Tip Report Templates

At USA, Canada, and other countries document knowledge system, we understand the importance of accurate reporting of tips. Our tip report collection, also known as reporting tips or tips reporting, provides you with the necessary documents and information to ensure compliance with tax regulations and fair labor standards.

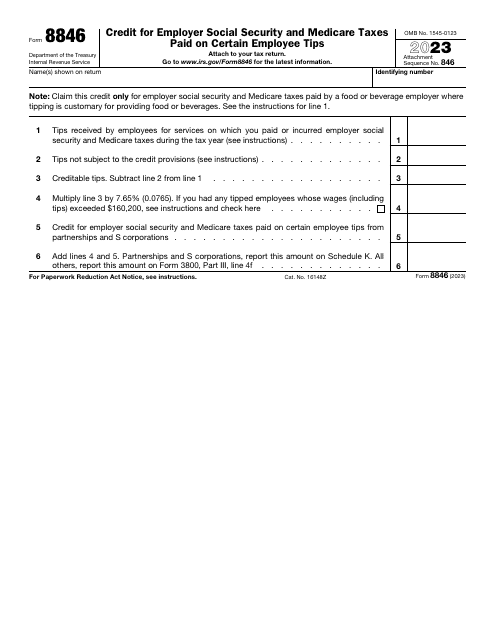

One of the essential documents in this collection is the IRS Form 8846 Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips. This form helps employers claim a credit for the social security and Medicare taxes they paid on employee tips.

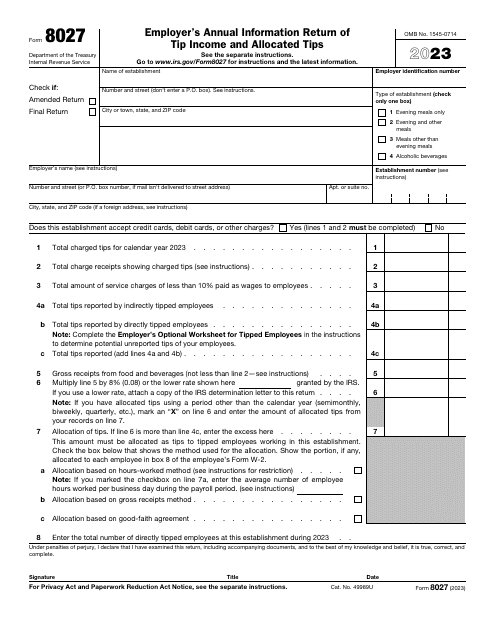

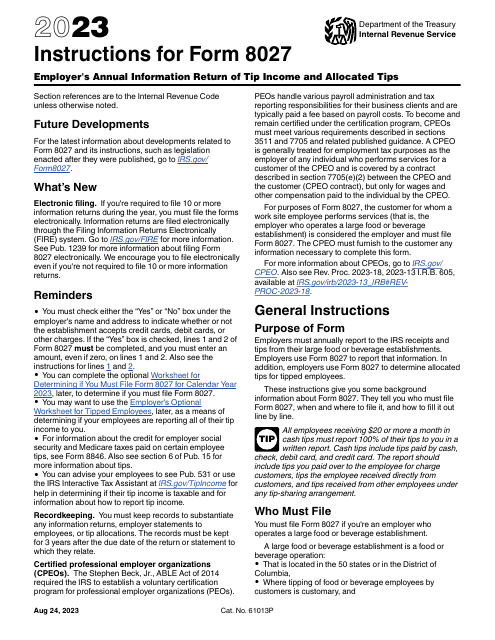

Another critical document is the IRS Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips. This form allows employers who operate large food and beverage establishments to report their employees' tip income and allocated tips accurately.

