Transition Tax Templates

The transition tax, also known as transit tax or transitional tax, is a crucial aspect of tax regulations in various countries. These taxes aim to address specific financial situations and transactions during a transitional period. Whether it's a statewide transit tax or a claim for refund of transit sales and use taxes, understanding and complying with the transition tax requirements is essential.

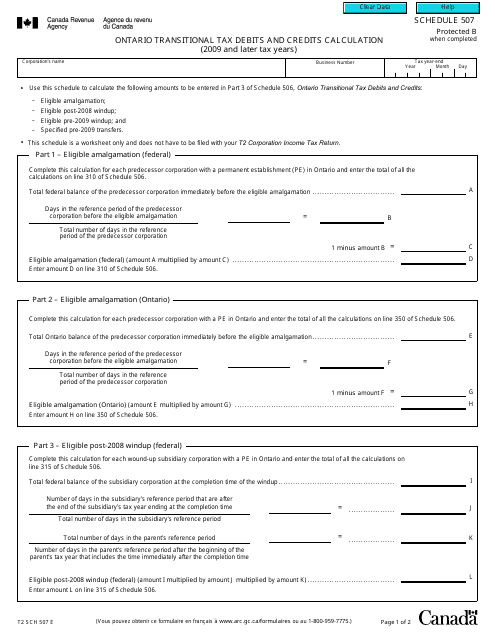

In Canada, the transition tax is well-defined by Form T2 Schedule 507 Ontario Transitional Tax Debits and Credits Calculation (2009 and Later Tax Years). This document provides detailed instructions on calculating and reporting transitional tax debits and credits for businesses in Ontario.

