Captive Insurance Companies Templates

Are you looking to start your own insurance company? Captive insurance companies, also known as captive insurance company, are a unique type of insurance company that provide coverage exclusively for their parent company or a group of related companies. These companies are formed to provide financial benefits and risk management strategies to the parent or related companies.

Captive insurance companies provide a wide range of insurance coverage options, including property and casualty insurance, professional liability insurance, and employee benefits coverage. By forming a captive insurance company, companies can have greater control over their insurance programs, customize coverage to better meet their specific needs, and potentially save on insurance costs.

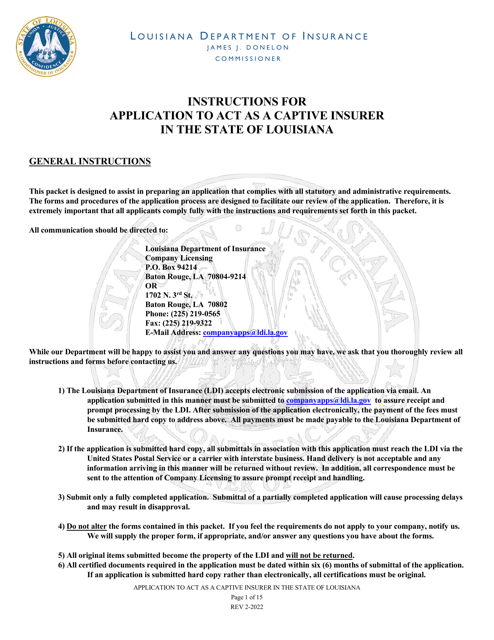

If you are considering starting a captive insurance company, our extensive collection of documents can provide you with the necessary guidance and resources. From application forms to actuarial services and loss reserve certifications, our documents cover the entire process of setting up and operating a captive insurance company.

