Business Tax Credits Templates

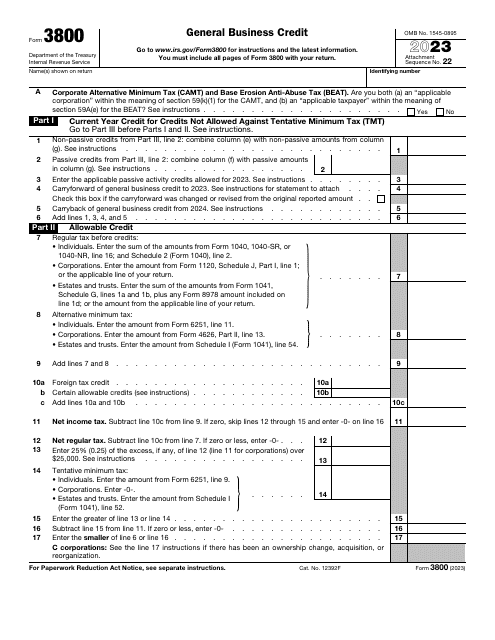

Are you a business owner looking to save money on your taxes? Look no further than the world of business tax credits! These credits are designed to incentivize and reward businesses for engaging in certain activities or meeting specific criteria.

Whether you refer to them as business tax credits, business tax credit, or any other alternate names, they all serve the same purpose - to help you reduce your tax liability and keep more money in your pocket.

