Schedule Nr Templates

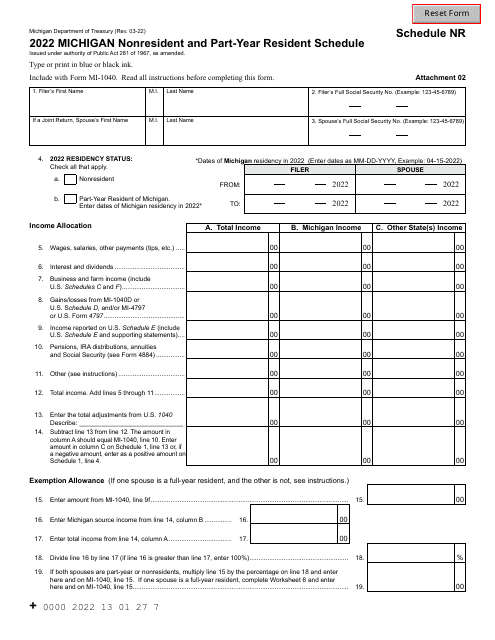

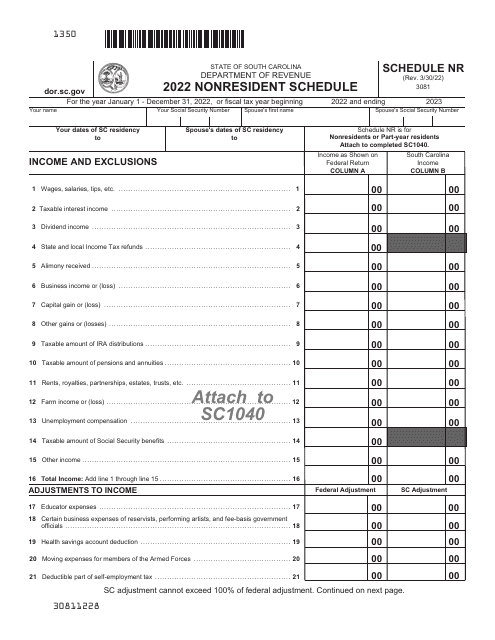

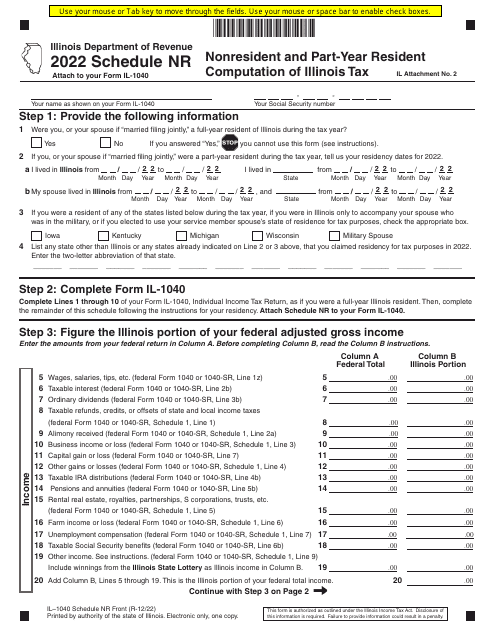

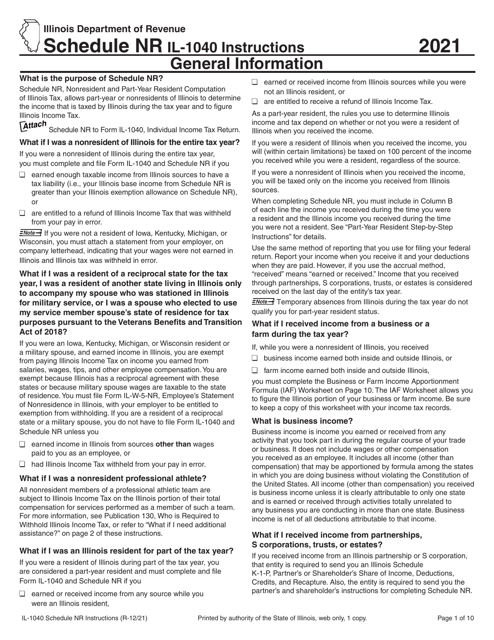

The Schedule NR, also known as the Nonresident Schedule, is a set of documents and instructions necessary for individuals or fiduciaries who have income in a state where they are nonresidents or part-year residents. It is primarily used to accurately calculate and report the tax liability in the respective state.

The Schedule NR is an essential resource for taxpayers residing in states such as Illinois and South Carolina who have income from different sources outside of their home state. These documents provide step-by-step instructions on how to determine the correct amount of tax owed or refunded, taking into account the specific rules and requirements of each state.

