Public Insurance Adjuster Templates

Public insurance adjusters play a crucial role in insurance claims by providing expert assistance to policyholders in navigating the complex process of filing and settling claims. These professionals are licensed and appointed by state insurance departments to advocate on behalf of policyholders during the claims process.

Whether you call them public insurance adjusters or something else, such as certified insurance consultants or public claims specialists, these professionals are trained and experienced in assessing and evaluating property and casualty insurance claims. They work independently from insurance companies, ensuring that policyholders receive fair and appropriate compensation for their losses.

Public insurance adjusters assist policyholders in many ways, from conducting thorough investigations of the damage to accurately valuing losses and negotiating with insurance companies to secure maximum settlements. They are well-versed in the intricacies of insurance policies, allowing them to effectively interpret policy terms and conditions for the benefit of policyholders.

By hiring a public insurance adjuster, policyholders can level the playing field and ensure they receive the compensation they deserve. These professionals are knowledgeable about the claims process and can help policyholders avoid common pitfalls and mistakes that could lead to claim denial or inadequate settlements.

Whether you're a homeowner dealing with property damage or a business owner facing a major loss, enlisting the expertise of a public insurance adjuster is a smart decision. They can provide peace of mind, save you time and effort, and ultimately maximize your insurance claim payout.

If you need assistance with your insurance claim, consider consulting a reputable public insurance adjuster who can guide you through the process and help you achieve a fair and favorable resolution.

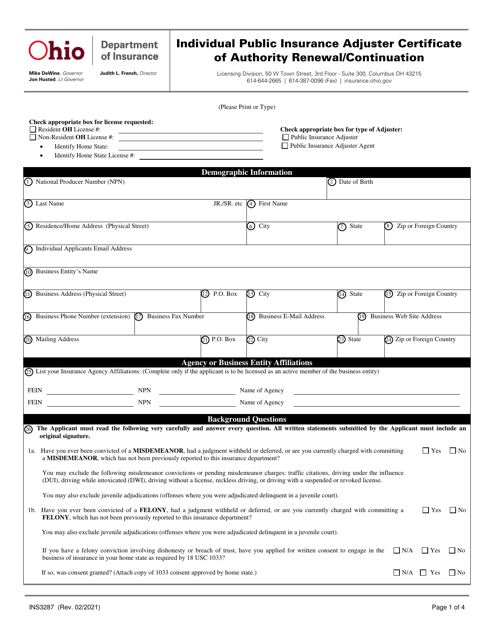

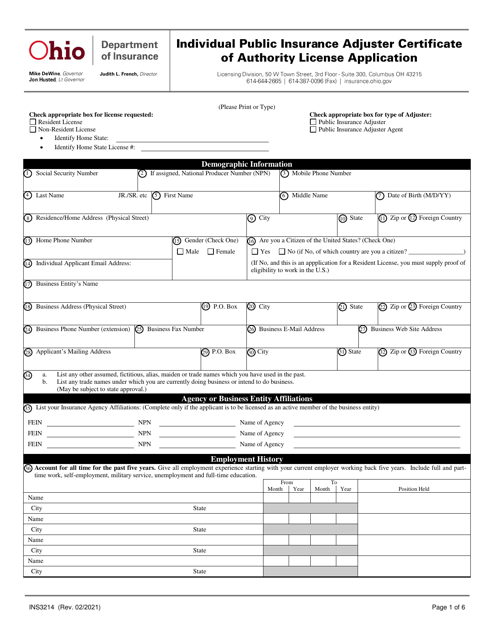

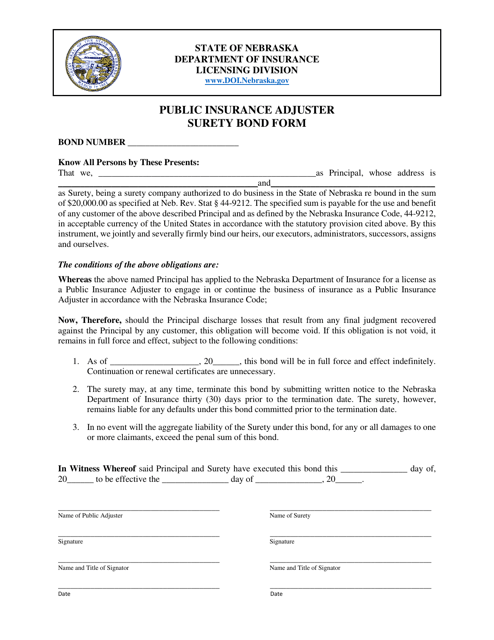

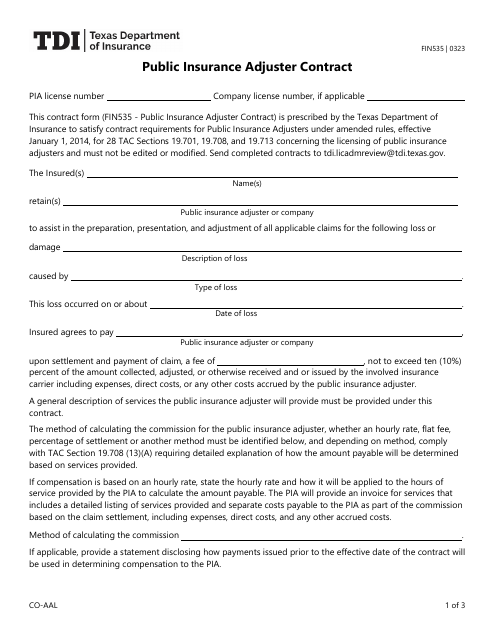

Documents:

10

This document is used for obtaining a surety bond for public insurance adjusters in Nebraska.