Expatriate Tax Templates

Are you an expatriate living and working abroad? Understanding expatriate tax requirements is crucial for maintaining compliance with the tax laws of your home country. Expatriate tax, also known as expatriation tax or expatriate taxes, refers to the set of rules and regulations that govern the taxation of individuals who have chosen to live and work overseas.

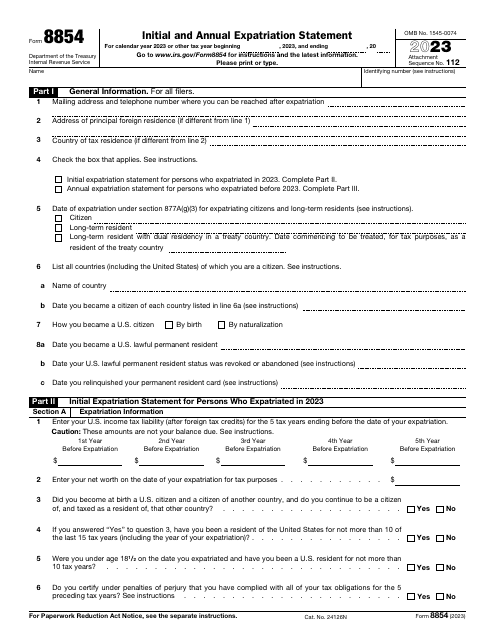

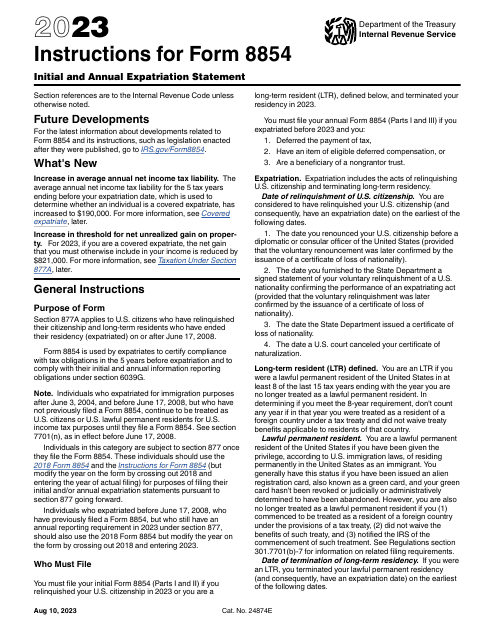

The expatriate tax system is complex and can vary depending on your home country's tax laws. For individuals from the United States, the Internal Revenue Service (IRS) has specific forms that need to be filed, such as the IRS Form 2555 Foreign Earned Income and IRS Form 8854 Initial and Annual Expatriation Statement.

The IRS Form 2555 Foreign Earned Income is designed for expatriates to report their foreign earned income and claim any applicable exclusions or deductions. This form ensures that expatriates are taxed only on the income they earn while living and working abroad, rather than being subject to double taxation.

On the other hand, the IRS Form 8854 Initial and Annual Expatriation Statement is a crucial document for expatriates who have chosen to permanently renounce their U.S. citizenship or long-term residency. This form provides the necessary information to the IRS about your expatriation, helping to determine any potential tax liabilities or consequences.

If you're unsure about how to navigate the intricacies of expatriate tax, it's essential to seek professional advice. Working with a qualified tax advisor who specializes in expatriate tax services can help ensure that you remain compliant with your home country's tax laws and take advantage of any available deductions or exclusions.

Whether you're a U.S. citizen living abroad or an expatriate from another country, understanding and fulfilling your expatriate tax obligations is crucial. Avoid potential penalties and stay on the right side of the law by familiarizing yourself with the necessary documents and seeking expert assistance when needed.

Documents:

9

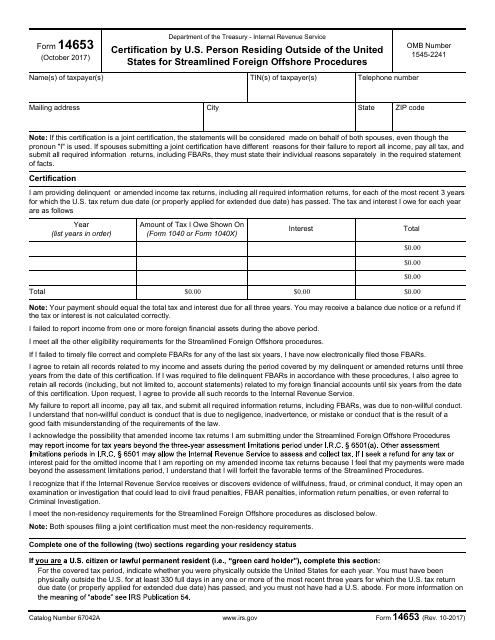

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.