Education Tax Templates

Are you looking for information on education tax, tax education, or filling out education tax forms? Look no further! Our comprehensive collection of education tax resources is designed to help individuals and businesses understand and navigate the complexities of taxation related to education expenses.

Whether you're a student trying to determine if you're eligible for educational tax credits or deductions, a parent interested in learning about tax-advantaged savings plans for education, or an educational institution needing guidance on tax-related compliance, our education tax resources have you covered.

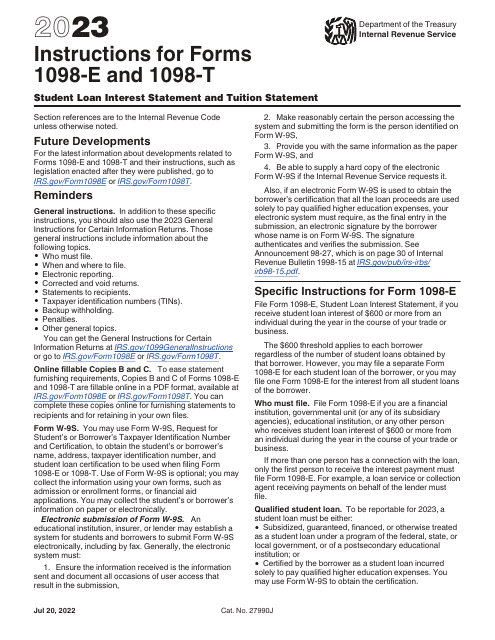

From IRS Form 1098-E and 1098-T instructions, which provide guidance on reporting and claiming educational loan interest deductions and tuition payments, to state-specific forms such as Form EDUC-1 - the Massachusetts Educational Income and Expense Form - our collection includes a wide range of tax forms and instructions.

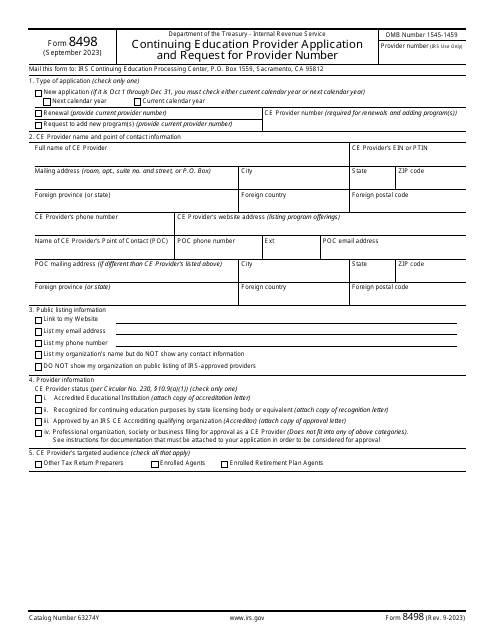

Looking to become an education tax professional? We've got you covered there too, with resources such as IRS Form 8498 - the Continuing Education Provider Application and Request for Provider Number. This form is essential for individuals or organizations seeking approval to offer educational courses or programs for continuing education credits.

Whether you're an individual or a business, staying up-to-date with education tax laws and regulations can be a daunting task. Our education tax resources provide the clarity and guidance you need to navigate the world of education-related taxation and make informed decisions.

Explore our comprehensive collection of education tax forms, instructions, and resources today, and let us be your trusted source for all your education tax needs.

Documents:

8

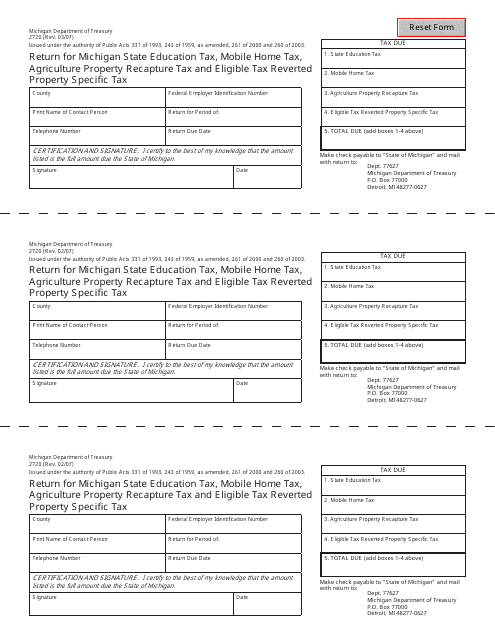

This form is used for reporting education tax, mobile home tax, agriculture property recapture tax, and eligible tax reverted property specific tax in the state of Michigan.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

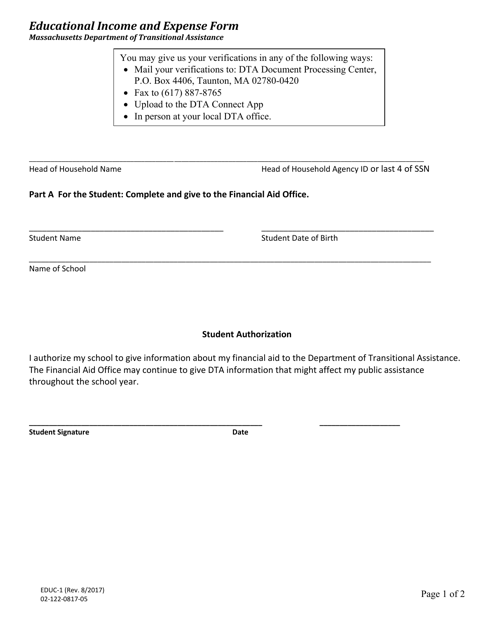

This Form is used for reporting educational income and expenses in Massachusetts.