Tax Disclosure Templates

Are you looking for information on tax disclosure? Look no further - we have everything you need to know about tax disclosure forms and requirements. Tax disclosure, also known as tax disclosures or tax disclosure forms, is an essential part of the tax filing process. It allows individuals and businesses to provide detailed information to the tax authorities, ensuring transparency and compliance with tax regulations.

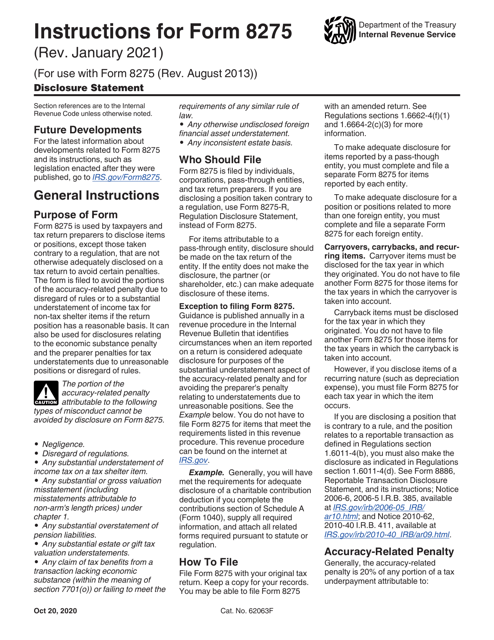

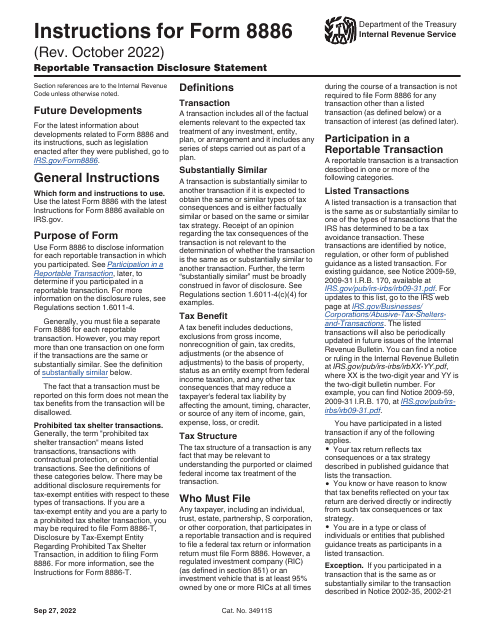

One example of a tax disclosure form is the IRS Form 8275 Disclosure Statement. This form allows taxpayers to disclose specific positions taken on their tax return that may be contrary to the IRS regulations. By filing this form, individuals and businesses can provide additional information that supports their tax positions and helps to reduce the risk of penalties or audits.

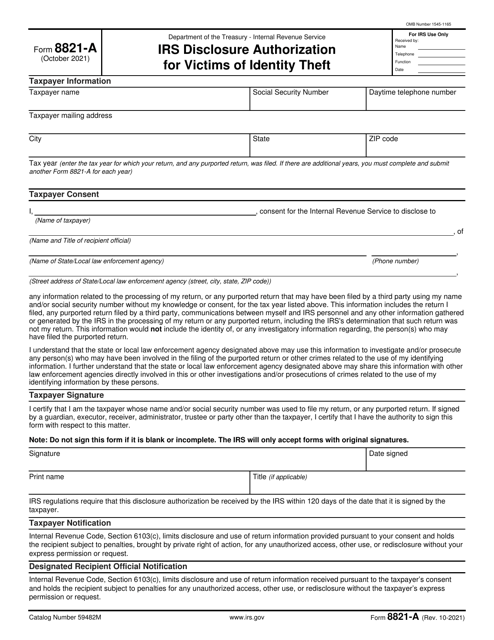

Another example is the IRS Form 8821-A IRS Disclosure Authorization for Victims of Identity Theft. This form enables victims of identity theft to authorize the IRS to disclose their tax information to designated third parties, such as law enforcement or credit bureaus. This helps victims protect themselves from further identity theft-related issues and resolves any discrepancies in their tax records.

