Fuel Tax Credit Templates

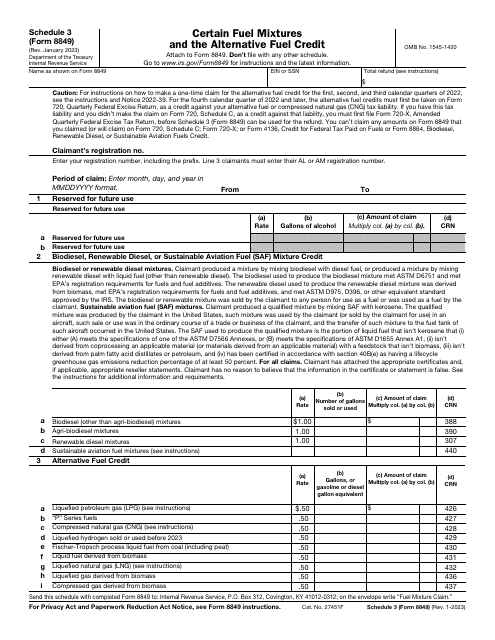

Are you a business owner or individual who often uses fuel for your operations or personal use? If so, you may be eligible for a fuel tax credit. The fuel tax credit is a government program that allows individuals and businesses to receive a credit or refund for the federal tax paid on fuels.

The fuel tax credit is also known as the fuel tax credits or federal tax credit on fuels. This program is designed to help offset the cost of fuel and encourage businesses and individuals to use alternative fuels.

