Energy Minerals Templates

Energy minerals play a crucial role in powering and fueling our modern society. From oil and gas to coal and uranium, these valuable resources provide the energy needed to light up our homes, run our vehicles, and drive technological advancements.

Our collection of documents on energy minerals provides a wealth of information and resources for individuals, businesses, and governments involved in the extraction, production, and regulation of these key resources. Whether you are a tax professional looking for guidance on energy minerals taxes and reporting, or a company seeking instructions on filing proper documentation, our documents cover it all.

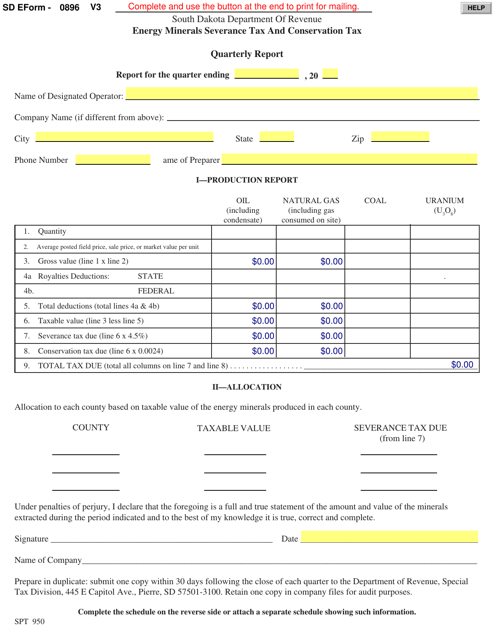

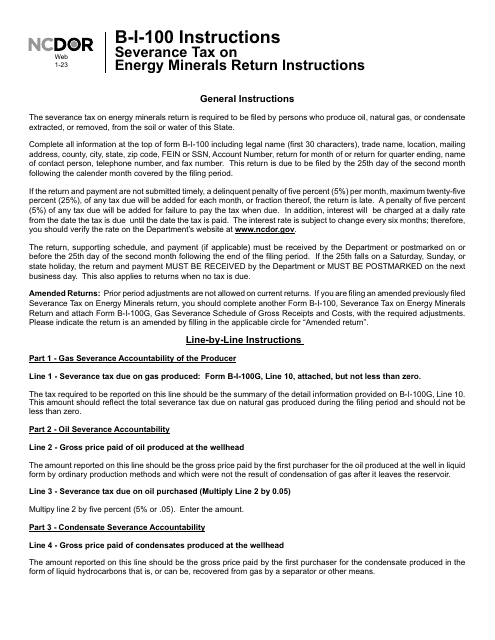

With documents such as the SD Form 0896 Energy Minerals Severance Tax and Conservation Tax Quarterly Report from South Dakota and the Form B-I-100 Severance Tax on Energy Minerals Return from North Carolina, we have you covered on all aspects of energy minerals taxation and compliance.

Browse through our wide range of documents and discover the necessary forms, instructions, and guidelines to effectively manage your energy minerals activities. Stay up to date with the latest regulations and reporting requirements by accessing our comprehensive collection of documents.

Energy minerals are a valuable resource, and understanding the intricacies of their taxation and regulatory frameworks is essential for individuals and organizations operating in this industry. At our document knowledge system, we strive to provide you with the most relevant and up-to-date information on energy minerals, making your decision-making and compliance processes easier and more streamlined.

Choose our document knowledge system for all your energy minerals needs, and gain the knowledge and insights to navigate this dynamic industry with success.

Documents:

5

This Form is used for reporting and paying the Energy Minerals Severance Tax and Conservation Tax on a quarterly basis in South Dakota.