Tax Forms for Business Templates

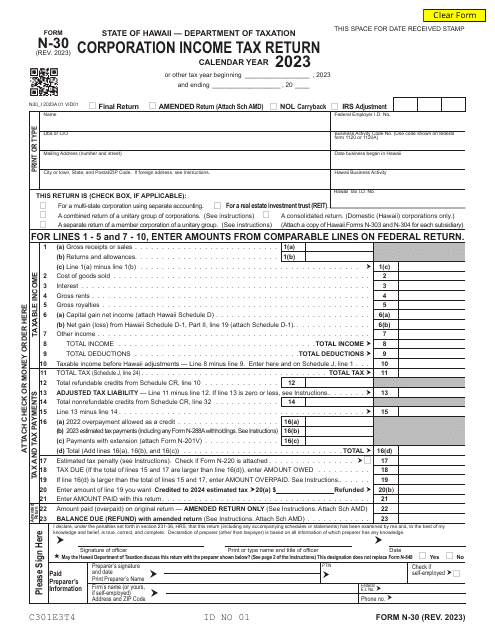

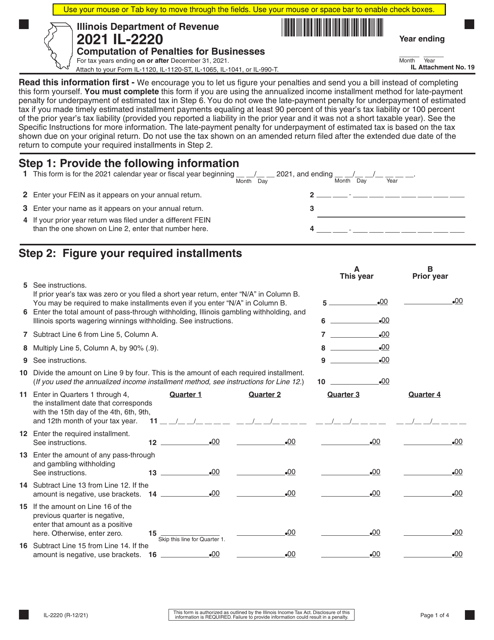

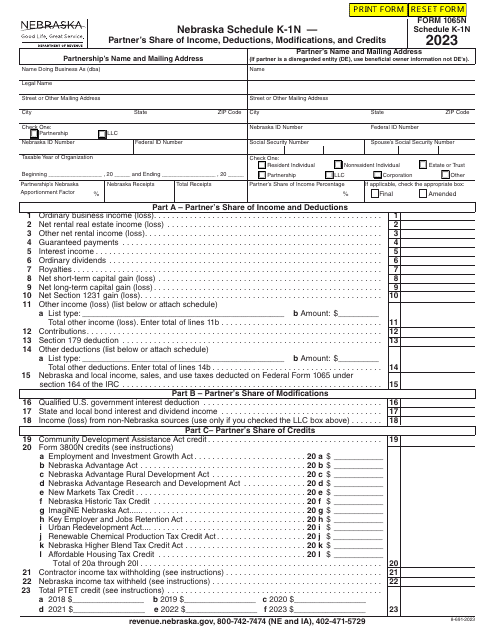

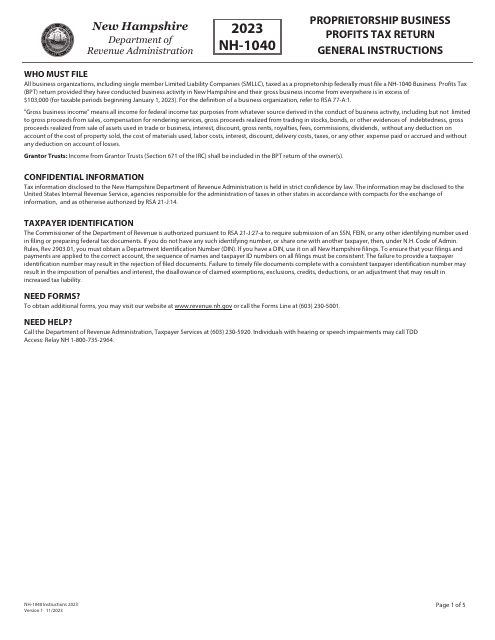

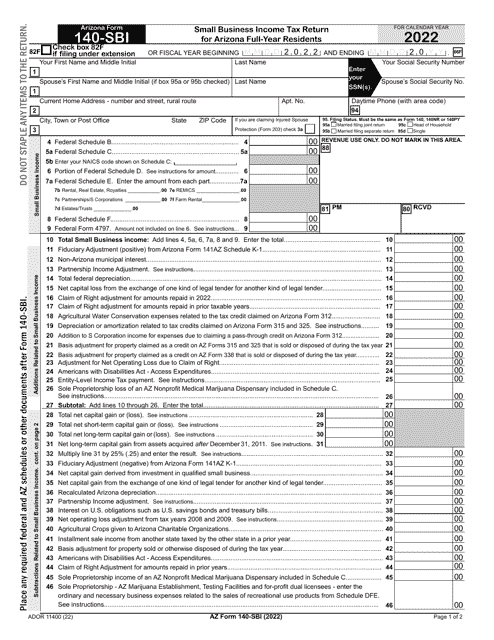

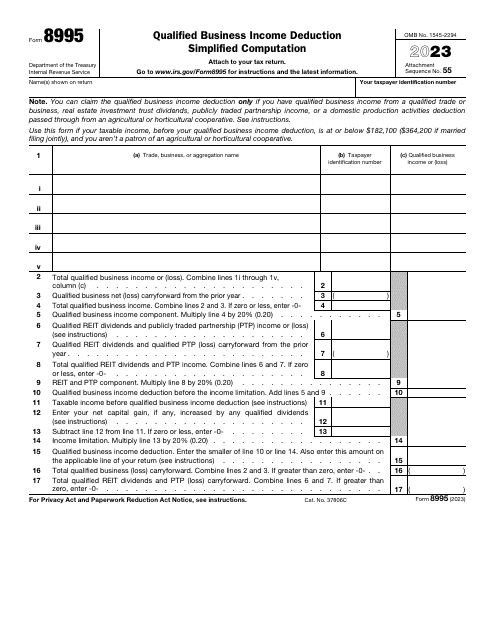

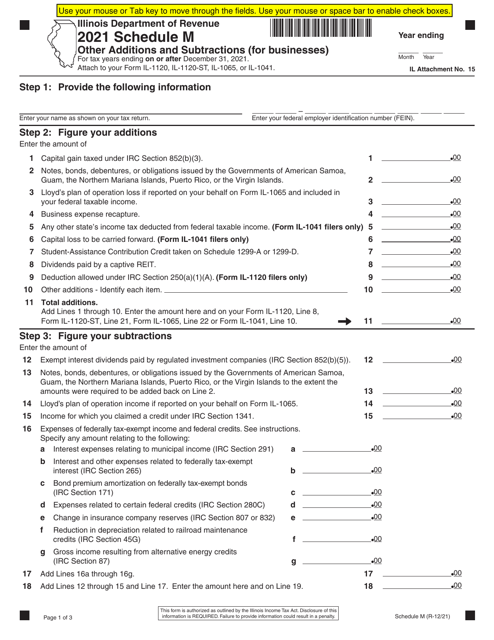

As a business owner, it is important to stay on top of your tax obligations to ensure compliance with the law. Our tax forms for business provide the necessary documentation for businesses to accurately report their financial information and fulfill their tax responsibilities. Whether you are a partnership, corporation, or other business entity, our tax forms cover a range of requirements to meet your specific needs.

