Voluntary Disclosure Agreement Templates

Welcome to our webpage on Voluntary Disclosure Agreements (VDAs), also known as Voluntary Disclosure Agreements. If you are a business owner or taxpayer looking to resolve any tax-related issues, the Voluntary Disclosure Agreement program could be an excellent option for you.

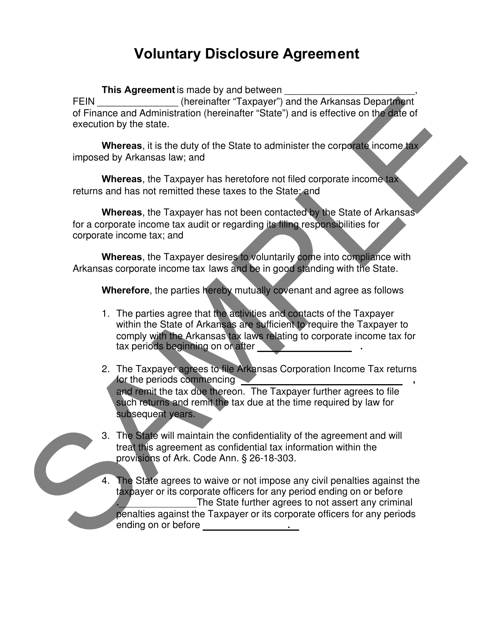

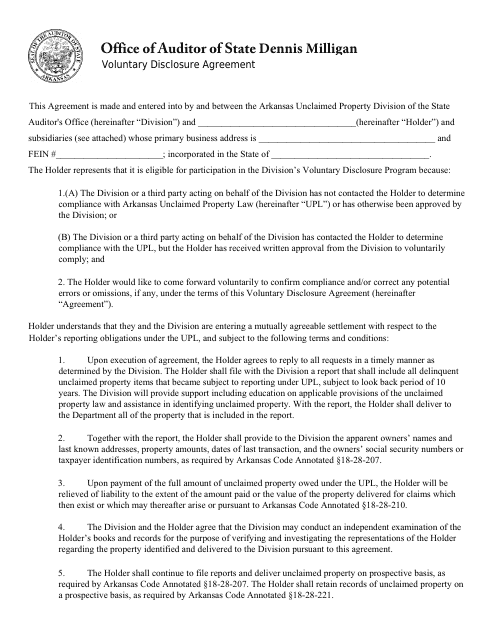

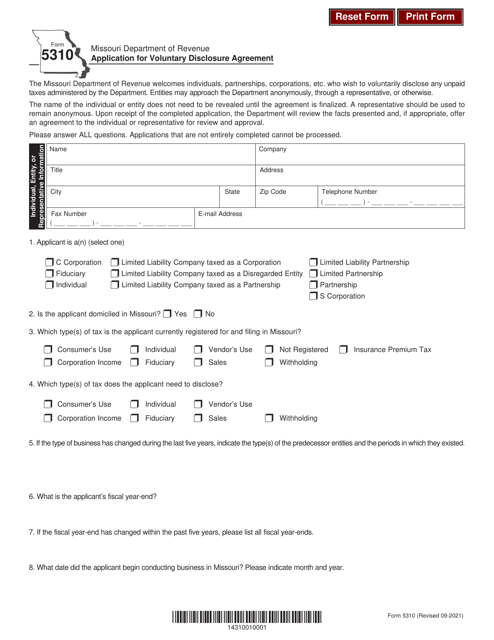

A Voluntary Disclosure Agreement is a program offered by various states in the USA, such as California, Ohio, Arkansas, and Missouri, among others. It allows taxpayers to come forward voluntarily and disclose any previously unreported tax liabilities. By doing so, taxpayers can avoid potential penalties and criminal prosecution that may arise from non-compliance.

The primary objective of the Voluntary Disclosure Agreement program is to encourage full tax compliance while providing taxpayers with an opportunity to rectify any past mistakes. Under this program, taxpayers can proactively work with the tax authorities, filing back taxes, and paying any outstanding liabilities without fear of punitive measures.

