Alternative Fuel Tax Credit Templates

Are you looking to save money on your taxes while also making a positive impact on the environment? If so, you may be eligible for the Alternative Fuel Tax Credit. This tax credit, also known as the Alternative-Fuel Tax Credit or the Alternative Fuel Tax Credit/Deduction, is available to individuals and businesses who use alternative fuels to power their vehicles.

By using alternative fuels such as biodiesel, electricity, natural gas, hydrogen, or ethanol, you can reduce your carbon footprint and potentially receive a tax credit for doing so. The Alternative Fuel Tax Credit is designed to incentivize the use of cleaner and more sustainable fuel sources, helping to reduce dependence on fossil fuels and promote a greener transportation sector.

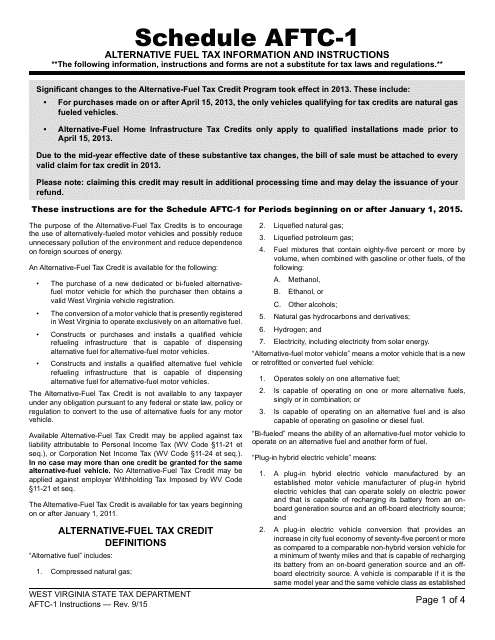

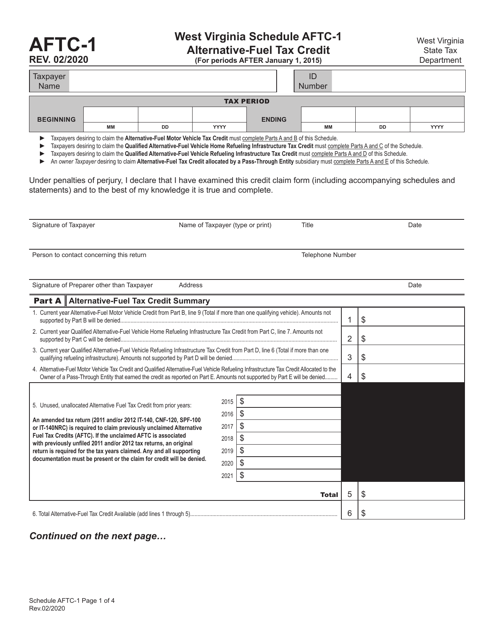

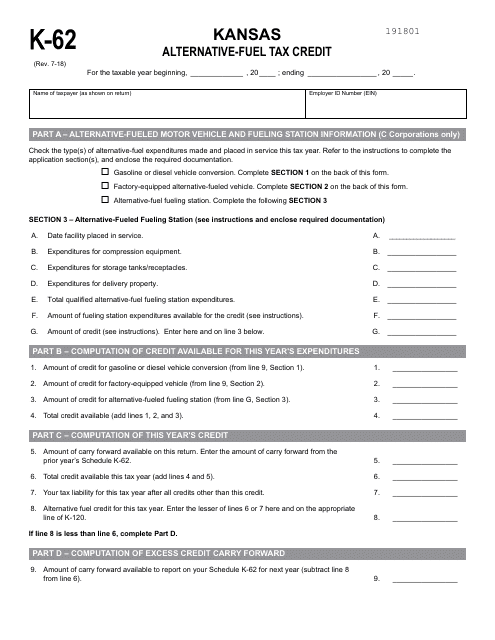

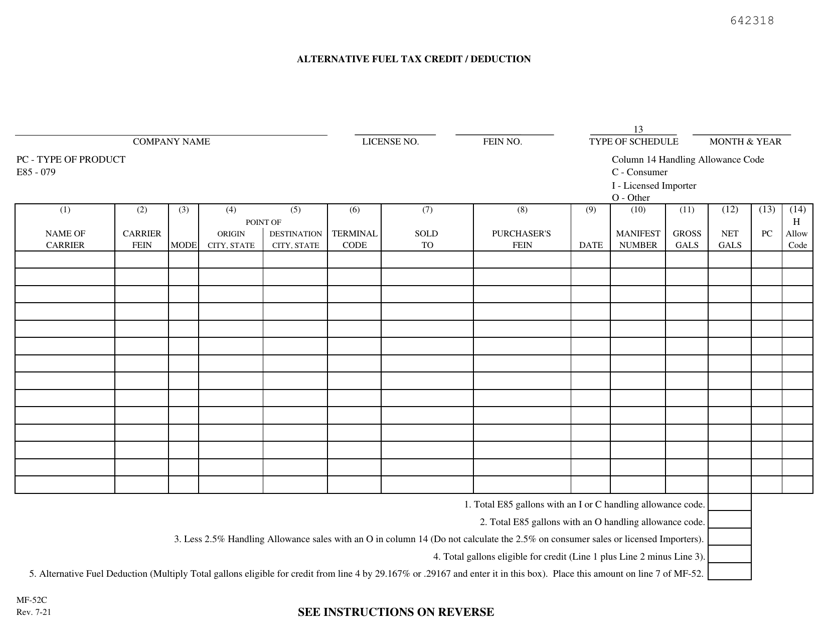

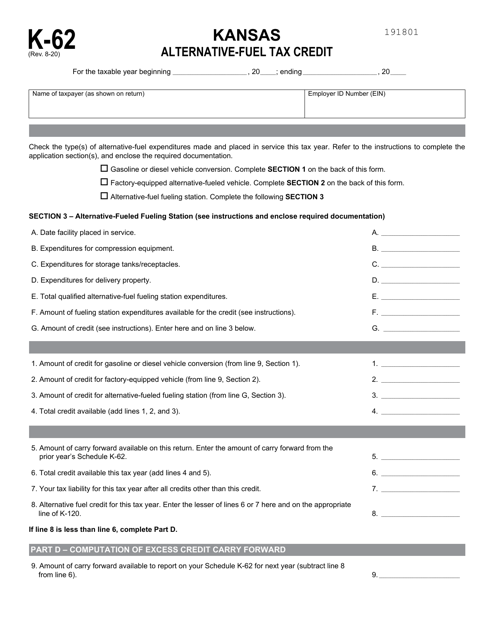

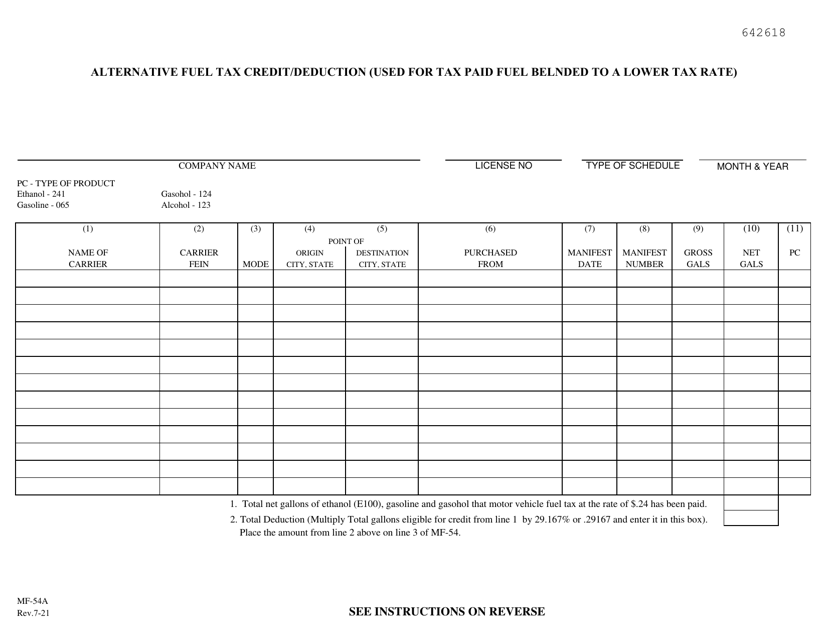

To claim the credit, you must file the appropriate forms and documentation with your tax return. Depending on the state you live in, this may include forms such as Schedule AFTC-1, Form K-62, or Form MF-54A, among others. Each state has its own specific requirements and guidelines for this tax credit, so it's important to carefully review the instructions and follow the proper procedures.

The Alternative Fuel Tax Credit can result in significant savings on your tax bill, potentially reducing the amount you owe or even providing a refund. The exact amount of the credit and eligibility criteria can vary depending on factors such as the type of alternative fuel used, the amount consumed, and the jurisdiction in which you reside.

If you're interested in learning more about the Alternative Fuel Tax Credit and how you can benefit from it, consult with a knowledgeable tax professional or visit the official website of your state's tax authority. They can provide you with the most up-to-date information and guidance on claiming this credit, ensuring that you maximize your tax savings while contributing to a cleaner and more sustainable future.

Documents:

7

This document provides instructions for Schedule AFTC-1, which is used to claim the Alternative Fuel Tax Credit in West Virginia for periods beginning on or after January 1, 2015.

This Form is used for claiming the Alternative-Fuel Tax Credit in the state of Kansas.

This document for claiming alternative-fuel tax credits in Kansas.