Credit History Templates

When it comes to financial matters, your credit history plays a crucial role. It serves as a record of your past borrowing and repayment activities, reflecting your financial responsibility and reliability. Having a good credit history is essential for obtaining loans, credit cards, and even renting a home.

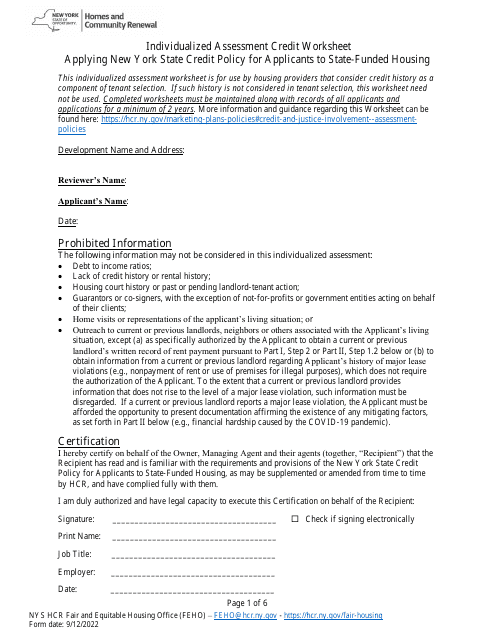

At Templateroller.com, we understand the importance of credit history, and we strive to provide you with reliable information and resources to help you navigate the intricacies of the credit system. Our collection of documents pertaining to credit history, also known as credit history reports, is designed to assist you in understanding and managing your creditworthiness.

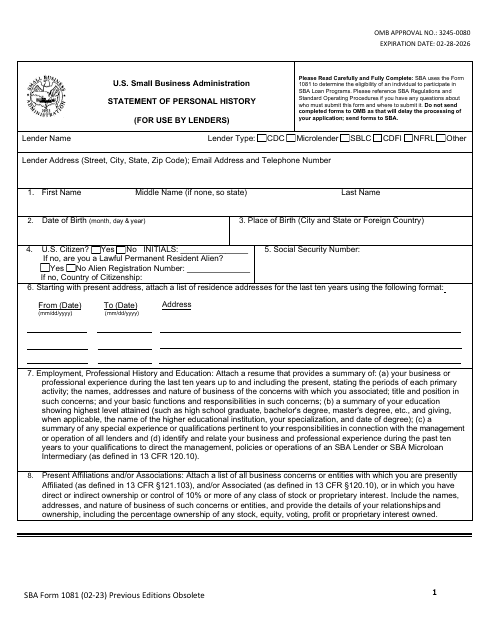

One valuable resource in our credit history collection is the SBA Form 1081 Statement of Personal History (For Use by Lenders). This form is utilized by lenders to assess an individual's creditworthiness when applying for small business loans. It provides a comprehensive overview of an individual's personal and financial background, allowing lenders to make informed decisions based on credit history.

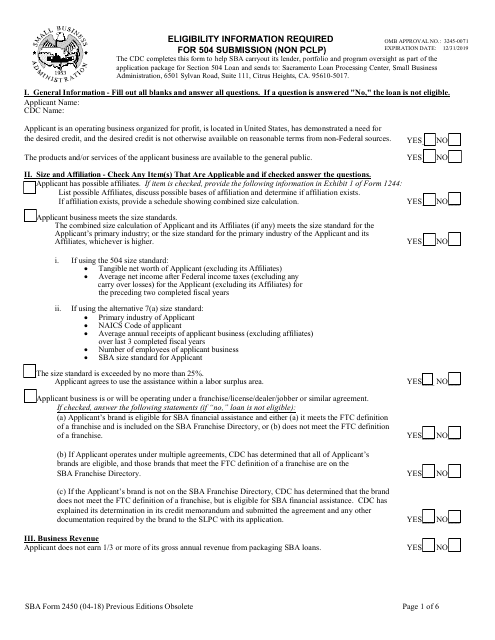

Another useful document in our collection is the SBA Form 2450 504 Eligibility Checklist (Non-PCLP). This checklist is specifically tailored for individuals seeking eligibility for the 504 loan program. It outlines the necessary requirements and criteria to qualify for this type of loan, which can help borrowers establish and build their credit history.