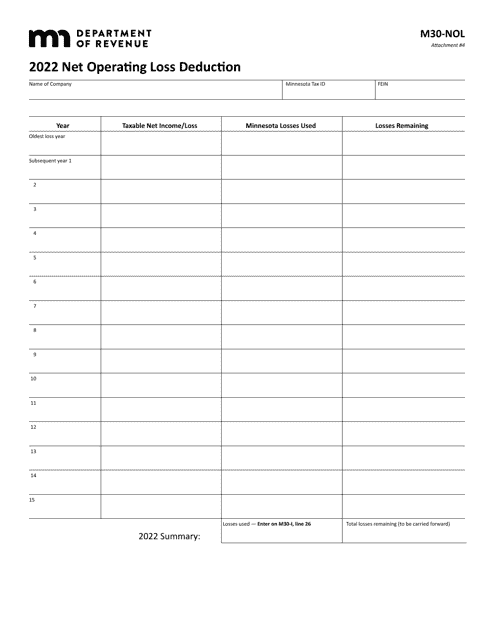

Our tax forms for business, also known as taxes for businesses or tax forms for businesses, offer a comprehensive collection of documents designed to assist you in properly reporting your income, expenses, deductions, and credits. These forms are essential for accurately calculating and paying your taxes, as well as maximizing any potential benefits or refunds.

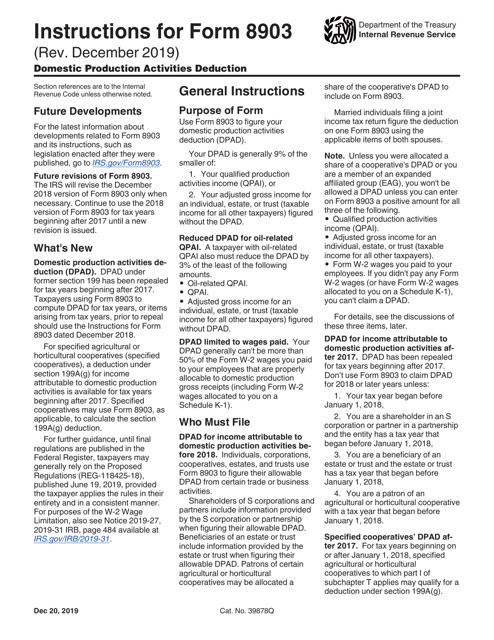

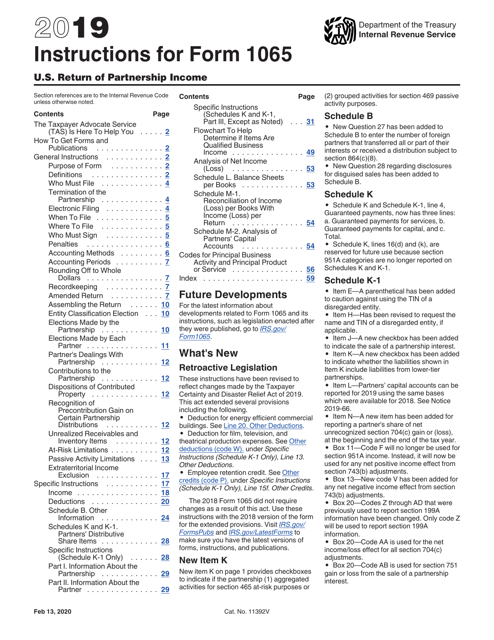

Within our tax forms for business collection, you will find a variety of documents to meet various tax requirements. From specialized forms such as the Form IT-QI Qualified Investor Tax Credit in Georgia (United States), to more common forms like the Instructions for IRS Form 1065 U.S. Return of Partnership Income, our collection caters to the diverse needs of businesses.