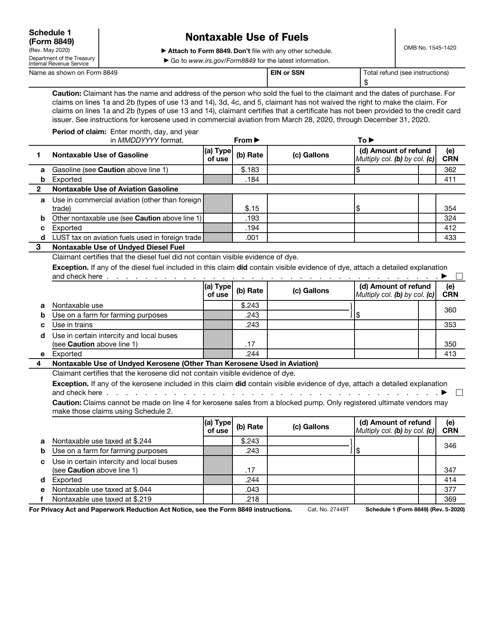

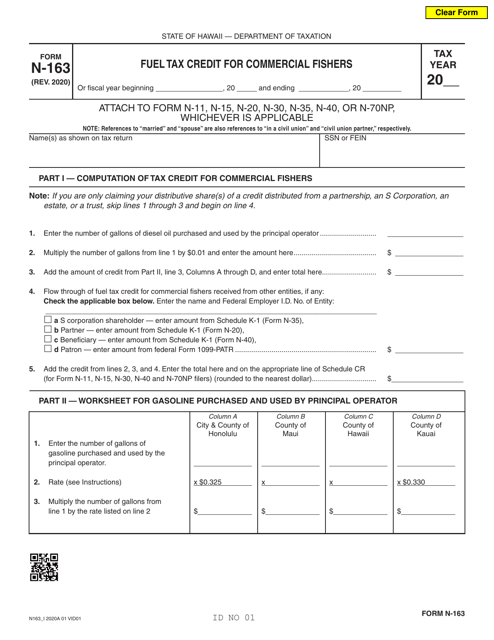

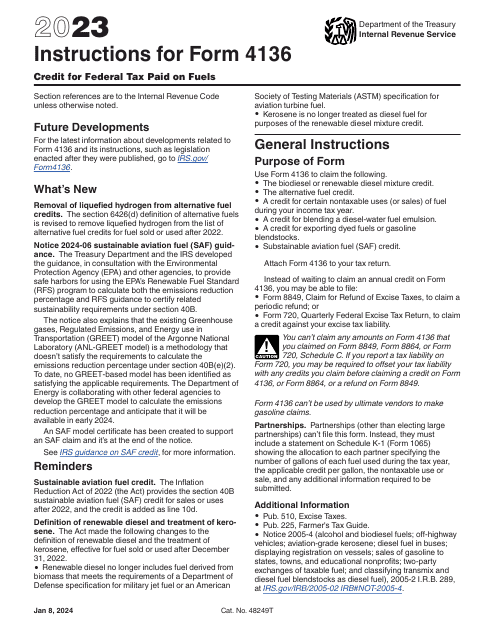

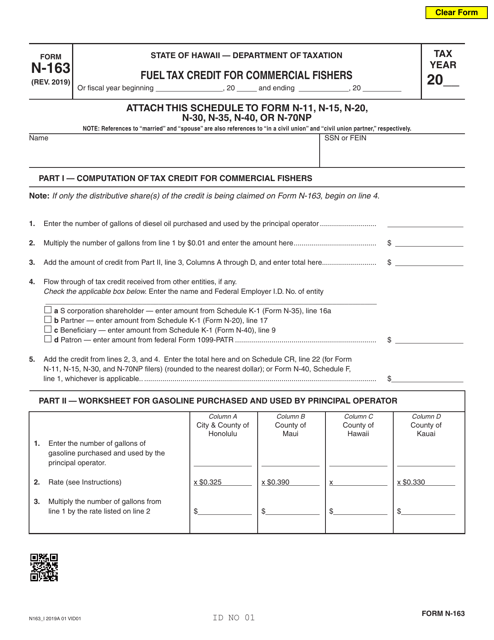

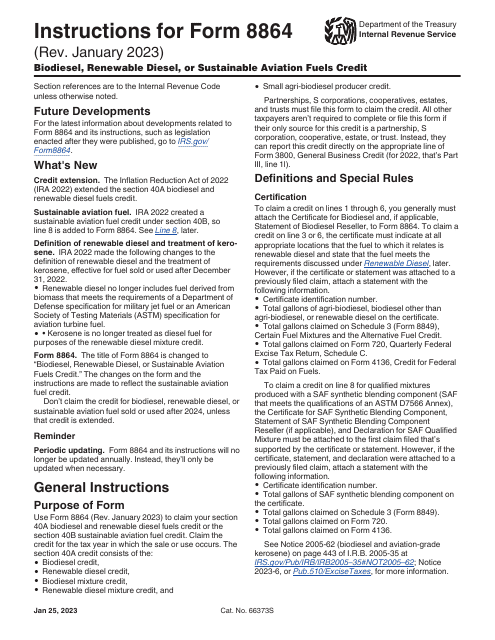

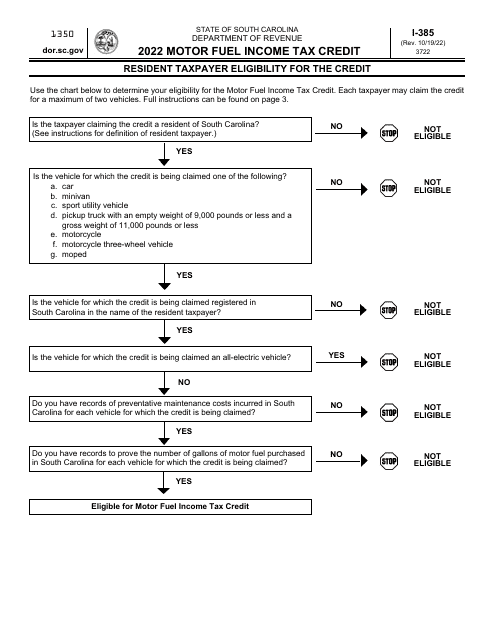

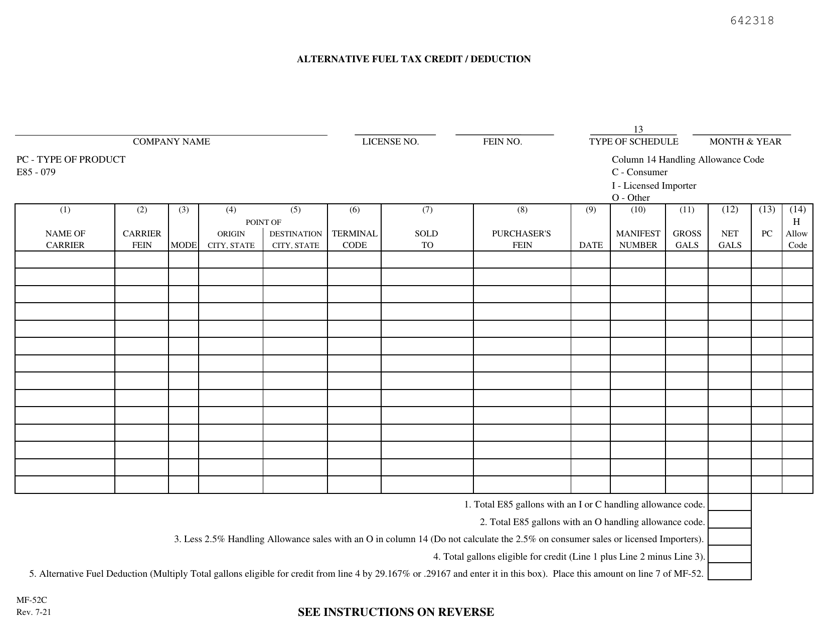

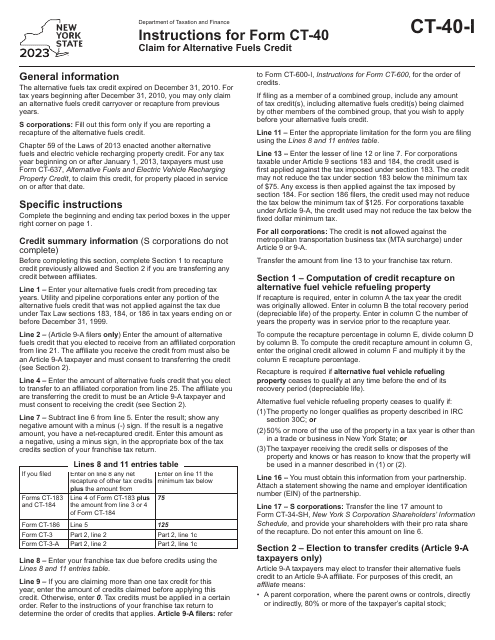

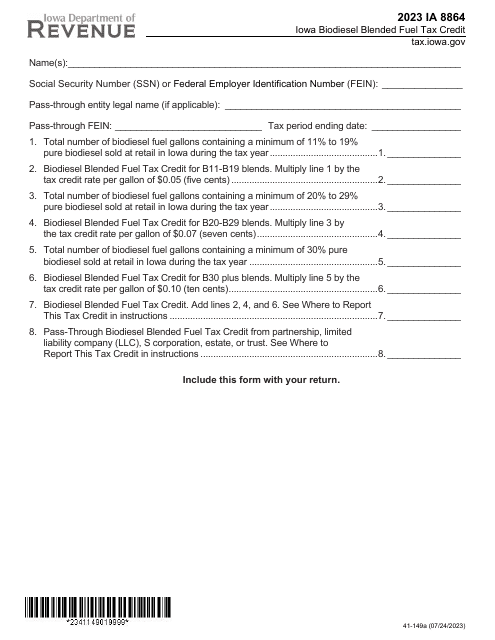

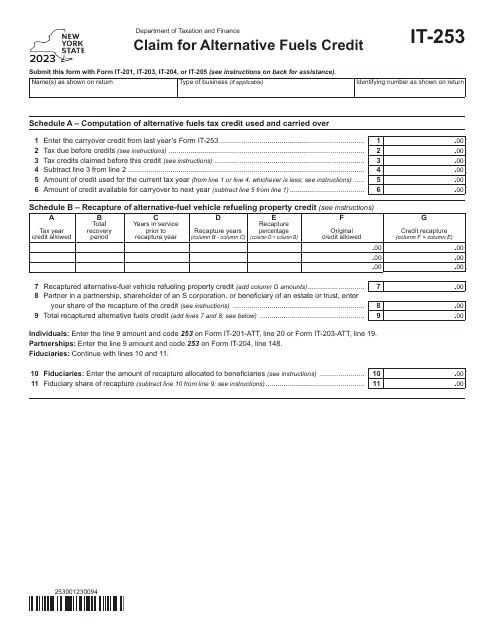

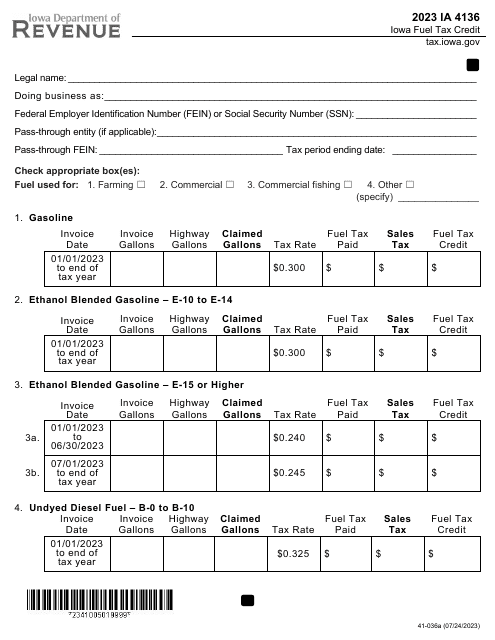

To benefit from the fuel tax credit, you will need to fill out the appropriate forms specific to your state or country. For example, in the United States, the IRS Form 4136 Credit for Federal Tax Paid on Fuels is used to claim the credit. Other states, such as