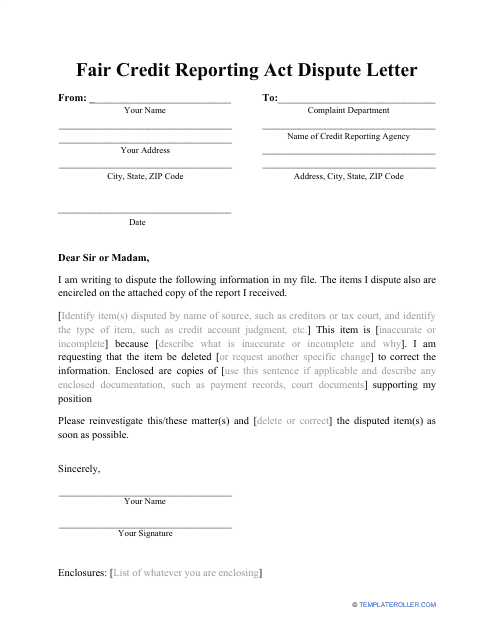

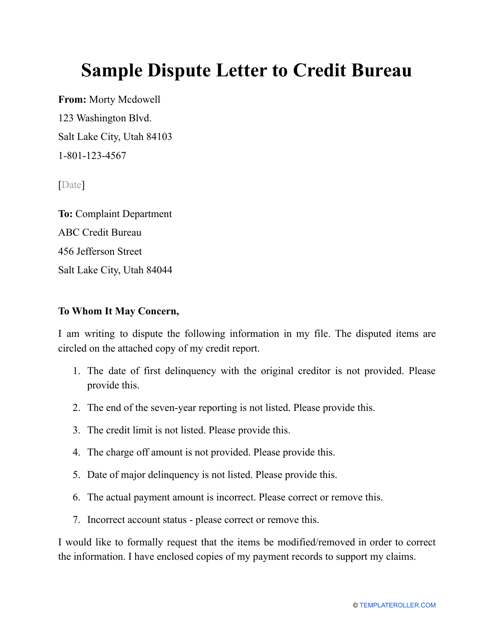

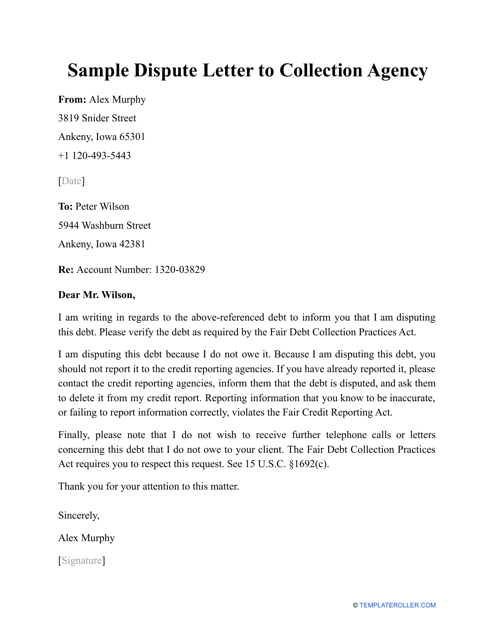

Our credit history collection also includes a sample dispute letter to credit bureaus. This letter serves as a template for individuals who want to contest inaccuracies or discrepancies in their credit reports. By addressing any incorrect information promptly, you can protect your credit history from potential negative impacts.

For those interested in credit unions in New York, we offer a personal questionnaire specific to credit unions. This questionnaire gathers essential information about your financial background and helps credit unions assess your creditworthiness when considering your membership application.

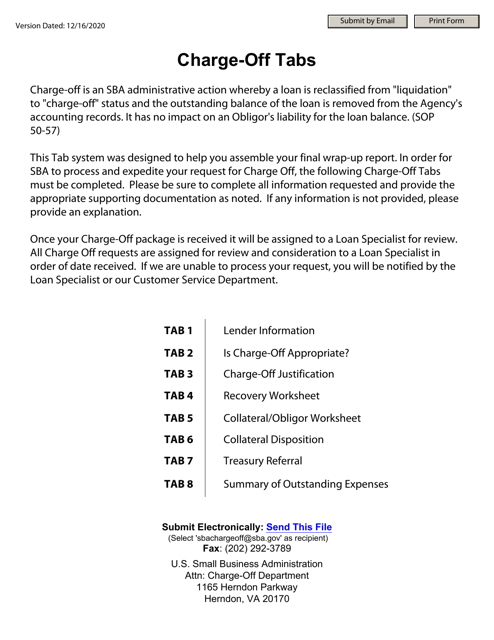

Lastly, our credit history collection includes materials related to charge-offs. Charge-offs occur when a creditor determines that it is unlikely to collect a debt and writes it off as a loss. Understanding how charge-offs can affect your credit history is vital in managing your financial reputation effectively.

Whether you're a small business owner, an individual seeking credit eligibility, or someone looking to maintain a positive credit history, our credit history collection provides comprehensive information and resources to support your financial goals. Trust Templateroller.com to equip you with the knowledge you need to make informed decisions and thrive in the credit system.

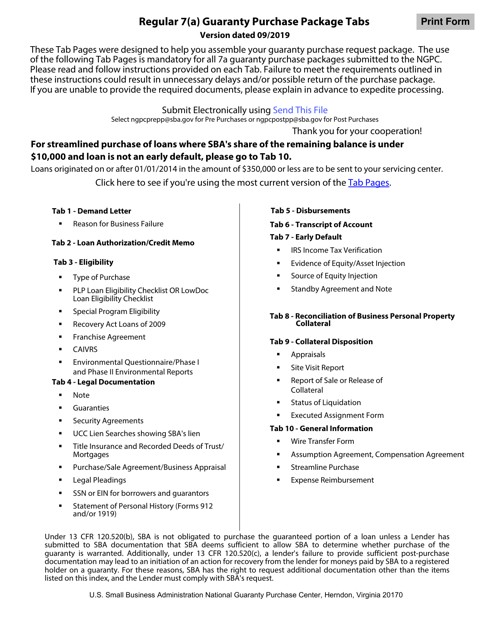

Documents:

41

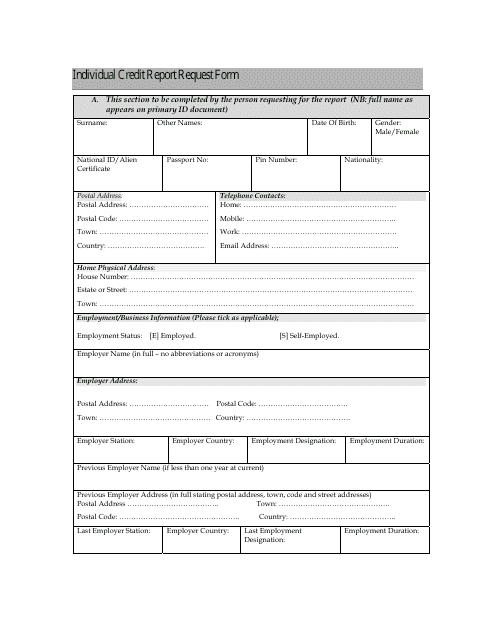

This document is used for requesting an individual credit report in Kenya.