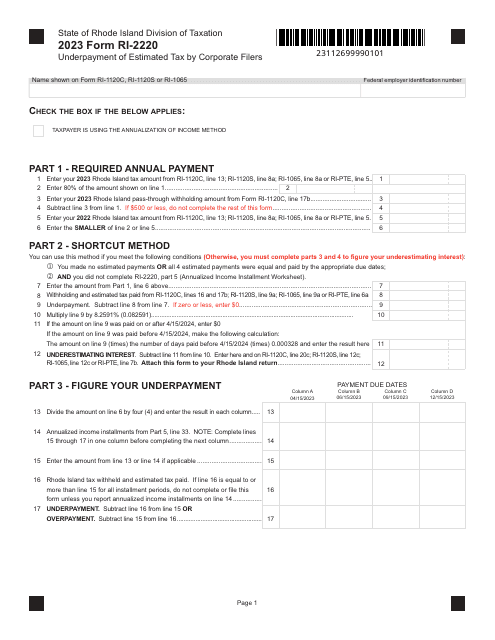

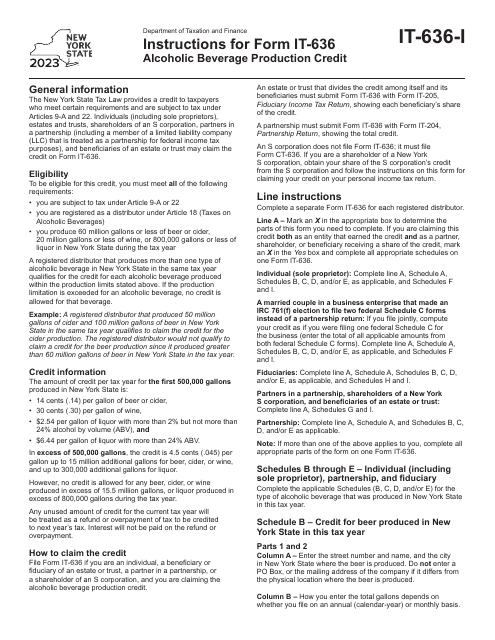

Additionally, our tax forms cover specific state requirements, ensuring that you have access to the necessary documentation tailored to your geographic location. Whether you are looking for forms like the Form RI-2220 Underpayment of Estimated Tax by Corporate Filers in Rhode Island or the Instructions for Form IT-636 Alcoholic BeverageProduction Credit in New York, we have you covered.

By utilizing our tax forms for business, you can save time and ensure accuracy in your tax reporting process. Our comprehensive collection, complete with alternate names such as taxes for businesses or tax form for businesses, aims to simplify the tax obligations that businesses face, making compliance easier and more efficient.

Please note that the examples provided here may not be an exhaustive representation of all the documents included in our tax forms for business collection. For a complete list and access to all the necessary documents, feel free to explore our website or get in touch with our team for assistance.

Documents:

17

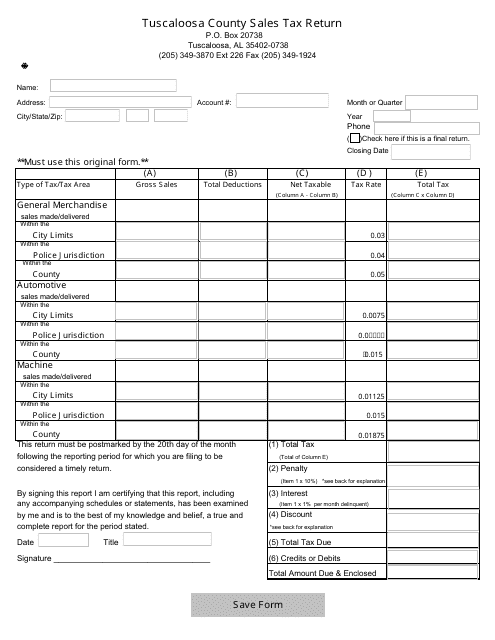

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

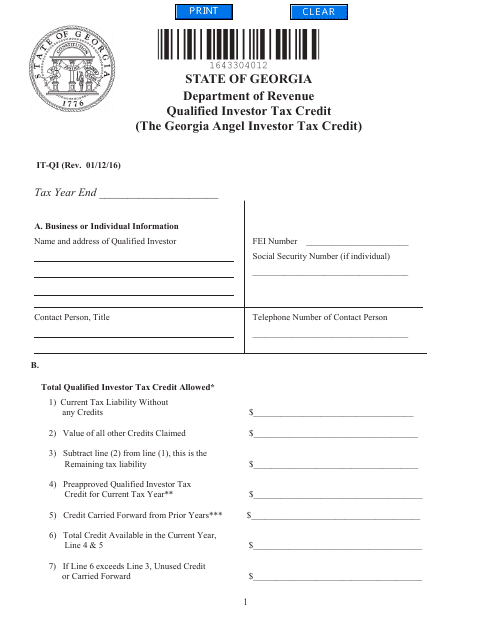

This form is used for claiming the Qualified Investor Tax Credit in the state of Georgia. Residents who meet the qualifying criteria can use this form to claim a tax credit for investing in certain businesses or projects.

