Tax Credits and Deductions Templates

Welcome to our comprehensive resource for tax credits and deductions! Whether you're filing your taxes at the federal, state, or provincial level, understanding the intricacies of various tax credits and deductions can help you maximize your savings and keep more money in your pocket.

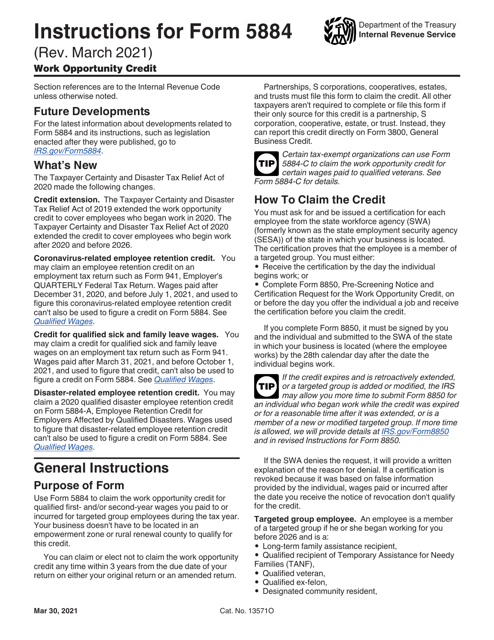

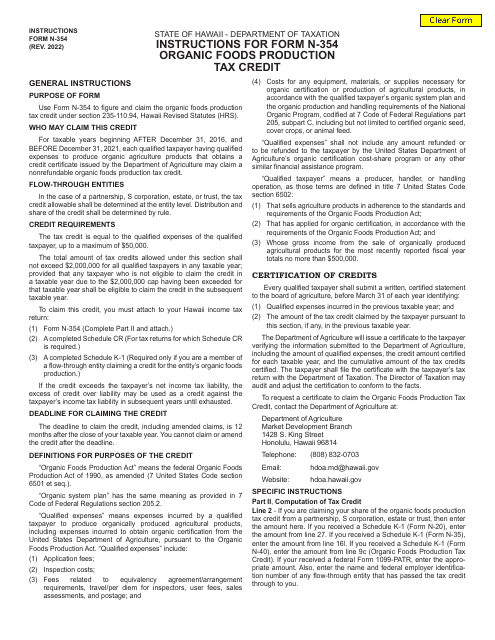

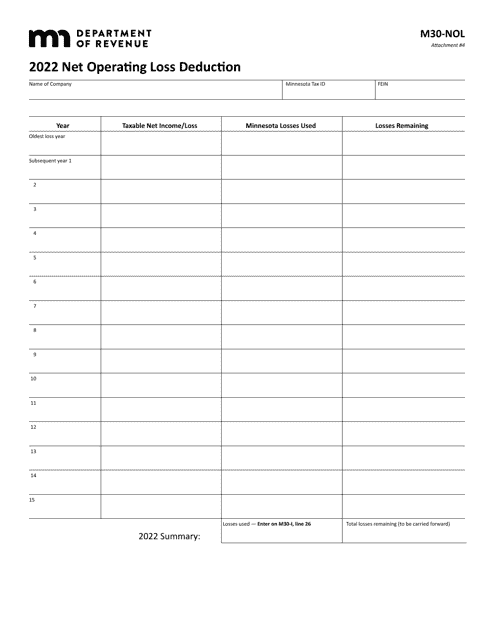

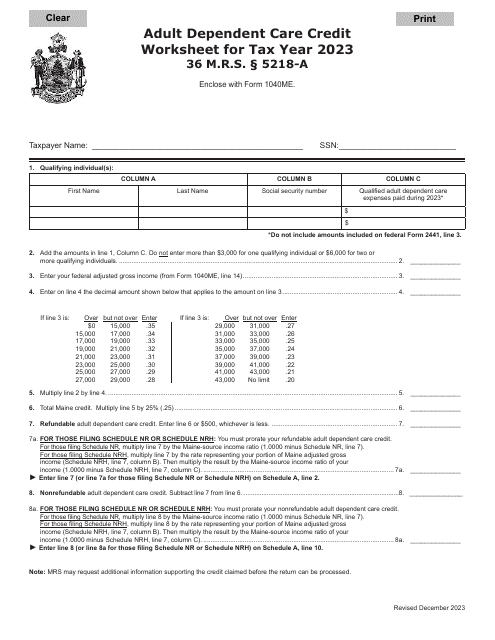

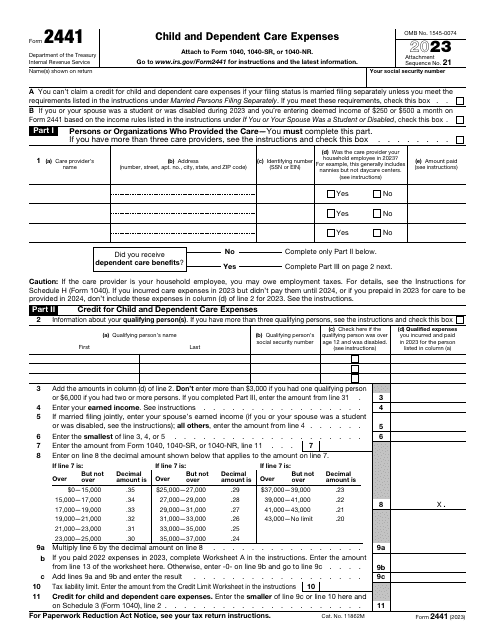

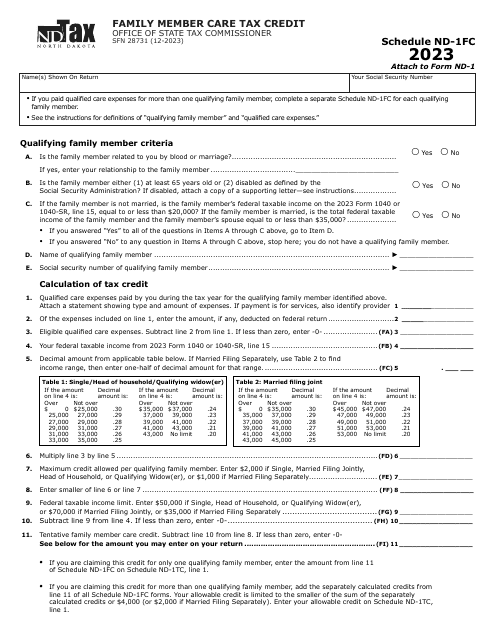

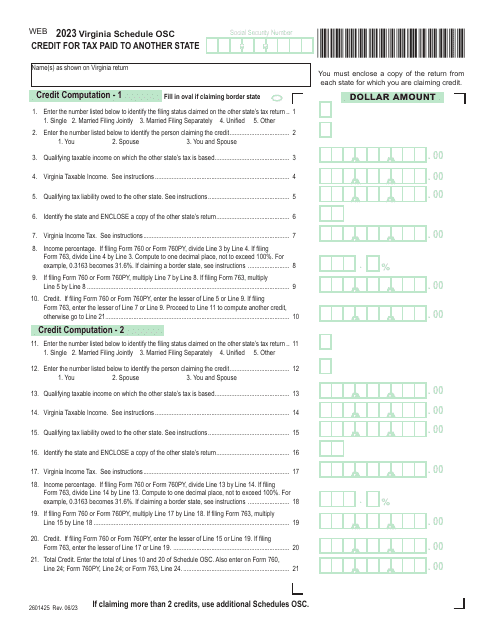

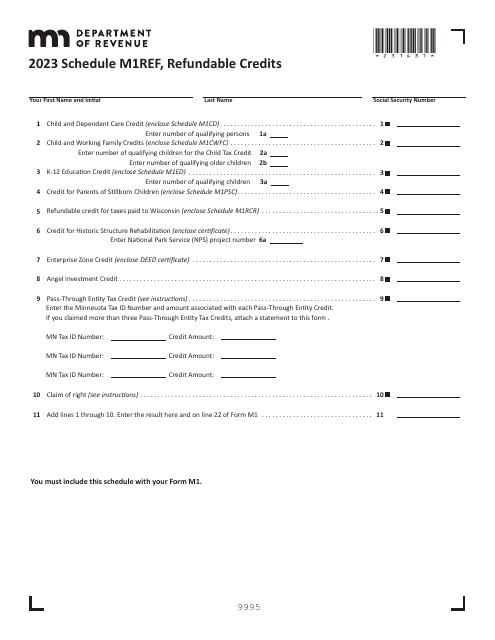

Our collection of documents provides valuable guidance and instructions on a wide range of tax credits and deductions. From federal tax credits like the Work Opportunity Credit and Child and Dependent Care Expenses to state-specific credits such as the Organic FoodsProduction Tax Credit in Hawaii or the Net Operating Loss Deduction in Minnesota, we've got you covered.