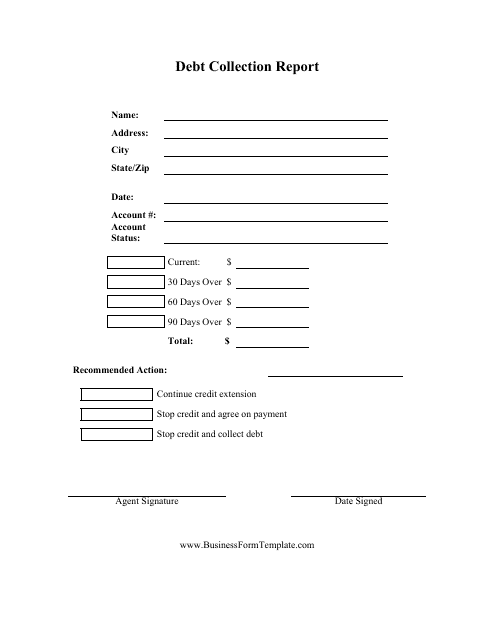

This document is a template for creating a debt collection report. It helps individuals or businesses organize and summarize their debt collection activities.

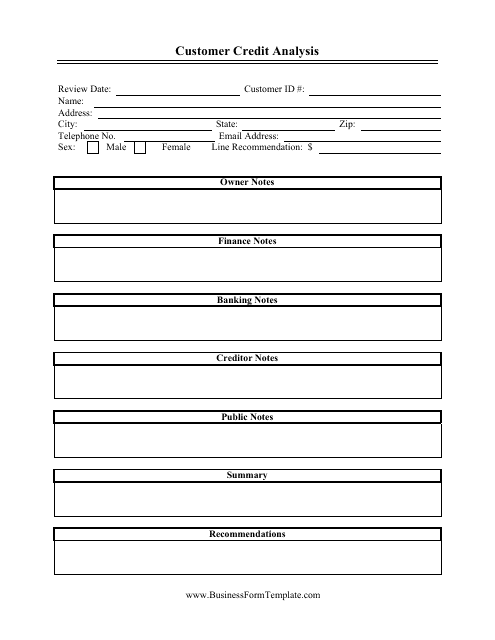

This document provides a template for analyzing and evaluating the creditworthiness of customers. It helps businesses assess the financial stability and risk associated with extending credit to their customers.

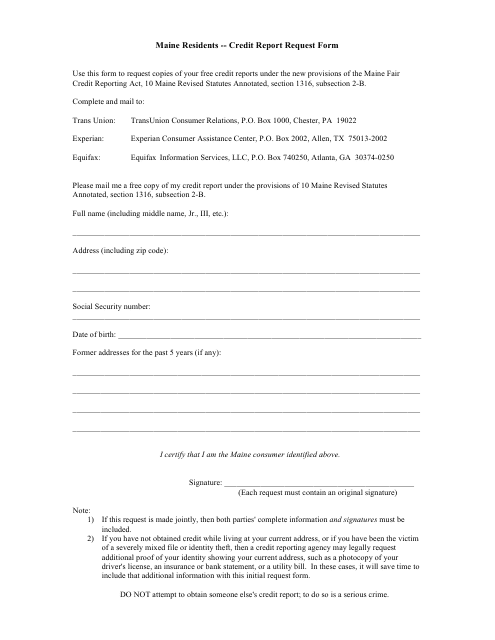

This Form is used for requesting a credit report in the state of Maine.

This document is a Fair Credit Reporting Act Dispute Letter. It is used to dispute any incorrect information on your credit report as per the guidelines of the Fair Credit Reporting Act.

This form is used and sent to the Small Business Administration (SBA). It verifies your eligibility for participation in the Agency's loan programs.