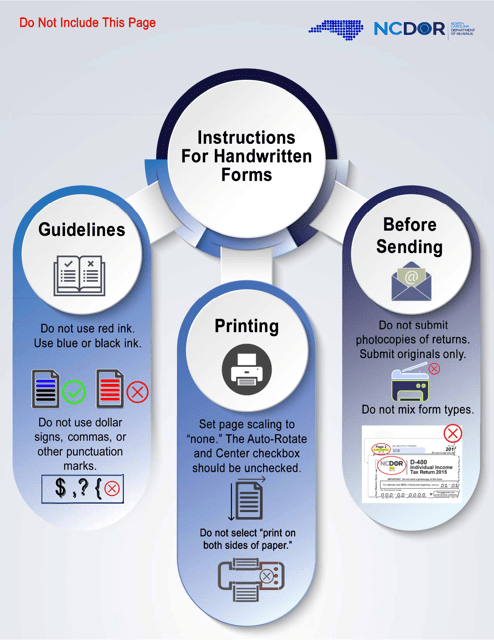

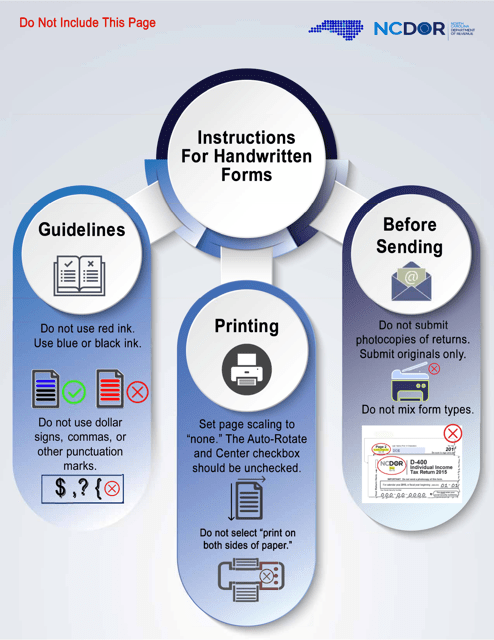

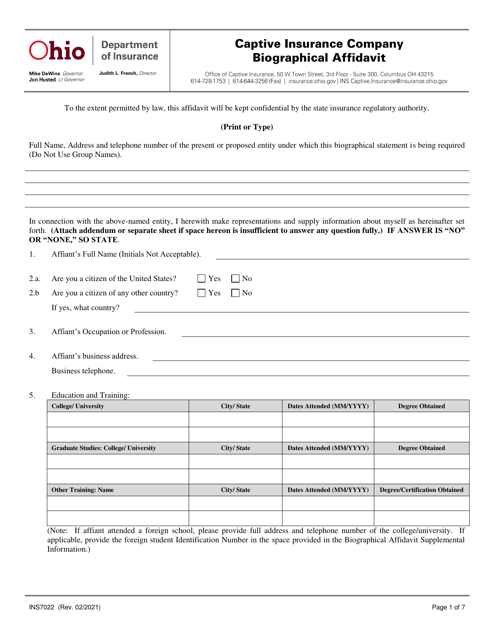

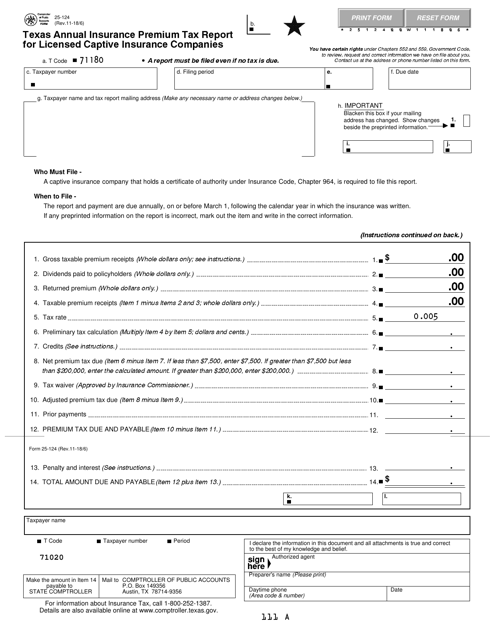

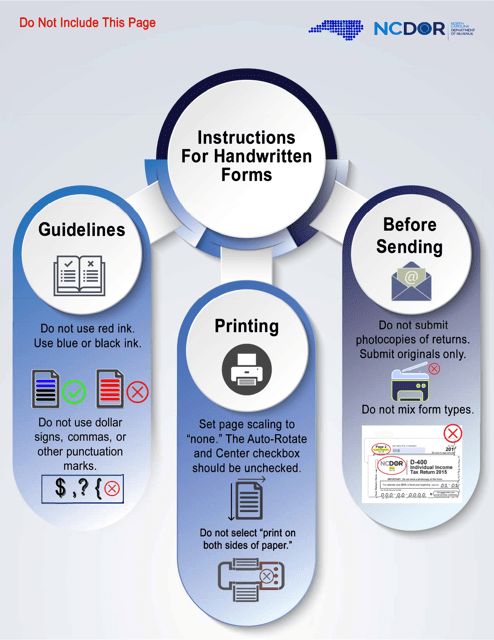

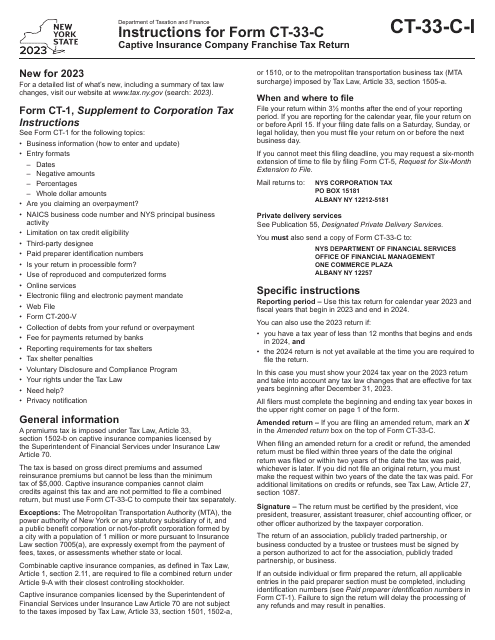

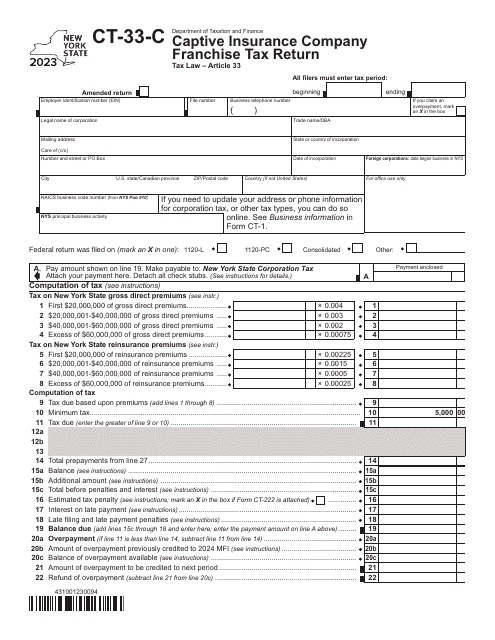

Whether you are located in Connecticut, North Carolina, Ohio, Vermont, or any other state, our documents cater to various jurisdictions and regulations. Our instructions for tax returns and biographical affidavits ensure that you comply with the specific requirements of each state when it comes to captive insurance companies.

