Surplus Lines Insurance Templates

Surplus Lines Insurance

Looking for specialized insurance coverage that goes beyond standard options? Consider surplus lines insurance, also known as surplus line insurance or surplus lines coverage. This unique type of insurance provides coverage for risks that are not readily available in the traditional insurance market.

Surplus lines insurance involves the participation of surplus lines insurers or surplus line insurers. These insurers specialize in providing coverage for risks that may be deemed too complex, high-risk, or unusual for standard insurance carriers. With surplus lines insurance, policyholders can obtain coverage for specific risks that are not easily covered by standard insurance policies.

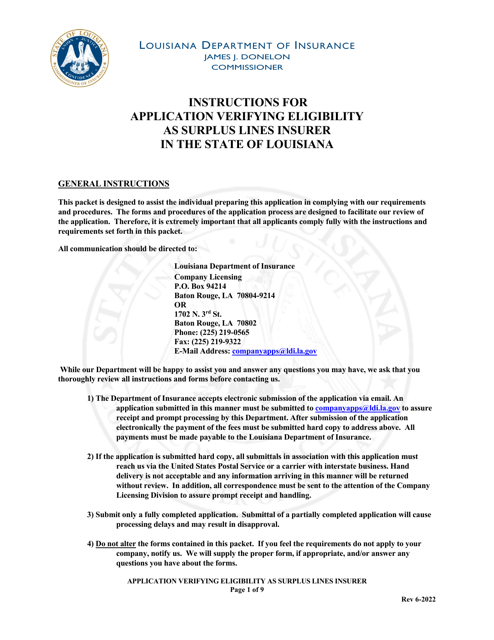

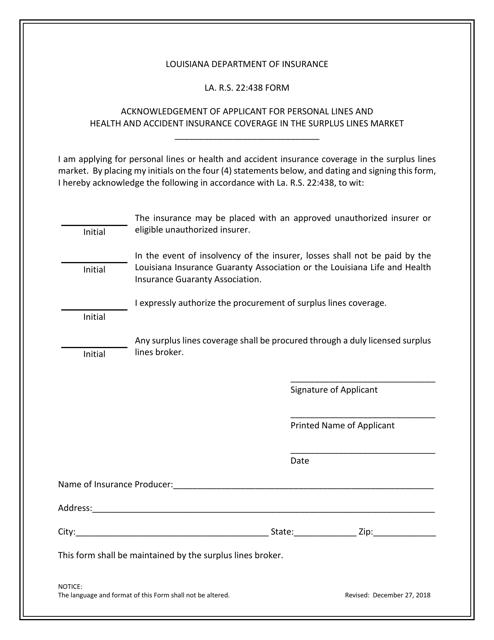

Surplus lines insurance is regulated by state-specific laws and regulations. For example, in Louisiana, you might come across documents such as the "Acknowledgement of Applicant for Personal Lines and Health and Accident Insurance Coverage in the Surplus Lines Market" or the "Application Verifying Eligibility as Surplus Lines Insurer in the State of Louisiana." These documents ensure that the surplus lines insurers comply with the state's requirements and regulations.

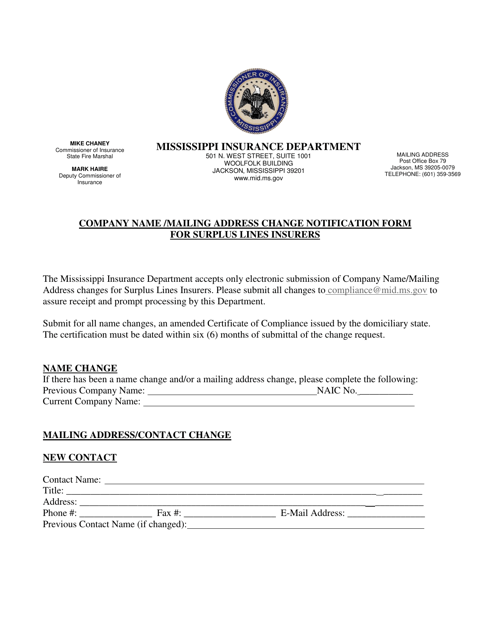

In other states like Mississippi, you might encounter documents like the "Company Name/Mailing Address Change Notification Form for Surplus Line Insurers." These documents highlight the administrative aspect of surplus lines insurance, making it easier for insurers to communicate changes in their contact information.