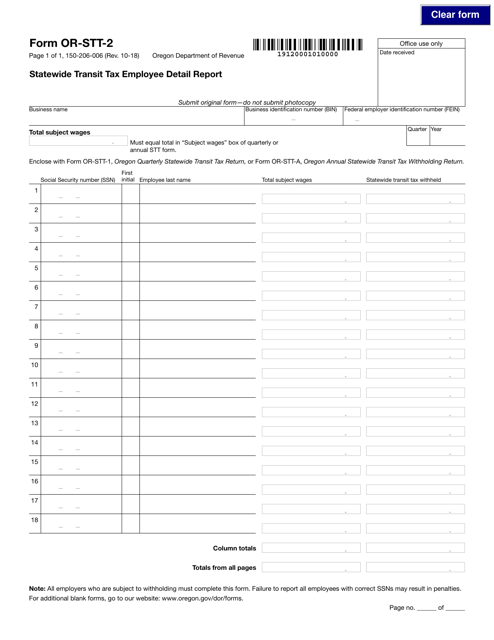

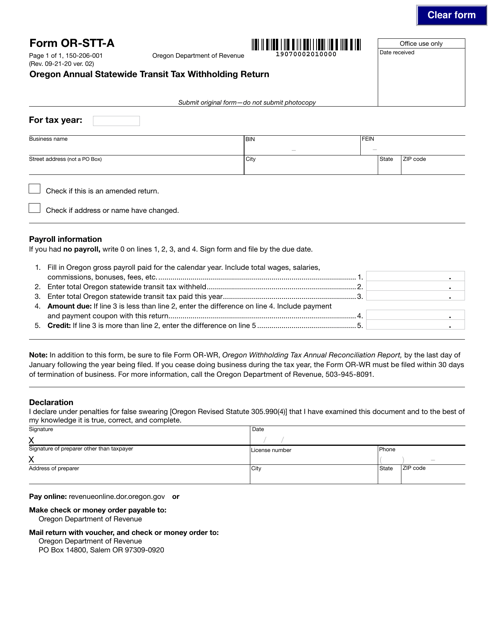

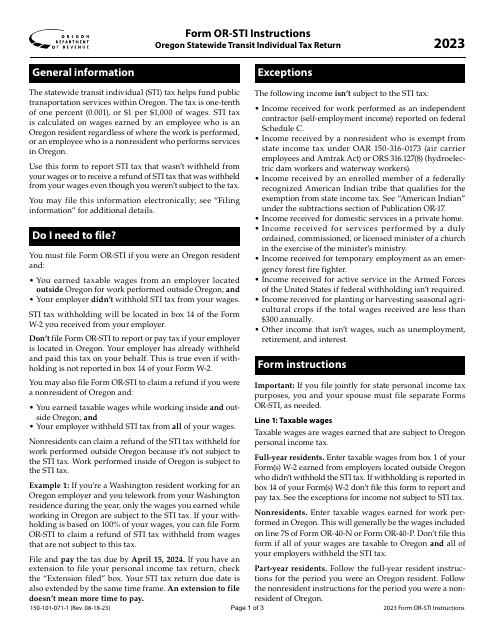

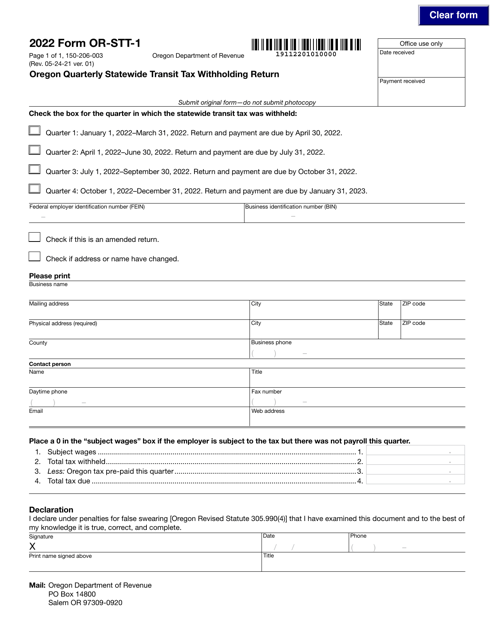

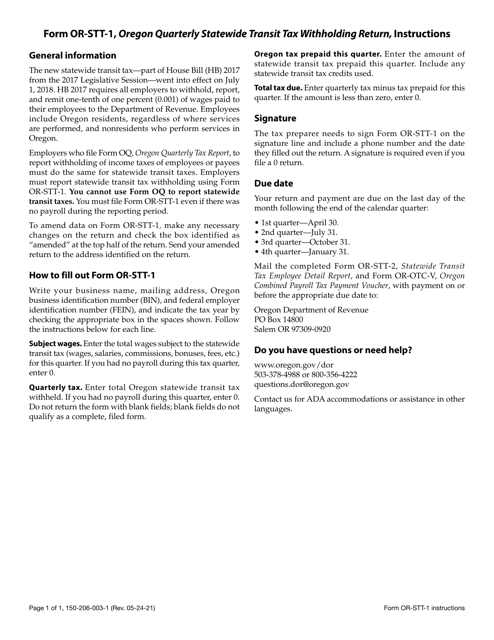

Similarly, in Oregon, the Statewide Transit Tax Employee Detail Report, referred to as Form 150-206-006 (OR-STT-2), is a vital document for employers. It allows them to report and provide necessary details regarding transit taxes withheld from their employees.