Take advantage of the benefits that captive insurance companies offer and explore our collection of documents today. Start your journey towards greater control over your insurance programs and improved risk management strategies by forming a captive insurance company.

Documents:

31

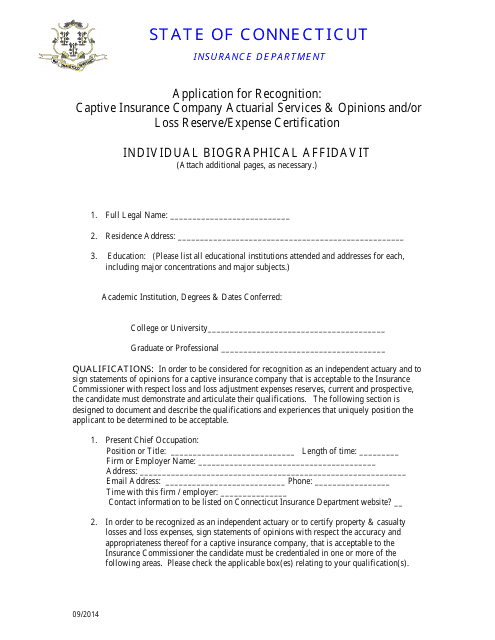

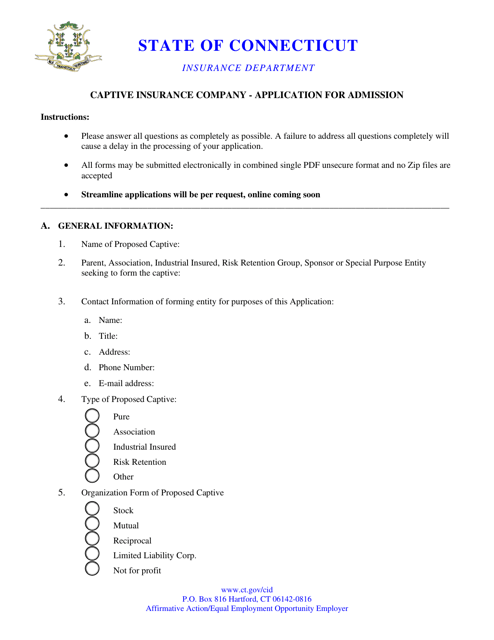

This document is used for applying for recognition under the Connecticut Captive Insurance Company Actuarial Services. It includes the services and opinions related to loss reserves and expense certification.