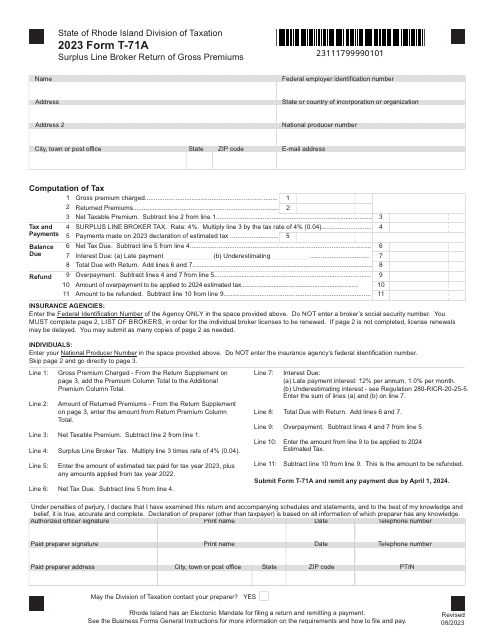

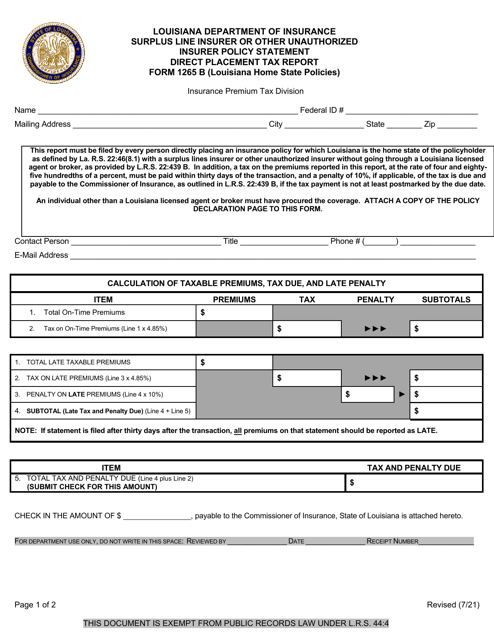

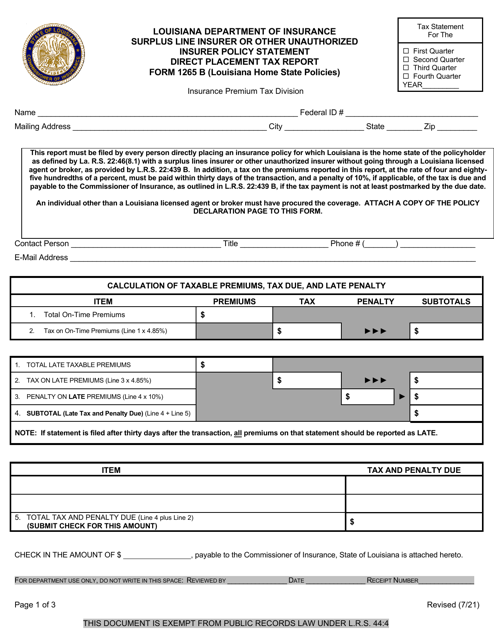

To ensure transparency and compliance, some states mandate surplus lines insurers to submit reports, such as the "Form 1265 B Surplus Line Insurer or Other Unauthorized Insurer Policy Statement Direct Placement Tax Report." These reports help track and monitor the surplus lines market and ensure that the insurers are adhering to relevant tax regulations.

Whether you refer to it as surplus lines insurance, surplus line insurance, surplus lines insurer, or surplus line insurer, the underlying concept remains the same. It is a form of insurance that fills the gaps in traditional insurance coverage, providing specialized solutions for unique risks in various industries.

Documents:

23

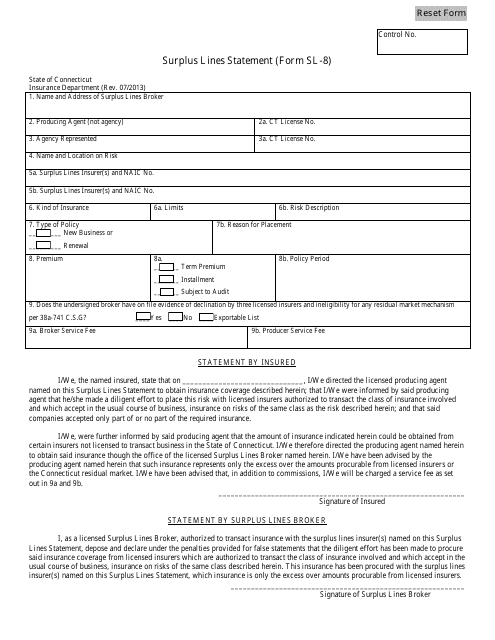

This form is used for filing a surplus lines statement in Connecticut.