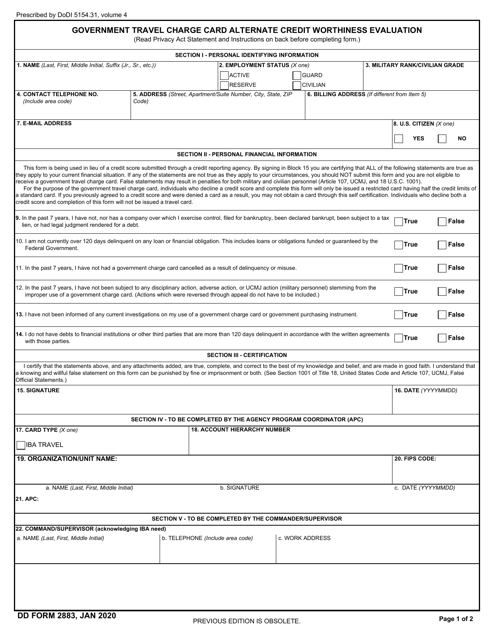

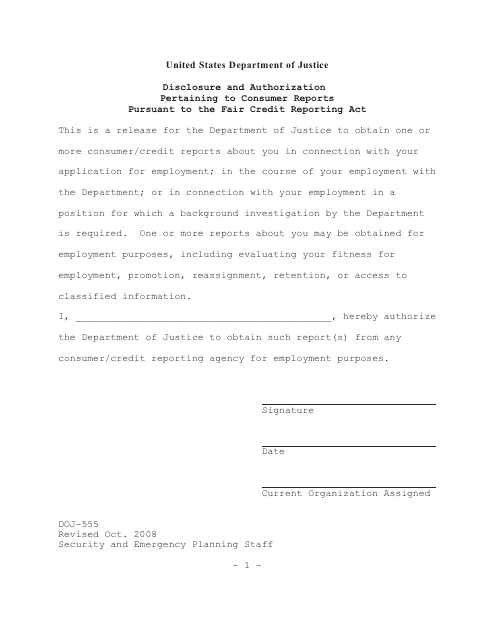

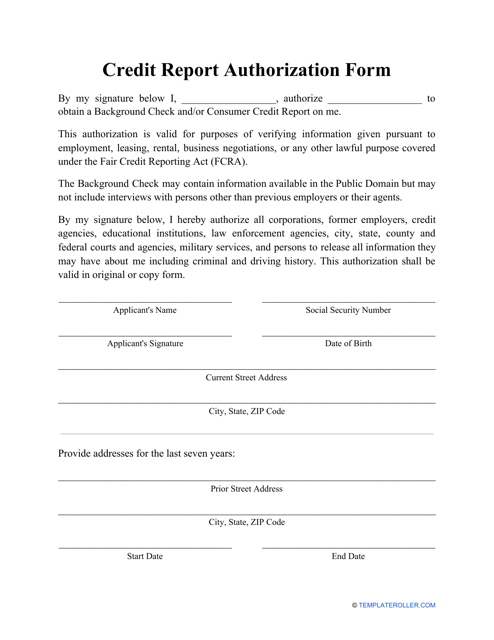

This document is used for authorizing the disclosure of consumer reports under the Fair Credit Reporting Act.

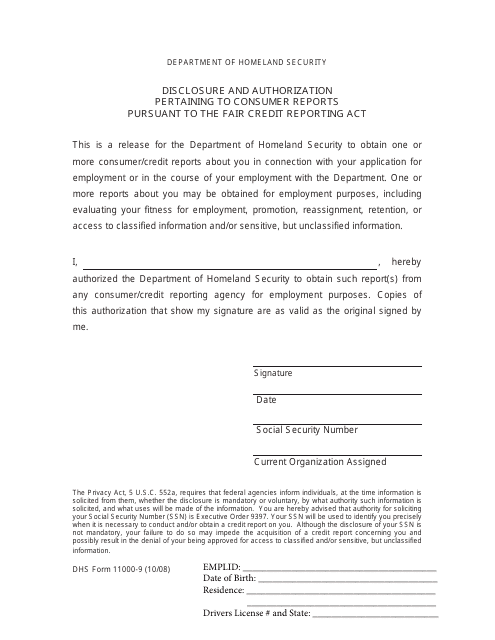

This document is used for obtaining disclosure and authorization from individuals for conducting consumer reports, in accordance with the Fair Credit Reporting Act (FCRA).

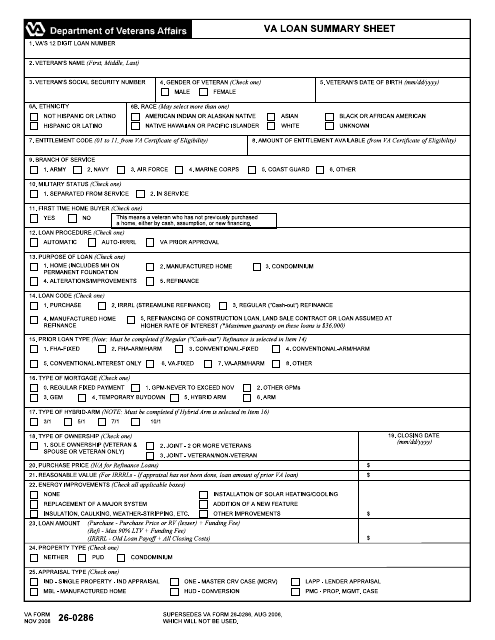

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

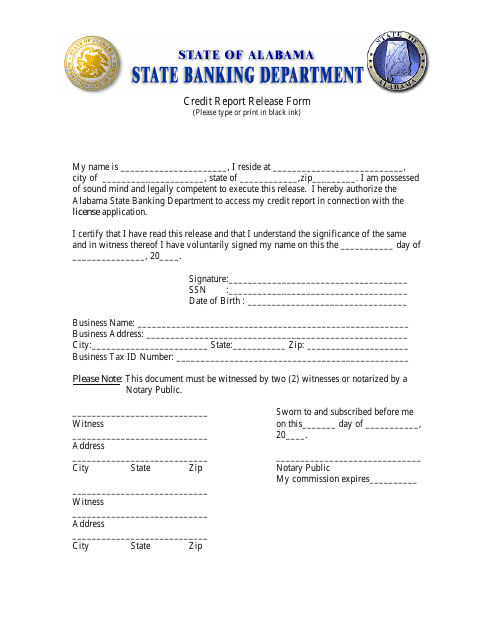

This Form is used for authorizing the release of credit report information in the state of Alabama.