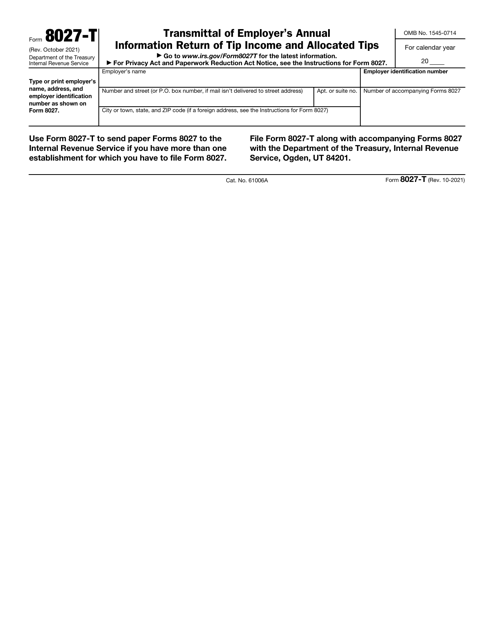

To accompany the Form 8027, we also have the IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips. This form serves as a cover sheet for the Form 8027, ensuring a complete and organized reporting process.

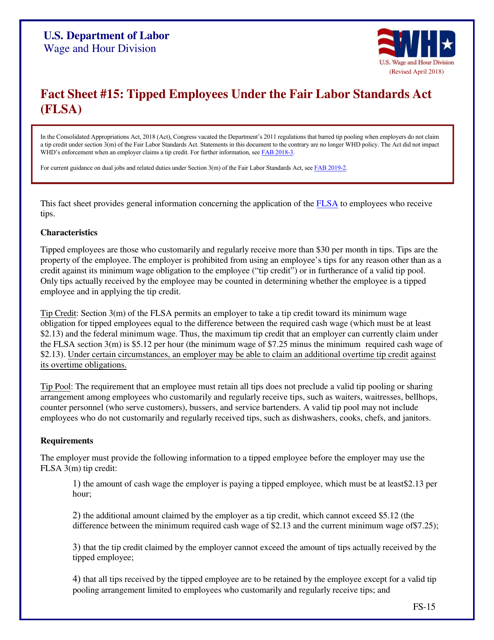

In addition to these specific forms, our tip report collection includes Fact Sheet #15: Tipped Employees Under the Fair Labor Standards Act (Flsa). This comprehensive resource provides employers and employees with valuable information about the rights and obligations concerning tipped employees under the Fair Labor Standards Act.

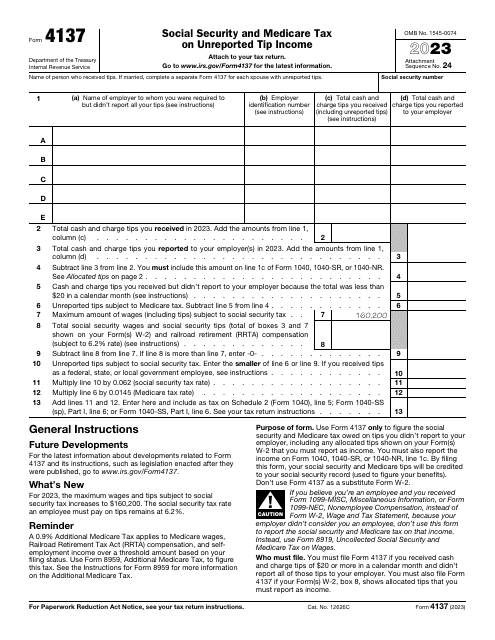

Lastly, our collection also features the IRS Form 4137 Social Security and Medicare Tax on Unreported Tip Income. This form allows individuals to report and calculate the social security and Medicare taxes they owe on unreported tip income.

With our tip report collection, you can stay compliant with tax regulations, ensure fair labor practices, and accurately report tip income. Whether you're an employer or an employee, these documents and resources will guide you through the reporting process.