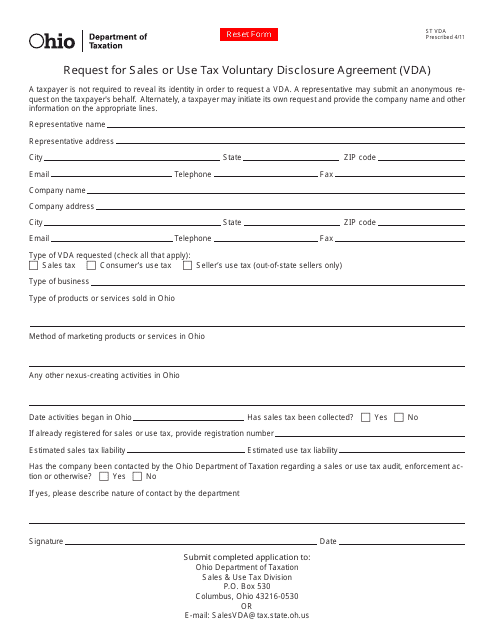

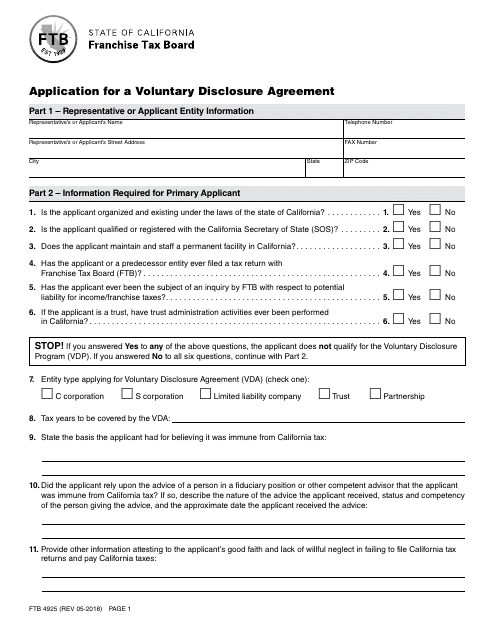

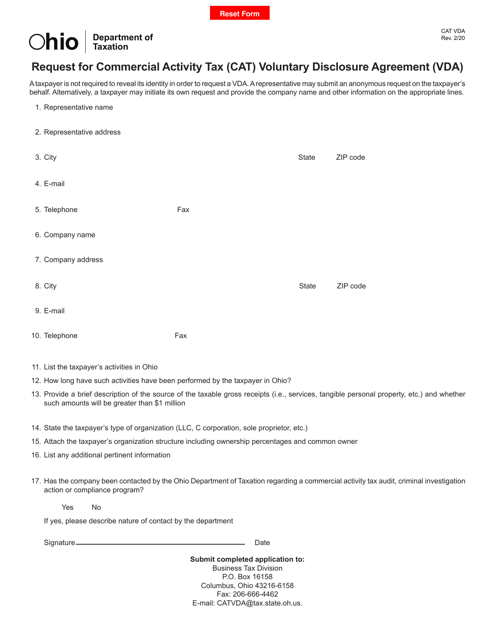

Each state may have its own specific requirements and procedures for entering into a Voluntary Disclosure Agreement. However, the general process typically involves submitting an application, such as Form FTB4925 in California or Form CAT VDA Request in Ohio. The taxpayer then works closely with the tax authorities to resolve all outstanding issues.

By participating in a Voluntary Disclosure Agreement, businesses can avoid potential legal consequences and penalties, gain peace of mind, and ensure their compliance with state tax regulations. Additionally, this program provides taxpayers with an opportunity to make things right while minimizing financial impact through penalty abatement and interest reduction.

If you find yourself with unreported taxes or past non-compliance, the Voluntary Disclosure Agreement program can offer a path to resolution. Reach out to our expert team, who can guide you through the process and help you navigate the complexities of state tax laws. Take this opportunity to rectify any mistakes and ensure your business is on the right track towards complete compliance.

Documents:

8

This form is used for requesting a Sales or Use Tax Voluntary Disclosure Agreement (VDA) in Ohio. It allows businesses to voluntarily disclose their unpaid taxes and enter into an agreement with the Ohio Department of Taxation to pay them.

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

This form is used for applying for a Voluntary Disclosure Agreement in Missouri.