Wage Garnishment Process Templates

Are you facing wage garnishment? Don't worry, we can guide you through the wage garnishment process. Wage garnishment, also known as wage execution or income withholding, is a legal process that allows a creditor to collect a debt directly from a debtor's wages or salary. It is a powerful tool that helps creditors recover what they are owed.

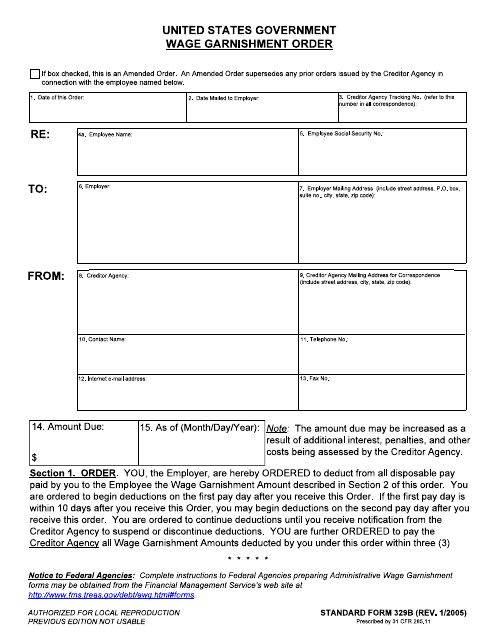

The wage garnishment process involves several steps and requires specific documents to be filed. One such document is the Wage Garnishment Order, also referred to as Form SF-329B. This document instructs the debtor's employer to withhold a portion of their wages and remit it to the creditor until the debt is satisfied.

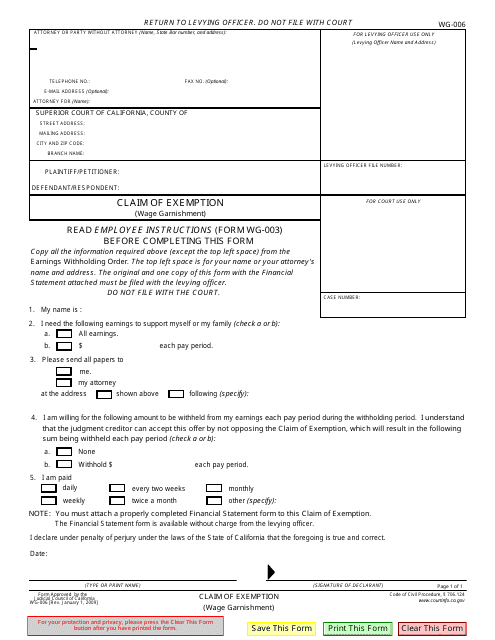

In some states like California, debtors can claim exemptions from wage garnishment using Form WG-006, known as the Claim of Exemption (Wage Garnishment). This form allows debtors to assert their rights to keep certain earnings from being garnished, protecting their income for essential expenses.

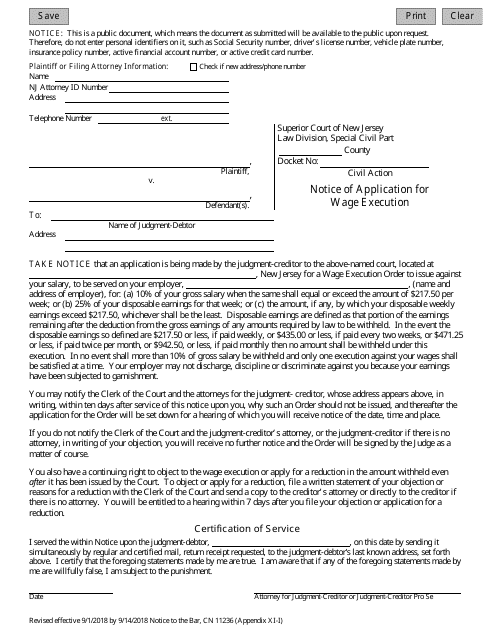

Different states may have their own specific forms for initiating a wage garnishment. For example, in New Jersey, creditors must file Form 11236 Appendix XI-I, commonly referred to as the Notice of Application for Wage Execution. This form serves as a notice to the debtor and their employer that a wage garnishment is being sought.

To ensure transparency and accuracy, garnishees, such as employers, are required to provide a Written Explanation of Garnishee's Computation of Earnings Withheld. This document, commonly used in Kansas, outlines how the garnishee calculated the amount withheld from the debtor's wages.

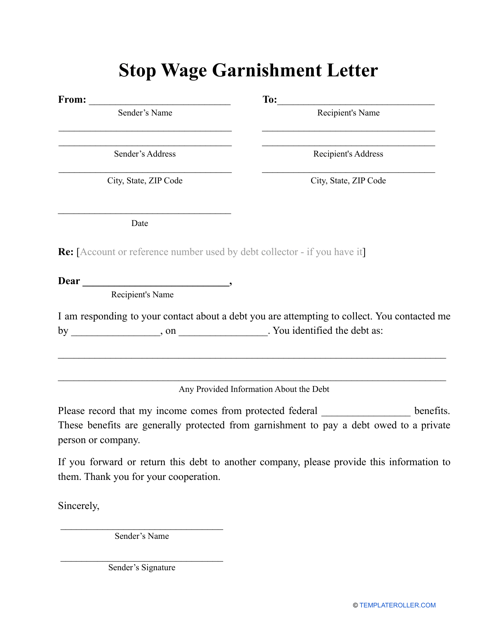

If you are struggling with wage garnishment, you may want to consider sending a Stop Wage Garnishment Letter to your creditor. This letter template, widely available, can help you communicate your intent to resolve the debt and negotiate alternative arrangements.

Understanding the wage garnishment process and having the right documents is crucial in protecting your rights and effectively managing your financial situation. Our comprehensive collection of documents related to wage garnishment can provide you with the necessary tools and resources to navigate through this challenging process successfully. Don't let wage garnishment overwhelm you – take control of your finances with our assistance.

(Word count: 358)

Documents:

4

This Form is used for obtaining a wage garnishment order to collect a debt. It allows the creditor to legally collect a portion of the debtor's wages.

This form is used for claiming exemption from wage garnishment in California. It allows individuals to protect a certain amount of their wages from being taken to satisfy a debt.

This Form is used for notifying the court about an application for wage execution in the state of New Jersey.

The purpose of this type of document is to convince your creditor to stop taking garnishments from an individual's salary.