Canadian Taxation Templates

Are you doing business in Canada or are you an individual taxpayer in Canada? Understanding the Canadian taxation system is essential for ensuring compliance and optimizing your financial situation. Our website provides a comprehensive collection of Canadian taxation documents and resources to help you navigate through the complexities of the tax system.

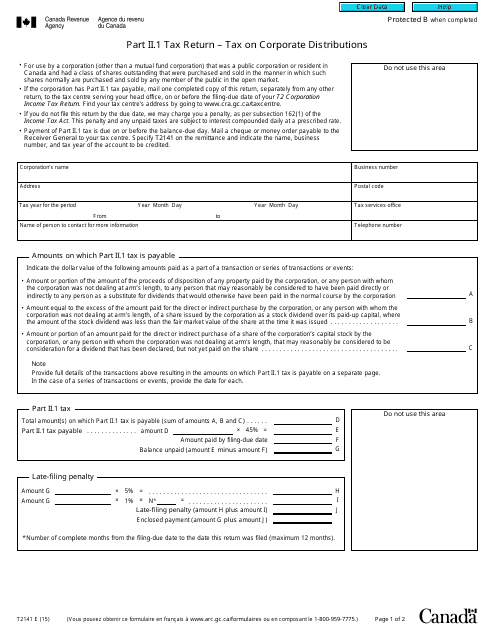

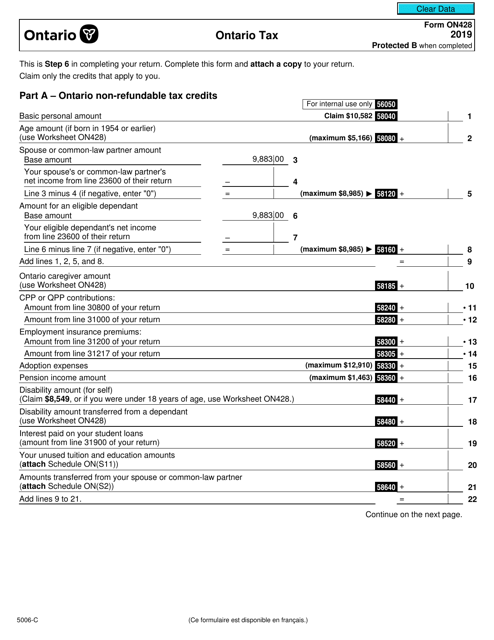

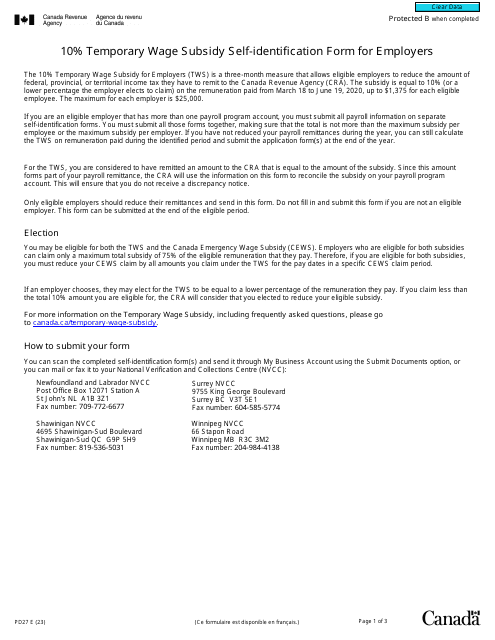

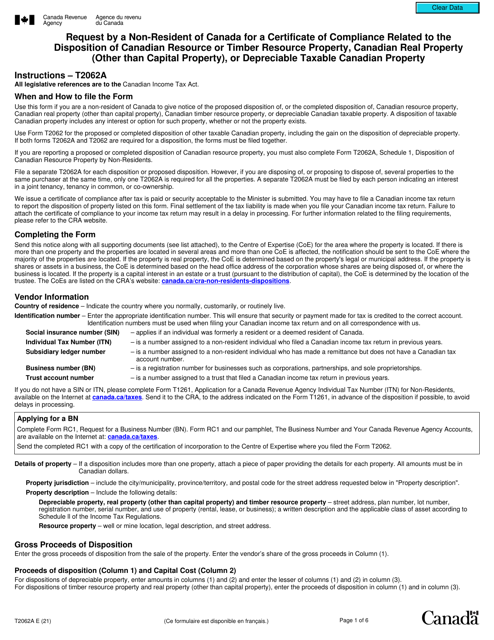

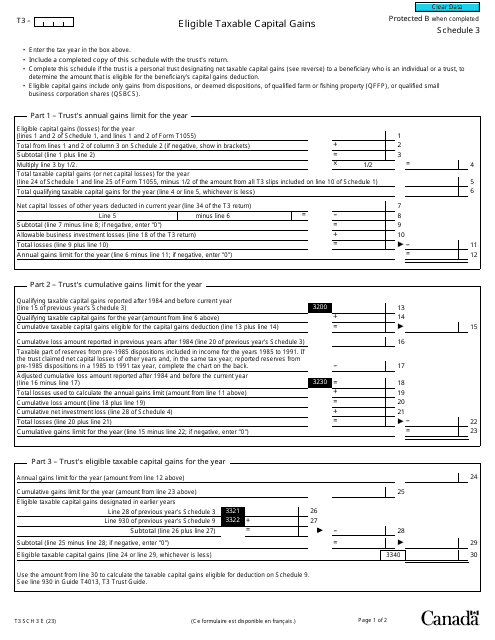

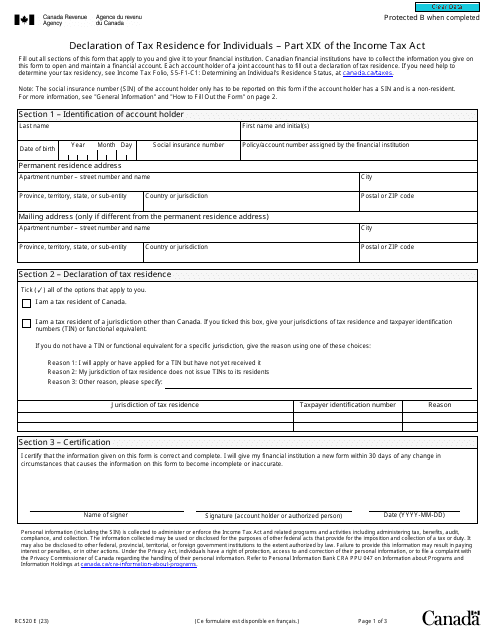

Our Canadian taxation documents cover a wide range of topics, including tax returns, tax on corporate distributions, provincial taxes, wage subsidies, and more. Whether you are a resident of Canada or a non-resident with Canadian assets, our collection includes forms such as Form T2141 for corporate distributions, Form ON428 for Ontario taxes, Form PD27 for wage subsidy identification, and Form T2062A for non-resident compliance regarding Canadian property disposition.

Sometimes referred to as the "Canadian Tax Library" or the "Taxation Documents Hub," our platform offers a user-friendly interface to help you easily access and download the necessary forms and information you need. Our resources are regularly updated to reflect changes in Canadian tax laws and regulations, ensuring you have the most accurate and up-to-date information at your fingertips.

Whether you are a beginner or an experienced taxpayer, our Canadian taxation documents have you covered. Our goal is to simplify the tax process for you and provide you with the knowledge and tools to make informed decisions regarding your taxes. Trust our comprehensive collection of Canadian taxation resources to guide you through the complex world of Canadian taxes and help you achieve your financial goals.

Documents:

6

This Form is used for reporting tax on corporate distributions in Canada.

This Form is used for reporting Ontario tax information to the Canada Revenue Agency (CRA).