At our website, you'll find helpful instructions and forms tailored to meet your specific tax needs. We make it our mission to simplify complex tax regulations and break down eligibility requirements, allowing you to navigate the world of tax credits and deductions with confidence.

With our user-friendly interface and up-to-date information, you can easily access the documents you need to claim the tax benefits you deserve. Whether you're a business owner looking to save on hiring costs or a parent seeking relief from child and dependent care expenses, our collection of tax credits and deductions resources will provide you with the knowledge and tools to make informed decisions about your finances.

Don't miss out on potential tax savings. Explore our extensive library of tax credits and deductions documents today and unlock the opportunities to reduce your tax liability and increase your financial well-being.

Documents:

17

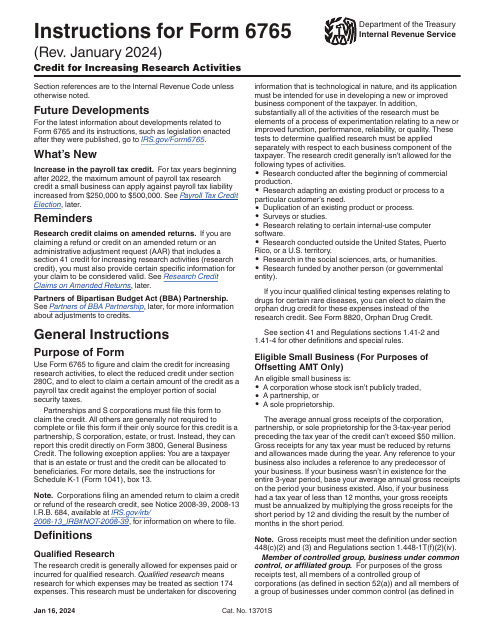

This is a document you may use to figure out how to properly complete IRS Form 6765

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.