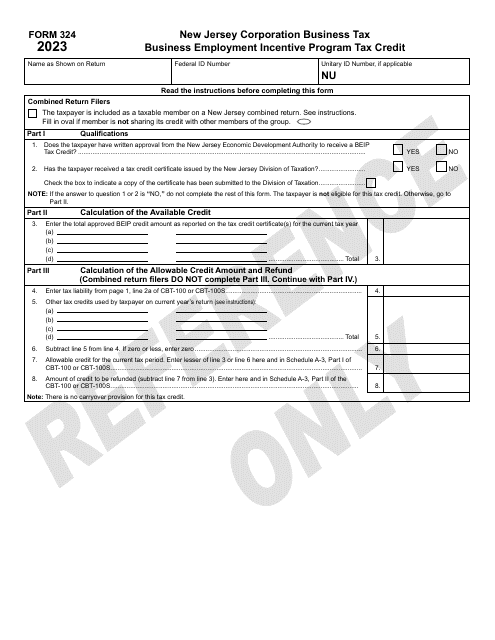

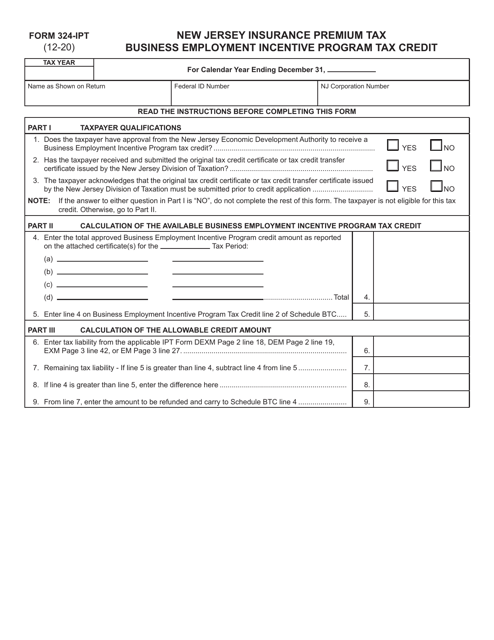

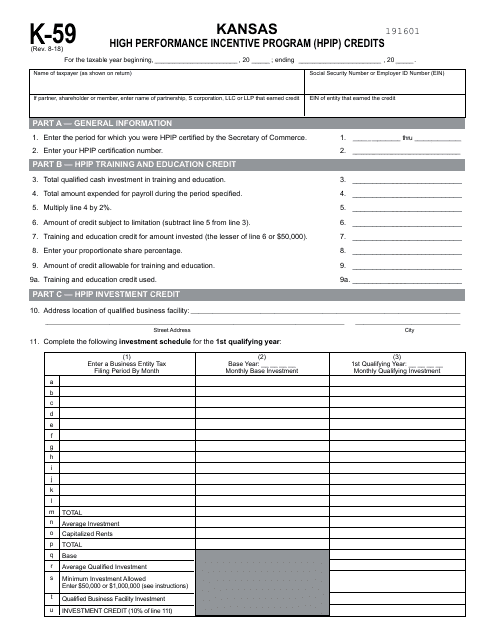

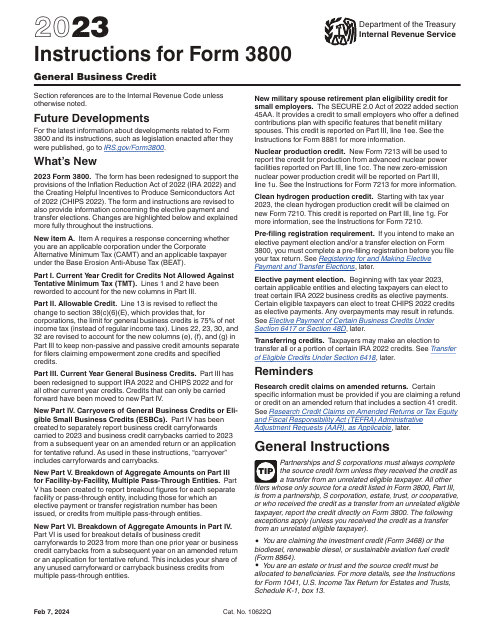

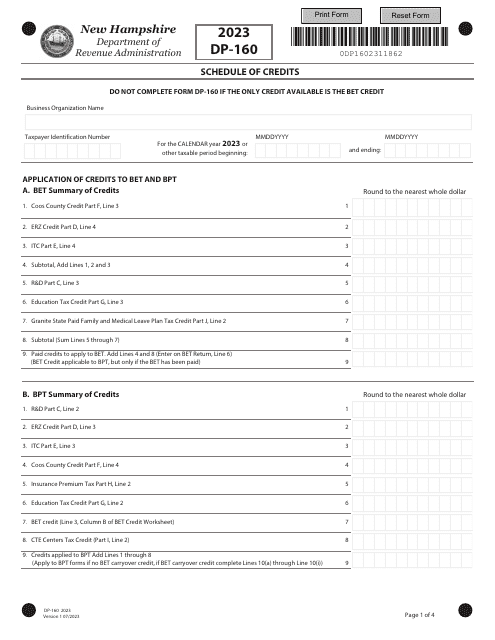

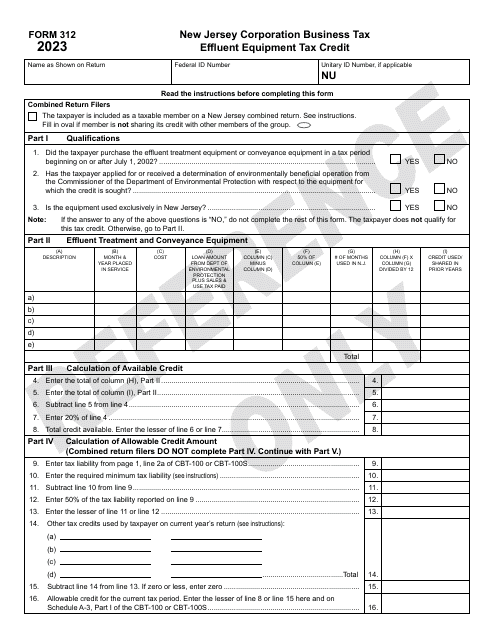

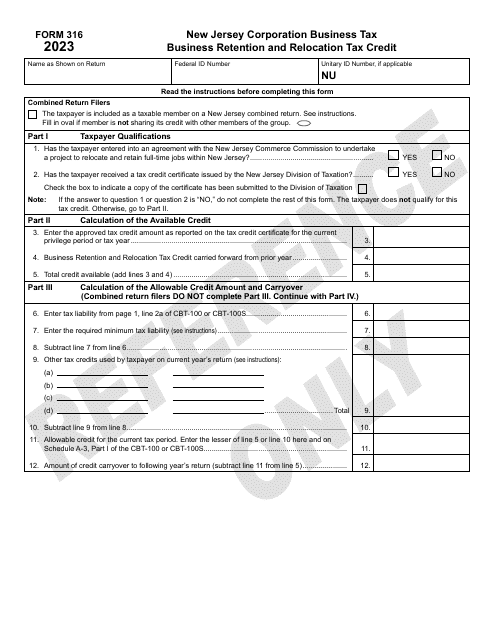

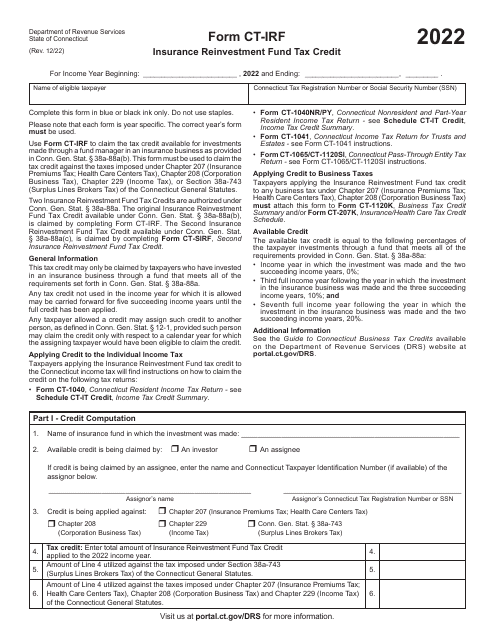

From the Form K-59 Kansas High Performance Incentive Program (HPIP) Credits in Kansas, to the Form CT-IRF Insurance Reinvestment Fund Tax Credit in Connecticut, there is a wide range of options available to businesses across the country.

