Foreign Earned Income Exclusion Templates

Are you a US citizen working abroad? If so, you may be eligible for the Foreign Earned Income Exclusion. This program allows you to exclude a certain amount of income earned from foreign sources from your taxable income. By taking advantage of this exclusion, you can significantly reduce your tax liability.

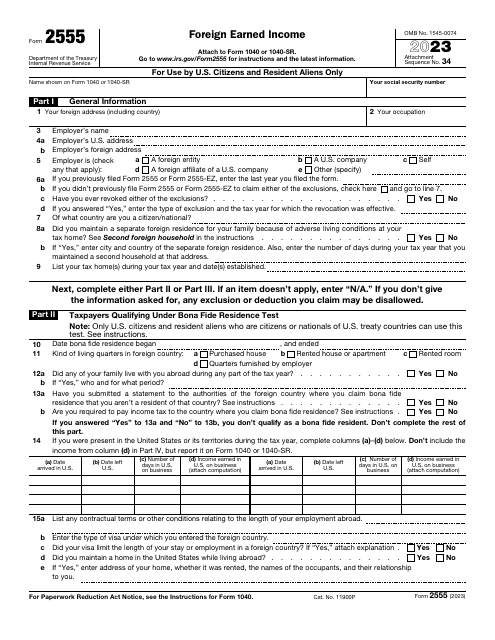

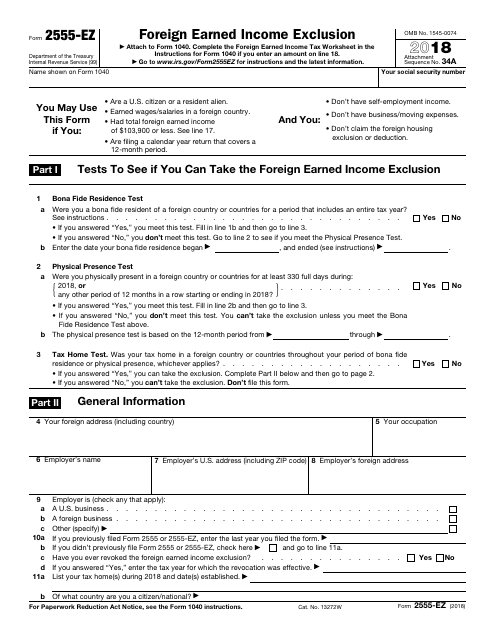

To apply for the Foreign Earned Income Exclusion, you will need to fill out IRS Form 2555 or IRS Form 2555-EZ. The former is a more comprehensive form that requires you to provide detailed information about your foreign income, while the latter is a simplified version of the form for eligible taxpayers.

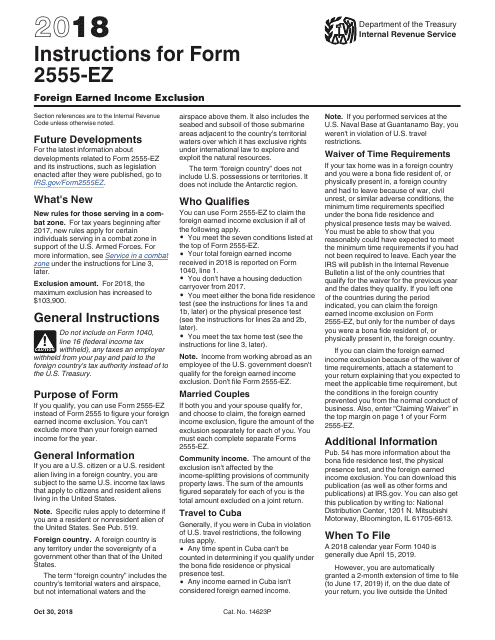

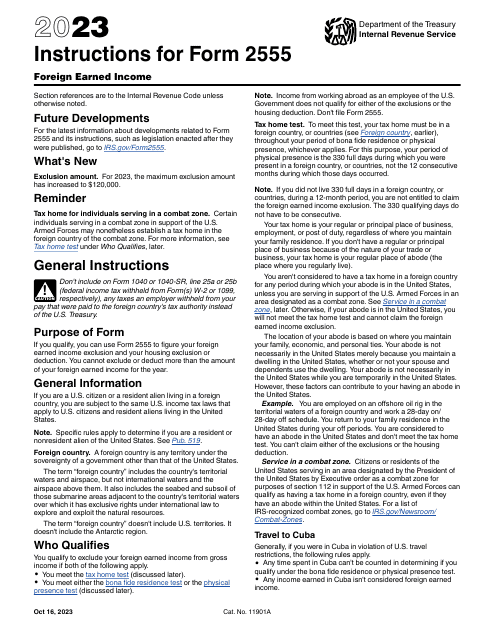

If you're unsure which form to use or how to properly complete it, don't worry. The IRS provides detailed instructions for both forms to guide you through the process. These instructions cover everything from determining your eligibility for the exclusion to calculating the amount of foreign income that can be excluded.

It's important to note that the Foreign Earned Income Exclusion is not limited to US citizens. US residents living and working abroad, as well as qualifying nonresident aliens, may also be eligible. This means that regardless of your citizenship status, if you meet the necessary requirements, you can take advantage of this beneficial program.

So, if you're earning income from foreign sources, don't let the fear of high taxes discourage you. Explore the Foreign Earned Income Exclusion and see how it can help you reduce your taxable income. Check out the IRS Form 2555 and IRS Form 2555-EZ, along with their accompanying instructions, to get started.

Documents:

8

This document is used for claiming the Foreign Earned Income Exclusion on your taxes.

This document provides instructions for completing IRS Form 2555-EZ, which is used to report and claim the foreign earned income exclusion for taxpayers who qualify.