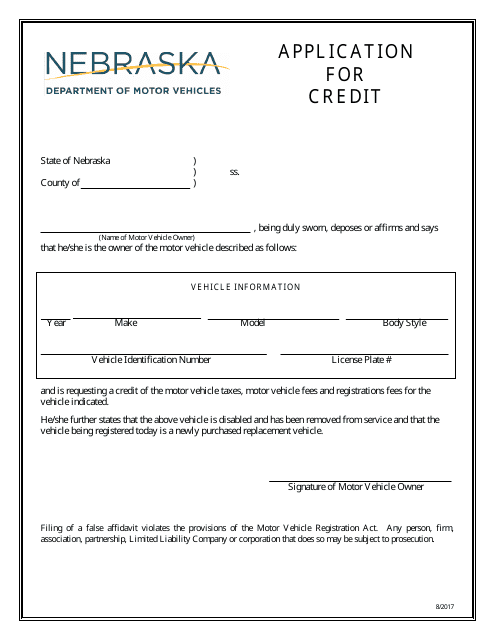

This document is used for applying for credit in the state of Nebraska. It is a form that individuals fill out to request credit from a lender or financial institution.

This document is completed by a Certified Development Company (CDC) to help the Small Business Administration (SBA) to apply for a Section 504 Loan.

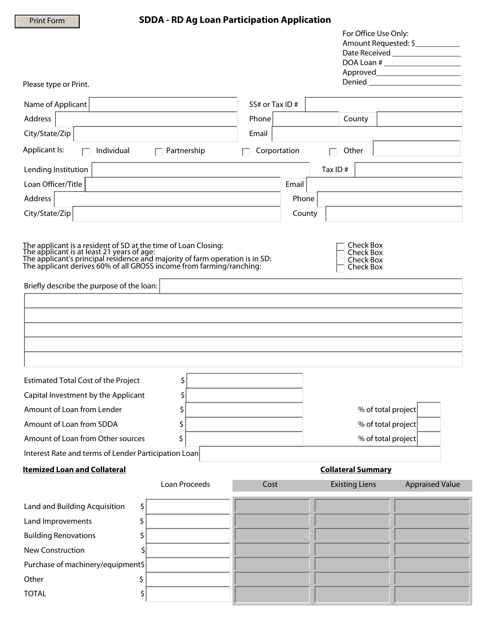

This form is used for applying for a loan participation program in South Dakota specifically for agricultural purposes.

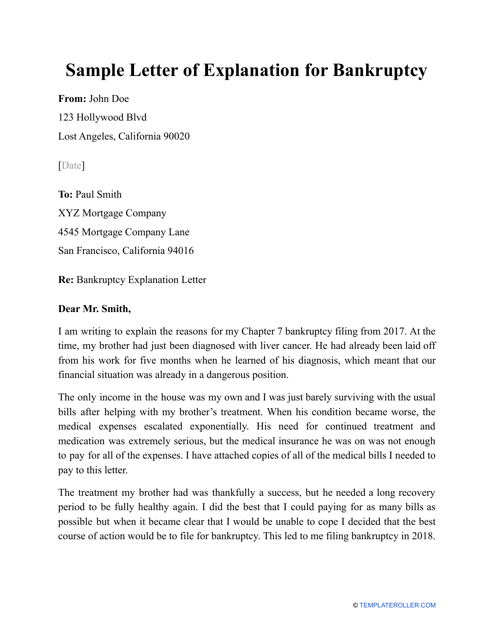

This letter serves as a statement from the borrower for the potential lender that clarifies why they had to file for bankruptcy in the past.

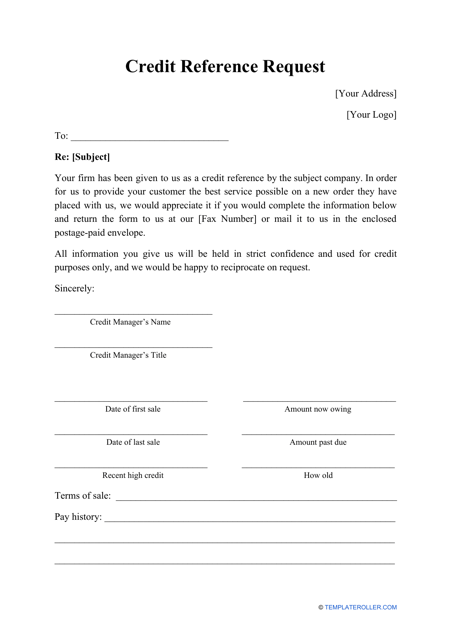

This form is completed in order to ask any company or financial institution you have worked with at some point in time for a reference required to obtain credit from a third party.