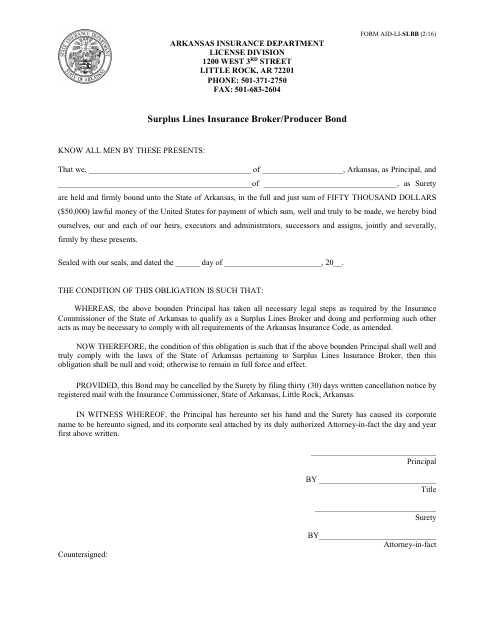

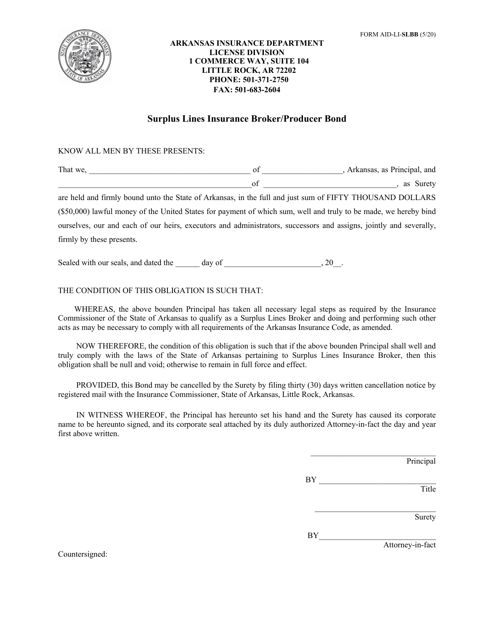

This form is used for obtaining a surplus lines insurance broker/producer bond in the state of Arkansas. The bond is required for individuals or businesses engaged in the surplus lines insurance industry to ensure compliance with state regulations.

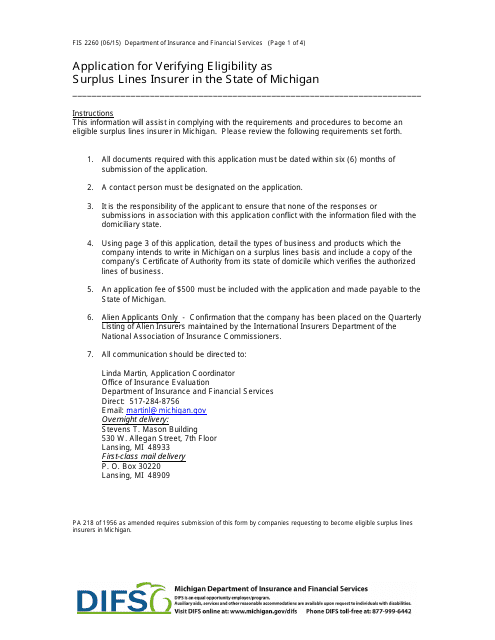

This form is used for applying to verify eligibility as a surplus lines insurer in the state of Michigan.

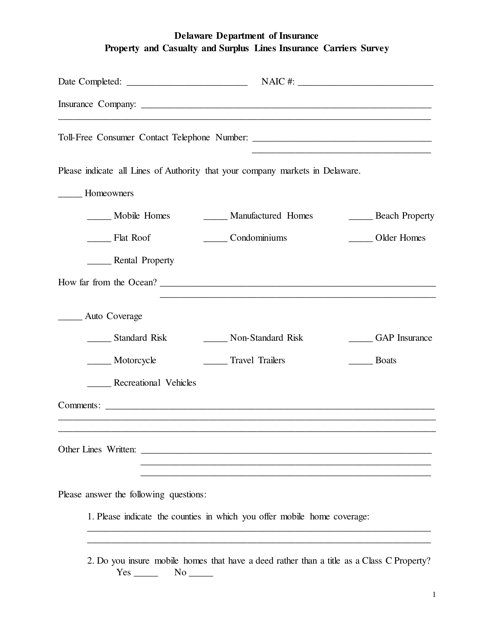

This survey is used to gather information about property and casualty insurance carriers in Delaware, including those that handle surplus lines.

