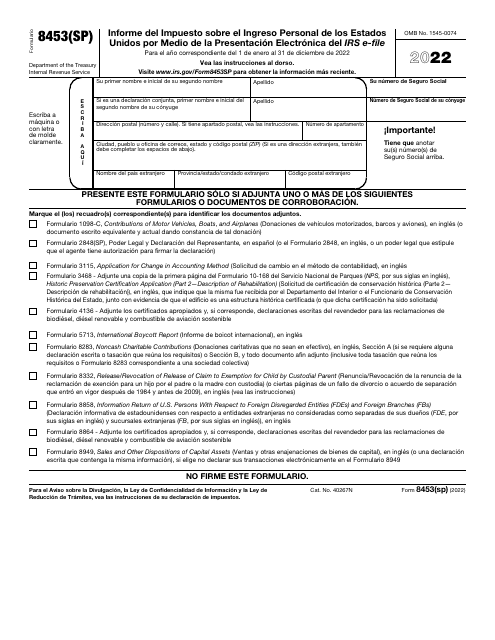

This Form is used for reporting wages and tax withholdings. It can also be used for reporting pension distributions, annuities, retirement income, IRA arrangements, insurance contracts, etc.