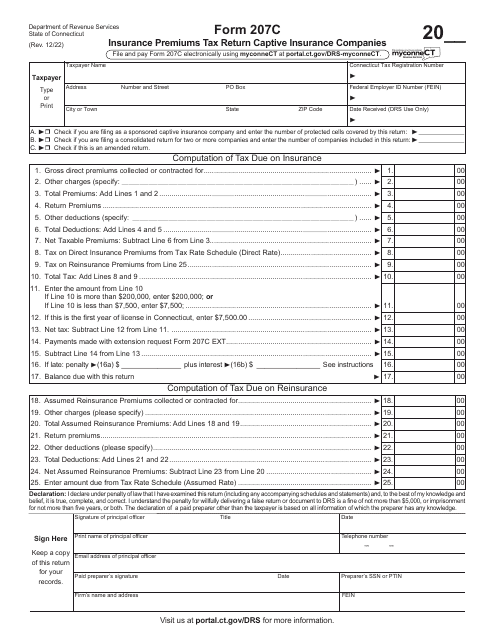

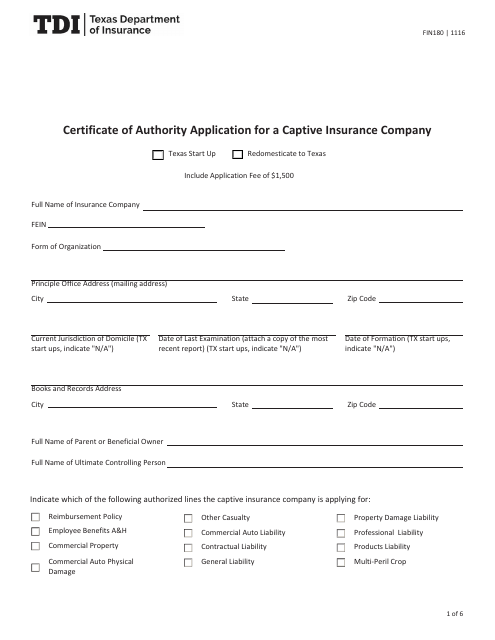

This Form is used for filing the annual insurance premium tax report for licensed captive insurance companies in Texas.

This Form is used for applying to establish a Captive Insurance Company in South Dakota.

This form is used for paying the annual renewal fee for a captive insurance company in Ohio.

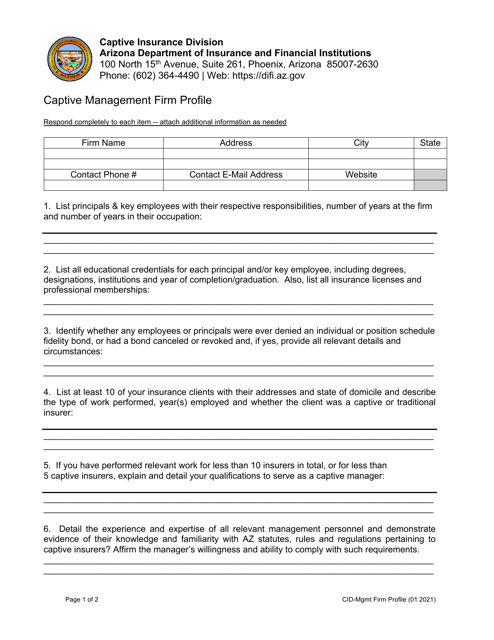

This Form is used for providing a profile of a captive management firm based in Arizona.

This form is used for applying for a license for a captive insurance company in the state of Arizona.

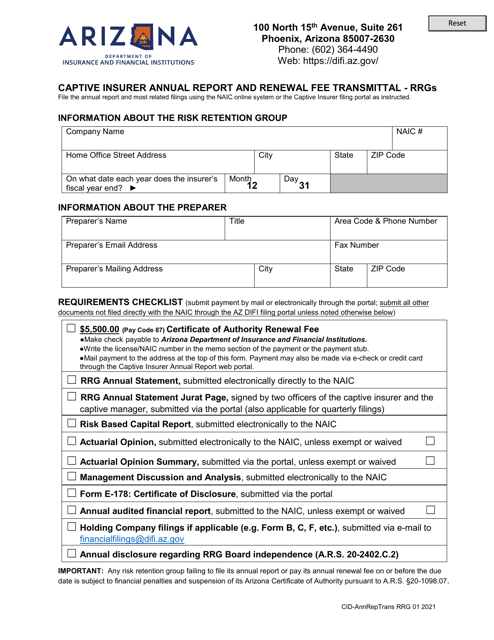

This Form is used for transmitting the annual report and renewal fee for captive insurers registered with the Risk Retention Groups in the state of Arizona.