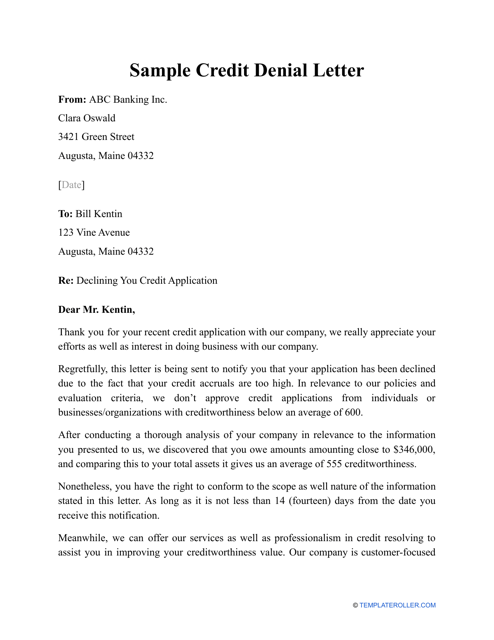

Financial institutions may use this letter for individuals or entities that have been declined an application to obtain credit.

If an individual notices an error in their credit report they can use this letter to have it corrected by the agency reporting the information.

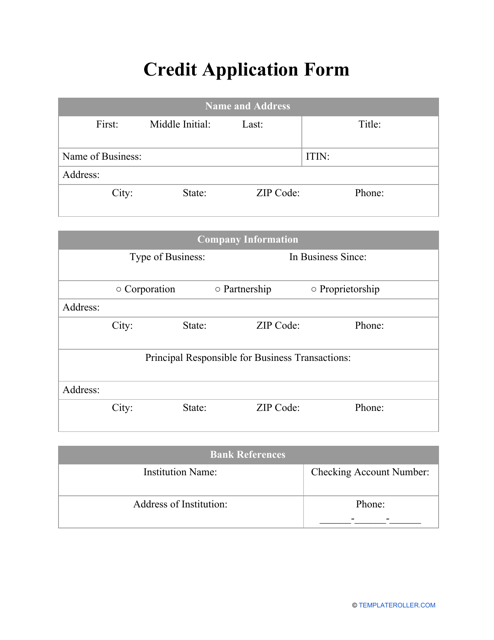

This document serves as a way for financial institutions to assess the creditworthiness of a potential individual or corporate customer.

Use this template to provide consent to a potential lender to learn more about the prospective borrower's credit history.

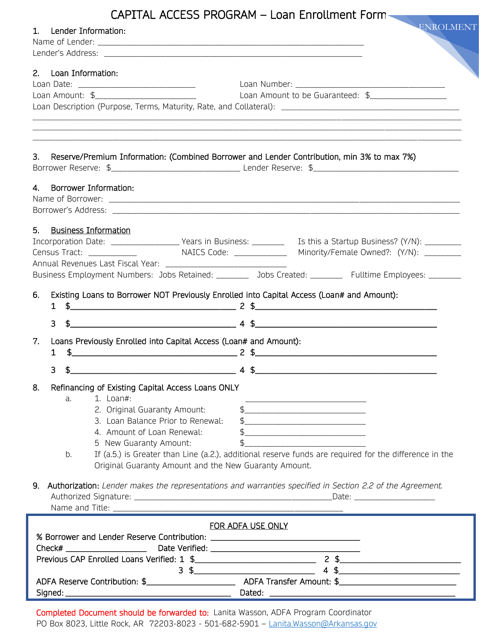

This form is used for enrolling in the Capital Access Program, which is a loan program in Arkansas.

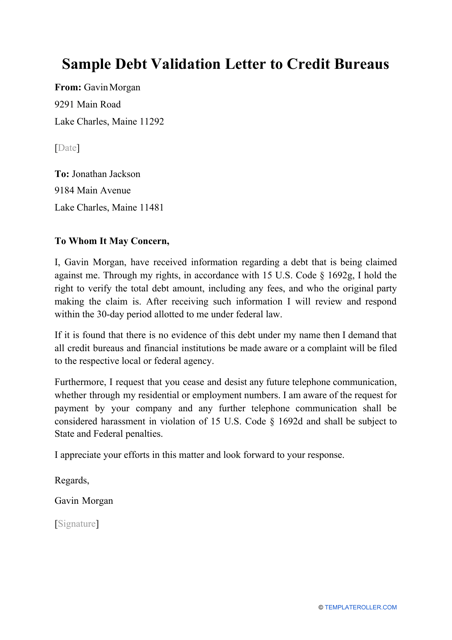

A debtor or their representative may prepare this letter with the intention of finding out whether their debt is real, to request information about an existing debt, and to warn the credit bureau that handles the debt to cease their harassing behavior if necessary.

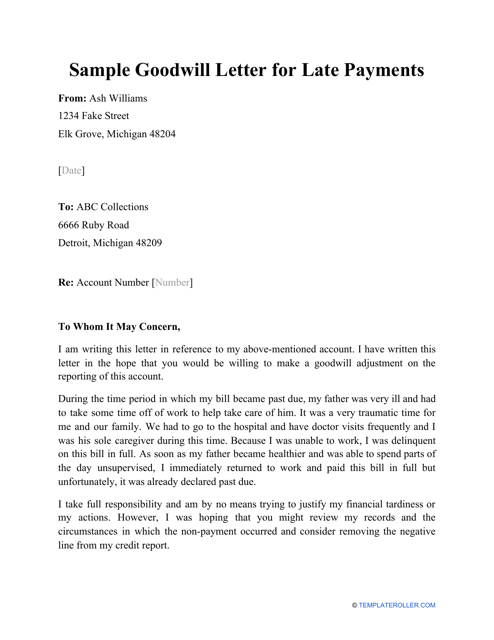

Individuals may use this type of letter when they want to try to remove late payments from their credit history.