Whether you are a nonresident individual or a fiduciary, filing a tax return can be complex. The Schedule NR acts as a guide, ensuring that you correctly report your income, claim any applicable deductions or exemptions, and fulfill your tax obligations. It covers various aspects of nonresident taxation, including computation of fiduciary income and determining the appropriate tax liability for nonresidents.

By following the instructions provided in the Schedule NR, you can have peace of mind knowing that you are adhering to the tax laws of the state(s) in which you have earned income. It is crucial to understand the specific requirements and guidelines outlined in these documents, especially if you have income from multiple jurisdictions.

In summary, the Schedule NR is a comprehensive collection of documents and instructions designed to assist nonresident individuals and fiduciaries in accurately calculating and reporting their tax liability for income earned outside of their home state. It is an invaluable resource for ensuring compliance with state tax laws and maximizing the efficiency of your tax filing process.

Documents:

33

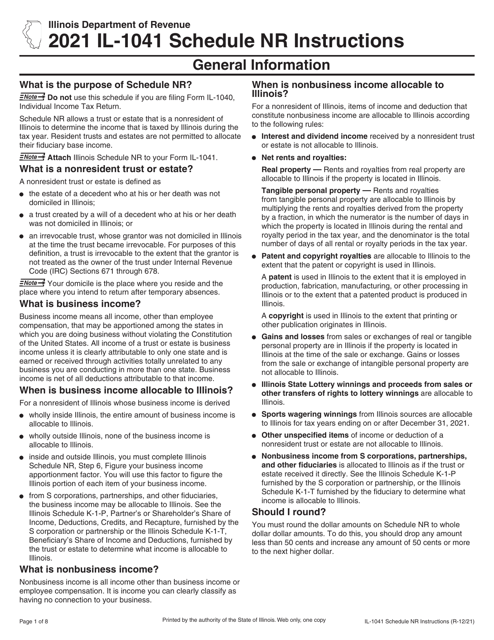

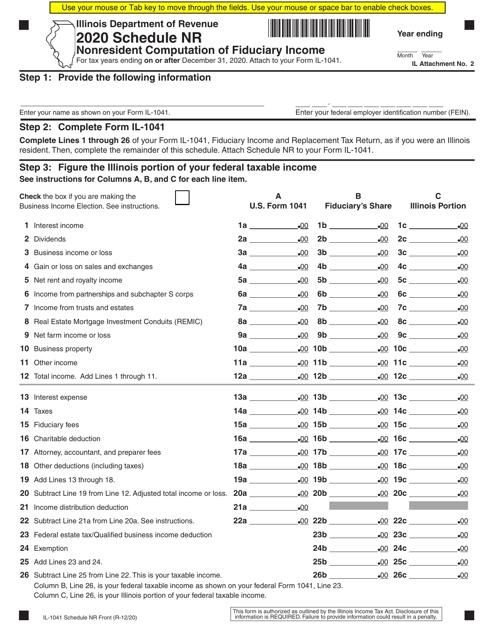

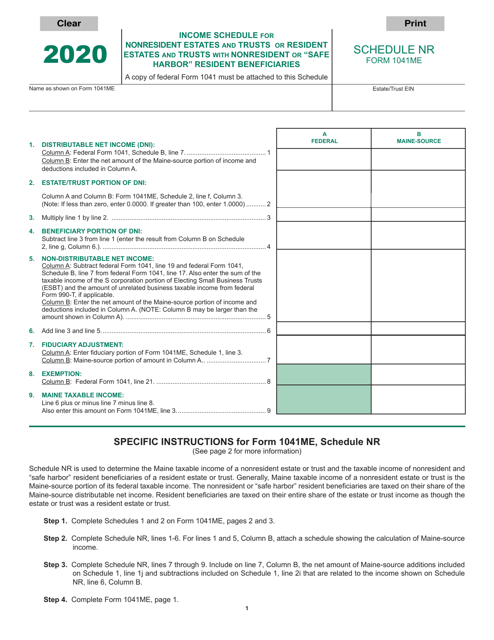

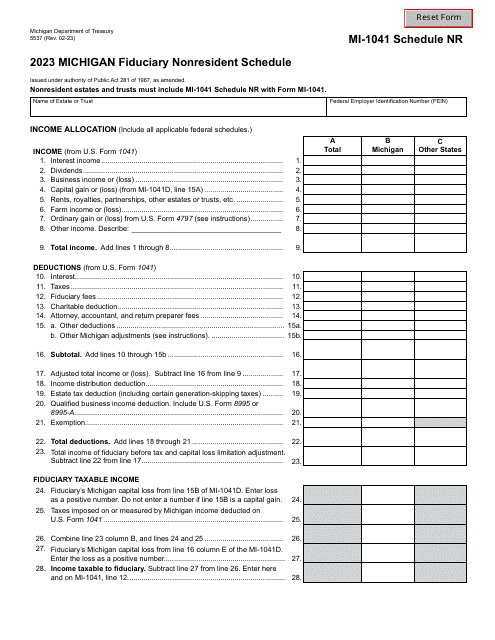

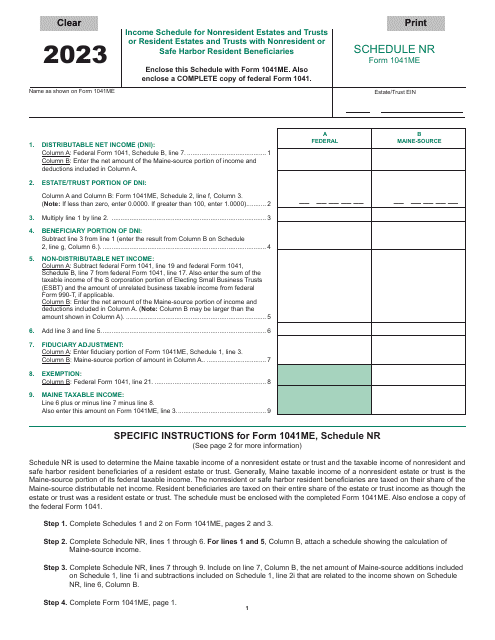

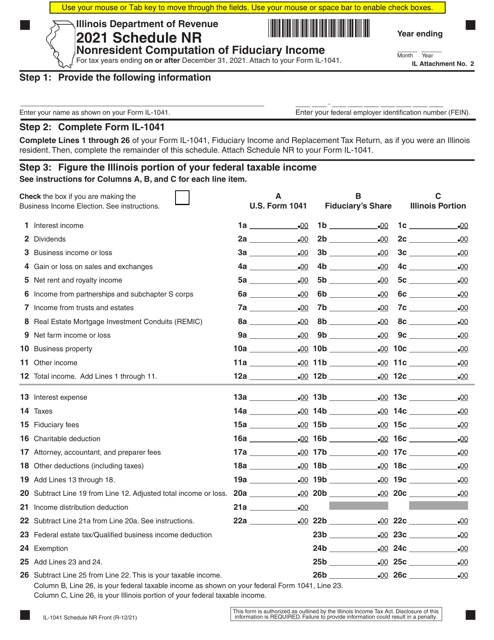

This document is used for calculating the fiduciary income for nonresidents in Illinois.

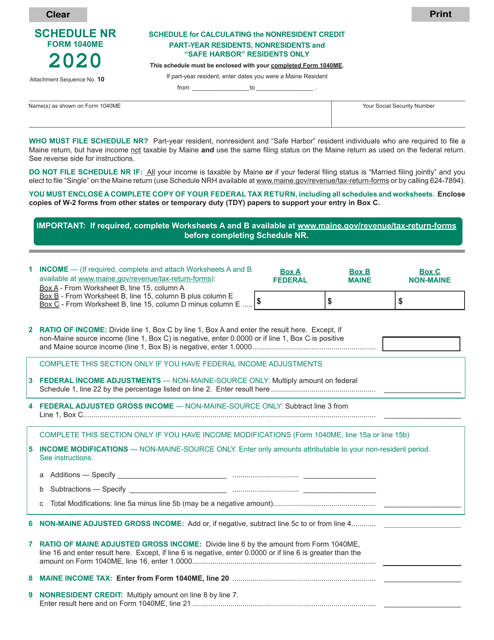

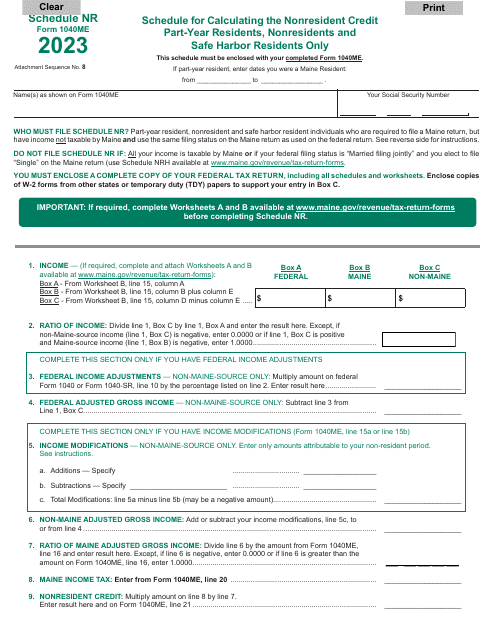

This form is used for calculating the nonresident credit for part-year residents, nonresidents, and "safe harbor" residents in Maine.

This form is used for nonresidents to calculate their fiduciary income in the state of Illinois. It is specifically for individuals who are the beneficiaries of trusts or estates in Illinois.