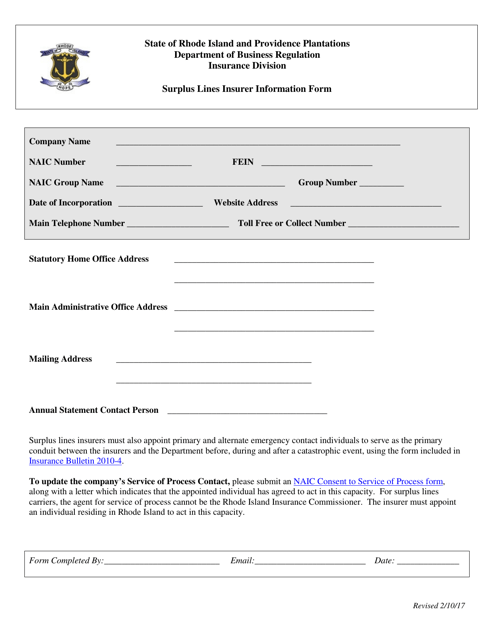

This document is used for providing information about surplus lines insurers operating in Rhode Island.

This form is used for acknowledging the applicant's request for personal lines and health and accident insurance coverage in the surplus lines market in Louisiana.

This document is used for obtaining a surplus lines insurance broker/producer bond in Arkansas.

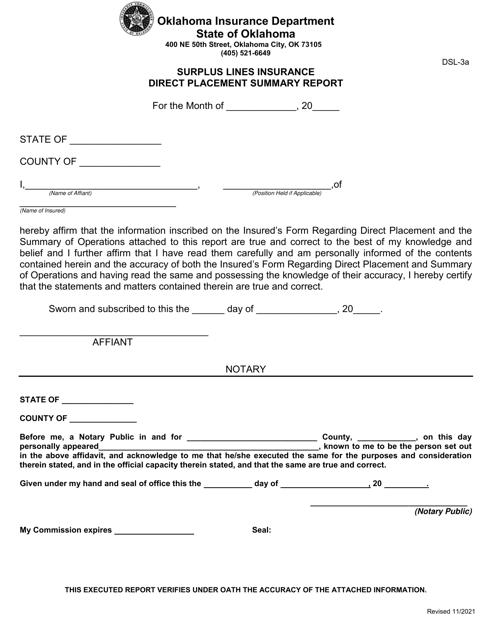

This form is used for reporting summary information about surplus lines insurance direct placements in the state of Oklahoma. It provides instructions on how to accurately complete Form DSL-3A, including detailed guidance on what information needs to be included and how to submit the report.

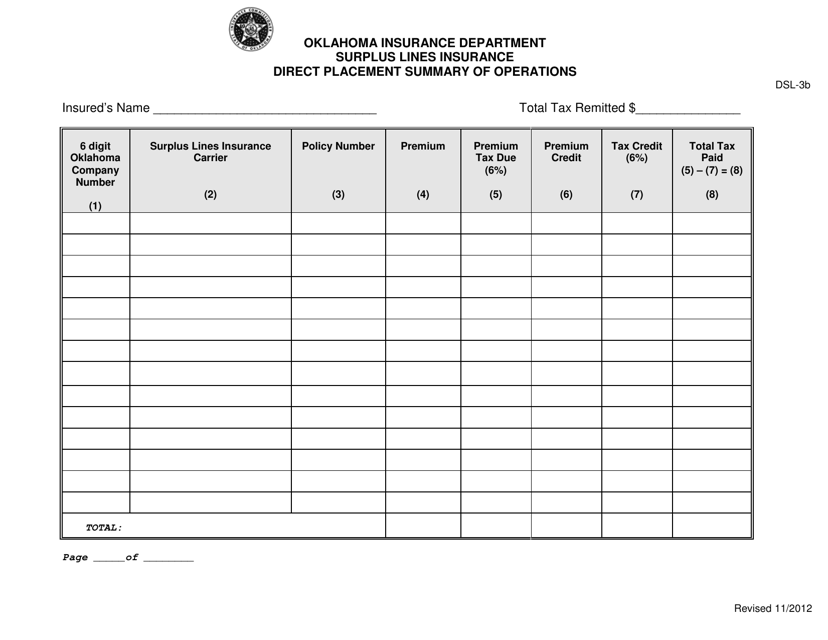

This document is used for providing a summary of operations for direct placement of surplus lines insurance in Oklahoma.