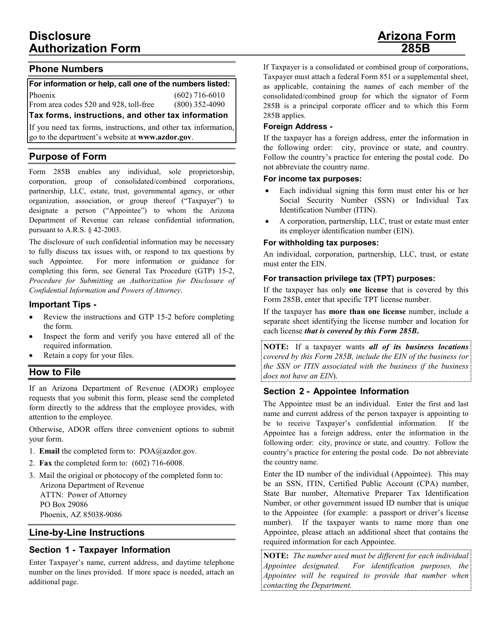

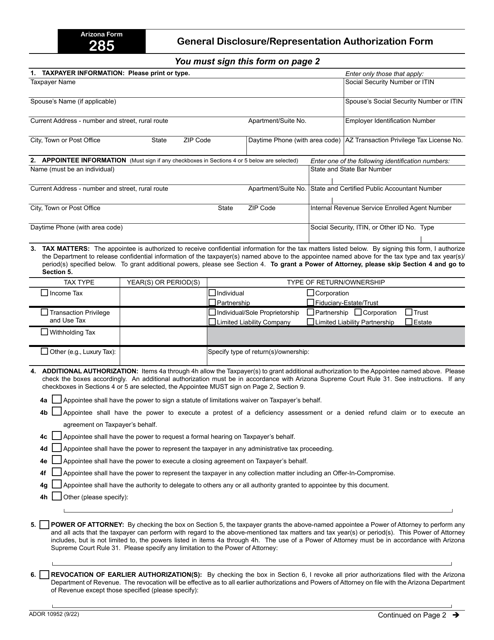

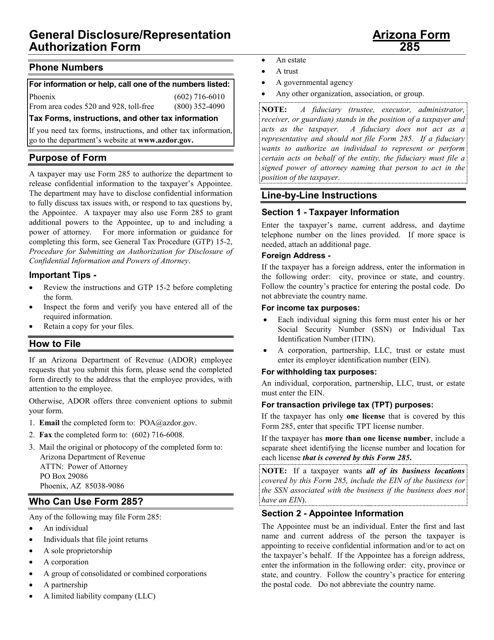

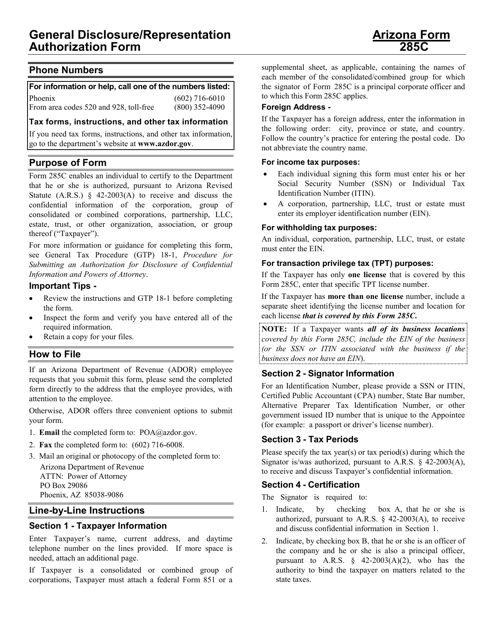

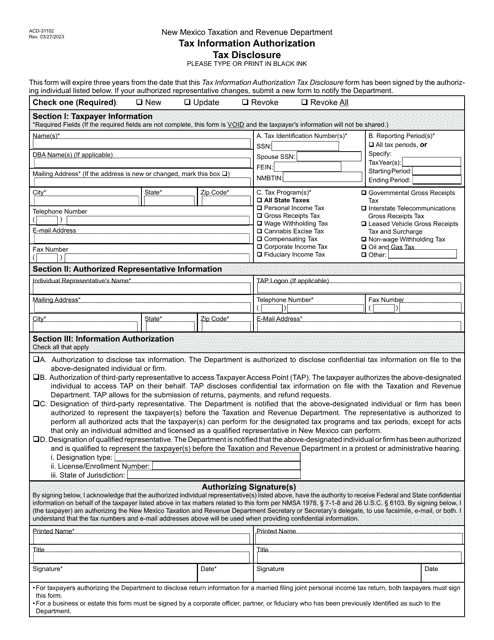

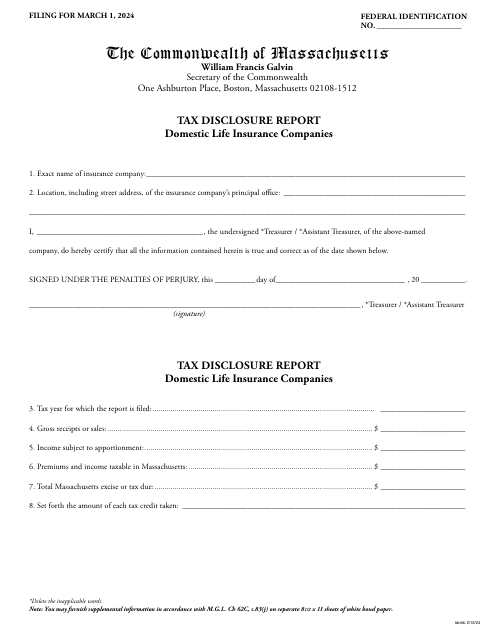

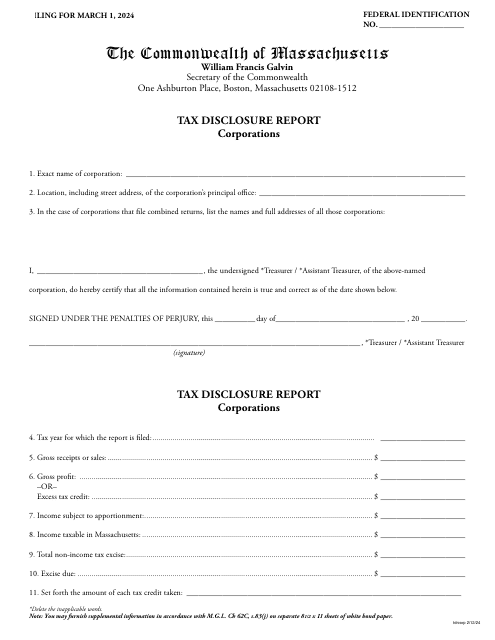

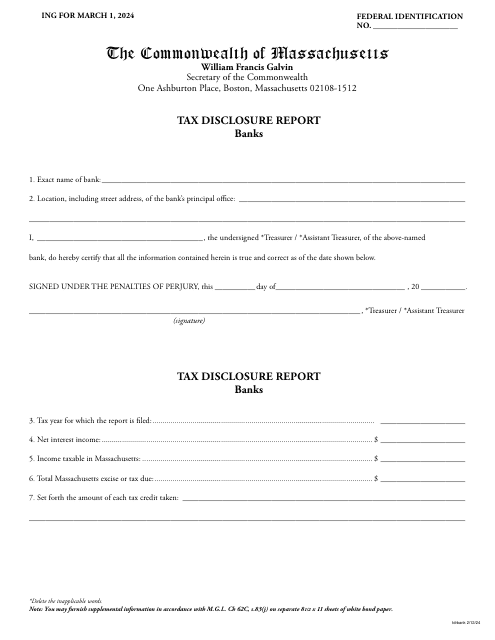

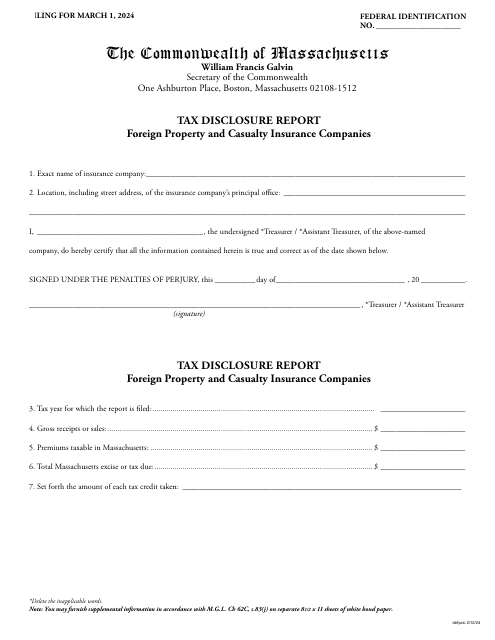

In addition to federal tax disclosure forms, various states also require tax disclosure reports. For instance, Arizona has the ADOR10955 Disclosure Authorization Form, which allows taxpayers to authorize the disclosure of their tax information to specified individuals or organizations. Similarly, Massachusetts mandates tax disclosure reports for corporations operating within the state.