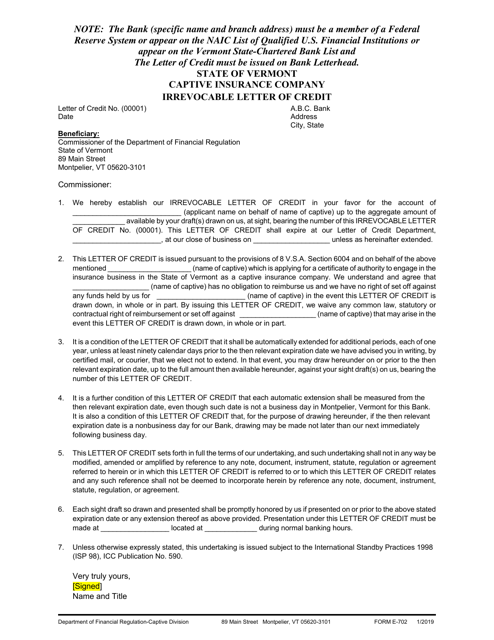

This Form is used for obtaining an Irrevocable Letter of Credit for a Captive Insurance Company in Vermont.

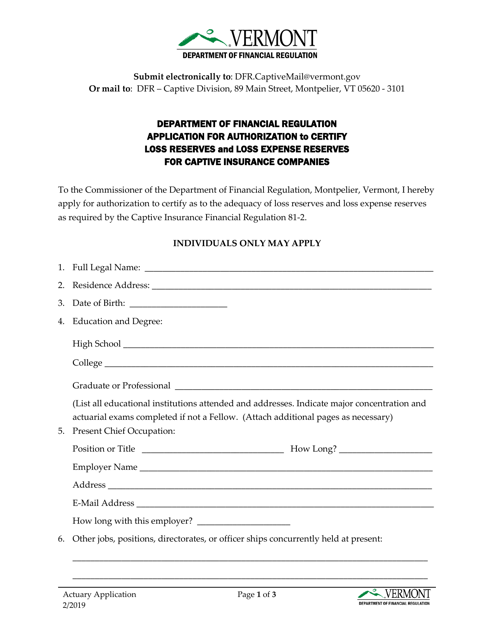

This document is used for applying for authorization to certify loss reserves and loss expense reserves for captive insurance companies in Vermont.

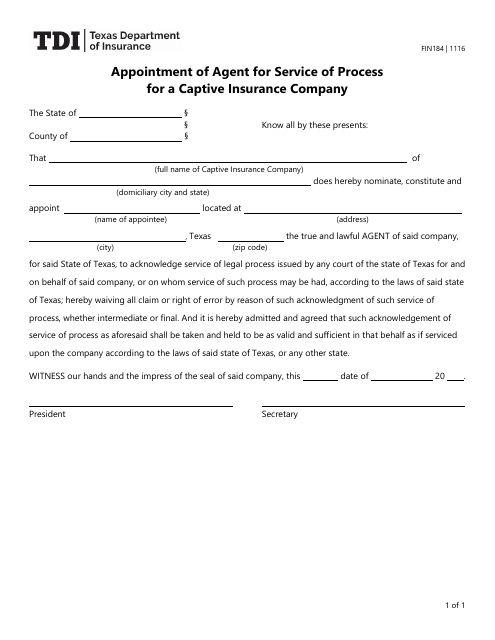

This form is used for appointing an agent for service of process for a captive insurance company in the state of Texas.