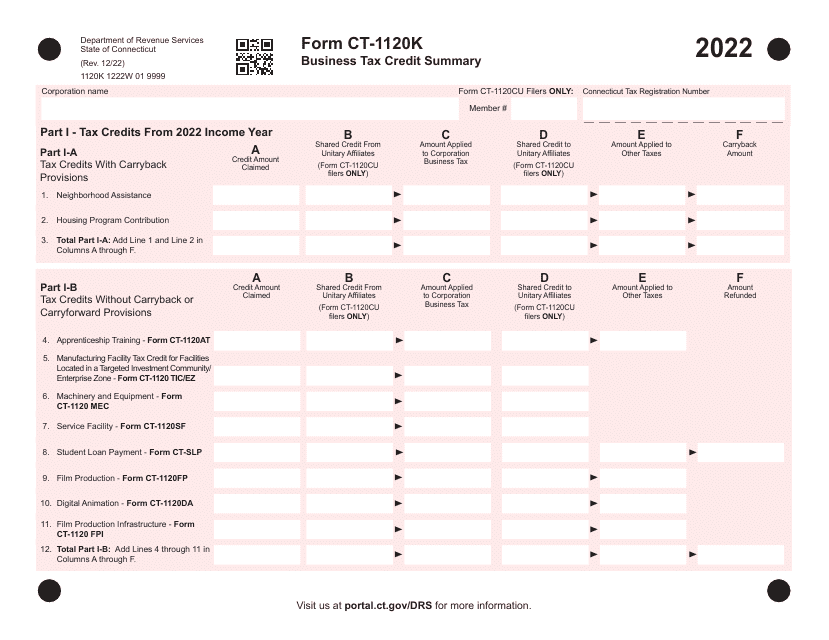

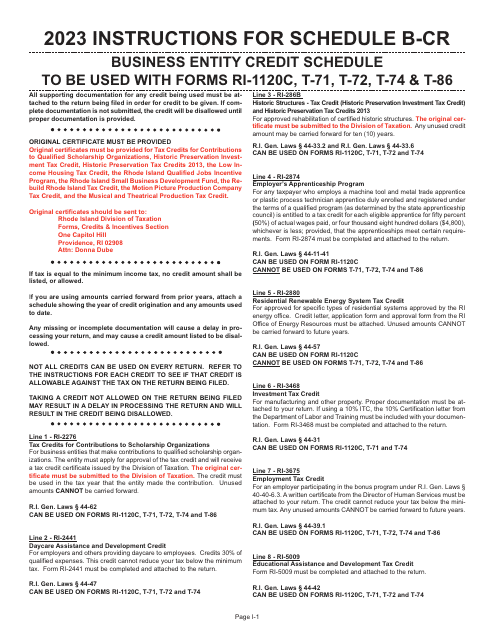

For instance, if you're a business operating in Rhode Island, you might be eligible for credits outlined in the Instructions for Schedule B-CR Business Entity Credit Schedule. Or if you're in Connecticut, you'll want to familiarize yourself with the Form CT-1120K Business Tax Credit Summary.

It's worth noting that each state may have its own unique set of business tax credits, so it's essential to consult with a tax professional or research your specific state's guidelines.

By taking advantage of these business tax credits, you can not only reduce your tax burden but also reinvest the savings back into your business. So, don't miss out on these valuable opportunities to maximize your tax savings!

Documents:

24

This form is used for claiming Kansas High Performance Incentive Program (HPIP) credits in the state of Kansas.

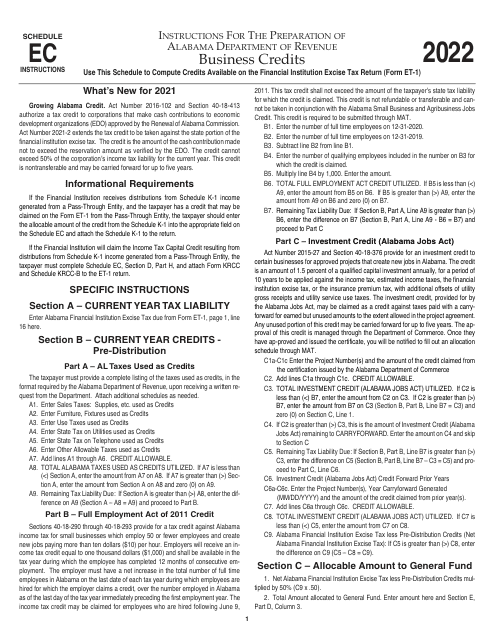

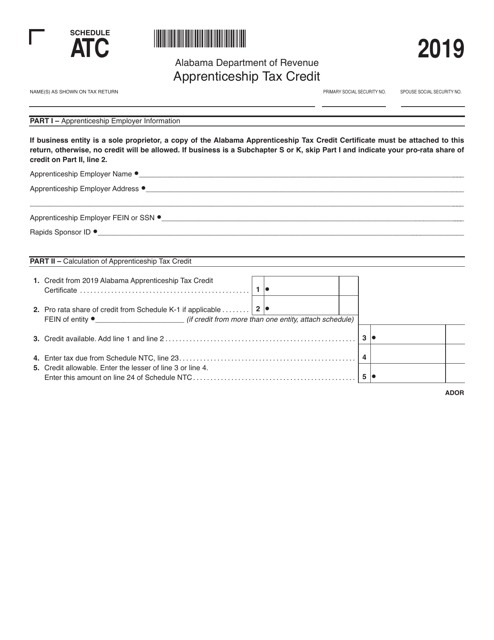

This document is a schedule for claiming the ATC Apprenticeship Tax Credit specific to the state of Alabama. It provides information on how to calculate and claim tax credits related to apprenticeship programs.