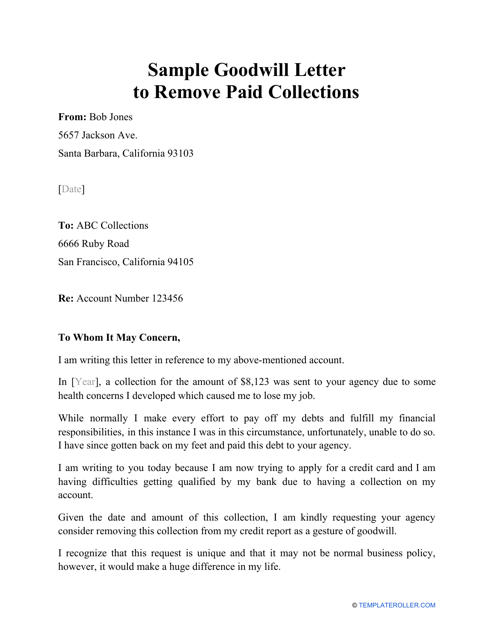

Individuals may use this letter when they would like to remove collection accounts on their credit report.

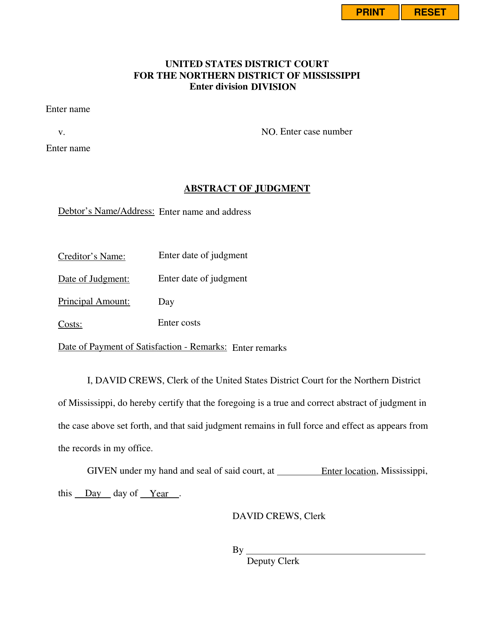

This document is used in Mississippi to record a court's decision and establish a legal claim against someone's property.

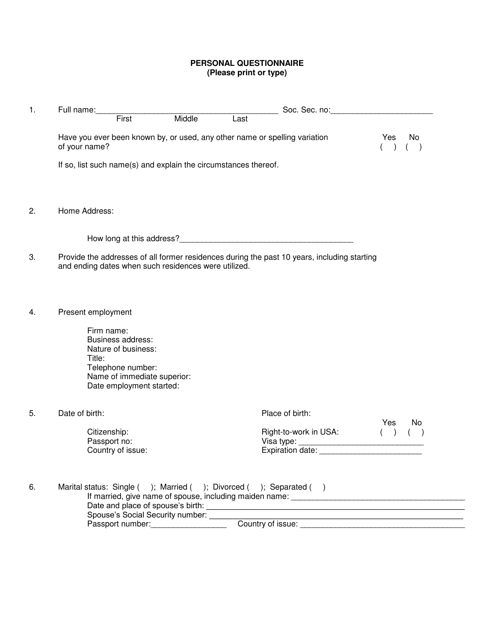

This type of document is a personal questionnaire specifically for credit unions in New York. It is used to collect personal information and financial details from individuals interested in joining or applying for services from credit unions.

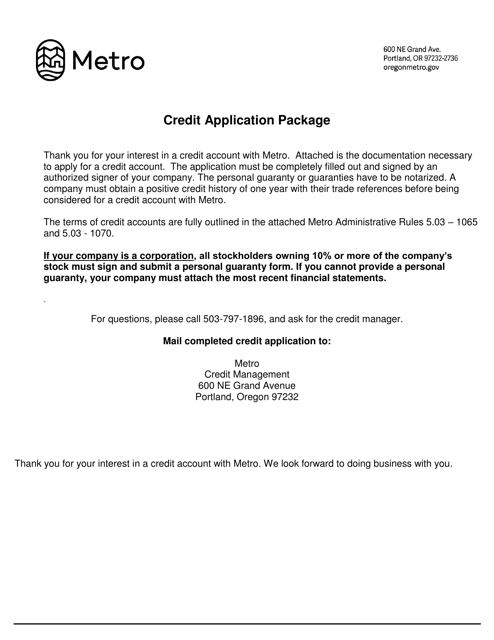

This document is used for applying for credit in the state of Oregon.

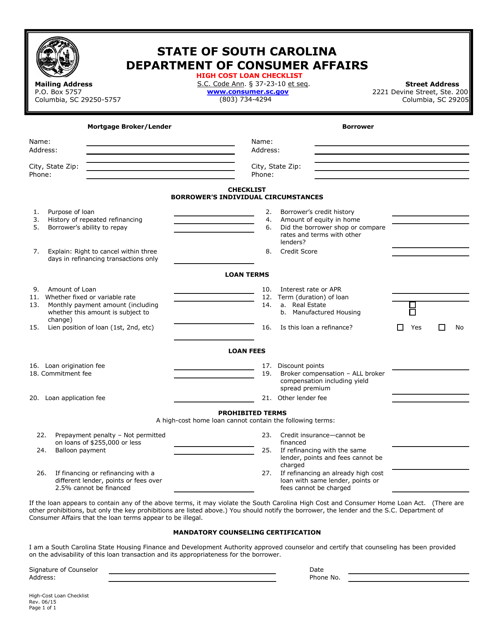

This document is a checklist that helps South Carolina residents assess the expenses and terms associated with high-cost loans in order to make informed decisions.