Documents:

13

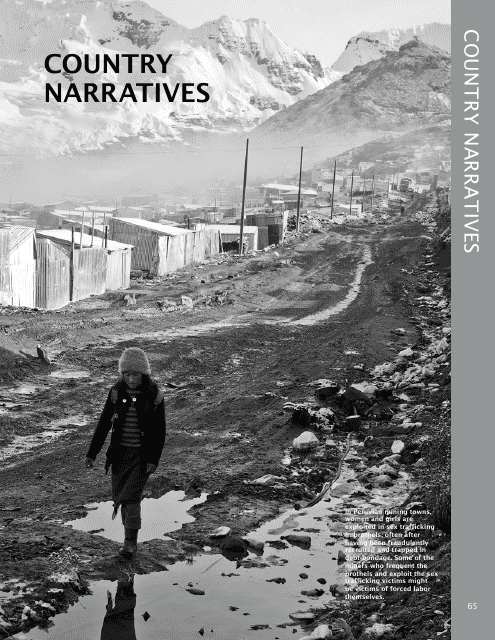

This document provides country-specific narratives on trafficking in persons, focusing on countries whose names begin with letters A-C.

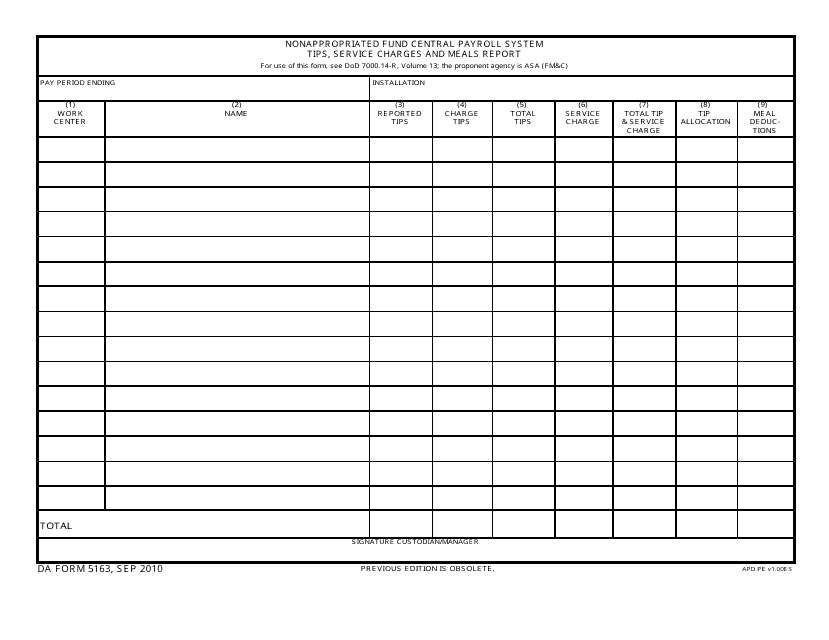

This Form is used for reporting tips, service charges, and meals in the Nonappropriated Fund Central Payroll System.

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

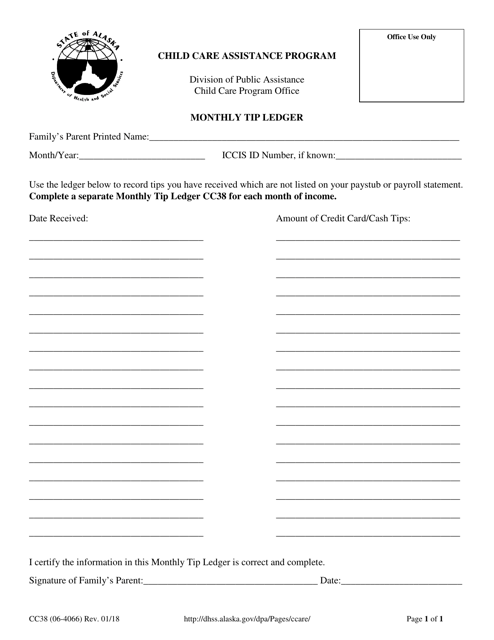

This Form is used for keeping a monthly record of tips in Alaska. Keep track of your tips with this ledger.

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.

This fact sheet provides information about the rules and regulations for tipped employees under the Fair Labor Standards Act (FLSA). It explains the minimum wage requirements, tip credit, and other guidelines for employers and employees in the United States.