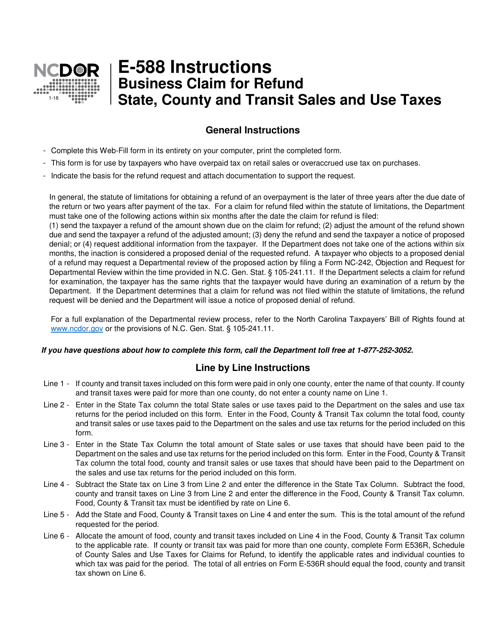

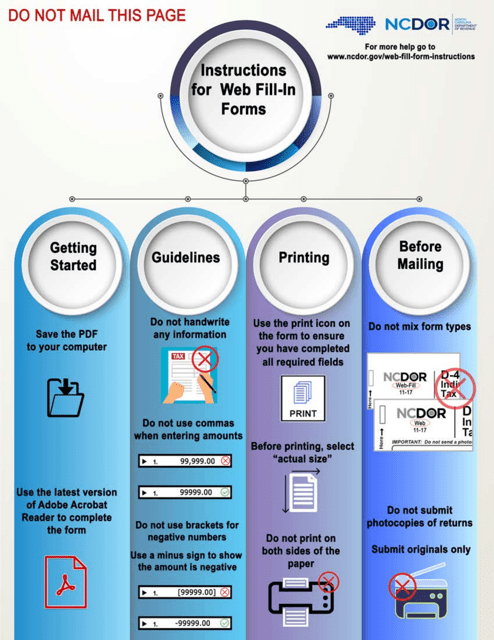

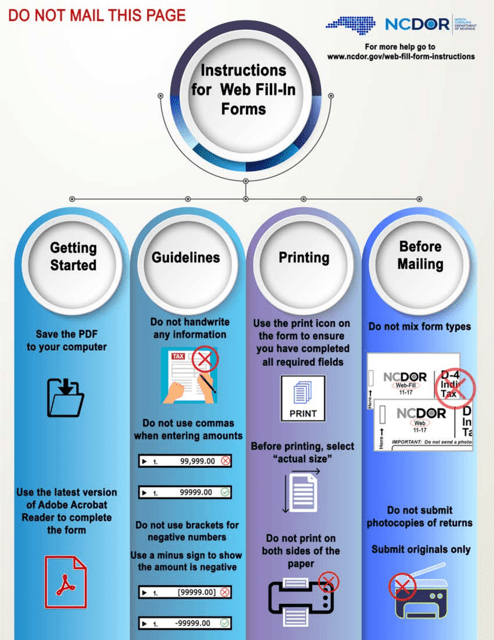

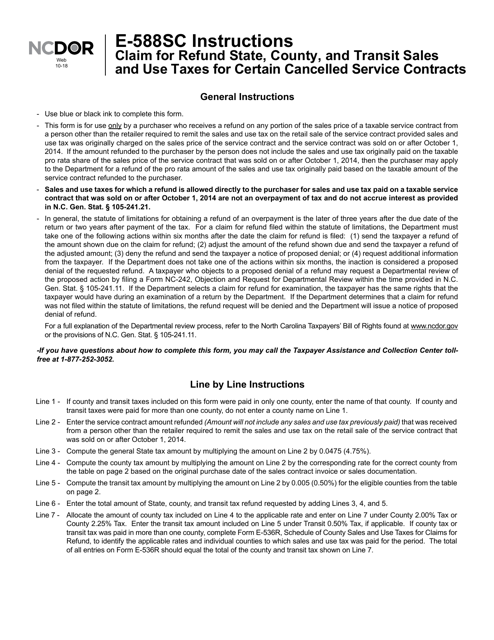

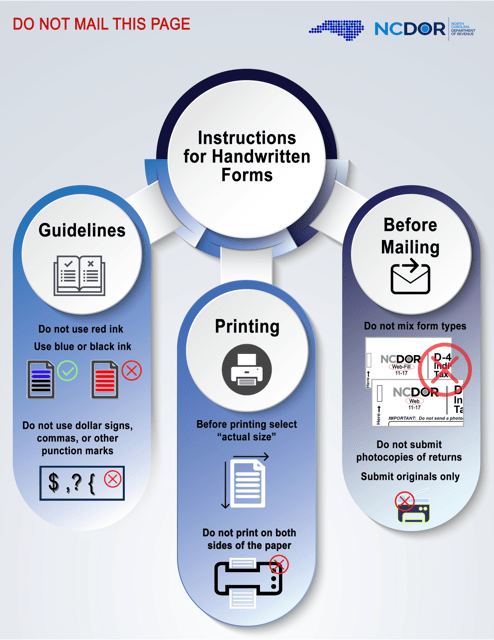

For individuals in North Carolina, there are specific forms to claim refunds for transit sales and use taxes. These include Form E-588SC, which applies to certain canceled service contracts, and Form E-585 for nonprofit and governmental entities.

Understanding and navigating the intricacies of the transition tax or transit tax system is crucial to ensure compliance and avoid penalties. Whether you are a business owner or an individual taxpayer, it is essential to stay informed and meet the requirements set forth by your local tax authorities.

Documents:

20

This form is used for employers in the sports and entertainment industries in Oregon to guide them on withholding and transit taxes.

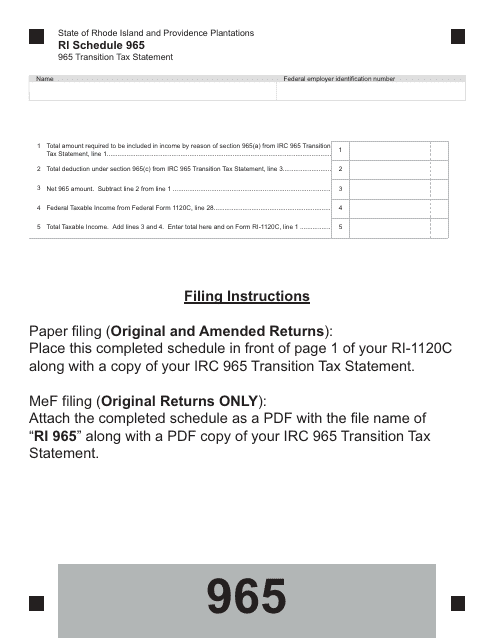

This document is for reporting the transition tax under Schedule 965 in Rhode Island.

This document is used for calculating transitional tax debits and credits in Ontario for the tax years of 2009 and later.

This document is for businesses in North Carolina who want to claim a refund for state, county, and transit sales and use taxes. It provides instructions on how to fill out and submit Form E-588.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

This Form is used for businesses in North Carolina to claim a refund on state, county, and transit sales and use taxes.

This form is used for claiming a refund for state, county, and transit sales and use taxes for certain cancelled service contracts in North Carolina. It provides instructions on how to fill out and submit the form to request a refund.

This Form is used for utility companies in North Carolina to claim a refund for state, county, and transit sales and use taxes.