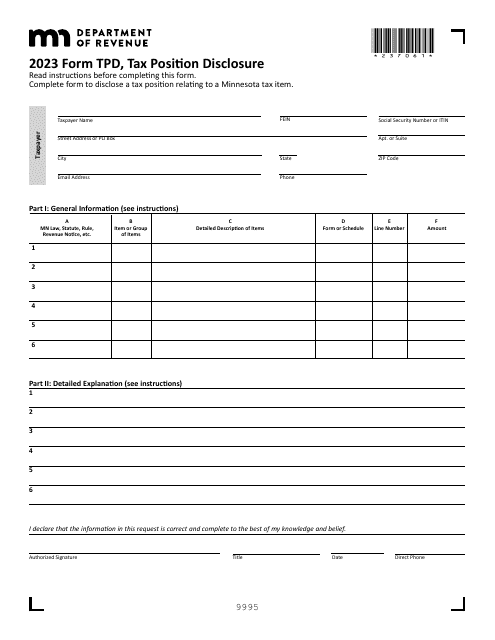

Tax disclosure forms play a crucial role in maintaining a fair and efficient tax system. They ensure that taxpayers provide accurate information to tax authorities and maintain transparency in their tax affairs. Understanding the requirements and properly completing tax disclosure forms can help individuals and businesses avoid penalties and navigate the complexities of tax regulations.

If you have questions about tax disclosure or need guidance on completing tax disclosure forms, our website is here to help. We provide comprehensive information and resources to assist you in understanding and fulfilling your tax disclosure obligations. Stay informed and compliant with tax regulations by exploring our website today.

Documents:

18

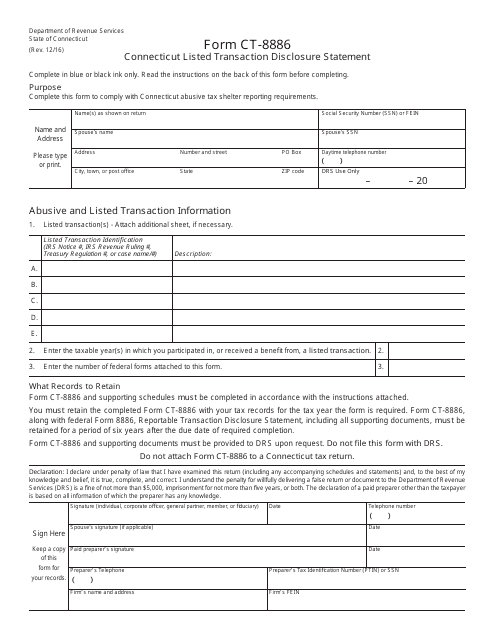

This Form is used for disclosing listed transactions in Connecticut.

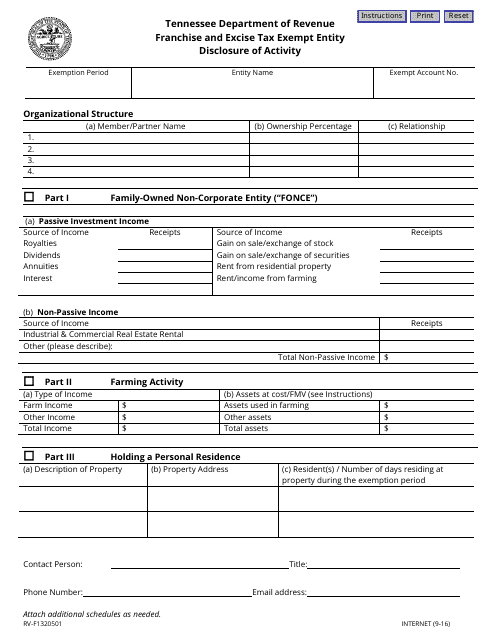

This Form is used for Tennessee businesses to disclose their activity as an exempt entity for franchise and excise tax purposes.

This document is used for disclosing authorization in Arizona.

This Form is used for providing general authorization and disclosure for representing taxpayers in Arizona. It is required by the Arizona Department of Revenue.

This form is used for disclosing certification information in Arizona. It is required to provide accurate and complete information to the Arizona Department of Revenue.