Hawaii, Kansas, and South Carolina, have their own forms, such as Form N-163 Fuel Tax Credit for Commercial Fishers, Form MF-52C Schedule 13 Alternative Fuel Tax Credit/Deduction, and Form I-385 Motor FuelIncome Tax Credit, respectively.

If you're a commercial fisher in Hawaii, a transporter of alternative fuels in Kansas, or a motor fuel user in South Carolina, these forms can help you benefit from the fuel tax credit. Additionally, other states may have similar forms based on their respective fuel tax credit programs.

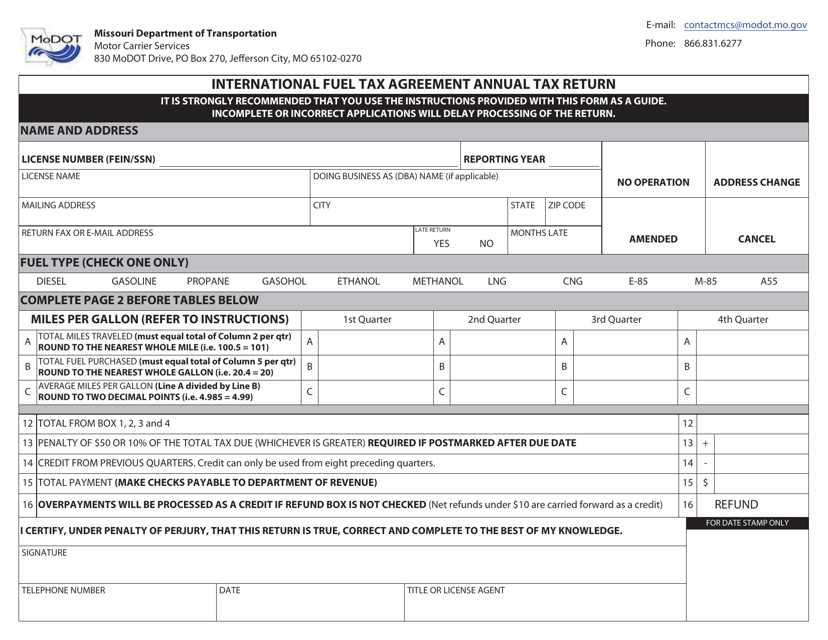

It's important to note that the International Fuel Tax Agreement (IFTA) also offers an annual tax return for fuel tax credits in certain states, such as Missouri. This agreement simplifies the reporting and payment of fuel taxes for interstate motor carriers.