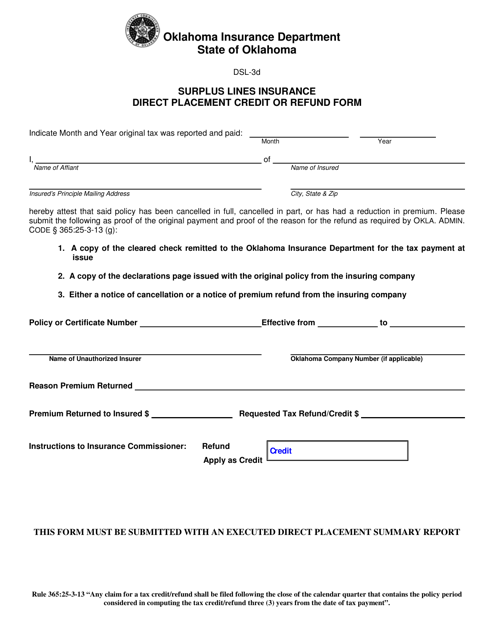

This form is used for requesting a credit or refund for surplus lines insurance direct placements in Oklahoma.

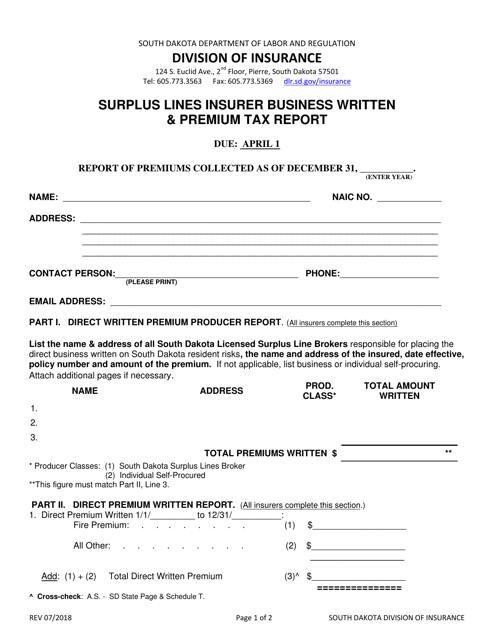

This document is used for reporting business written and premium tax for surplus lines insurers in South Dakota.

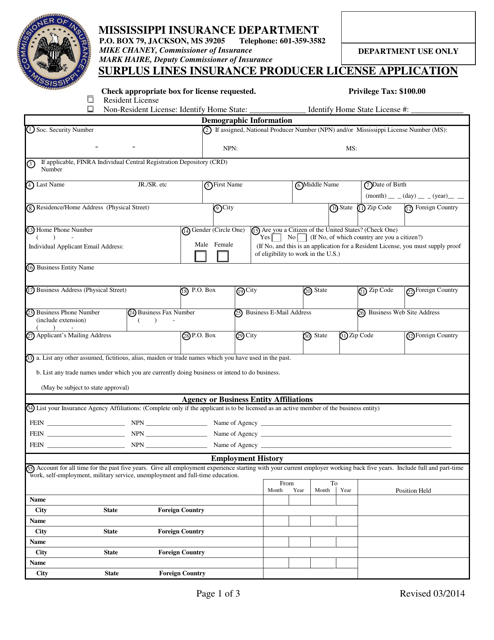

This document is used for applying for a surplus lines insurance producer license in the state of Mississippi. It is required for those who wish to sell surplus lines insurance policies in the state.

This Form is used for notifying the Mississippi Department of Insurance about changes in the company name or mailing address of surplus line insurers operating in Mississippi.

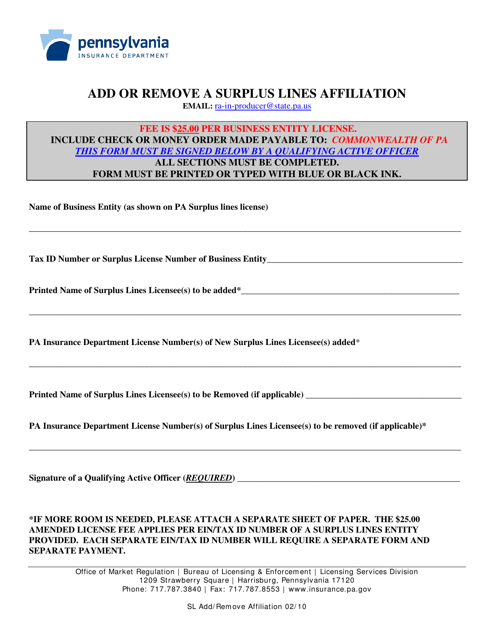

This document is used to add or remove a surplus lines affiliation in Pennsylvania.

This Form is used for reporting tax information related to direct placements with surplus line insurers or other unauthorized insurers in Louisiana.