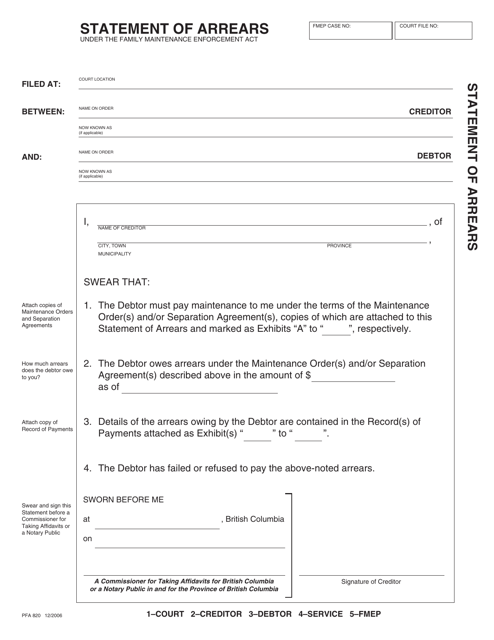

This form is used for reporting arrears in the province of British Columbia, Canada.

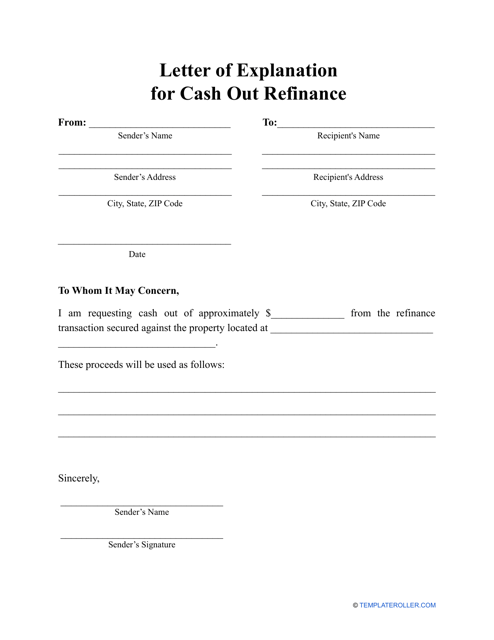

Individuals can use this type of letter when they want to explain to their potential lender why they need cash out refinancing.

This is a formal document composed by an individual who was informed about the existence of a debt in their name and wants to request details about the alleged debt.

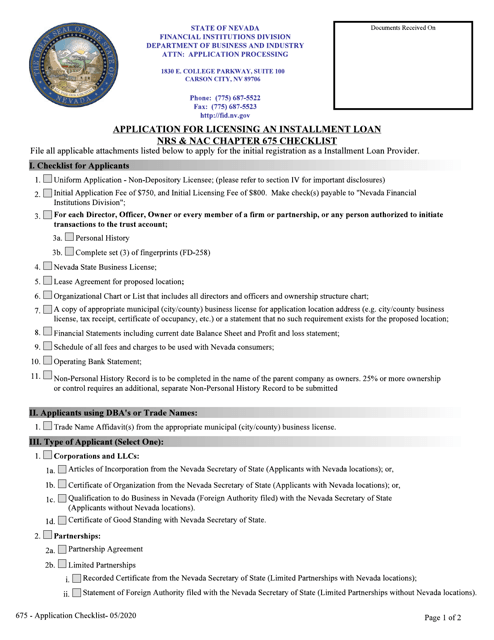

This document provides a checklist for applicants of installment loans from a company in Nevada. It includes the necessary requirements and supporting documents needed for the loan application process.

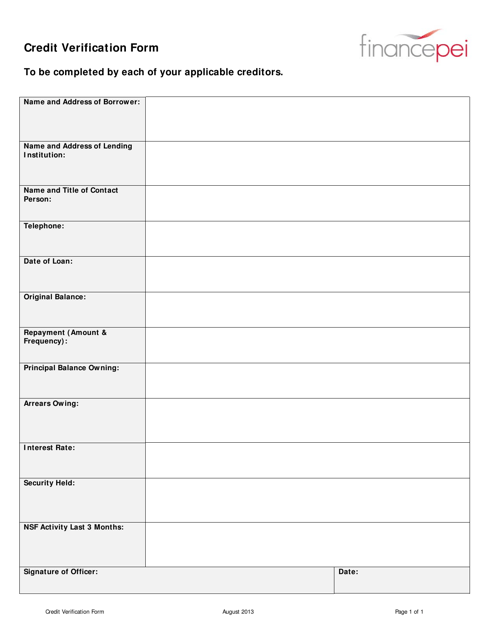

This document is used to verify an individual's credit information in Prince Edward Island, Canada.

This form is used for authorizing a criminal background and credit check in the state of Oregon.

This Form is used for users in Michigan to prequalify for the Safe Harbor Rate by answering financial questions.

This document is used for conducting a financial background investigation in New York City. It may contain questions related to an individual's financial history, assets, and liabilities.