So, whether you're an individual or a business owner, consider exploring the fuel tax credit program to potentially save on your fuel expenses. Make sure to consult the appropriate forms and guidelines for your state or country to ensure you're eligible and to maximize your savings.

Documents:

22

This form is used for claiming a fuel tax credit for commercial fishers in Hawaii.

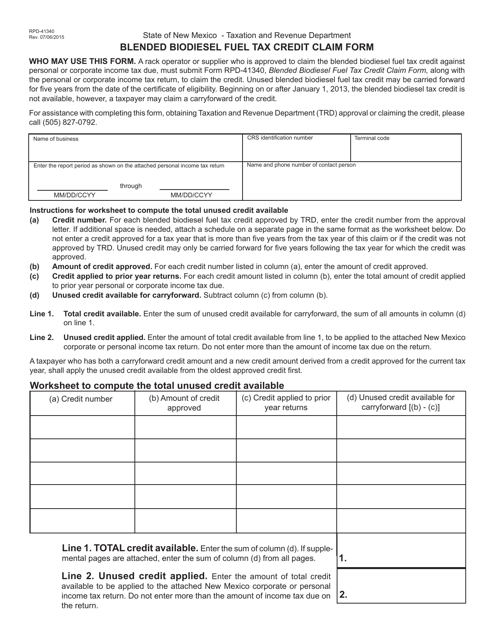

This form is used for claiming the Blended Biodiesel Fuel Tax Credit in New Mexico.

This document is used for filing the annual tax return related to the International Fuel Tax Agreement in the state of Missouri.