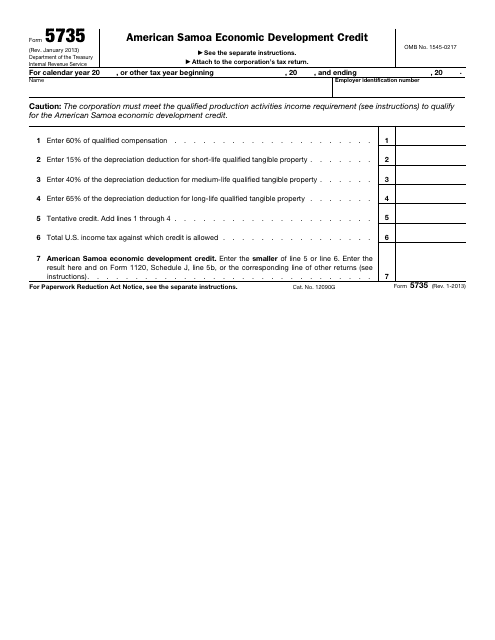

This form is used for claiming the American Samoa Economic Development Credit on your federal taxes.

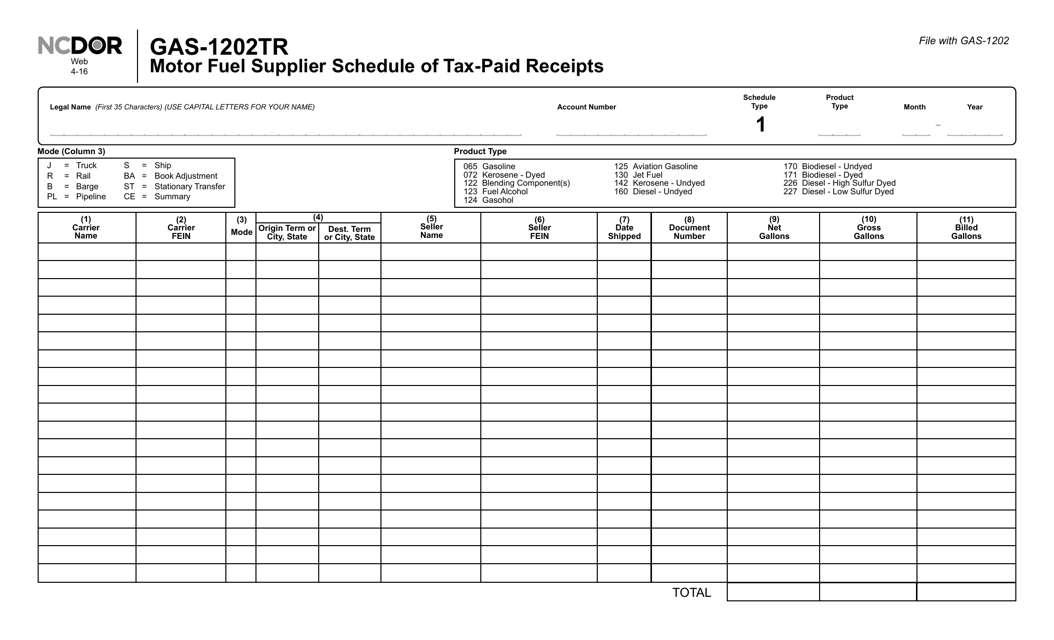

This Form is used for reporting tax-paid receipts for motor fuel suppliers in North Carolina.